3 Things to Know in the Housing Market Today!

A lot is happening in the world, and it’s having a direct impact on the housing market. The reality is this: some of it is positive and some of it may be negative. Some we just don’t know yet.

The following three areas of the housing market are critical to understand: interest rates, building materials, and the outlook for an economic slowdown.

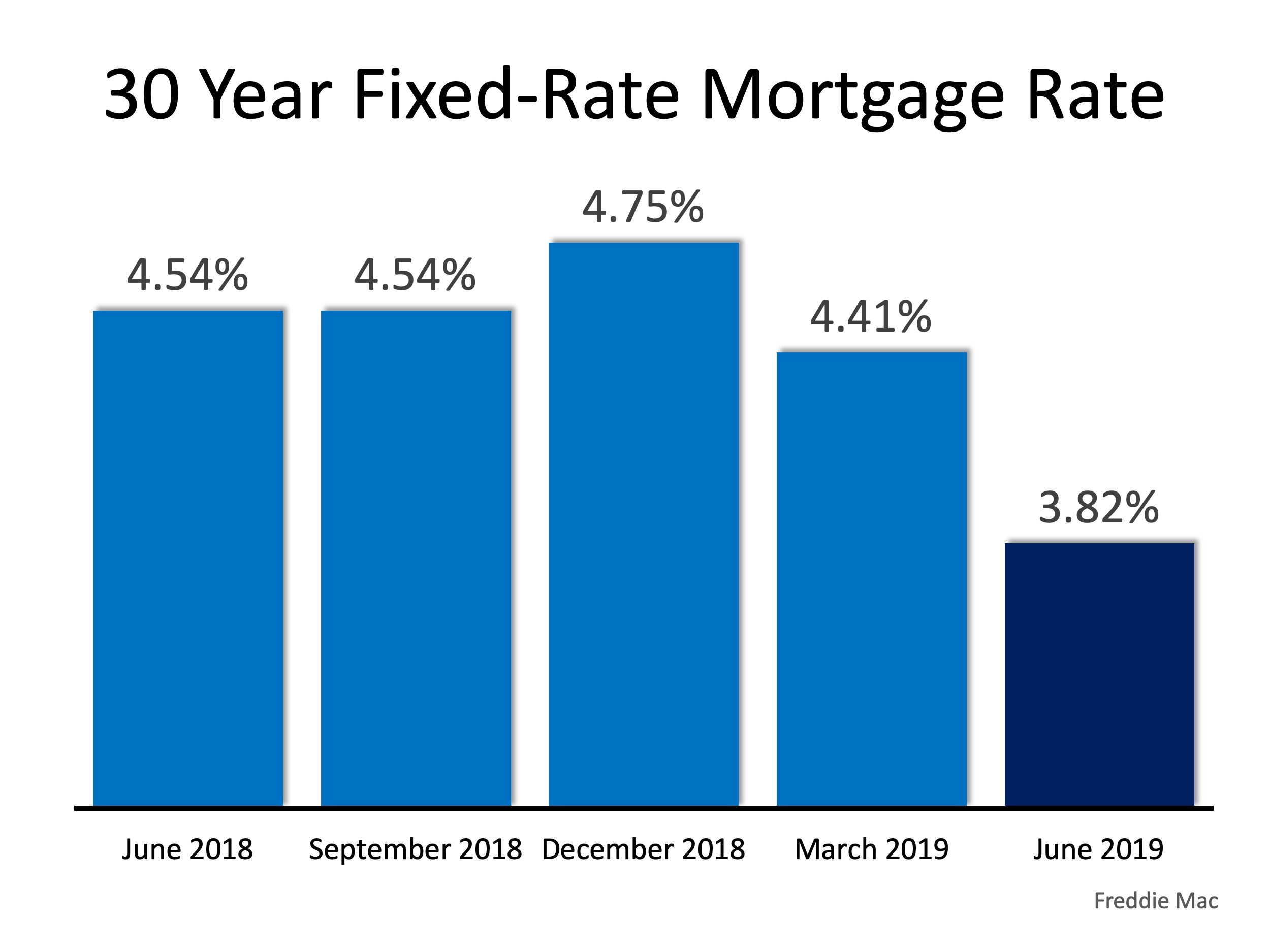

1. Interest Rates

One of the most important things to consider when buying a home is the interest rate you will be charged to borrow the money. In our recent post we posed the question, “Are Low Interest Rates Here To Stay?” The latest information from Freddie Mac makes it appear they are. We are currently at a 21-month low in interest rates.

2. Building Materials

Talk of tariffs could also affect the housing market. According to a recent article, the National Association of Home Builders reports that as much as $10 billion in goods imported from China are used in homebuilding. Depending on the outcome of the tariff and trade discussions between several countries, there could be as much as a 25% boost in the cost of building materials.

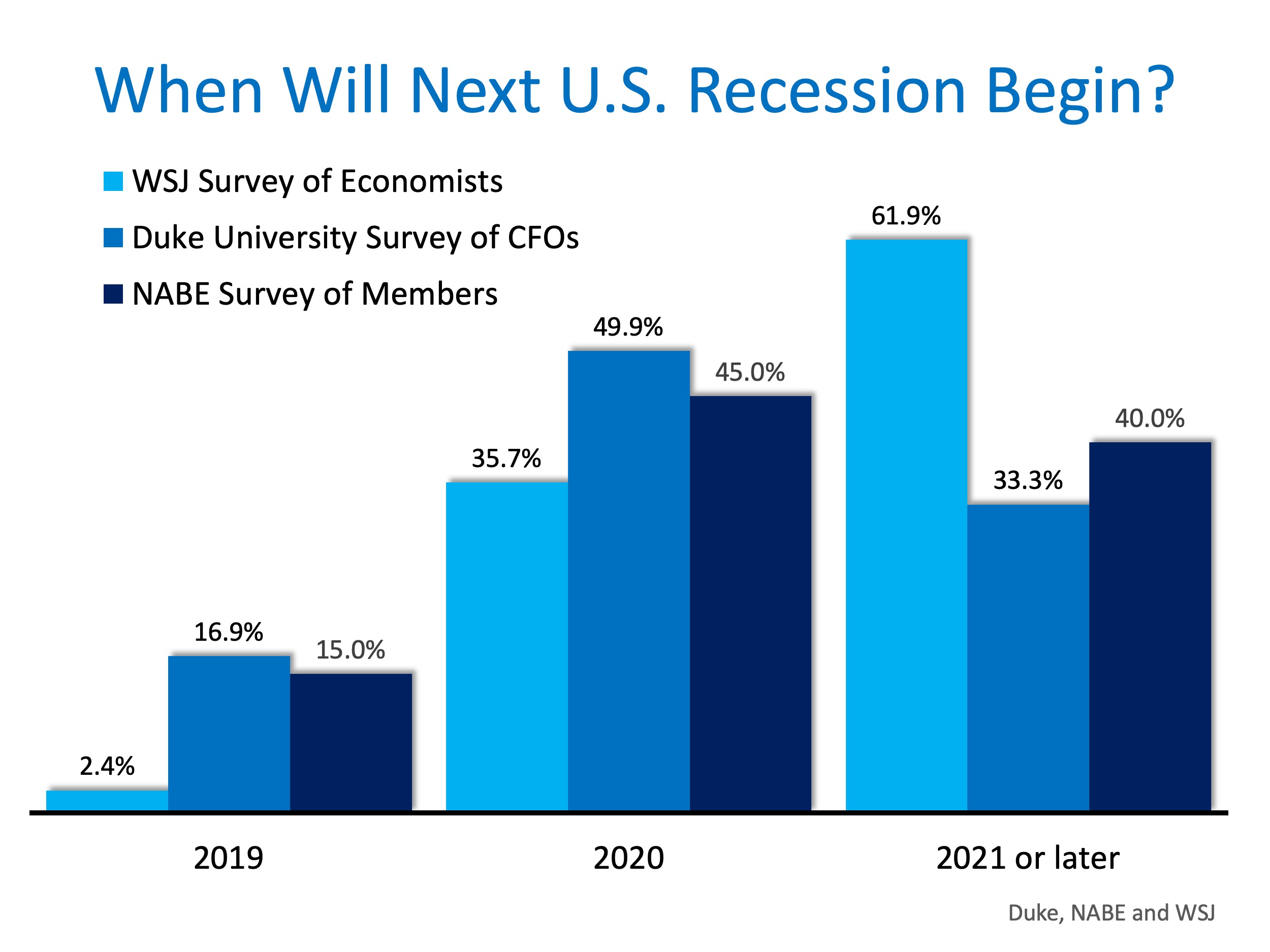

3. Economic Slowdown

In a prior blog post on this topic, we began the year with many economic leaders thinking we could expect a recession in late 2019 or early 2020. As spring approached, we reported that economists had started to push that projection past 2020. Now, three leading surveys indicate that it may begin in the next eighteen months.

Bottom Line

We are in a strong housing market. Wages are increasing, home prices are appreciating, and mortgage rates are the lowest they have been in 21 months. Whether you are thinking of buying or selling, it’s a great time to be in the market.

Today’s mortgage rates are still incredibly low compared to the historical norm. Let’s connect so you can strike while the iron is hot.

There's Still Time To Take Advantage of Historically Low Mortgage RatesToday's...

Why You May Want To Cash in on Your Second Home

Why You May Want To Cash in on Your Second HomeWhen stay-at-home mandates were enforced last year, many households realized their homes didn’t really fulfill their new lifestyle needs. An office (in some cases two), a media room, space for children to learn, a gym,...

Buying a Home Is Still Affordable

Buying a Home Is Still AffordableThe last year has put emphasis on the importance of one’s home. As a result, some renters are making the jump into homeownership while some homeowners are re-evaluating their current house and considering a move to one that better fits...

3 Things To Prioritize When Selling Your House

3 Things To Prioritize When Selling Your HouseToday’s housing market is full of unprecedented opportunities. High buyer demand paired with record-low housing inventory is creating the ultimate sellers’ market, which means it’s a fantastic time to sell your house....

Why Is This Spring a Great Time to Sell Your House?

Why Is This Spring a Great Time to Sell Your House?

Your House Could Be the Oasis in an Inventory Desert

Your House Could Be the Oasis in an Inventory DesertHomebuyers are flooding the housing market right now to take advantage of record-low mortgage rates. Many have a sense of urgency to find a home soon since experts forecast a steady rise in both rates and home prices...

It’s Not Too Late To Apply For Forbearance

It’s Not Too Late To Apply For Forbearance Over the past year, the pandemic made it challenging for some homeowners to make their mortgage payments. Thankfully, the government initiated a forbearance program to provide much-needed support. Unless they’re extended once...

Americans Have Their Hearts Set on Homeownership

801-205-3500

Are Interest Rates Expected to Rise Over the Next Year?

Are Interest Rates Expected to Rise Over the Next Year?So far this year, mortgage rates continue to hover around 3%, encouraging many hopeful homebuyers to enter the housing market. However, there’s a good chance rates will increase later this year and going into...