3 Questions You Need To Ask Before Buying A Home

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.

Ask yourself the following three questions to help determine if now is a good time for you to buy in today’s market.

1. Why am I buying a home in the first place?

This is truly the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with money.

For example, a study by realtor.com found that “73% said buying in a good school district was “important” in their search.”

This report supports a study by the Joint Center for Housing Studies at Harvard University which revealed that the top four reasons Americans buy a home have nothing to do with money. The actual reasons are:

- A good place to raise children and provide them with a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of that space

What does owning a home mean to you? What non-financial benefits will you and your family gain from owning a home? The answer to that question should be the biggest reason you decide to purchase or not.

2. Where are home values headed?

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), the median price of homes sold in February (the latest data available) was $249,500. This is up 3.6% from last year. The increase also marks the 84th consecutive month with year-over-year gains.

Looking at home prices year over year, CoreLogic is forecasting an increase of 4.6%. In other words, a home that costs you $250,000 today will cost you an additional $11,500 if you wait until next year to buy it.

What does that mean to you?

Simply put, with prices increasing, it may cost you more if you wait until next year to buy. Your down payment will also need to be higher in order to account for the higher price of the home you wish to buy.

3. Where are mortgage interest rates headed?

A buyer must be concerned about more than just prices. The ‘long-term cost’ of a home can be dramatically impacted by even a small increase in mortgage rates.

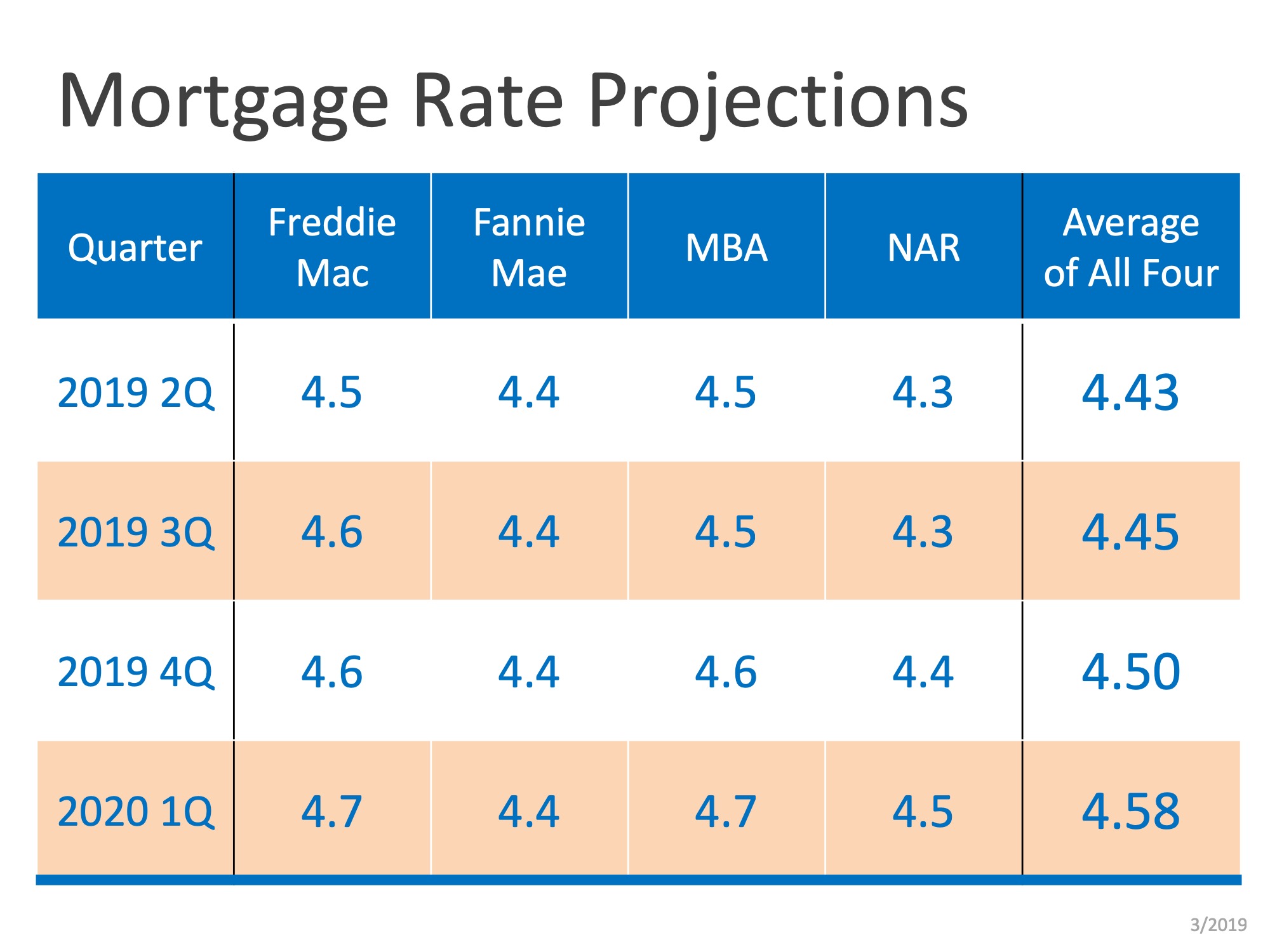

Freddie Mac, Fannie Mae, the Mortgage Bankers Association and NAR have all projected that mortgage interest rates will increase over the next twelve months, as you can see in the chart below:

Bottom Line

Only you and your family will know for certain if now is the right time to purchase a home. Answering these questions will help you make that decision.

The Beginning of an Economic Recovery In Utah

The Beginning of an Economic RecoveryThe news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand...

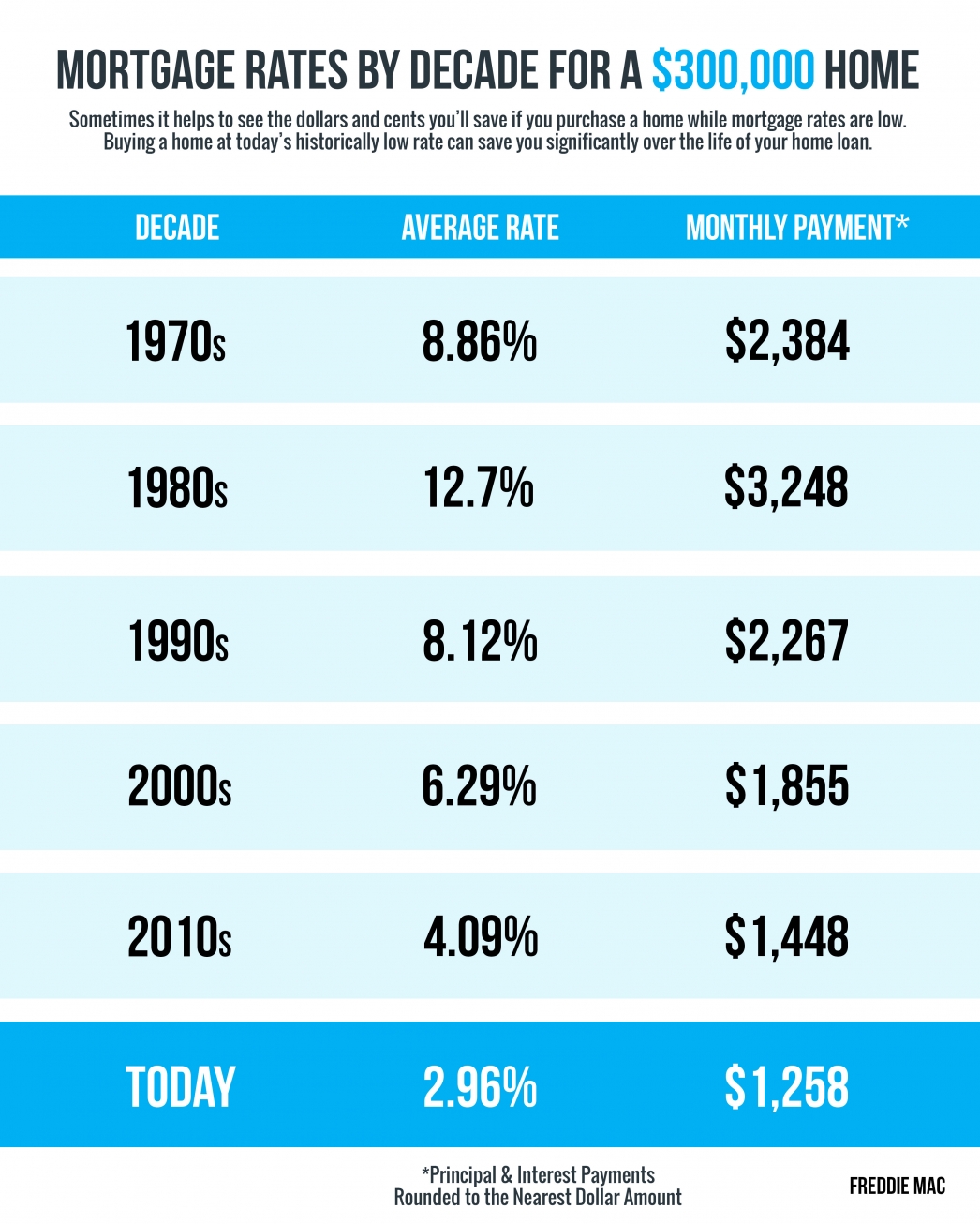

Mortgage Rates and Payments by Each Decade

Mortgage Rates & Payments by DecadeSome HighlightsSometimes it helps to see the dollars and cents you’ll save when you purchase a home while mortgage rates are low.Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your...

Housing by the Numbers by Utah Realty

Homes Are More Affordable Right Now Than They Have Been in Years

Homes Are More Affordable Right Now Than They Have Been in YearsToday, home prices are appreciating. When we hear prices are going up, it’s normal to think a home will cost more as the trend continues. The way the housing market is positioned today, however, low...

Why Foreclosures Won’t Crush the Housing Market Next Year

Why Foreclosures Won’t Crush the Housing Market Next YearWith the strength of the current housing market growing every day and more Americans returning to work, a faster-than-expected recovery in the housing sector is already well...

The Latest Unemployment Report: Slow and Steady Improvement

The Latest Unemployment Report: Slow and Steady ImprovementLast Friday, the Bureau of Labor Statistics (BLS) released its latest Employment Situation Summary. Going into the release, the expert consensus was for 1.58 million jobs to be added in July, and for the...

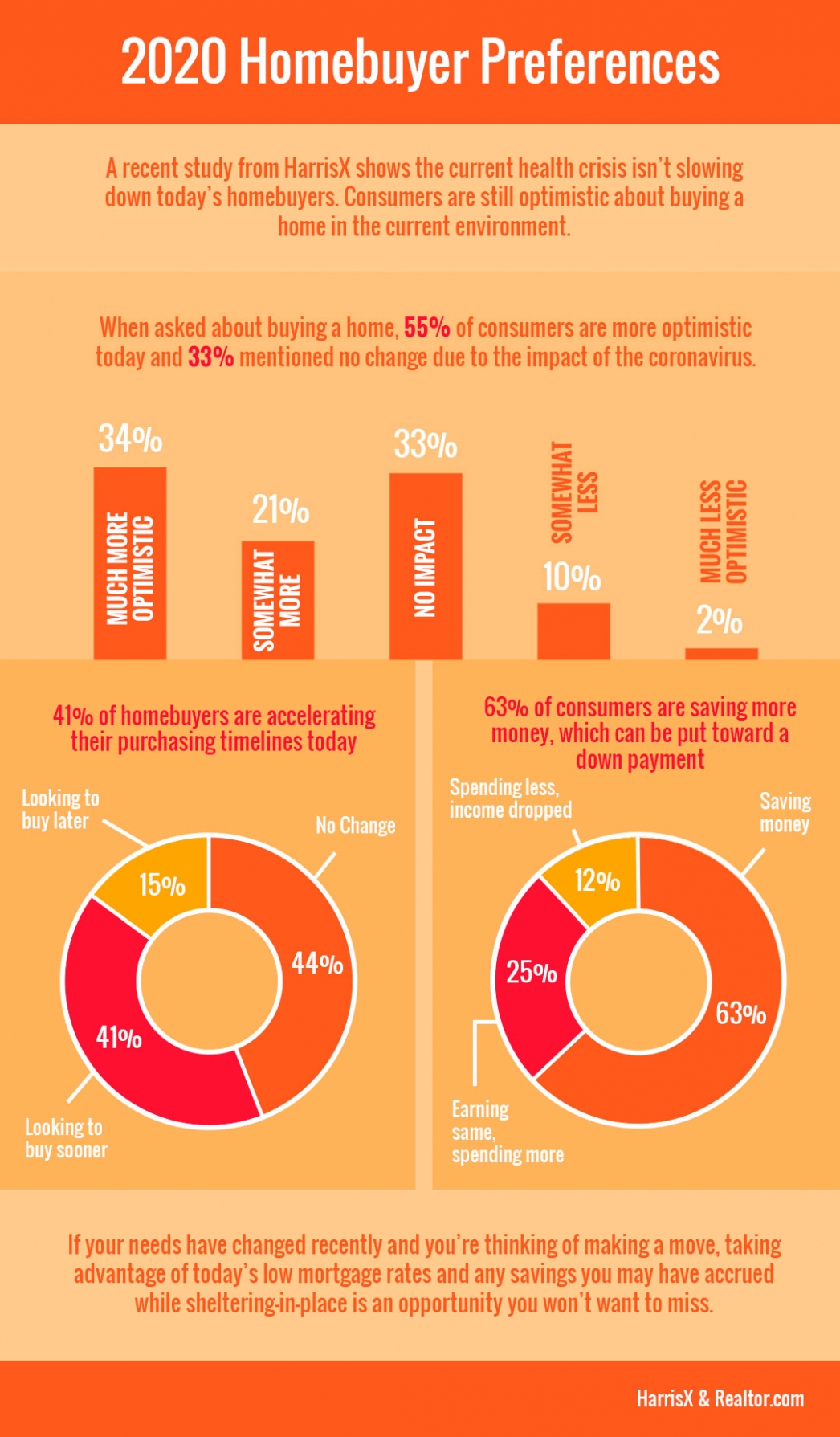

2020 Homebuyer Preferences

2020 Homebuyer PreferencesSome HighlightsA recent study from HarrisX shows the current health crisis isn’t slowing down today’s homebuyers.Many buyers are accelerating their timelines to take advantage of low mortgage rates, and staying home has enabled some to save...

Expert Reactions to the 2020 Housing Market Recovery

America Has a Surprising New Favorite Room in the House

Photo Copyright Marty Gale The family room has long been the favorite room in the house—it’s where homeowners get to spend quality time with other family members. However, as the significant increase in time spent at home during the pandemic has changed preferences,...

How Is Remote Work Changing Homebuyer Needs?

How Is Remote Work Changing Homebuyer Needs?With more companies figuring out how to efficiently and effectively enable their employees to work remotely (and for longer than most of us initially expected), homeowners throughout the country are re-evaluating their...