2 Myths Holding Back Home Buyers

Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that,

“For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment…

…Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20% down.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the funds needed to qualify for a home loan. According to the same report:

22% of renters and 31% of homeowners believe lenders require 20% or more of a home’s sale price as a down payment for a typical mortgage today. And,

“If a 20% down payment was required, 70% of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30% indicated they would never be able to afford a home.”

While many believe at least 20% down is necessary to buy the home of their dreams, they do not realize programs are available which permit as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined!

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Many either don’t know or are misinformed concerning the FICO® score necessary to qualify, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

3D Virtual Tours Now Available

Above is an example of how your home could be presented.

Ultimate Sellers Guide

Free Expert Home Evaluation [advanced_iframe securitykey="65d612b00c4a9e142a2baed3667b9d4fc85250c7" src="https://listings.utahrealtyplace.com/idx/homevaluation"...

MASTER BATHROOM REMODEL

https://realtytimes.com/consumeradvice/homeownersadvice/item/1014870-20180209-lessons-learned-from-a-master-bathroom-remodel?rtmpage=GaleTeam

Mortgage Rates for 2018

https://goo.gl/Pw4cmy

Why Work with a Realtor

8 Reasons Why You Should Work With a REALTOR® Not all real estate practitioners are REALTORS®. The term REALTOR® is a registered trademark that identifies a real estate professional who is a member of the NATIONAL ASSOCIATION of REALTORS® and subscribes to...

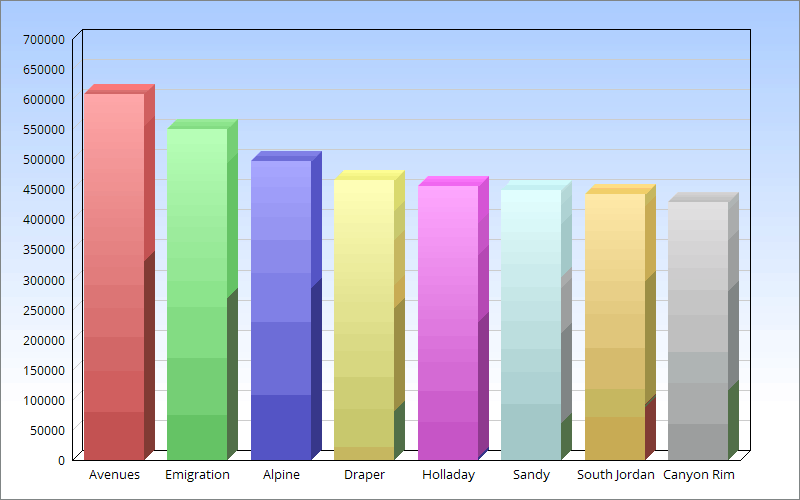

Salt Lake County Home Prices

[masterslider id="1"] SANDY (Oct. 31, 2017) – The price of a single-family home increased to its highest point ever before, according to the Salt Lake Board of Realtors®. In the July-August-September quarter, the median price of a Salt Lake County...

Realtors with HEART

Helping Families With Home Matters Real Estate With H.E.A.R.T. H onest, Helpful E xtraordinary A chieve, Action, Amazed R ealistic, Remarkable, Responsible, Ready T op Producing, Trustworthy NEVER MISS A PRICE DROP OR NEW LISTING SAVE...

Outdoor Kitchens

5 KITCHEN STYLES TO WATCH FOR

The L-shaped kitchen has nudged aside the U-shaped kitchen to become the most popular layout among U.S. homeowners changing their kitchen layout in a remodel, according to recent Houzz data. And farmhouse style has unseated traditional style for a spot in...

Find Cheap Homes for Sale in Utah

UTAH Short Sales, FSBO, Bank Owned, and Tax Sales Bargains Search bargain homes in Utah now to see the freshest listings of short sales, rent to own and tax sales. Buy from a seller using these creative sales strategies, and you can save you thousands on...