2 Myths Holding Back Home Buyers

Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that,

“For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment…

…Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20% down.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the funds needed to qualify for a home loan. According to the same report:

22% of renters and 31% of homeowners believe lenders require 20% or more of a home’s sale price as a down payment for a typical mortgage today. And,

“If a 20% down payment was required, 70% of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30% indicated they would never be able to afford a home.”

While many believe at least 20% down is necessary to buy the home of their dreams, they do not realize programs are available which permit as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined!

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Many either don’t know or are misinformed concerning the FICO® score necessary to qualify, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

Top Reasons to Own Your Home

Economists Forecast Recovery to Begin in the Second Half of 2020

Economists Forecast Recovery to Begin in the Second Half of 2020With the U.S. economy on everyone’s minds right now, questions about the country’s financial outlook continue to come up daily. The one that seems to keep rising to the top is: when will the economy begin...

Buying or Selling a Home? You Need an Expert Kind of Guide

Buying or Selling a Home? You Need an Expert Kind of GuideIn a normal housing market, whether you’re buying or selling a home, you need an experienced guide to help you navigate through the process. You need someone you can turn...

We Remember & Honor Those Who Gave All

We Remember & Honor Those Who Gave All We remember, today and always.

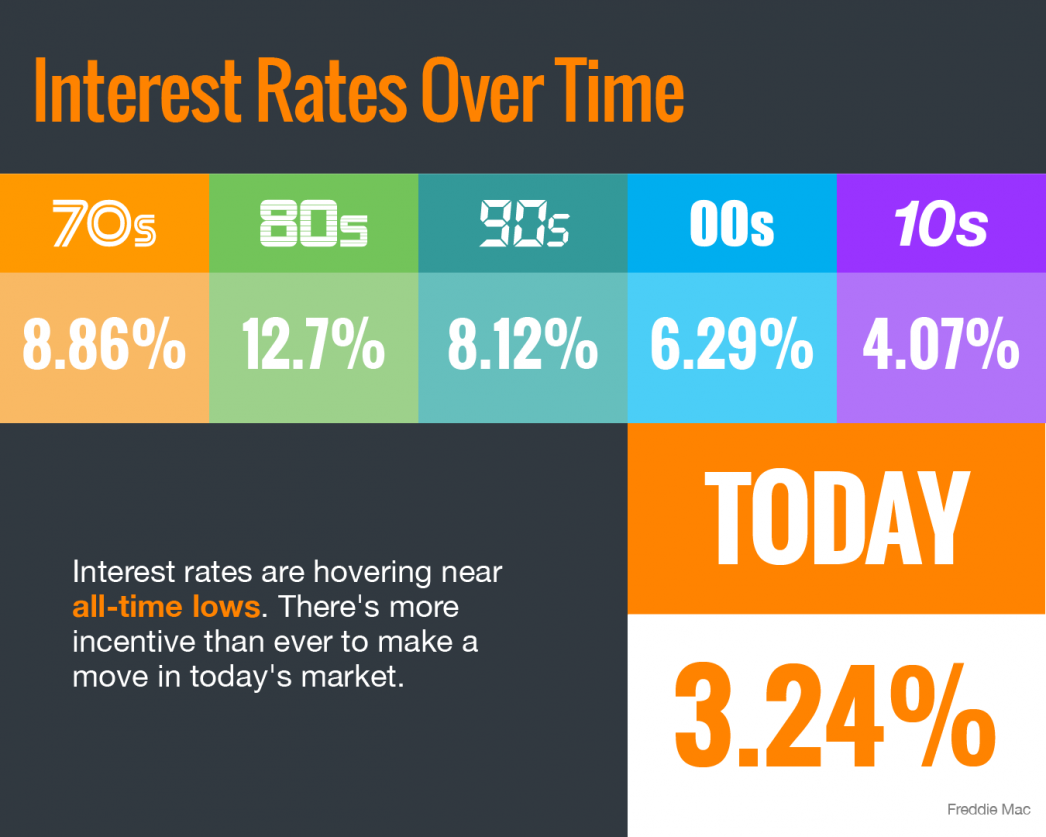

Interest Rates Hover Near Historic All-Time Lows

Interest Rates Hover Near Historic All-Time LowsSome HighlightsMortgage interest rates have dropped considerably this spring and are hovering at a historically low level.Locking in at a low rate today could save you thousands of dollars over the lifetime of your home...

Summer is the new Spring for Placing your home on the Market

Experts Predict Economic Recovery Should Begin in the Second Half of 2020

Experts Predict Economic Recovery Should Begin in the Second Half of the Year One of the biggest questions we all seem to be asking these days is: When are we going to start to see an economic recovery? As the country begins to slowly reopen, moving forward in...

6 Reasons Why Selling Your House on Your Own Is a Mistake

6 Reasons Why Selling Your House on Your Own Is a Mistake There are many benefits to working with a real estate professional when selling your house. During challenging times like the one we face today, it becomes even more important to have an expert help guide you...

Housing Market Positioned to Bring Back the Economy

Housing Market Positioned to Bring Back the EconomyAll eyes are on the American economy. As it goes, so does the world economy. With states beginning to reopen, the question becomes: which sectors of the economy will drive its recovery? There seems to be a growing...

#1 Financial Benefit of Homeownership: Family Wealth

#1 Financial Benefit of Homeownership: Family WealthWhile growing up, we were taught by our parents and grandparents that owning a home is a financially savvy move. They explained how a mortgage is like a “forced savings plan.” When you pay rent, that money is lost...