2 Myths Holding Back Home Buyers

Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that,

“For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment…

…Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20% down.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the funds needed to qualify for a home loan. According to the same report:

22% of renters and 31% of homeowners believe lenders require 20% or more of a home’s sale price as a down payment for a typical mortgage today. And,

“If a 20% down payment was required, 70% of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30% indicated they would never be able to afford a home.”

While many believe at least 20% down is necessary to buy the home of their dreams, they do not realize programs are available which permit as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined!

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Many either don’t know or are misinformed concerning the FICO® score necessary to qualify, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

The Benefits of Selling Now, According to Experts

The Benefits of Selling Now, According to Experts If you’re trying to decide if now’s the time to sell your house, here’s what you should know. The limited number of homes available right now gives you a big advantage. That’s because there are more buyers out there...

Why Buyers Need an Expert Agent by Their Side

Why Buyers Need an Expert Agent by Their Side The process of buying a home can feel a bit intimidating, even under normal circumstances. But today's market is still anything but normal. There continues to be a very limited number of homes for sale, and that’s creating...

What You Need To Know About Home Price News

What You Need To Know About Home Price News The National Association of Realtors (NAR) will release its latest Existing Home Sales Report tomorrow. The information it contains on home prices may cause some confusion and could even generate some troubling headlines....

Homeowners Have Incredible Equity To Leverage Right Now

Homeowners Have Incredible Equity To Leverage Right Now Even though home prices have moderated over the last year, many homeowners still have an incredible amount of equity. But what is equity? In the simplest terms, equity is the difference between the market value...

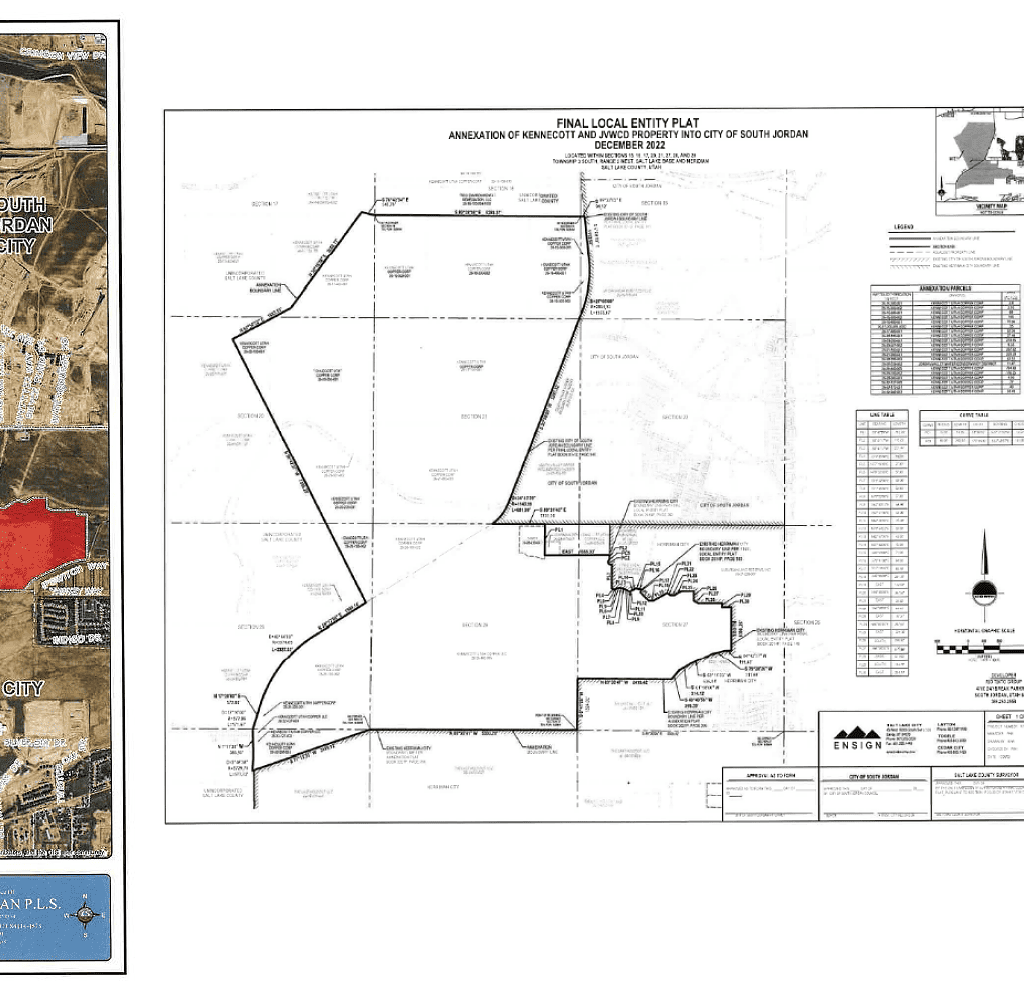

South Jordan City Council has recently announced the annexation of over 2,000 acres of land

South Jordan City Council has recently announced the annexation of over 2,000 acres of land. This move is expected to bring significant growth and development to the area. The annexed land is located in the western part of the city and includes several large parcels...

Is Now a Good Time to Buy in Utah

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY HOME MARKETING SPECIALIST (CLHM) PSA (Pricing Strategy Advisor) General Contractor 2000 (in-active) e-pro (advanced digital marketing)...

Why Today’s Housing Market Is Not About To Crash

Why Today’s Housing Market Is Not About To Crash There’s been some concern lately that the housing market is headed for a crash. And given some of the affordability challenges in the housing market, along with a lot of recession talk in the media, it’s easy enough to...

Cinco de Mayo -Mexican Independence Day!

Today is Cinco de Mayo May 5th Happy Cinco de Mayo! Cinco de Mayo is a holiday that is celebrated in the United States every year on May 5th. While many people associate the holiday with Mexican Independence Day, which is actually celebrated on September 16th, Cinco...

How Homeowners Win When They Downsize

How Homeowners Win When They Downsize Downsizing has long been a popular option when homeowners reach retirement age. But there are plenty of other life changes that could make downsizing worthwhile. Homeowners who have experienced a change in their lives or no longer...

What’s in store for the Housing Market for the rest of 2023, and beyond?

What’s in store for the Housing Market for the rest of 2023, and beyond? According to industry experts, the housing market is expected to remain strong in the coming years, with steady demand and limited supply driving up prices. This trend is likely to continue into...