Why It Makes No Sense to Wait for Spring to Sell

The price of any item (including residential real estate) is determined by the theory of ‘supply and demand.’ If many people are looking to buy an item and the supply of that item is limited, the price of that item increases.

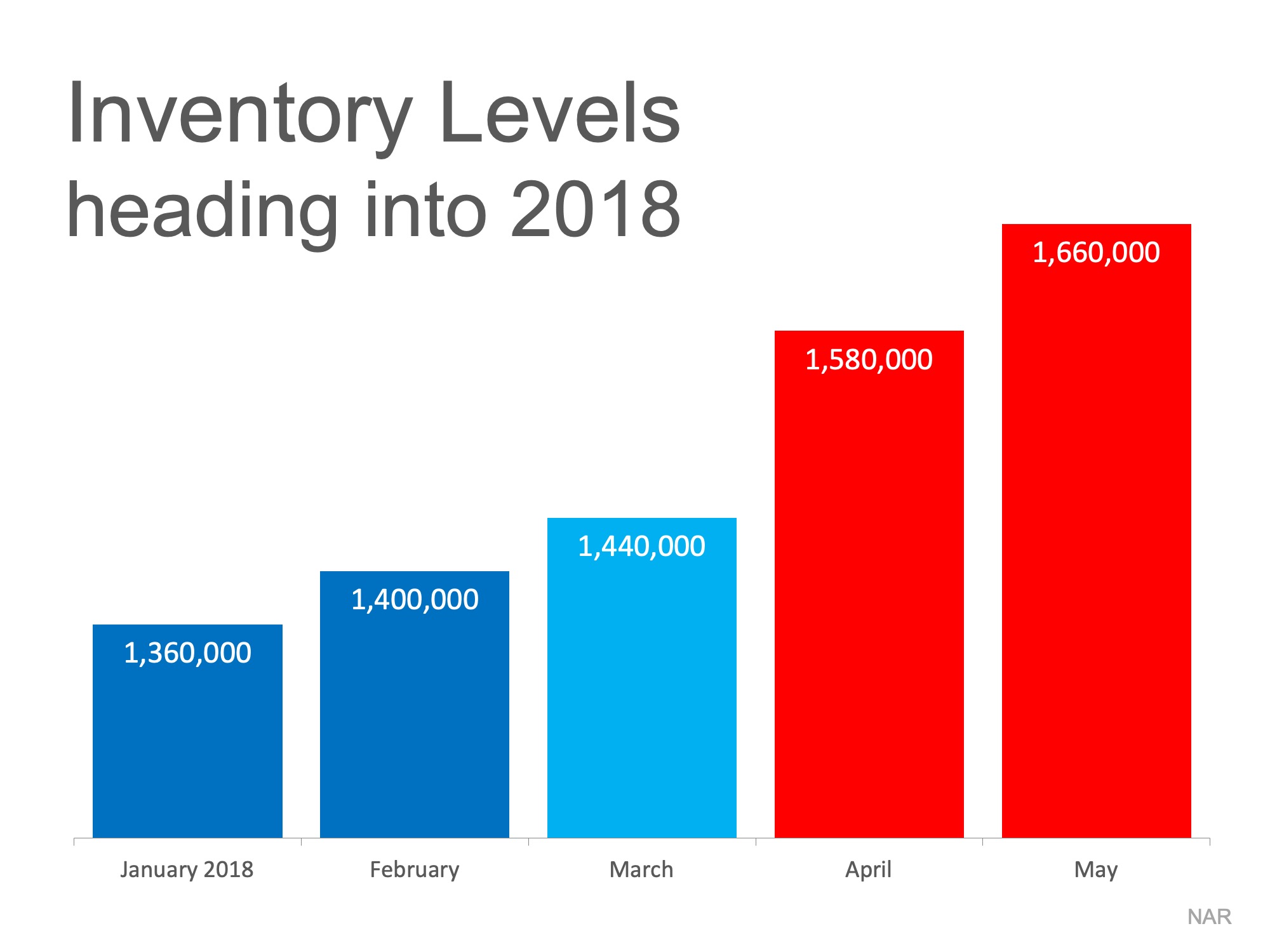

The supply of homes for sale dramatically increases every spring, according to the National Association of Realtors (NAR). As an example, here is what happened to housing inventory at the beginning of 2018:

Putting your home on the market now, rather than waiting for increased competition in the spring, might make a lot of sense.

Bottom Line

Buyers in the market during the winter are truly motivated purchasers and they want to buy now. With limited inventory currently available in most markets, sellers are in a great position to negotiate.

Steps to Take Between Mortgage Closing and Moving Day

After closing on your mortgage, follow this checklist to prepare for moving into your new home. Change your address with the Post Office and update utilities. Review your inspection report for necessary repairs and create a maintenance schedule. Deep clean your new...

Guide for First-Time Homebuyers

Buying your first house can be both exciting and overwhelming. Resources are available to empower you with the knowledge needed for homeownership. You can save up to $1,250, and if you find lower costs elsewhere, there are incentives. Local experts are available to...

Housing Market Predictions 2025

In 2025, the housing market shows slow stabilization with mortgage rates declining from near 7%, boosting buyer interest. Home sales remain sluggish but may rise 6% by year-end, while prices continue modest growth due to limited supply. Inventory has increased,...

What Mortgage Rate Will Get Buyers Moving?

A 6% mortgage rate could make homes affordable for 5.5 million more households, potentially unlocking major buying activity across key U.S. metro areas. NAR forecasts rates falling to 6% by 2026, possibly increasing home sales 14%. Current high rates and inventory...

Homeowner Equity Grows Even as Home Prices Dip

After 3 quarters of slipping, equity-rich homes finally ticked up in Q2 2025. ~50% of U.S. homes with mortgages are now equity-rich. Equity-rich = owing less than 50% of your home’s value. In just one quarter, equity-rich homes jumped from 46.2% to 47.4% nationwide....

Is a 31% Boom in Home Prices Possible by 2029?

US home prices ↑ 19.8% cumulatively from 2025 to 2029, averaging ↑ 3.7% annual growth. Annual growth accelerates to ↑ 10.8% by 2027, then reaches ↑ 19.8% cumulative increase in 2029. Optimistic forecasts predict up to ↑ 31% total growth by 2029, pessimistic as low as...

Happy Labor Day

Happy Labor Day! Labor Day is a day dedicated to honoring the contributions and achievements of workers and the labor movement. It marks summer's informal end in the U.S., as schools often start after the holiday. It offers a chance to ponder the historical...

8 Tips For First-Time Homebuyers

First-time homebuyers should follow eight essential steps: assess debt and ensure a manageable debt-to-income ratio, check and correct credit score errors, review budget for additional costs, determine down payment, get preapproved for a mortgage, identify desired...

2.25% Fed Rate: Coming by 2027?

Fed projects a 2% in rate cuts by end of 2027. Forecast: Fed funds rate to decline to 2.25%–2.50% by late 2027. Despite tariff-driven inflation bumps, slowing growth will push Fed to cut further. 10-year Treasury yield forecast to fall to 3.25% by 2028, down from 4.2%...

2025 Housing Forecast: Housing Prices up 3%

The experts forecast a 3% national housing price increase in 2025 due to limited supply. High mortgage rates discourage homeowners from selling, keeping supply low and supporting price stability.