What FICO® Score Do You Need to Qualify for a Mortgage?

While a recent announcement from CNBC shares that the average national FICO® score has reached an all-time high of 706, the good news for potential buyers is that you don’t need a score that high to qualify for a mortgage. Let’s unpack the credit score myth so you can to become a homeowner sooner than you may think.

With today’s low interest rates, many believe now is a great time to buy – and rightfully so! Fannie Mae recently noted that 58% of Americans surveyed say it is a good time to buy. Similarly, the Q3 2019 HOME Survey by the National Association of Realtors said 63% of people believe now is a good time to buy a home. Unfortunately, fear and misinformation often hold qualified and motivated buyers back from taking the leap into homeownership.

According to the same CNBC article,

“For the first time, the average national credit score has reached 706, according to FICO®, the developer of one of the most commonly used scores by lenders.”

This is great news, as it means Americans are improving their credit scores and building toward a stronger financial future, especially after the market tumbled during the previous decade. With today’s strong economy and increasing wages, many Americans have had the opportunity to improve their credit over the past few years, driving this national average up.

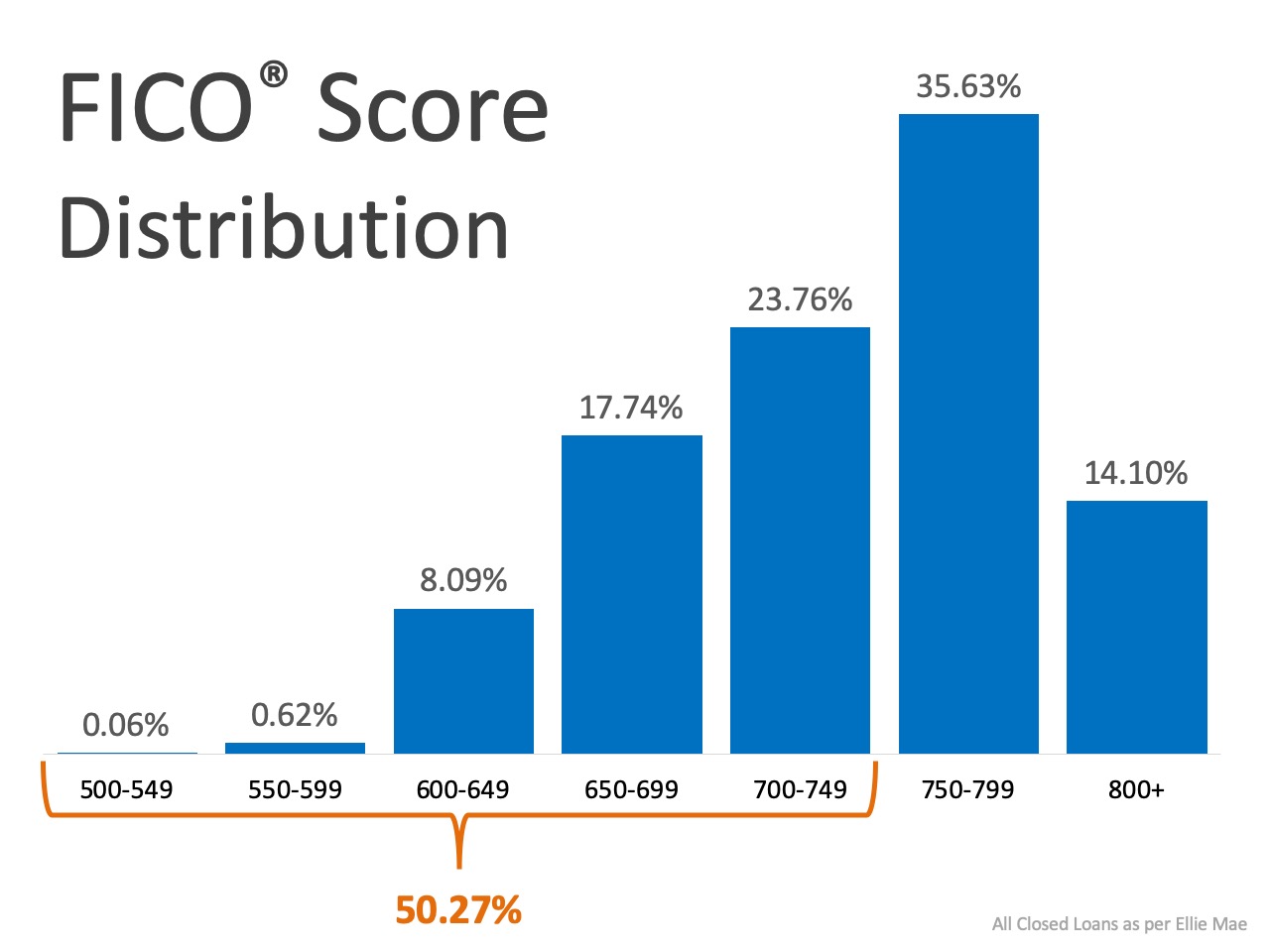

Since Americans with stronger credit are now entering the housing market, we are seeing an increase in the FICO® Score Distribution of Closed Loans (see graph below): But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

FHA Loan: “FHA loans are ideal for those who have less-than-perfect credit and may not be able to qualify for a conventional mortgage loan. The size of your required down payment for an FHA loan depends on the state of your credit score: If your credit score is between 500 and 579, you must put 10% down. If your credit score is 580 or above, you can put as little as 3.5% down (but you can put down more if you want to).”

Conventional Loan: “It’s possible to get approved for a conforming conventional loan with a credit score as low as 620, although some lenders may look for a score of 660 or better.”

USDA Loan: “While the USDA doesn’t have a set credit score requirement, most lenders offering USDA-guaranteed mortgages require a score of at least 640.”

VA Loan: “As with income levels, lenders set their own minimum credit requirements for VA loan borrowers. Lenders are likely to check credit scores as part of their screening process, and most will set a minimum score, or cutoff, that loan applicants must exceed to be considered.”

Bottom Line

As you can see, plenty of loans are granted to buyers with a FICO® score that is lower than the national average. If you’d like to understand the next steps to take when determining your credit score, let’s get together so you can learn more.

Steps to Take Between Mortgage Closing and Moving Day

After closing on your mortgage, follow this checklist to prepare for moving into your new home. Change your address with the Post Office and update utilities. Review your inspection report for necessary repairs and create a maintenance schedule. Deep clean your new...

Guide for First-Time Homebuyers

Buying your first house can be both exciting and overwhelming. Resources are available to empower you with the knowledge needed for homeownership. You can save up to $1,250, and if you find lower costs elsewhere, there are incentives. Local experts are available to...

Housing Market Predictions 2025

In 2025, the housing market shows slow stabilization with mortgage rates declining from near 7%, boosting buyer interest. Home sales remain sluggish but may rise 6% by year-end, while prices continue modest growth due to limited supply. Inventory has increased,...

What Mortgage Rate Will Get Buyers Moving?

A 6% mortgage rate could make homes affordable for 5.5 million more households, potentially unlocking major buying activity across key U.S. metro areas. NAR forecasts rates falling to 6% by 2026, possibly increasing home sales 14%. Current high rates and inventory...

Homeowner Equity Grows Even as Home Prices Dip

After 3 quarters of slipping, equity-rich homes finally ticked up in Q2 2025. ~50% of U.S. homes with mortgages are now equity-rich. Equity-rich = owing less than 50% of your home’s value. In just one quarter, equity-rich homes jumped from 46.2% to 47.4% nationwide....

Is a 31% Boom in Home Prices Possible by 2029?

US home prices ↑ 19.8% cumulatively from 2025 to 2029, averaging ↑ 3.7% annual growth. Annual growth accelerates to ↑ 10.8% by 2027, then reaches ↑ 19.8% cumulative increase in 2029. Optimistic forecasts predict up to ↑ 31% total growth by 2029, pessimistic as low as...

Happy Labor Day

Happy Labor Day! Labor Day is a day dedicated to honoring the contributions and achievements of workers and the labor movement. It marks summer's informal end in the U.S., as schools often start after the holiday. It offers a chance to ponder the historical...

8 Tips For First-Time Homebuyers

First-time homebuyers should follow eight essential steps: assess debt and ensure a manageable debt-to-income ratio, check and correct credit score errors, review budget for additional costs, determine down payment, get preapproved for a mortgage, identify desired...

2.25% Fed Rate: Coming by 2027?

Fed projects a 2% in rate cuts by end of 2027. Forecast: Fed funds rate to decline to 2.25%–2.50% by late 2027. Despite tariff-driven inflation bumps, slowing growth will push Fed to cut further. 10-year Treasury yield forecast to fall to 3.25% by 2028, down from 4.2%...

2025 Housing Forecast: Housing Prices up 3%

The experts forecast a 3% national housing price increase in 2025 due to limited supply. High mortgage rates discourage homeowners from selling, keeping supply low and supporting price stability.