What FICO® Score Do You Need to Qualify for a Mortgage?

While a recent announcement from CNBC shares that the average national FICO® score has reached an all-time high of 706, the good news for potential buyers is that you don’t need a score that high to qualify for a mortgage. Let’s unpack the credit score myth so you can to become a homeowner sooner than you may think.

With today’s low interest rates, many believe now is a great time to buy – and rightfully so! Fannie Mae recently noted that 58% of Americans surveyed say it is a good time to buy. Similarly, the Q3 2019 HOME Survey by the National Association of Realtors said 63% of people believe now is a good time to buy a home. Unfortunately, fear and misinformation often hold qualified and motivated buyers back from taking the leap into homeownership.

According to the same CNBC article,

“For the first time, the average national credit score has reached 706, according to FICO®, the developer of one of the most commonly used scores by lenders.”

This is great news, as it means Americans are improving their credit scores and building toward a stronger financial future, especially after the market tumbled during the previous decade. With today’s strong economy and increasing wages, many Americans have had the opportunity to improve their credit over the past few years, driving this national average up.

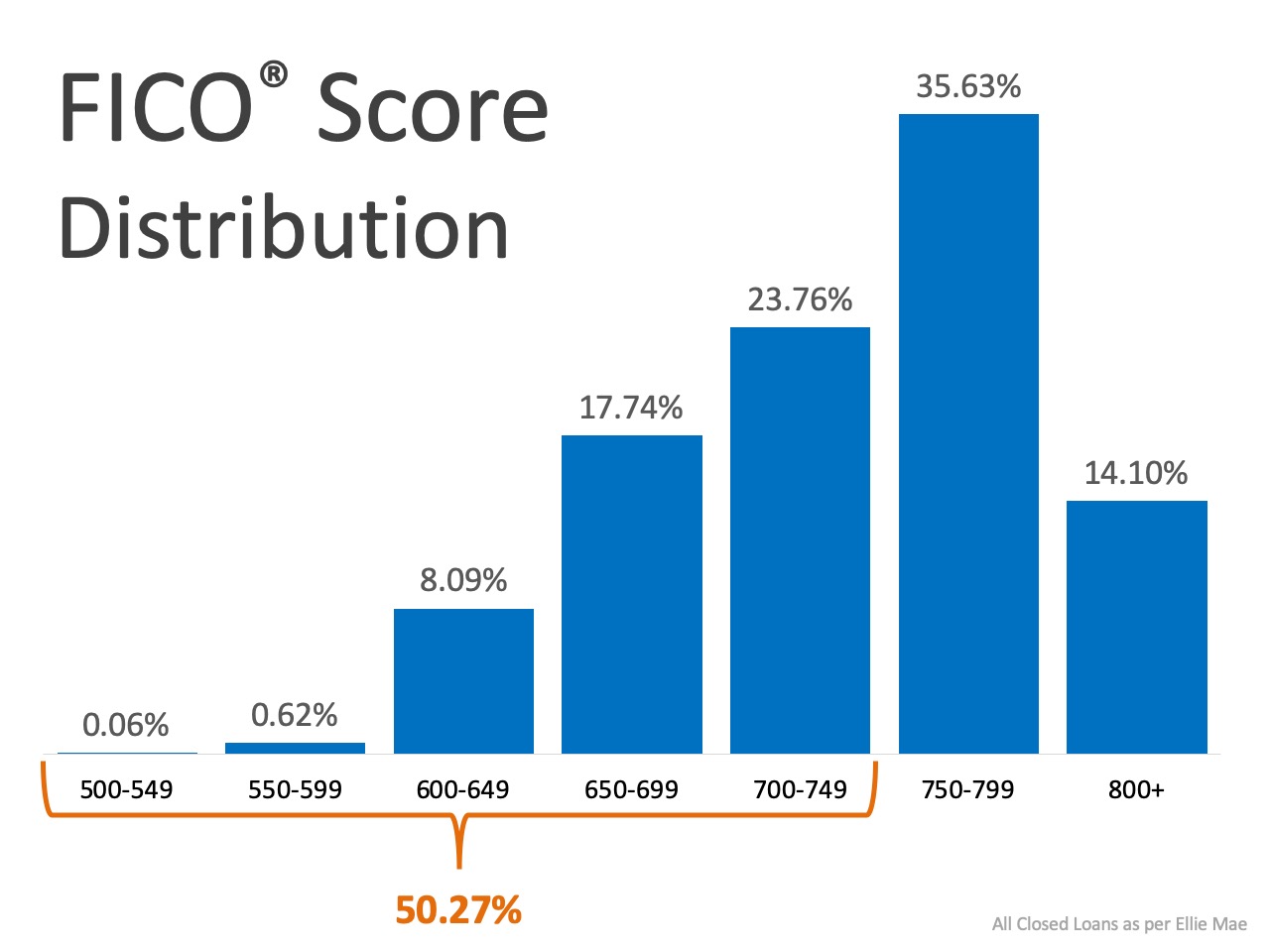

Since Americans with stronger credit are now entering the housing market, we are seeing an increase in the FICO® Score Distribution of Closed Loans (see graph below): But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

FHA Loan: “FHA loans are ideal for those who have less-than-perfect credit and may not be able to qualify for a conventional mortgage loan. The size of your required down payment for an FHA loan depends on the state of your credit score: If your credit score is between 500 and 579, you must put 10% down. If your credit score is 580 or above, you can put as little as 3.5% down (but you can put down more if you want to).”

Conventional Loan: “It’s possible to get approved for a conforming conventional loan with a credit score as low as 620, although some lenders may look for a score of 660 or better.”

USDA Loan: “While the USDA doesn’t have a set credit score requirement, most lenders offering USDA-guaranteed mortgages require a score of at least 640.”

VA Loan: “As with income levels, lenders set their own minimum credit requirements for VA loan borrowers. Lenders are likely to check credit scores as part of their screening process, and most will set a minimum score, or cutoff, that loan applicants must exceed to be considered.”

Bottom Line

As you can see, plenty of loans are granted to buyers with a FICO® score that is lower than the national average. If you’d like to understand the next steps to take when determining your credit score, let’s get together so you can learn more.

Happy Halloween

Halloween falls on October 31 because the ancient Gaelic festival of Samhain, considered the earliest known root of Halloween, occurred on this day. In the eighth century, Pope Gregory III designated November 1 as a time to praise all saints. Soon, All Saints'...

Relocation Trends: Why High-Net-Worth Buyers Are Choosing the Mountain West States

High-net-worth buyers are increasingly relocating to the Mountain West states—Idaho, Montana, Wyoming, Utah, and Colorado—attracted by tax advantages, privacy, natural beauty, and outdoor recreation. Luxury real estate has evolved from rustic cabins to sophisticated...

Buying or Selling: What’s Your Agent Strategy?

Visit Real Estate offices early and ask questions to gauge their professionalism and fit. Understand seller motivations to make offers with attractive terms that could win deals.

How to get a mortgage when you’re self-employed

Self-employed individuals can qualify for a home loan, but they may face additional challenges in proving income stability. To improve approval chances, consider non-conforming loans, make larger down payments, raise credit scores, and lower debts. Lenders require...

Most Affordable Cities to Buy a Home in Utah (2025)

Here is an overview of affordable cities in Utah for homebuyers in 2025, highlighting median prices, cost of living, and unique features for each city. This provides an at-a-glance guide to communities where your housing dollar might stretch further. Most Affordable...

Will the Housing Market Rebound? Predictions for 2025 and 2026

The U.S. housing market is expected to see gradual growth through late 2025 and into 2026, with no major price drops on the horizon. Existing-home sales rose 2% in July 2025, inventory is up 15.7% year-over-year, and the median price is holding steady at $422,400....

Global Real Estate: $19.5T by 2031

The global residential Real Estate market will reach USD 19.5T by 2031, growing at 9.2% CAGR. Urban growth in emerging nations will drive increased demand for residential Real Estate by 2030.

Salt Lake County Shines as Top Choice for New Families

Childcare costs as a percent of median household income: 21.34% Housing costs as a percentage of median household income: 20.84% Percentage of population under age 10: 13.12% Number of children under age 10: 155,636 Ratio of total population to primary care...

Top 10 Tips for First-Time Homebuyers

First-time homebuyers should identify their current and future needs, understand the true cost of homeownership including taxes and maintenance, and start saving early for down payments and closing costs. Building and managing credit wisely is crucial. Research...

Time to Sell? Key Market Signals

Outgrowing or underusing your space signals it might be time to sell and move on. A strong seller’s market boosts sale price, speed, and overall success of your listing.