What FICO® Score Do You Need to Qualify for a Mortgage?

While a recent announcement from CNBC shares that the average national FICO® score has reached an all-time high of 706, the good news for potential buyers is that you don’t need a score that high to qualify for a mortgage. Let’s unpack the credit score myth so you can to become a homeowner sooner than you may think.

With today’s low interest rates, many believe now is a great time to buy – and rightfully so! Fannie Mae recently noted that 58% of Americans surveyed say it is a good time to buy. Similarly, the Q3 2019 HOME Survey by the National Association of Realtors said 63% of people believe now is a good time to buy a home. Unfortunately, fear and misinformation often hold qualified and motivated buyers back from taking the leap into homeownership.

According to the same CNBC article,

“For the first time, the average national credit score has reached 706, according to FICO®, the developer of one of the most commonly used scores by lenders.”

This is great news, as it means Americans are improving their credit scores and building toward a stronger financial future, especially after the market tumbled during the previous decade. With today’s strong economy and increasing wages, many Americans have had the opportunity to improve their credit over the past few years, driving this national average up.

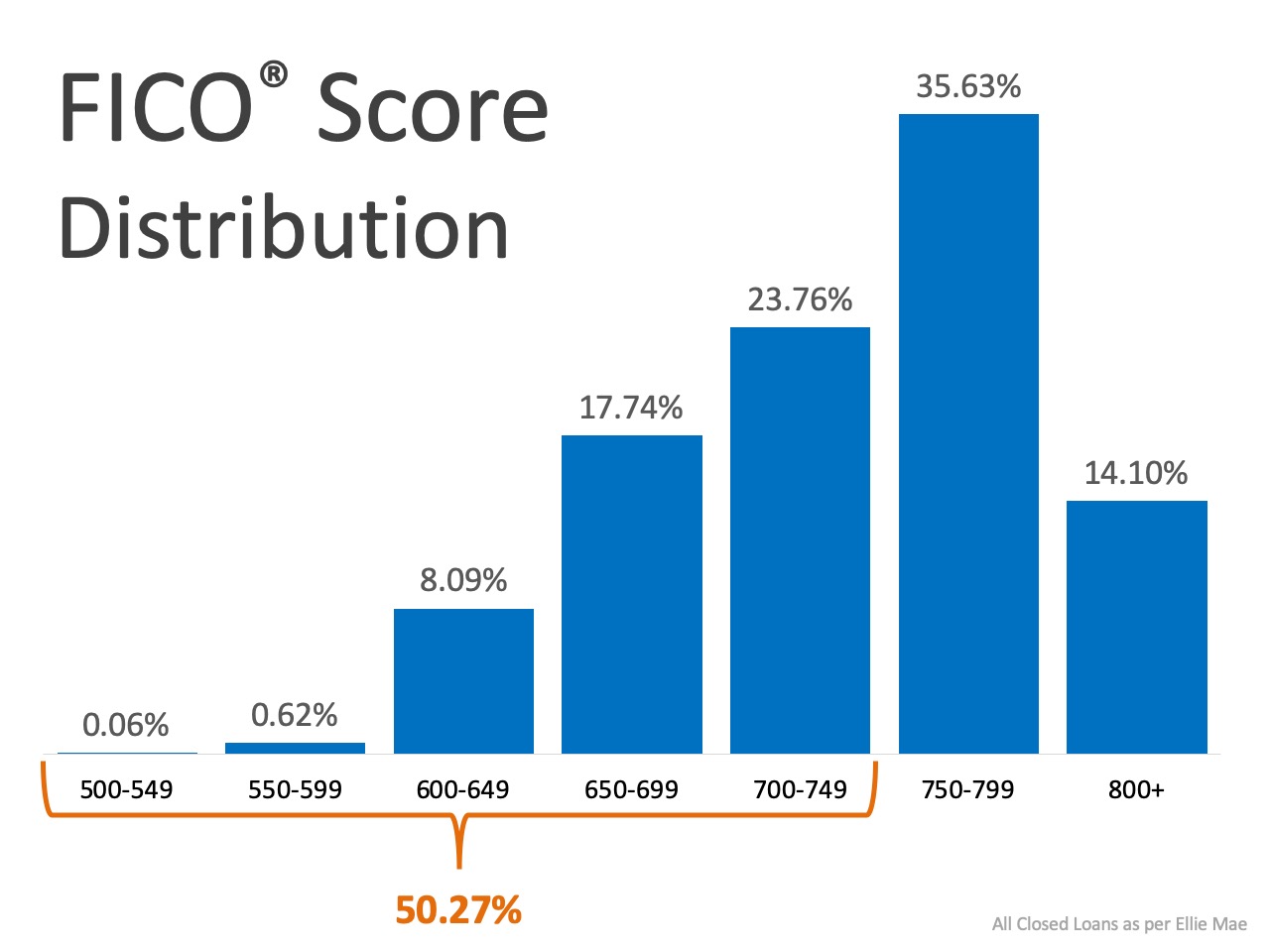

Since Americans with stronger credit are now entering the housing market, we are seeing an increase in the FICO® Score Distribution of Closed Loans (see graph below): But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

But hang on – don’t forget that this does not mean you need a FICO® score over 700 to qualify for a mortgage. Here’s what Experian, the global leader in consumer and business credit reporting, says:

FHA Loan: “FHA loans are ideal for those who have less-than-perfect credit and may not be able to qualify for a conventional mortgage loan. The size of your required down payment for an FHA loan depends on the state of your credit score: If your credit score is between 500 and 579, you must put 10% down. If your credit score is 580 or above, you can put as little as 3.5% down (but you can put down more if you want to).”

Conventional Loan: “It’s possible to get approved for a conforming conventional loan with a credit score as low as 620, although some lenders may look for a score of 660 or better.”

USDA Loan: “While the USDA doesn’t have a set credit score requirement, most lenders offering USDA-guaranteed mortgages require a score of at least 640.”

VA Loan: “As with income levels, lenders set their own minimum credit requirements for VA loan borrowers. Lenders are likely to check credit scores as part of their screening process, and most will set a minimum score, or cutoff, that loan applicants must exceed to be considered.”

Bottom Line

As you can see, plenty of loans are granted to buyers with a FICO® score that is lower than the national average. If you’d like to understand the next steps to take when determining your credit score, let’s get together so you can learn more.

The Perks of Downsizing When You Retire

The Perks of Downsizing When You Retire Some Highlights If you’re about to retire, or just did, downsizing can be a good way to try to cut down on some of your expenses. Smaller homes typically have lower energy and maintenance costs. Plus, you may have...

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home You may have heard headlines in the news lately about agents in the real estate industry and discussions about their commissions. And if you’re following along, it can be pretty confusing....

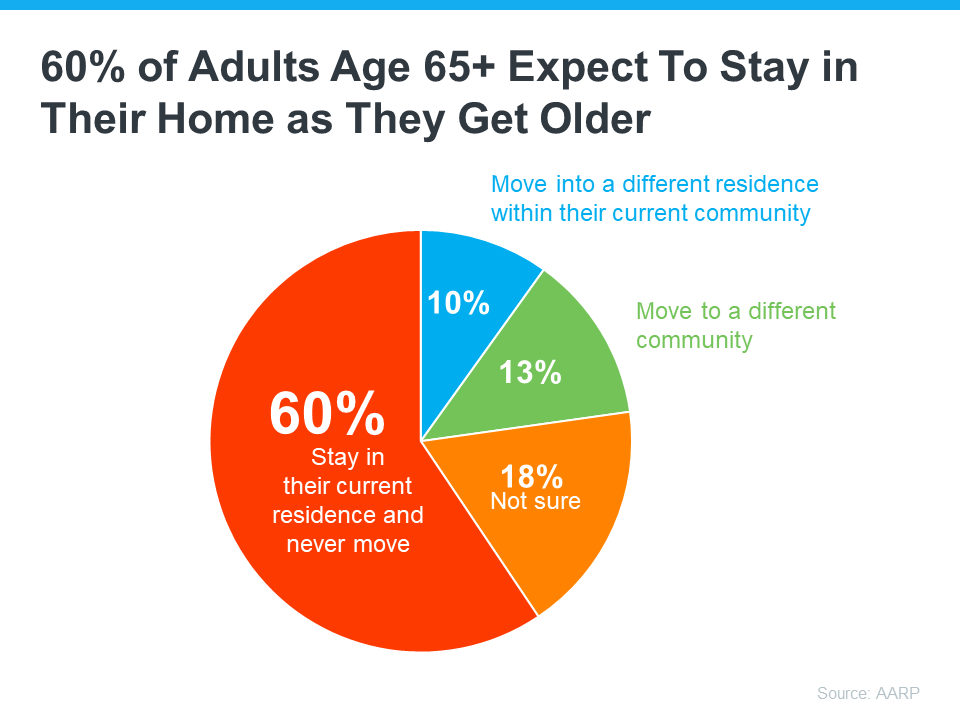

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami Have you heard the term “Silver Tsunami” getting tossed around recently? If so, here’s what you really need to know. That phrase refers to the idea that a lot of baby boomers are going to move or downsize...

Utah Licensed Real Estate Agents

In the past, we have had over 30,000 Active licenses. At the End of 2023 here is where we stand. Data is sourced from the Utah Division of Real Estate 22, 853 Active Licensees Sales Agent - 18,517 Principal Broker - 2442 Branch Broker - 171 Inactive - 4016 In...

11 Must-Do Actions To Ensure A Smooth Transition Into Your New Residence

11 Must-Do Actions To Ensure A Smooth Transition Into Your New Residence Moving into a new residence marks a significant milestone that brims with excitement and potential. However, to translate this new beginning into a seamless transition, careful planning and a...

3 Helpful Tips for First-Time Homebuyers

3 Helpful Tips for First-Time Homebuyers Some Highlights Trying to buy your first home? If you’re worried about affordability today or the limited number of homes for sale, these tips can help. Look into homebuyer programs, expand your search area, and consider...

Short list of things that you must get rid of before moving

Embarking on a new chapter of your life by relocating to a different home can be an exciting yet daunting process. The key to ensuring a smooth and stress-free move lies in effective preparation and organization, of which a critical component is the pre-move purge....

What Are Experts Saying About the Spring Housing Market?

What Are Experts Saying About the Spring Housing Market? If you’re planning to move soon, you might be wondering if there'll be more homes to choose from, where prices and mortgage rates are headed, and how to navigate today’s market. If so, here's what the...

NAR Lawsuit Update – How does this effect Utah Realty?

NAR Lawsuit Update What we Know.... The NAR has reached a settlement agreement on the class action lawsuits relating to the offer of compensation rule. Details are in the link below. There is much to digest and more info and training will come out in the days ahead....

Why Access Is So Important When Selling Your House

Why Access Is So Important When Selling Your House If you’re gearing up to sell your house this spring, one of the early conversations you’ll have with your agent is about how much access you want to give buyers. And you may not realize just how important it is to...