What Credit Score Do You Need To Buy A House?

There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are misinformed!

Only 25% of the Americans have a FICO® Score between 740 and 800. Here is the breakdown according to Experian:

- 16% Very Poor (300-579)

- 18% Fair (580-669)

- 21% Good (670-739)

- 25% Very Good (740-799)

- 20% Exceptional (800-850)

Randy Hopper, Senior Vice President of Mortgage Lending for Navy Federal Credit Union said,

“Just because you have a low credit score doesn’t mean you can’t purchase a home. There are a lot of options out there for consumers with low FICO® scores,”

There are many programs available with low or no credit score requirement. The Federal Housing Administration (FHA) now requires a minimum FICO® score of 580 if you want to qualify for the low down payment advantage. The US Department of Agriculture (USDA) does not set a minimum credit score requirement, but most lenders require a score of at least 640. Veterans Affairs (VA) loans have no credit score requirement.

As you can see, none of them are above 700!

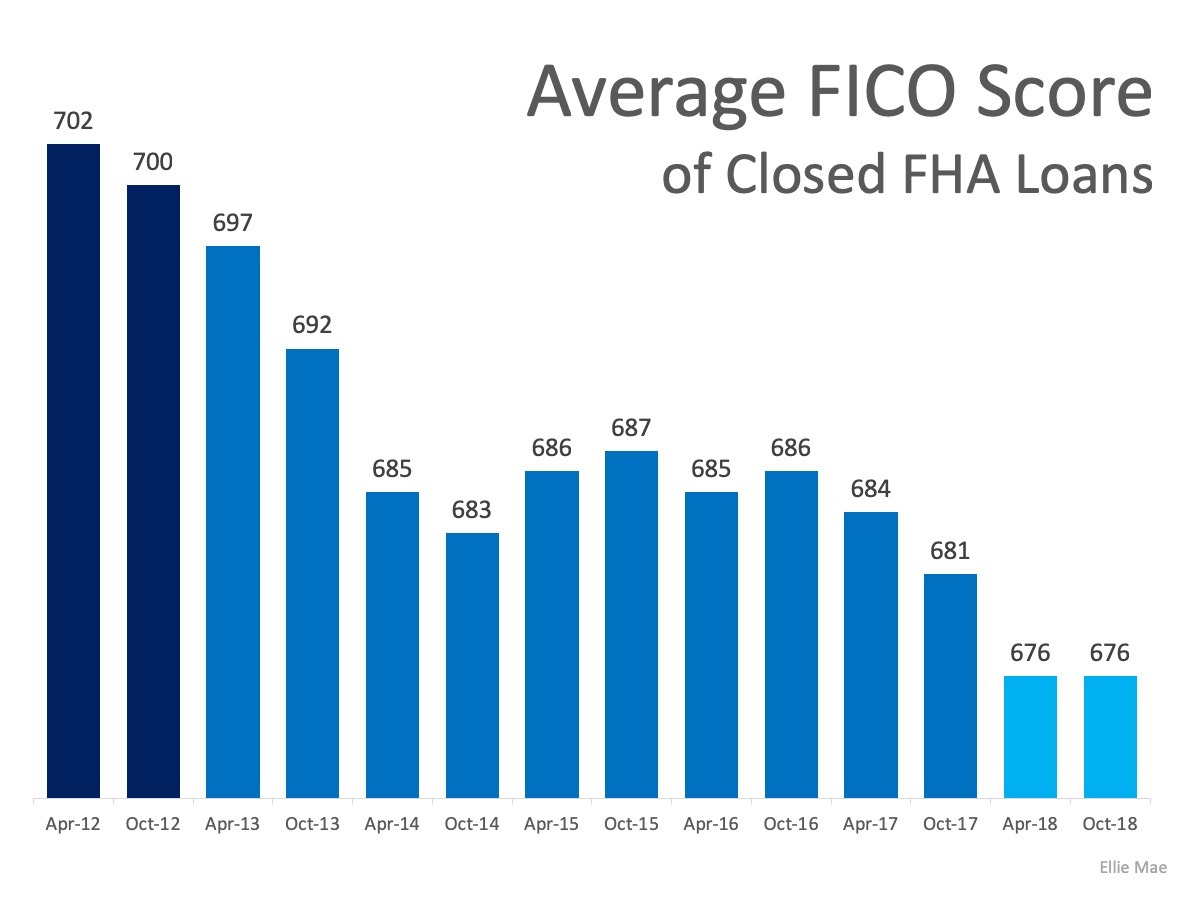

It is true that the average FICO® score for all closed loans in January was 726, but there are plenty of people taking advantage of the low credit score requirements. Here is the average FICO® Score of closed FHA Loans since April 2012 according to Ellie Mae: As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year.

FICO® reported,

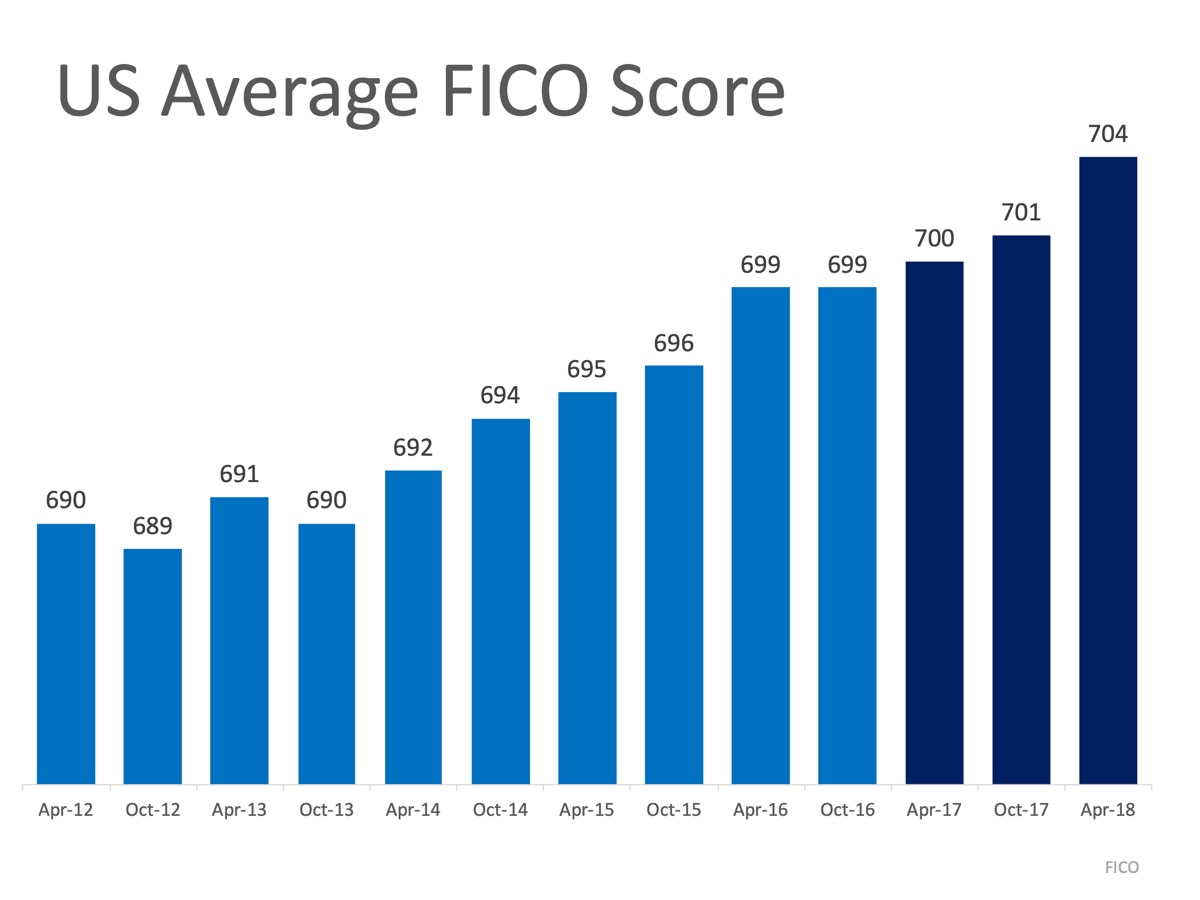

“Since October 2009, the average year-over-year FICO® Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.”

Here is the increase in the average US FICO® Score over the same period of time as the graph earlier.

Bottom Line

At least 84% of Americans have a score that will allow them to buy a house. If you are unsure what your score is or would like to improve your score in order to become a homeowner, let’s get together to help you set a path to reach your dream!

Entry-Level Homeowners Are in the Driver’s Seat

Entry-Level Homeowners Are in the Driver’s Seat One thing helping homeowners right now is price appreciation, especially in the entry-level market. In the latest Home Price Insights report, CoreLogic reveals how home prices increased by 4% year-over-year and projects...

Opportunity in the Luxury Market This Year

Opportunity in the Luxury Market This Year Homes priced in the top 25% of a price range for a particular area of the country are considered “premium homes.” At the start of last year, many of the more expensive homes listed for sale hadn’t seen as much interest, since...

Whats Trending in Outdoor Kitchens?

Outdoor kitchens have been popular for years. Not only do they give you an excuse to enjoy beautiful weather outdoors but they’re also great for entertaining. Having a nice outdoor kitchen can even improve the overall value of your home! While these kitchens...

Breaking News Housing Inventory

Breaking News! Housing Inventory Is Falling! February 2-22-20 Utah Active Homes From Utah Real Estate >>> 6161 Salt Lake County Active Homes for Sale >>> 1265 Utah County Active Homes for Sale >>> 1387 Davis County Active Homes for Sale...

![Interest Rates Over Time [INFOGRAPHIC]](https://files.mykcm.com/2020/02/20093247/20200221-MEM-1046x837.jpg)

Interest Rates Over Time [INFOGRAPHIC]

Interest Rates Over Time [INFOGRAPHIC] Some Highlights: With interest rates hovering at near historic lows, now is a great time to look back at where they’ve been, and how much they’ve changed over time. According to Freddie Mac, mortgage interest rates are currently...

You May Have More Home Equity Than You Think

You May Have More Home Equity Than You Think With home values appreciating, there's a good chance you have more home equity than you think. Let's connect to explore how you can use your equity in your next move.

The #1 Misconception in the Homebuying Process

The #1 Misconception in the Homebuying Process After over a year of moderating home prices, it appears home value appreciation is about to reaccelerate. Skylar Olsen, Director of Economic Research at Zillow, explained in a recent article: “A year ago, a combination...

The Many Benefits of Aging in a Community

The Many Benefits of Aging in a Community There’s comfort in being around people who share common interests, goals, and challenges. That comfort in a community doesn’t wane with age – it actually deepens. Whether it’s proudly talking about grandchildren or lamenting...

Ways to Declutter Before Listing the Family Home

Ways to Declutter Before Listing the Family Home 1. Toss the Trash We often become “clutter blind” to things that collect in our homes. If you have mail waiting to be sorted, handled, and discarded, magazines and newspapers you intended toread (but probably won’t),...

Adapting Your Home

Adapting with Age Most of us would prefer to age in our current home. But as health and aging issues make more areas of the home hard to access or pose a greater risk of injury, doing so can be difficult. We can begin to feel trapped and that selling our home is the...