What Credit Score Do You Need To Buy A House?

There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are misinformed!

Only 25% of the Americans have a FICO® Score between 740 and 800. Here is the breakdown according to Experian:

- 16% Very Poor (300-579)

- 18% Fair (580-669)

- 21% Good (670-739)

- 25% Very Good (740-799)

- 20% Exceptional (800-850)

Randy Hopper, Senior Vice President of Mortgage Lending for Navy Federal Credit Union said,

“Just because you have a low credit score doesn’t mean you can’t purchase a home. There are a lot of options out there for consumers with low FICO® scores,”

There are many programs available with low or no credit score requirement. The Federal Housing Administration (FHA) now requires a minimum FICO® score of 580 if you want to qualify for the low down payment advantage. The US Department of Agriculture (USDA) does not set a minimum credit score requirement, but most lenders require a score of at least 640. Veterans Affairs (VA) loans have no credit score requirement.

As you can see, none of them are above 700!

It is true that the average FICO® score for all closed loans in January was 726, but there are plenty of people taking advantage of the low credit score requirements. Here is the average FICO® Score of closed FHA Loans since April 2012 according to Ellie Mae: As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year.

FICO® reported,

“Since October 2009, the average year-over-year FICO® Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.”

Here is the increase in the average US FICO® Score over the same period of time as the graph earlier.

Bottom Line

At least 84% of Americans have a score that will allow them to buy a house. If you are unsure what your score is or would like to improve your score in order to become a homeowner, let’s get together to help you set a path to reach your dream!

3 Graphs To Show This Isn’t a Housing Bubble

3 Graphs To Show This Isn’t a Housing Bubble With all the headlines and buzz in the media, some consumers believe the market is in a housing bubble. As the housing market shifts, you may be wondering what’ll happen next. It’s only natural for concerns to creep in that...

Why the Forbearance Program Changed the Housing Market

Why the Forbearance Program Changed the Housing Market When the pandemic hit in 2020, many experts thought the housing market would crash. They feared job loss and economic uncertainty would lead to a wave of foreclosures similar to when the housing bubble burst over...

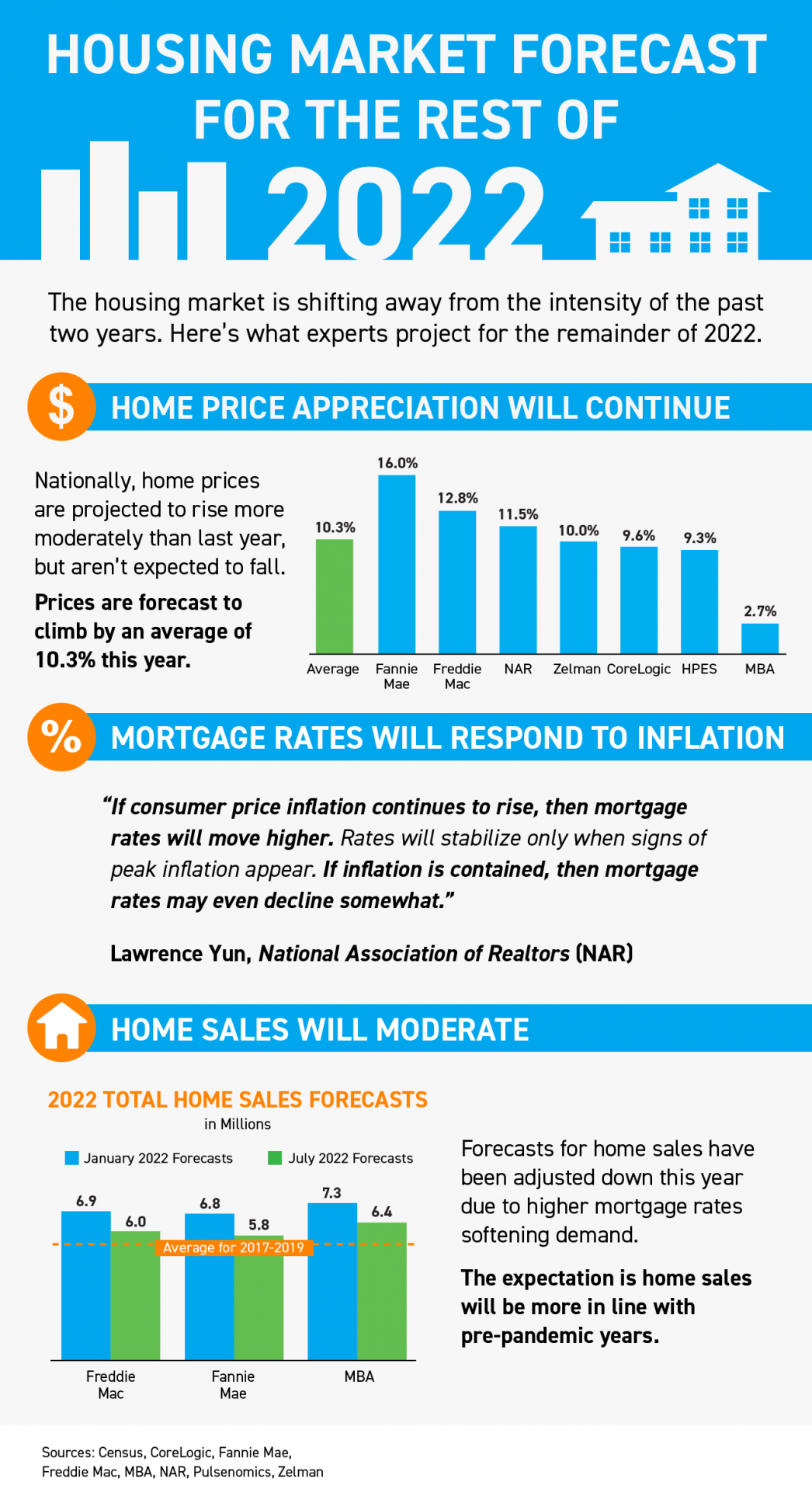

Housing Market Forecast for the Rest of 2022

Housing Market Forecast for the Rest of 2022 Some Highlights The housing market is shifting away from the intensity of the past two years. Here’s what experts project for the remainder of 2022. Home prices are forecast to rise more moderately than last year. Mortgage...

Why It’s Still a Sellers’ Market

Why It’s Still a Sellers’ Market As there’s more and more talk about the real estate market cooling off from the peak frenzy it saw during the pandemic, you may be questioning what that means for your plans to sell your house. If you’re thinking of making a move, you...

Pre-Approval Is a Strategic Move When You’re Buying a Home

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...

Expert Housing Market Forecasts for the Second Half of the Year

Expert Housing Market Forecasts for the Second Half of the Year The housing market is at a turning point, and if you’re thinking of buying or selling a home, that may leave you wondering: is it still a good time to buy a home? Should I make a move this year? To help...

Happy 4th of July

Happy Independence Day

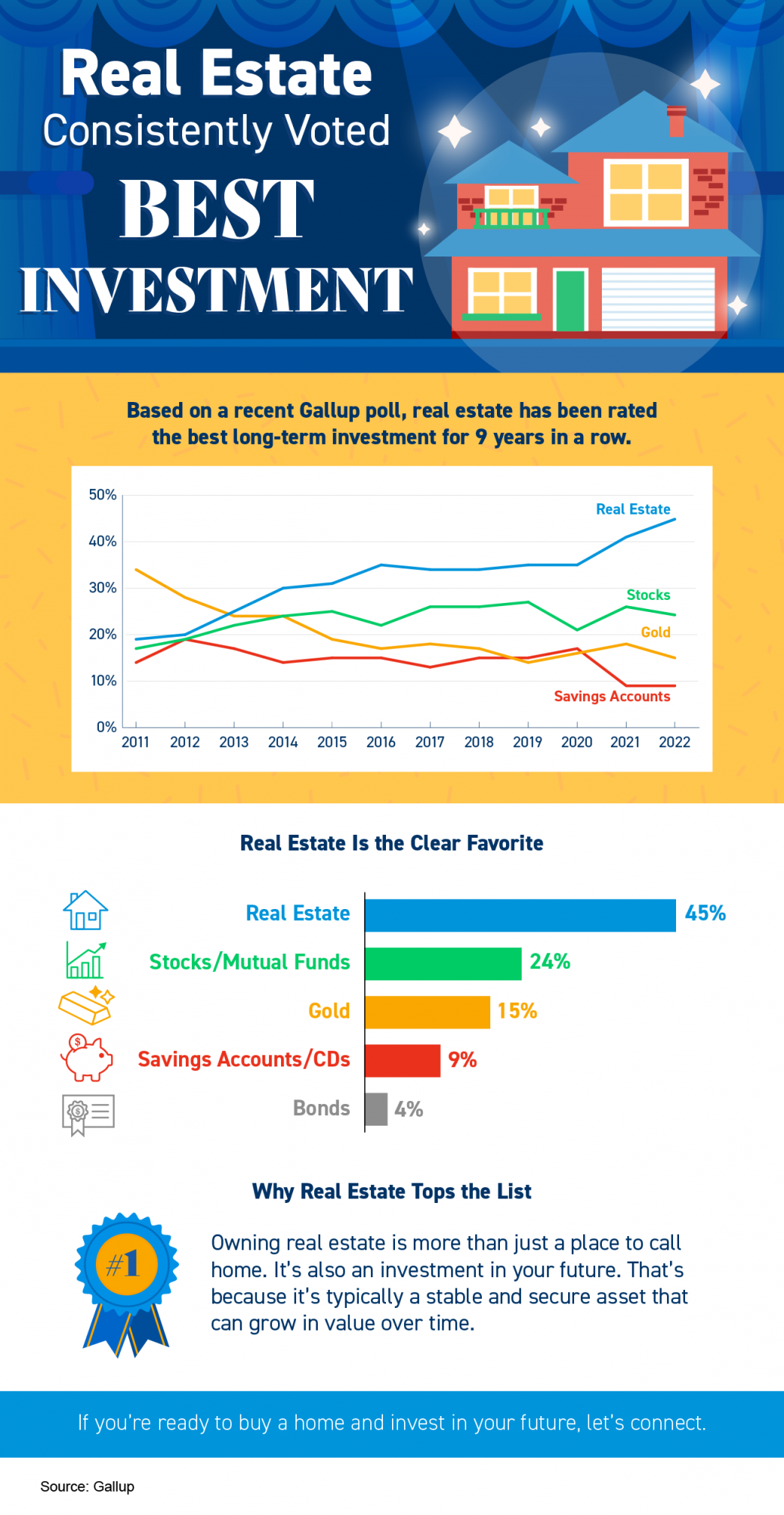

Real Estate Consistently Voted Best Investment

Real Estate Consistently Voted Best Investment Some Highlights Based on a recent Gallup poll, real estate has been rated the best long-term investment for nine years in a row. Owning real estate is more than just a place to call home. It’s also an investment in your...

Why an Agent Is Essential When Pricing Your House

Why an Agent Is Essential When Pricing Your House Some Highlights When it comes to pricing your house, there’s a lot to consider. The only way to ensure you price it right is by partnering with a local real estate professional. To find the best price, your agent...

A Recession Doesn’t Equal a Housing Crisis

If you're following the news, you might be wondering what could happen to the housing market if there's a recession. Let's connect to discuss why history shows a recession doesn't equal a housing crisis.Buy or Sell with Marty Gale "Its The Experience" Principal Broker...