What Credit Score Do You Need To Buy A House?

There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are misinformed!

Only 25% of the Americans have a FICO® Score between 740 and 800. Here is the breakdown according to Experian:

- 16% Very Poor (300-579)

- 18% Fair (580-669)

- 21% Good (670-739)

- 25% Very Good (740-799)

- 20% Exceptional (800-850)

Randy Hopper, Senior Vice President of Mortgage Lending for Navy Federal Credit Union said,

“Just because you have a low credit score doesn’t mean you can’t purchase a home. There are a lot of options out there for consumers with low FICO® scores,”

There are many programs available with low or no credit score requirement. The Federal Housing Administration (FHA) now requires a minimum FICO® score of 580 if you want to qualify for the low down payment advantage. The US Department of Agriculture (USDA) does not set a minimum credit score requirement, but most lenders require a score of at least 640. Veterans Affairs (VA) loans have no credit score requirement.

As you can see, none of them are above 700!

It is true that the average FICO® score for all closed loans in January was 726, but there are plenty of people taking advantage of the low credit score requirements. Here is the average FICO® Score of closed FHA Loans since April 2012 according to Ellie Mae: As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year.

FICO® reported,

“Since October 2009, the average year-over-year FICO® Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.”

Here is the increase in the average US FICO® Score over the same period of time as the graph earlier.

Bottom Line

At least 84% of Americans have a score that will allow them to buy a house. If you are unsure what your score is or would like to improve your score in order to become a homeowner, let’s get together to help you set a path to reach your dream!

Expert News on Mortgage Rates

What Do Experts Say About Today’s Mortgage Rates? Mortgage rates are hovering near record lows, and that’s good news for today’s homebuyers. The graph below shows mortgage rates dating back to 2016 and where today falls by comparison.Generally speaking, when rates are...

Auto DraftTime Is Money When It Comes to Your Home

If you bought your home a number of years ago, chances are you have a lot of opportunities between your home equity and today's low mortgage rates. Let's connect to make sure you don't miss out.

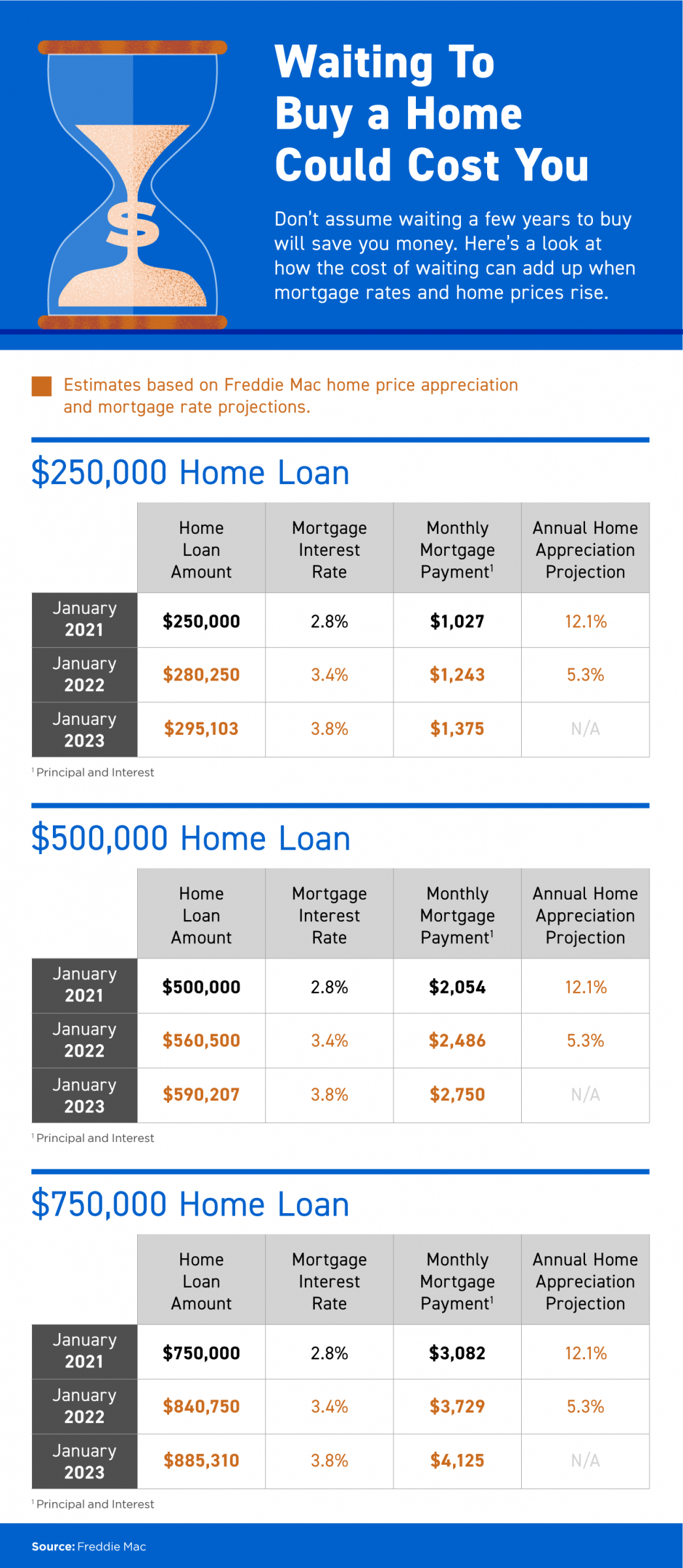

Important News! Buying a Home Could Cost You!

Waiting To Buy a Home Could Cost You Some Highlights If you’re thinking of buying a home but wondering if waiting a few years will save you in the long run, think again. The longer the wait, the more you’ll pay, especially when mortgage rates and home prices rise....

A Look at Home Price Appreciation Through 2025

A Look at Home Price Appreciation Through 2025 Home prices have increased significantly over the last year, which in turn has grown the net worth of homeowners. Appreciation and home equity are directly linked – as the value of a home increases, so does a homeowner’s...

Happy Independence Day

Happy Independence Day!Wishing you a happy and safe Independence Day.

What Do Experts See on the Horizon for the Second Half of the Year 2021?

What Do Experts See on the Horizon for the Second Half of the Year?As we move into the latter half of the year, questions about what’s to come are top of mind for buyers and sellers. Near record-low mortgage rates coupled with rising home price appreciation kicked off...

What To Expect as Appraisal Gaps Grow

What To Expect as Appraisal Gaps GrowIn today’s real estate market, low inventory and high demand are driving up home prices. As many as 54% of homes are getting offers over the listing price, based on the latest Realtors Confidence Index from the National Association...

Save Time and Effort by Selling with the Right Agent

Save Time and Effort by Selling with the Right AgentSelling a house is a time-consuming process – especially if you decide to do it on your own, known as a For Sale By Owner (FSBO). From conducting market research to reviewing legal documents, handling negotiations,...

Tips for Today’s Sellers

Tips for Today's Sellers Even in today's ultimate sellers' market, it's key to have an expert guide when you sell your house. Let's connect to optimize your home sale this summer.

Don’t Wait To Sell Your House

Don’t Wait To Sell Your HouseWe’re in the ultimate sellers’ market right now. If you’re a homeowner thinking about selling, you have a huge advantage in today’s housing market. High buyer demand paired with very few houses for sale makes this the optimal time to sell...