A mother and her son are hugging in their living room. The mother is wearing a military uniform.

Today, on Veterans Day, we salute those who have served our country in war or peace, and we thank them for their sacrifice.

This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI Bill. Since 1944, this law has created opportunities for those who have served our country, ranging from vocational training to home loans.

Facts About VA Home Loans:

- Nearly 24 million home loans have been guaranteed by the Veterans Administration.

- Nearly 82% of VA home loans are made with no down payment.

- The VA also provides grants to help seriously disabled Veterans purchase, modify, or construct a home to meet their needs. Last year the VA provided 2,000 grants totaling $104 million.

Benefits of a VA Home Loan:

- No down payment

- No Private Mortgage Insurance*

- Lower credit score requirements

- Limitation on closing costs

- Lower average interest rates

*More information on VA Home Loan Fees

Bottom Line

The best thing you can do today to celebrate Veterans Day is to share this information with those who can benefit from these opportunities. For more information, or to find out how to qualify to use a VA Home Loan Benefit, let’s get together to navigate through the process. Thank you for your service!

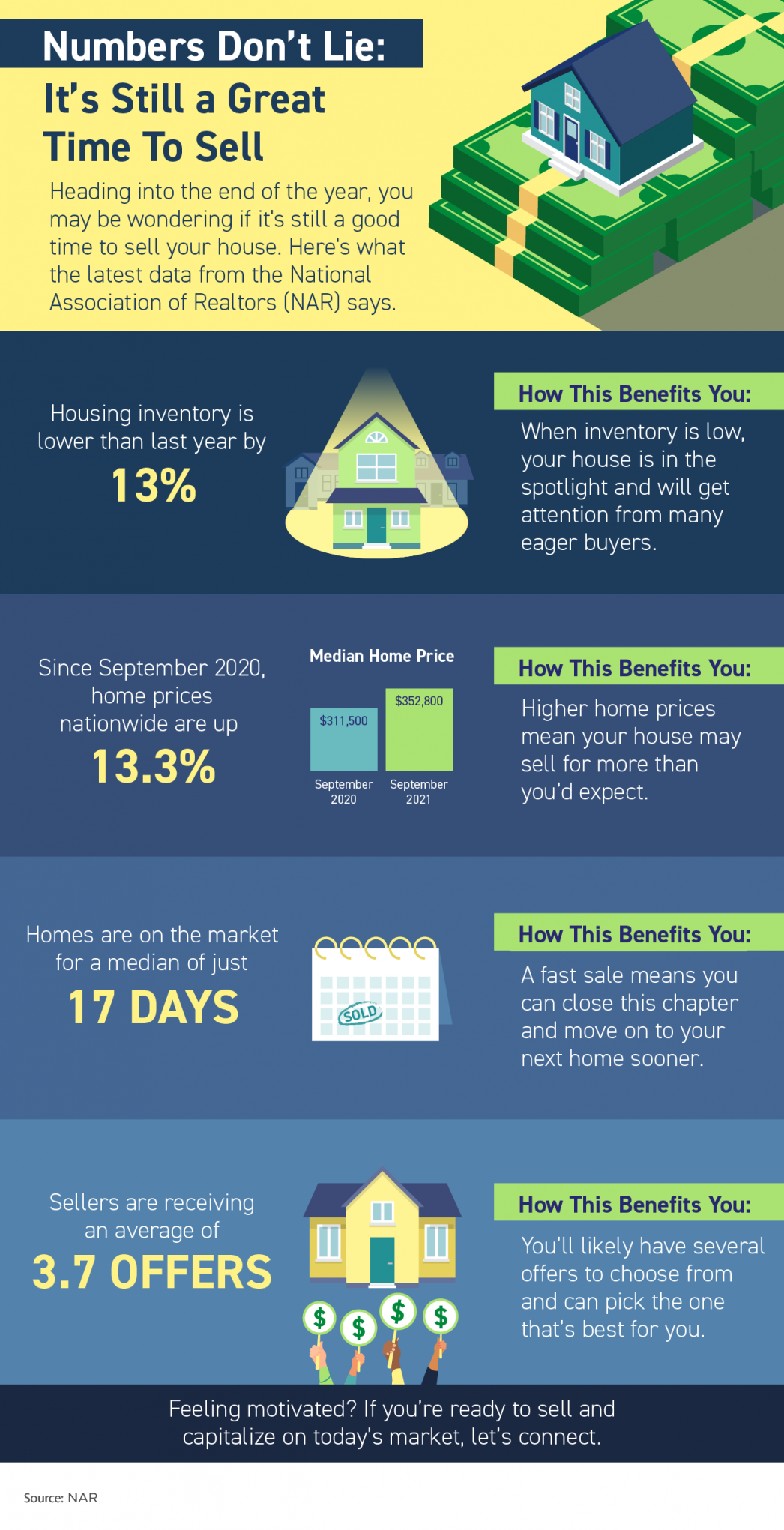

Numbers Don’t Lie – It’s Still a Great Time To Sell

Numbers Don’t Lie – It’s Still a Great Time To Sell Some Highlights Heading into the end of the year, you might wonder if it’s still a good time to sell your house. Here’s what the latest data from the National Association of Realtors (NAR) says. Housing supply is...

Experts Project Mortgage Rates Will Continue To Rise in 2022

Experts Project Mortgage Rates Will Continue To Rise in 2022 Mortgage rates are one of several factors that impact how much you can afford if you’re buying a home. When rates are low, they help you get more house for your money. Within the last year, mortgage rates...

Sellers Have Incredible Leverage in Today’s Market

Sellers Have Incredible Leverage in Today’s Market With mortgage rates climbing above 3% for the first time in months, serious buyers are more motivated than ever to find a home before the end of the year. Lawrence Yun, Chief Economist for the National Association of...

The Mortgage Process Doesn’t Have To Be Scary

The Mortgage Process Doesn’t Have To Be Scary Some Highlights Applying for a mortgage is a big step towards homeownership, but it doesn’t need to be one you fear. Here are some tips to help you prepare. Know your credit score and work to build strong credit. When...

Housing Challenge or Housing Opportunity? It Depends.

Housing Challenge or Housing Opportunity? It Depends. The biggest challenge in real estate today is the lack of available homes for sale. The low housing supply has caused homes throughout the country to appreciate at a much faster rate than what we’ve experienced...

There Are More Homes Available Now than There Were This Spring

There Are More Homes Available Now than There Were This Spring There’s a lot of talk lately about how challenging it can be to find a home to buy. While housing inventory is still low, there are a few important things to understand about the supply of homes for sale...

Knowledge Is Power When It Comes to Appraisals and Inspections

Knowledge Is Power When It Comes to Appraisals and Inspections Buyers in today’s market often have questions about the importance of getting a home appraisal and an inspection. That’s because high buyer demand and low housing supply are driving intense competition and...

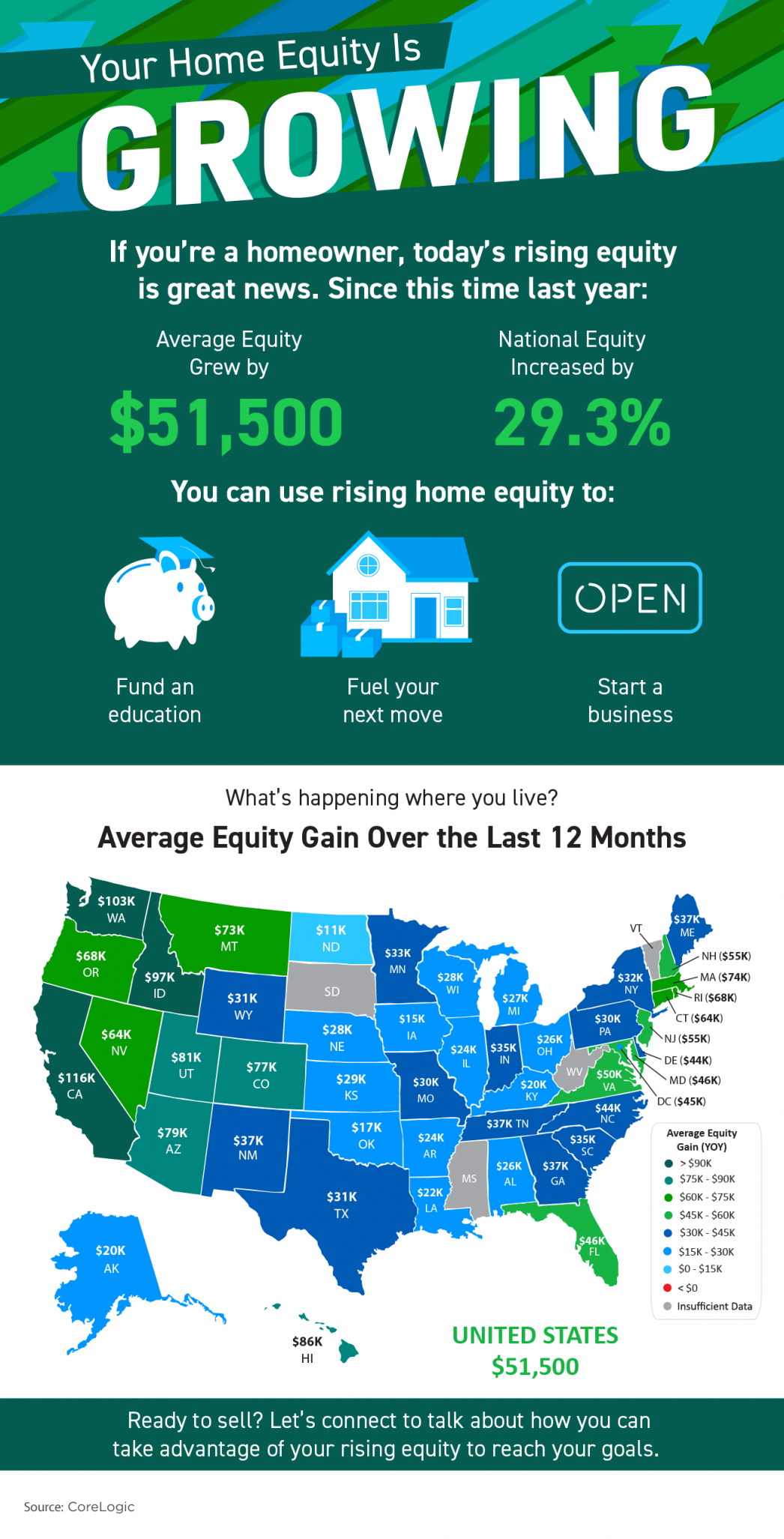

Your Home Equity Is Growing

Your Home Equity Is Growing Some Highlights If you’re a homeowner, today’s rising equity is great news. On average, homeowners have gained $51,500 in equity since this time last year. Whether it’s funding an education, fueling your next move, or starting a business,...

Important Distinction: Homes Are Less Affordable, Not Unaffordable

Important Distinction: Homes Are Less Affordable, Not Unaffordable It’s impossible to research the subject of buying a home without coming across a headline declaring that the fall in home affordability is a crisis. However, when we add context to the most recent...

Perfect Combination

In today’s housing market, houses are selling quickly and are receiving multiple offers from eager buyers. That combination means it’s a great time to sell. DM me so we can discuss how your house plus today’s sellers’ market adds up to a great opportunity for you this...