Did you know?

Utah Housing has made some changes to our Loan Programs; these changes will become effective with Mortgage Purchase Agreements (interest rate locks) issued on or after February 11, 2019. https://utahhousingcorp.org/

| HomeAgain: | May include an owner occupied One-to-Two Unit Dwelling, such as a Duplex, mother in law apartment or Accessory Dwelling Unit (ADU) as defined by FHA. Follow FHA requirements when including any rental income to qualify. Rental income used to qualify the Borrower must be included in UHC qualifying income limits. |

| HomeAgain: | Non-Occupant Co-Borrowers are allowed. The Non-Occupant Co-Borrower debt ratio cannot exceed 45% |

| FirstHome: | The Non-Occupant Co-Signer’s debt ratio has increased from 41% to 45% |

| Insurance: | Addition of UHC Insurance requirements as currently listed in our Selling Supplement. |

https://utahhousingcorp.org/

The Beginning of an Economic Recovery In Utah

The Beginning of an Economic RecoveryThe news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand...

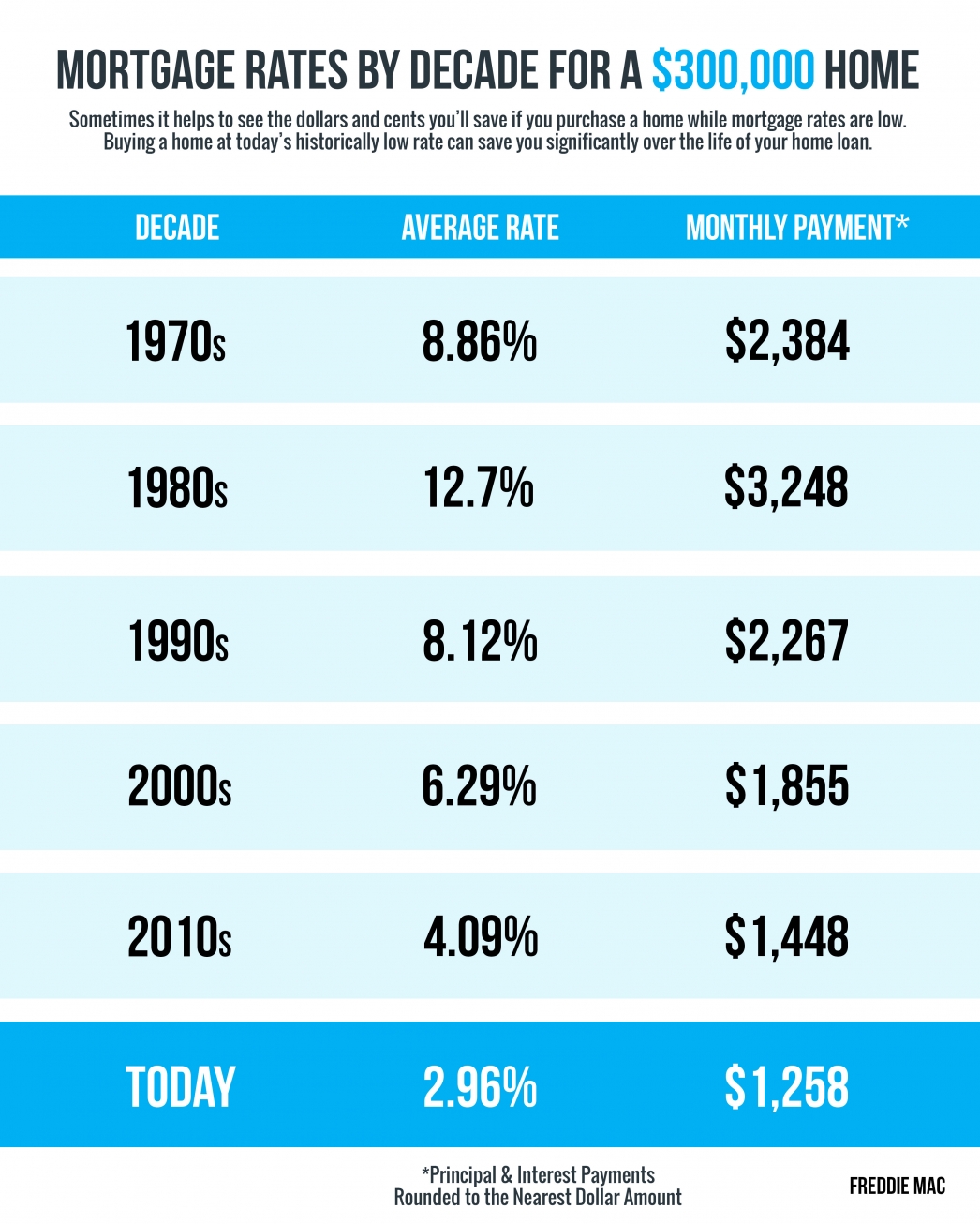

Mortgage Rates and Payments by Each Decade

Mortgage Rates & Payments by DecadeSome HighlightsSometimes it helps to see the dollars and cents you’ll save when you purchase a home while mortgage rates are low.Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your...

Housing by the Numbers by Utah Realty

Homes Are More Affordable Right Now Than They Have Been in Years

Homes Are More Affordable Right Now Than They Have Been in YearsToday, home prices are appreciating. When we hear prices are going up, it’s normal to think a home will cost more as the trend continues. The way the housing market is positioned today, however, low...

Why Foreclosures Won’t Crush the Housing Market Next Year

Why Foreclosures Won’t Crush the Housing Market Next YearWith the strength of the current housing market growing every day and more Americans returning to work, a faster-than-expected recovery in the housing sector is already well...

The Latest Unemployment Report: Slow and Steady Improvement

The Latest Unemployment Report: Slow and Steady ImprovementLast Friday, the Bureau of Labor Statistics (BLS) released its latest Employment Situation Summary. Going into the release, the expert consensus was for 1.58 million jobs to be added in July, and for the...

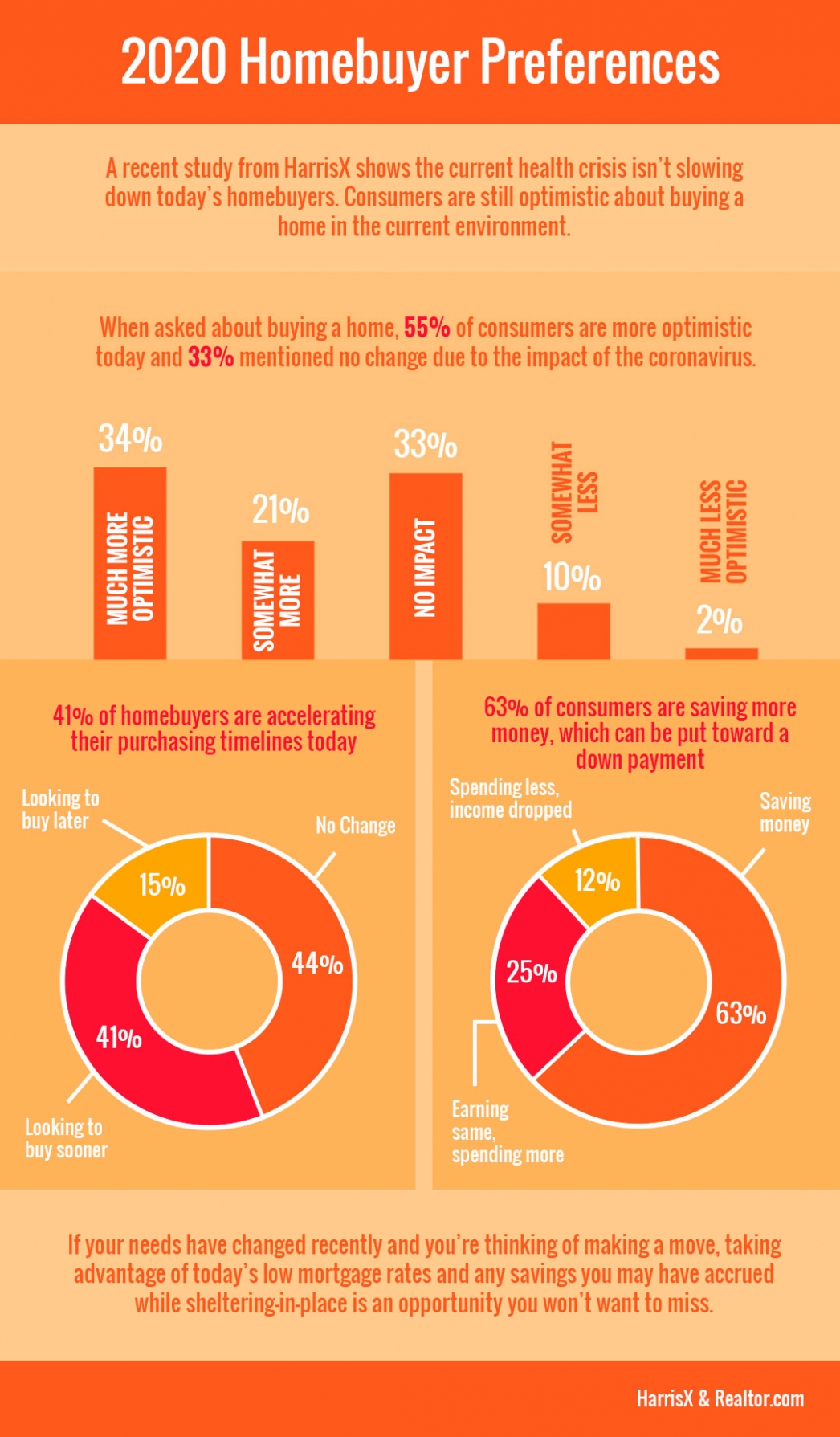

2020 Homebuyer Preferences

2020 Homebuyer PreferencesSome HighlightsA recent study from HarrisX shows the current health crisis isn’t slowing down today’s homebuyers.Many buyers are accelerating their timelines to take advantage of low mortgage rates, and staying home has enabled some to save...

Expert Reactions to the 2020 Housing Market Recovery

America Has a Surprising New Favorite Room in the House

Photo Copyright Marty Gale The family room has long been the favorite room in the house—it’s where homeowners get to spend quality time with other family members. However, as the significant increase in time spent at home during the pandemic has changed preferences,...

How Is Remote Work Changing Homebuyer Needs?

How Is Remote Work Changing Homebuyer Needs?With more companies figuring out how to efficiently and effectively enable their employees to work remotely (and for longer than most of us initially expected), homeowners throughout the country are re-evaluating their...