Did you know?

Utah Housing has made some changes to our Loan Programs; these changes will become effective with Mortgage Purchase Agreements (interest rate locks) issued on or after February 11, 2019. https://utahhousingcorp.org/

| HomeAgain: | May include an owner occupied One-to-Two Unit Dwelling, such as a Duplex, mother in law apartment or Accessory Dwelling Unit (ADU) as defined by FHA. Follow FHA requirements when including any rental income to qualify. Rental income used to qualify the Borrower must be included in UHC qualifying income limits. |

| HomeAgain: | Non-Occupant Co-Borrowers are allowed. The Non-Occupant Co-Borrower debt ratio cannot exceed 45% |

| FirstHome: | The Non-Occupant Co-Signer’s debt ratio has increased from 41% to 45% |

| Insurance: | Addition of UHC Insurance requirements as currently listed in our Selling Supplement. |

https://utahhousingcorp.org/

The Average Homeowner Gained $64K in Equity over the Past Year

The Average Homeowner Gained $64K in Equity over the Past Year If you own a home, your net worth likely just got a big boost thanks to rising home equity. Equity is the current value of your home minus what you owe on the loan. And today, based on recent home price...

More Americans Choose Real Estate as the Best Investment Than Ever Before

More Americans Choose Real Estate as the Best Investment Than Ever Before Americans’ opinion on the value of real estate as an investment is climbing. That’s according to an annual survey from Gallup. Not only is real estate viewed as the best investment for the ninth...

Why the Growing Number of Homes for Sale Is Good for Your Move Up

Why the Growing Number of Homes for Sale Is Good for Your Move Up Are you thinking about selling your current home? If so, the biggest question on your mind may be: if I sell now, where will I go? If this resonates with you, there’s something you should know....

June is National Homeownership Month

How Homeownership Impacts You June is National Homeownership Month, and it’s the perfect time to reflect on how impactful owning a home can truly be. When you purchase a house, it becomes more than just a space you occupy. It’s your stake in the community,...

Sellers Have an Opportunity with Today’s Home Prices

"IT'S THE EXPERIENCE" It’s difficult to know when is the best time to sell, or how to get the most money for your house, but you don’t need to go through the process alone. You may be wondering if prices are projected to rise or fall…or how much competition you may...

What’s on the Horizon for the Housing Market in the Second Half of 2022?

The One Thing Every Homeowner Needs To Know About a Recession

The One Thing Every Homeowner Needs To Know About a Recession A recession does not equal a housing crisis. That’s the one thing that every homeowner today needs to know. Everywhere you look, experts are warning we could be heading toward a recession, and if true, an...

How Homeownership Can Bring You Joy

How Homeownership Can Bring You Joy If you're trying to decide whether to rent or buy a home, you're probably weighing a few different factors. The financial benefits of homeownership might be one of the reasons you want to make a purchase if you’re a renter, but...

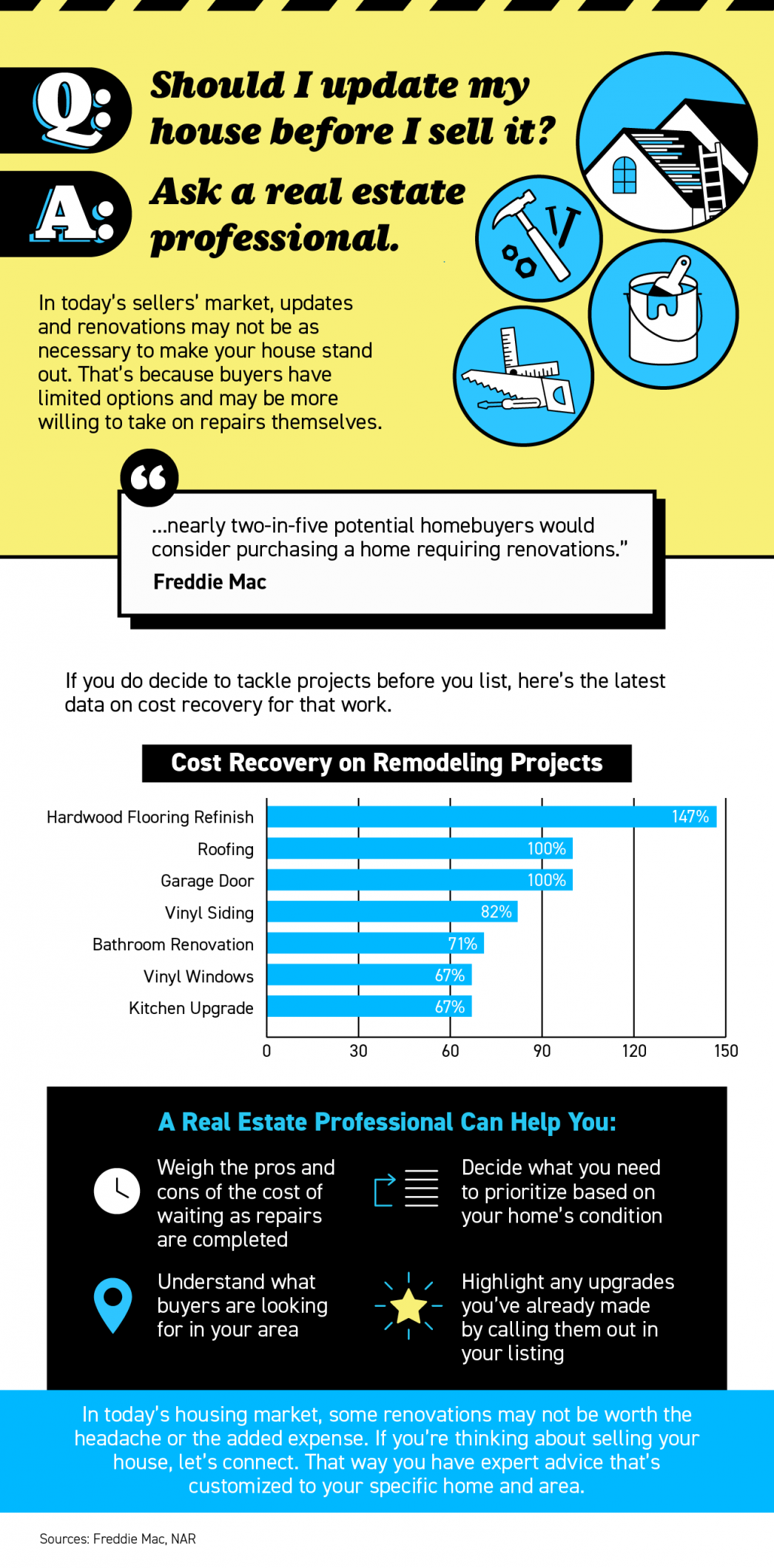

Should You Update Your House Before Selling? Ask a Real Estate Professional.

Should You Update Your House Before Selling? Ask a Real Estate Professional. Some Highlights If you’re deciding whether you should make updates before you sell your house, lean on your trusted real estate advisor to be your guide. In today’s sellers’ market, buyers...