Time for Your Dream Home, Gen X!

During the housing market crash, Gen X homeowners lost more wealth than other generations. However, things are changing now! A strong economy, increasing home prices, and the recovery of the housing market are helping this generation to regain their lost wealth.

According to Pew Research Center,

“Their fortunes have rebounded more than those of other generations during the post-recession economic expansion and as home and stock prices have risen. Since 2010, the median net worth of Gen X households has risen 115%. In fact, in 2016, the most recent year with available data, the net worth of a typical Gen X household had surpassed what it was in 2007 ($84,200 vs. $63,400)”.

The same report also mentioned,

“15% of Gen X’s homeowners were ‘underwater’ on their homes in 2010 (meaning they owed more than they owned). By 2016 only 3% were underwater.”

As a result of homes regaining market value and their increasing net worth, many Gen Xers are presented with the opportunity of selling their current home in order to move up to the house they always dreamed of!

According to the 2019 Home Buyers and Sellers Generational Trends Report by the National Associations of Realtors, in 2018 Gen Xers made up the second largest share of home buyers by generation at 24%.

The report also provided some highlights about their purchase:

- Greatest share that purchased a multi-generational home (16%).

- Largest share that purchased a detached single-family home (88%).

- Highest median household income ($111,100).

- Bought the most expensive homes of all the generations.

- Job-related relocation was identified as the primary reason to buy.

But this generation is not only buying- they are selling too!

- Largest share of home sellers (25%).

- Highest median household income among sellers ($123,600).

- Tenure in the previous home was a median of 9 years.

- House too small was indicated as the primary reason to sell.

- 91% sold the home using a real estate professional.

Bottom Line

If you are a Gen Xer who would like to know exactly how much your house is worth today so you can move up to the home of your dreams, let’s get together to analyze your current circumstances.

Early October is the Sweet Spot for Buyers

Early October is the Sweet Spot for Buyers Are you looking to buy a home? If so, we’ve got good news for you. While there’s no denying the housing market is having a great year, many of the headlines are focused on the perks for sellers. But what about buyers today?...

As Home Equity Rises, So Does Your Wealth

As Home Equity Rises, So Does Your Wealth Homeownership is still a crucial part of the American dream. For those people who own a home (and those looking to buy one), it’s clear that being a homeowner has considerable benefits both emotionally and financially. In...

Free Fall Selling Guide is Here! Get Yours!

Selling your home this fall? Free Fall Selling Guide is Here! Get Yours!

If You’re a Buyer, Is Offering Asking Price Enough?

If You’re a Buyer, Is Offering Asking Price Enough? In today’s real estate market, buyers shouldn’t shop for a home with the expectation they’ll be able to negotiate a lower sales price. In a typical housing market, buyers try to determine how much less than the...

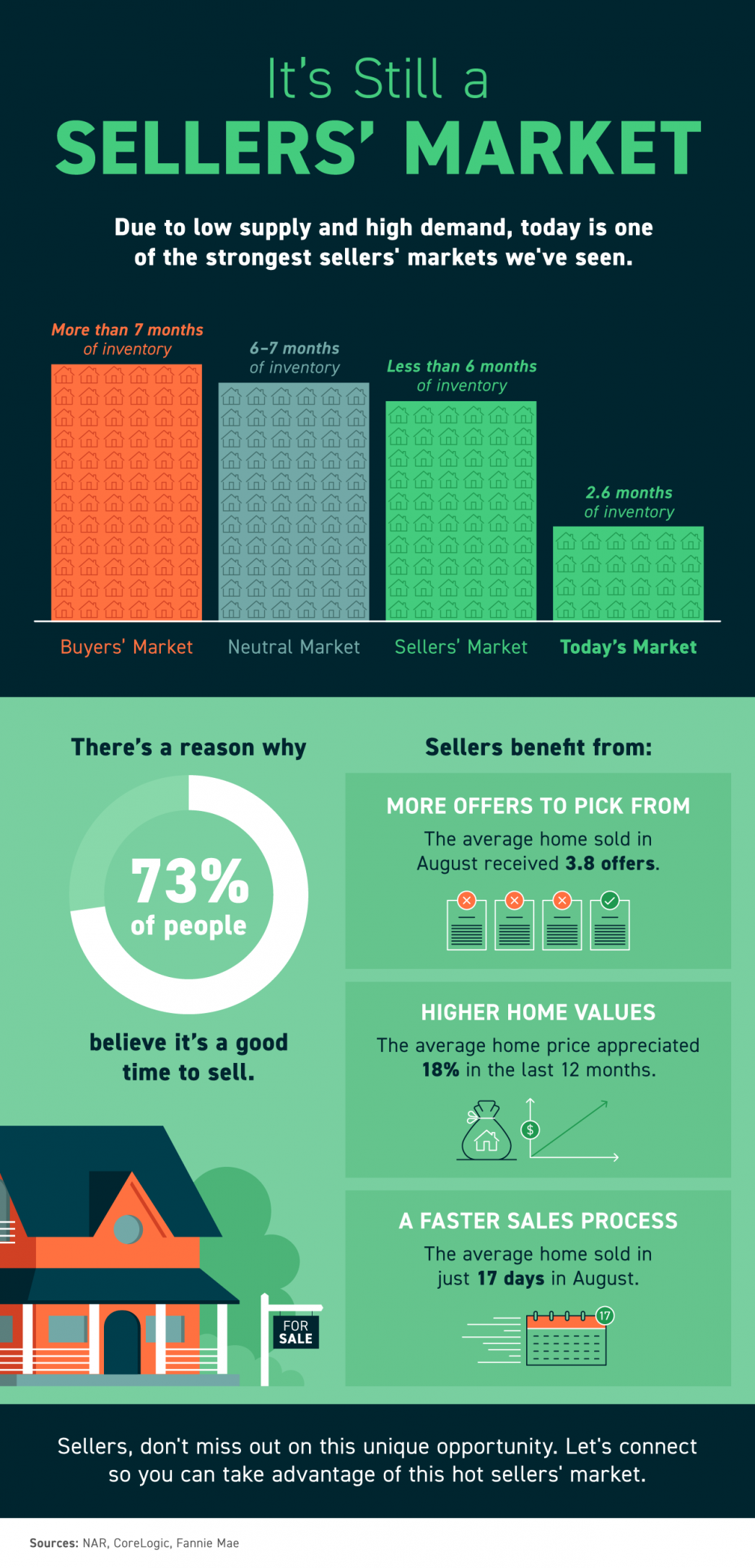

It’s Still a Sellers’ Market In Utah

It’s Still a Sellers’ Market Some Highlights Due to low supply and high demand, today is one of the strongest sellers’ markets we’ve seen. Sellers can benefit from more offers to pick from, higher home values, and a faster sales process. That might be why 73% of...

Is a 20% Down Payment Really Necessary To Purchase a Home?

Is a 20% Down Payment Really Necessary To Purchase a Home? There’s a common misconception that, as a homebuyer, you need to come up with 20% of the total sale price for your down payment. In fact, a recent survey by Lending Tree asks what is keeping consumers from...

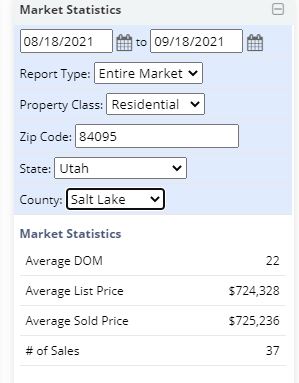

Market Stats for So Jo

South Jordan Market Update

Have You Ever Seen a Housing Market Like This?

Have You Ever Seen a Housing Market Like This? Some Highlights Whether you’re buying or selling – today’s housing market has plenty of good news to go around. Buyers can take advantage of today's mortgage rates to escape rising rents and keep monthly...

Is the Number of Homes for Sale Finally Growing?

Is the Number of Homes for Sale Finally Growing? Salt Lake County Active Single Family on September 1st was at 820 Units as of September 16th up slightly to 887 Utah County September 1st was at 664 as of September 16th down to 651 An important metric in today’s...

Reasons You Should Consider Selling This Fall

Reasons You Should Consider Selling This Fall If you're trying to decide when to sell your house, there may not be a better time to list than right now. The ultimate sellers' market we're in today won't last forever. If you’re thinking of making a move, here are four...