Time for Your Dream Home, Gen X!

During the housing market crash, Gen X homeowners lost more wealth than other generations. However, things are changing now! A strong economy, increasing home prices, and the recovery of the housing market are helping this generation to regain their lost wealth.

According to Pew Research Center,

“Their fortunes have rebounded more than those of other generations during the post-recession economic expansion and as home and stock prices have risen. Since 2010, the median net worth of Gen X households has risen 115%. In fact, in 2016, the most recent year with available data, the net worth of a typical Gen X household had surpassed what it was in 2007 ($84,200 vs. $63,400)”.

The same report also mentioned,

“15% of Gen X’s homeowners were ‘underwater’ on their homes in 2010 (meaning they owed more than they owned). By 2016 only 3% were underwater.”

As a result of homes regaining market value and their increasing net worth, many Gen Xers are presented with the opportunity of selling their current home in order to move up to the house they always dreamed of!

According to the 2019 Home Buyers and Sellers Generational Trends Report by the National Associations of Realtors, in 2018 Gen Xers made up the second largest share of home buyers by generation at 24%.

The report also provided some highlights about their purchase:

- Greatest share that purchased a multi-generational home (16%).

- Largest share that purchased a detached single-family home (88%).

- Highest median household income ($111,100).

- Bought the most expensive homes of all the generations.

- Job-related relocation was identified as the primary reason to buy.

But this generation is not only buying- they are selling too!

- Largest share of home sellers (25%).

- Highest median household income among sellers ($123,600).

- Tenure in the previous home was a median of 9 years.

- House too small was indicated as the primary reason to sell.

- 91% sold the home using a real estate professional.

Bottom Line

If you are a Gen Xer who would like to know exactly how much your house is worth today so you can move up to the home of your dreams, let’s get together to analyze your current circumstances.

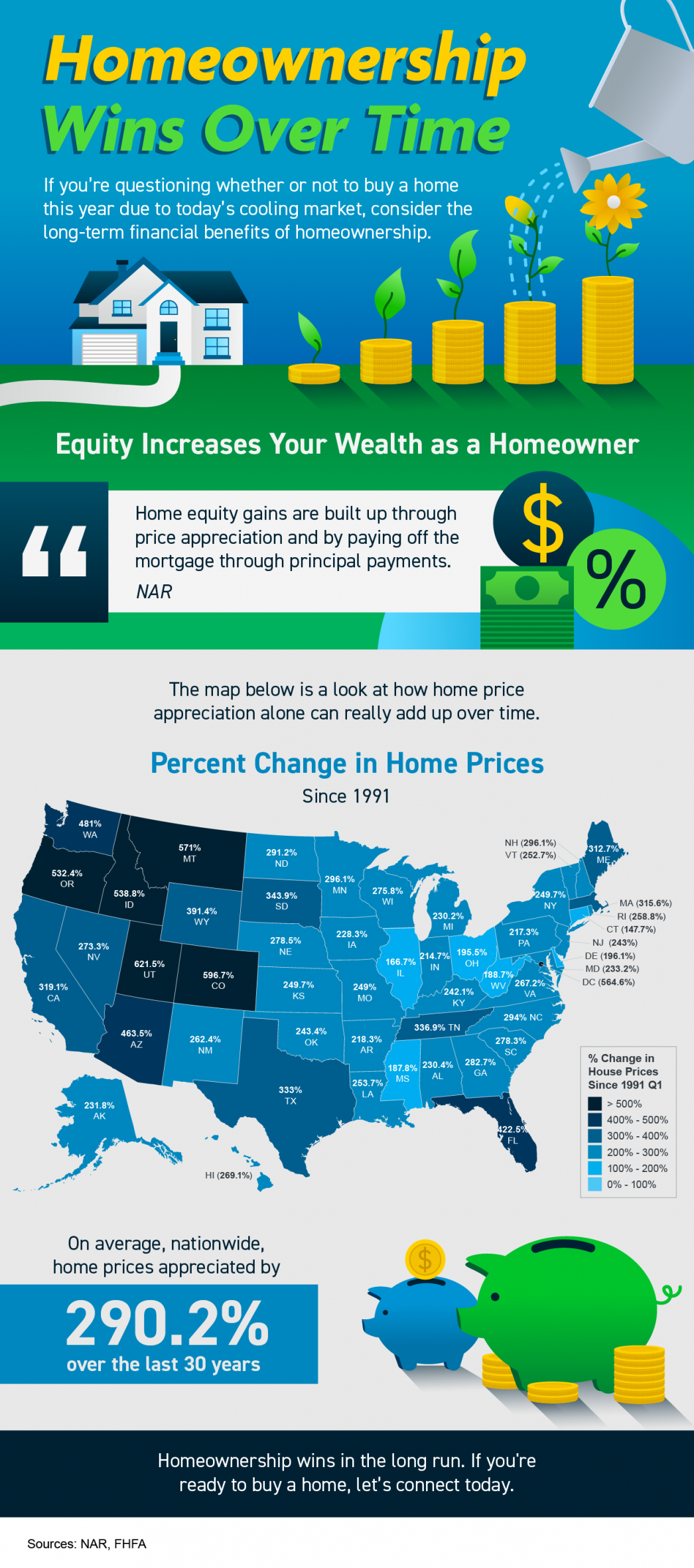

Homeownership Wins Over Time

Homeownership Wins Over Time Some Highlights If you’re questioning whether or not to buy a home this year due to today’s cooling market, consider the long-term financial benefits of homeownership. As a homeowner, equity increases your wealth. On average, nationwide,...

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn’t Have To Be.

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn’t Have To Be. It turns out, millennials aren’t the renter generation after all. The 2022 Consumer Insights Report from Mynd says there’s a portion of millennial and Gen Z buyers who are pursuing...

Sell Your House Before the Holidays

Sell Your House Before the Holidays As you look ahead to the winter season, you’re likely making plans and thinking about what you want to achieve before the year ends. One of those key decision points could be whether or not you want to move this year. If the...

Taking the Fear out of Saving for a Home

Taking the Fear out of Saving for a Home If you’re planning to buy a home, knowing what to budget for and how to save may sound scary at first. But it doesn’t have to be. One way to take the fear out of budgeting is understanding some of the costs you might...

when one door closes

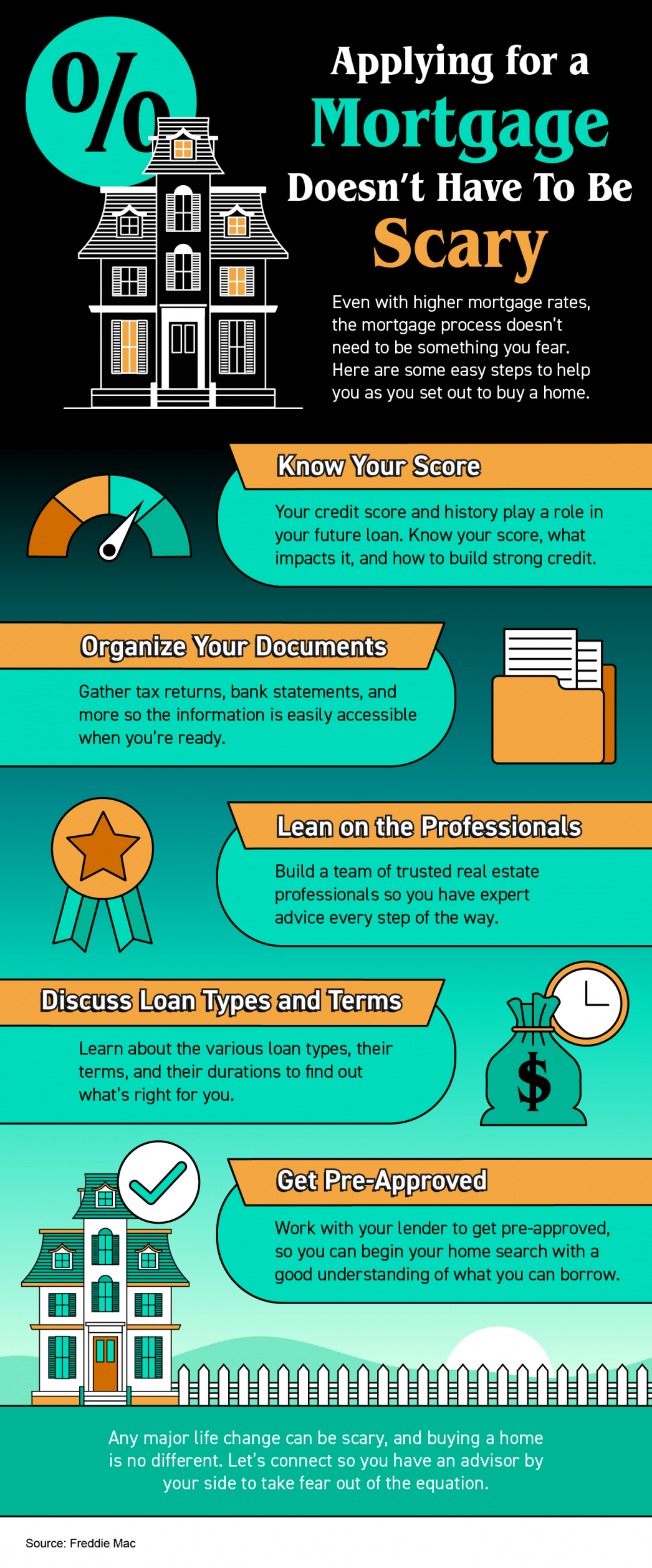

Applying for a Mortgage Doesn’t Have To Be Scary

Applying for a Mortgage Doesn’t Have To Be Scary Some Highlights Even with higher mortgage rates, the mortgage process doesn’t need to be something you fear. Here are some steps to help as you set out to buy a home. Know your credit score and work to build strong...

Millennials Are Still a Driving Force of Today’s Buyer Demand

Millennials Are Still a Driving Force of Today’s Buyer Demand If you’re thinking about selling your house but wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what...

3 Graphs Showing Why Today’s Housing Market Isn’t Like 2008

3 Graphs Showing Why Today’s Housing Market Isn’t Like 2008 With all the headlines and talk in the media about the shift in the housing market, you might be thinking this is a housing bubble. It’s only natural for those thoughts to creep in that make you think it...

Pre-Approval Is a Critical First Step on Your Homebuying Journey

Pre-Approval Is a Critical First Step on Your Homebuying Journey If you’re planning to buy a home this year, one of the first steps on your journey is getting pre-approved. Especially in today’s market when mortgage rates are higher than they were just a few months...

Tips For First-Time Homebuyers

Tips For First-Time Homebuyers Some Highlights If you’re trying to buy your first home in today’s housing market, you’ll want to know what you can do as mortgage rates rise and inventory stays low overall. Connect with a lender to get pre-approved, prioritize your...