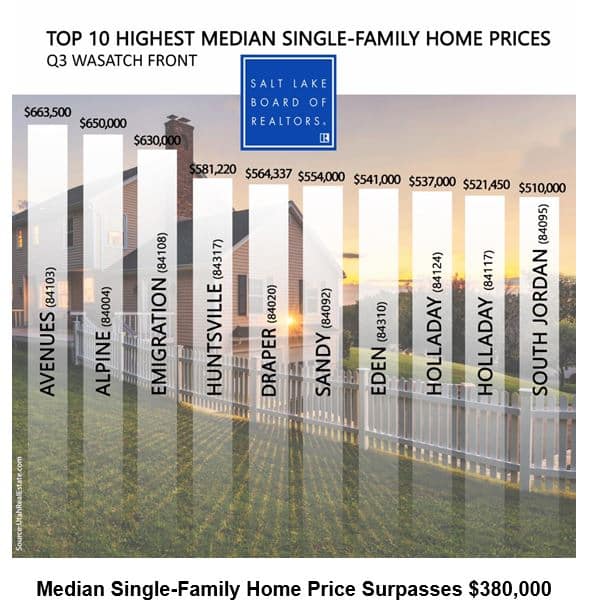

Top 10 Highest Median Single-Family Home Prices along the Greater Wasatch Front

Salt Lake County home prices climbed to an all-time high in the third quarter, according to the Salt Lake Board of Realtors®. The median single-family home price in the July-through-September period reached $381,500. That’s up 7.5 percent compared to a median price of $355,000 in last year’s third quarter. Just three years ago, the median single-family home price reached $300,000, which was then an all-time high price. The previous peak home price was in the third quarter of 2007, when home prices topped $256,000 (or $298,085 in inflation-adjusted dollars). Home prices increased across all Wasatch Front counties including: Davis, up 6.2 percent; Tooele, up 2.6 percent; Utah, up 4.4 percent; and Weber, up 10.3 percent. Sales of single-family homes in Salt Lake County were flat (up 0.7 percent) in the third quarter year-over-year. Davis County saw sales increase 9.8 percent. Sales in Tooele County were up 4.7 percent. Utah County sales were up 11.8 percent. Sales in Weber County were up 12.1 percent. In the third quarter, the typical Salt Lake home was on the market 37 days before it sold – six days longer than the average time for a home to sell during the third quarter of 2018

VA Loans Can Help Veterans Achieve Their Dream of Homeownership

VA Loans Can Help Veterans Achieve Their Dream of Homeownership For over 78 years, Veterans Affairs (VA) home loans have provided millions of veterans with the opportunity to purchase homes of their own. If you or a loved one have served, it’s important to understand...

What’s Ahead for Mortgage Rates and Home Prices?

Utah Realty Blog & News The Latest news for Real Estate both local and National. Buyers Sellers SeniorsWhat’s Ahead for Mortgage Rates and Home Prices? Now that the end of 2022 is within sight, you may be wondering what’s going to happen in the housing market next...

The Majority of Americans Still View Homeownership as the American Dream

The Majority of Americans Still View Homeownership as the American Dream Buying a home is a powerful decision, and it remains a key part of the American Dream. In fact, the 2022 Consumer Insights Report from Mynd found the majority of people polled still view...

Key Factors Affecting Home Affordability Today

Key Factors Affecting Home Affordability Today Every time there’s a news segment about the housing market, we hear about the affordability challenges buyers are facing today. Those headlines are focused on how much mortgage rates have climbed this year. And while it’s...

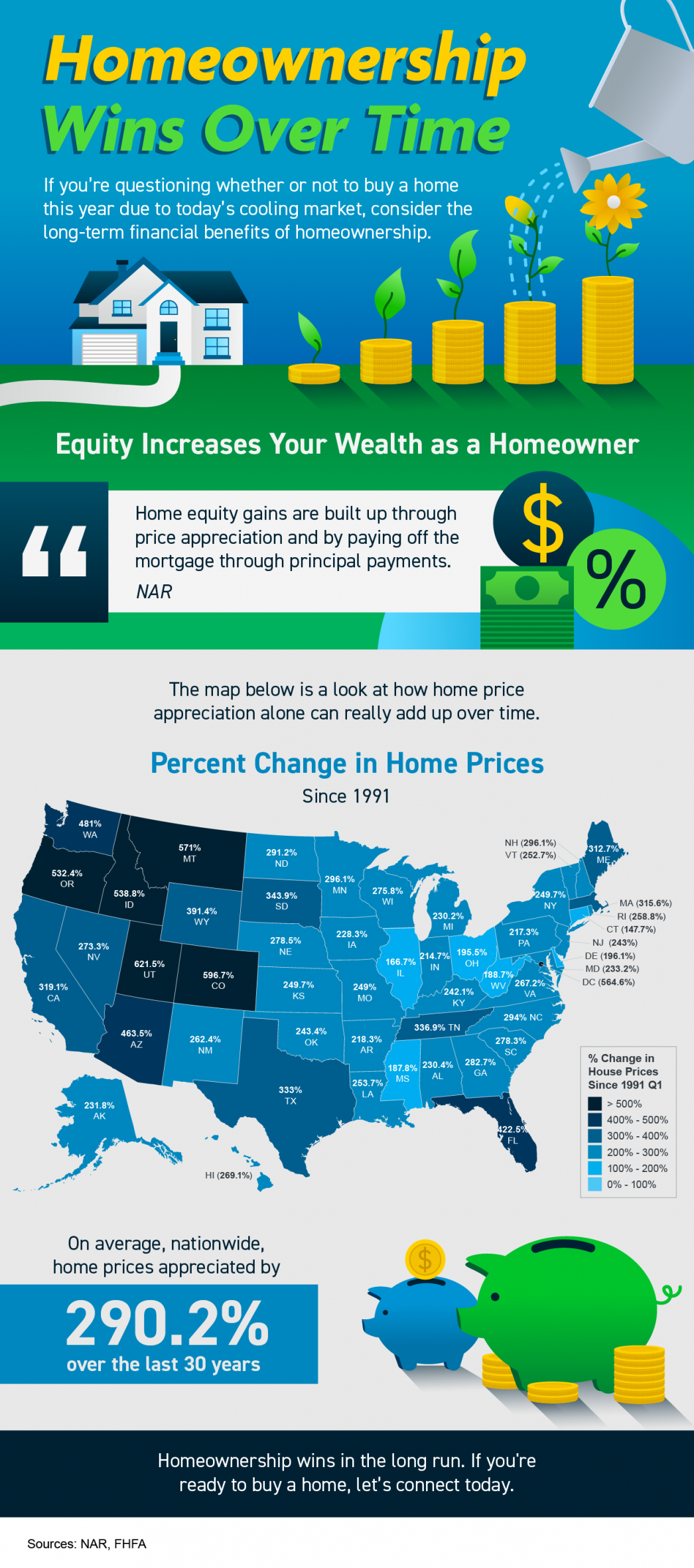

Homeownership Wins Over Time

Homeownership Wins Over Time Some Highlights If you’re questioning whether or not to buy a home this year due to today’s cooling market, consider the long-term financial benefits of homeownership. As a homeowner, equity increases your wealth. On average, nationwide,...

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn’t Have To Be.

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn’t Have To Be. It turns out, millennials aren’t the renter generation after all. The 2022 Consumer Insights Report from Mynd says there’s a portion of millennial and Gen Z buyers who are pursuing...

Sell Your House Before the Holidays

Sell Your House Before the Holidays As you look ahead to the winter season, you’re likely making plans and thinking about what you want to achieve before the year ends. One of those key decision points could be whether or not you want to move this year. If the...

Taking the Fear out of Saving for a Home

Taking the Fear out of Saving for a Home If you’re planning to buy a home, knowing what to budget for and how to save may sound scary at first. But it doesn’t have to be. One way to take the fear out of budgeting is understanding some of the costs you might...

when one door closes

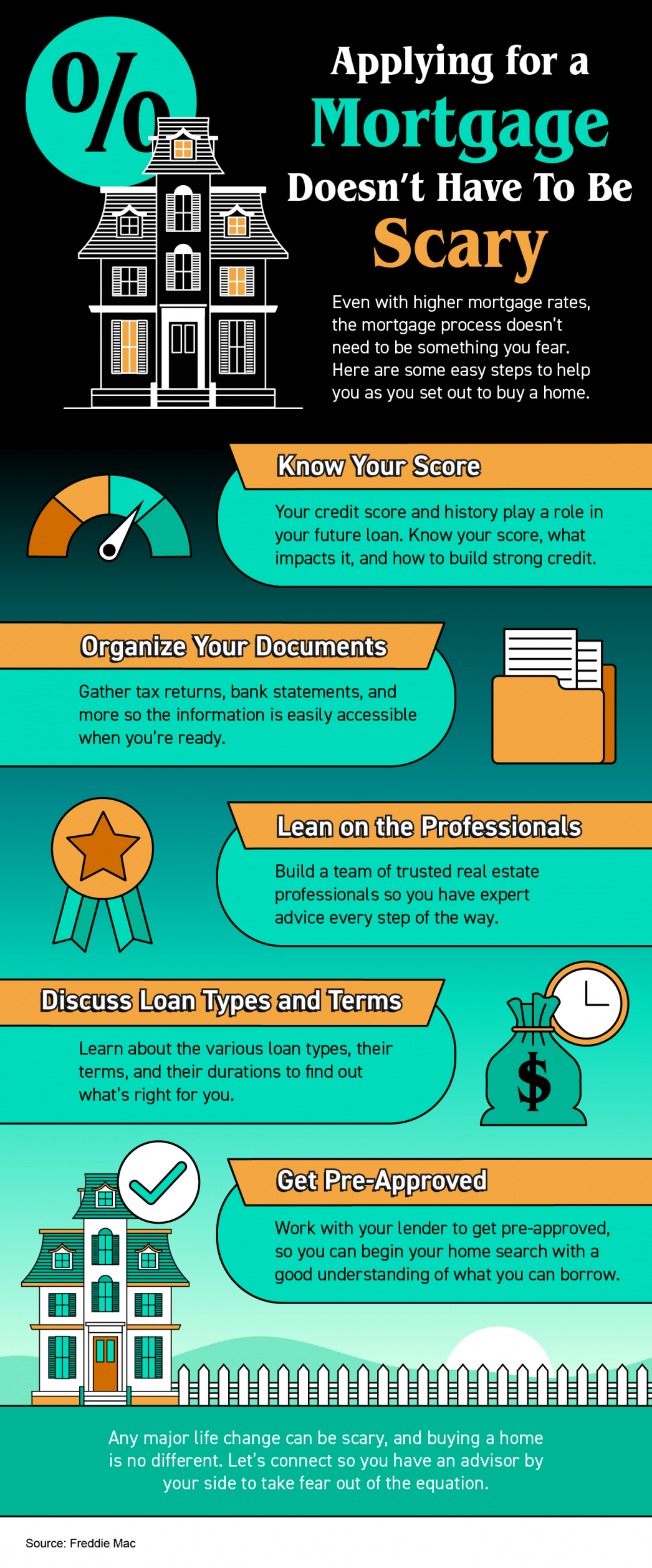

Applying for a Mortgage Doesn’t Have To Be Scary

Applying for a Mortgage Doesn’t Have To Be Scary Some Highlights Even with higher mortgage rates, the mortgage process doesn’t need to be something you fear. Here are some steps to help as you set out to buy a home. Know your credit score and work to build strong...