The 2 Surprising Things Homebuyers Really Want

In a market where current inventory is low, it’s normal to think buyers might be willing to give up a few desirable features in their home search in order to make finding a house a little easier. Don’t be fooled, though – there’s still an interest in the market for some key upgrades. Here’s a look at the two surprising things buyers seem to be searching for in today’s market, and how they’re impacting new home builds.

Homebuyers Are Not Giving Up Their Garages

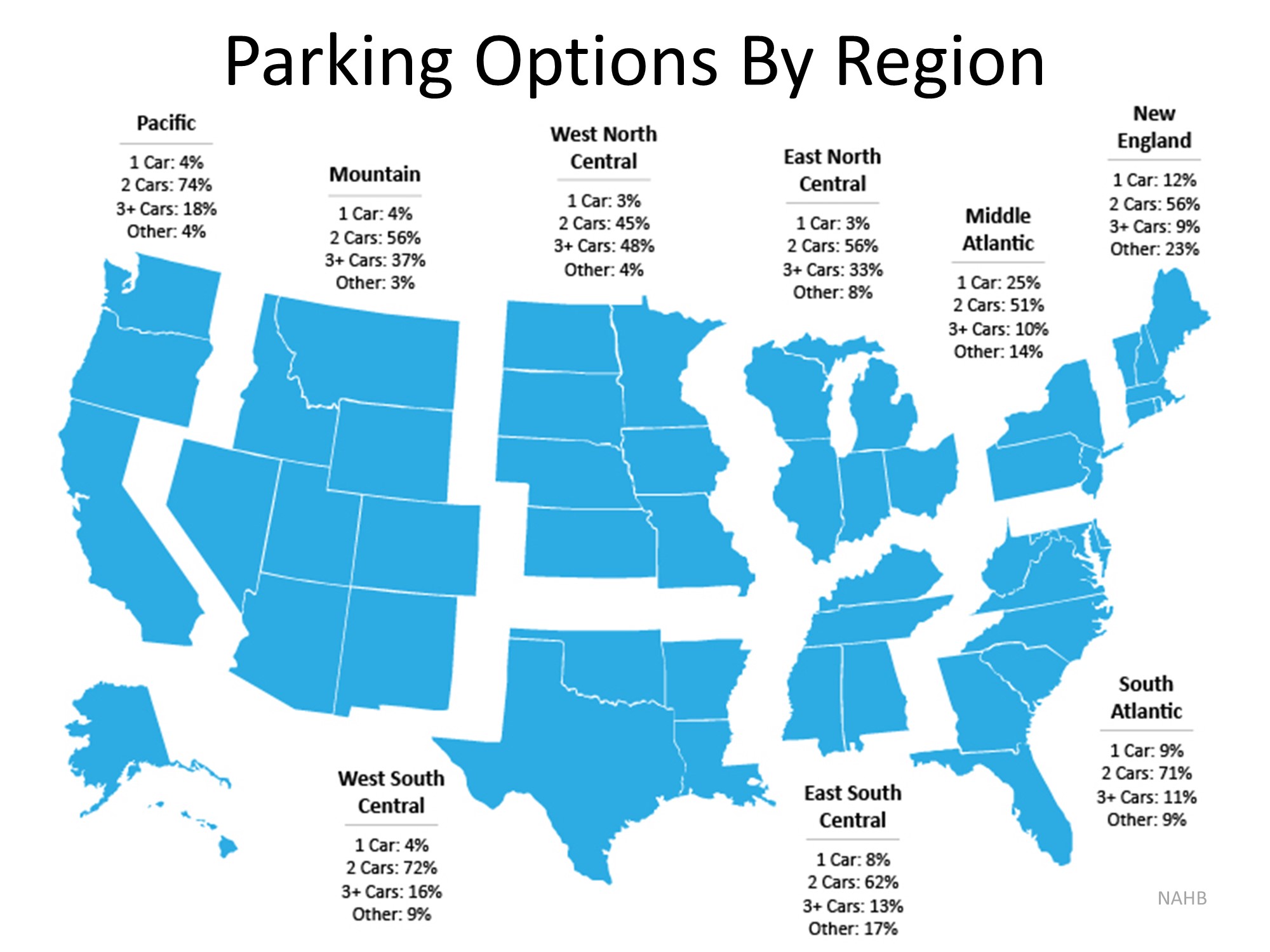

The National Association of Home Builders (NAHB) recently released an article showing the percentage of new single-family homes completed in 2018. The data reveals,

- 64% of new homes offer a 2-car garage

- 21% have a garage large enough to hold 3 or more cars

- 7% have a 1-car garage

- 7% do not include a garage or carport

- 1% have a carport

The following map represents this breakdown by region: Evidently, a garage is something homebuyers are looking for in their searches, but that’s not all.

Evidently, a garage is something homebuyers are looking for in their searches, but that’s not all.

Homebuyers Are Not Giving Up Their Patios

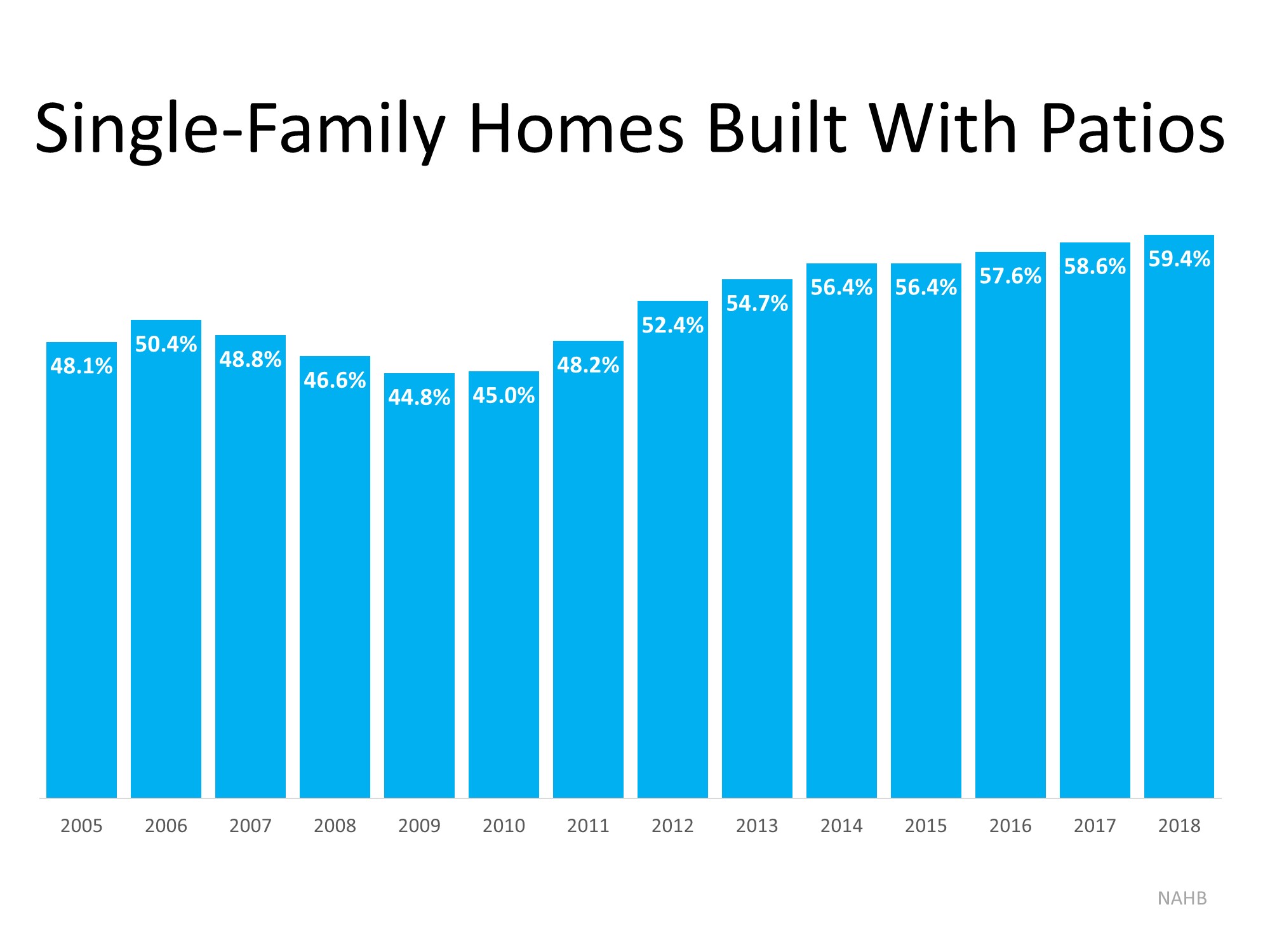

Patios are on the radar for buyers as well. Community areas are often common amenities in new neighborhoods, but as it turns out, private outdoor spaces are quite desirable too. NAHB also found that,

“Of the roughly 876,000 single-family homes started in 2018, 59.4% came with patios…This is the highest the number has been since NAHB began tracking the series in 2005.”

As shown in the graph below, the number of new homes built with patios has been increasing for the past 9 years. Clearly, they’re a desirable feature for new homeowners too.

Bottom Line

Homebuyers are looking for garage space and outdoor patio living. If you’re a homeowner thinking of selling a house with these amenities, it appears buyers are willing to spring for those key features. Let’s get together today to determine the current value and demand for your home.

Happy Halloween

Halloween falls on October 31 because the ancient Gaelic festival of Samhain, considered the earliest known root of Halloween, occurred on this day. In the eighth century, Pope Gregory III designated November 1 as a time to praise all saints. Soon, All Saints'...

Relocation Trends: Why High-Net-Worth Buyers Are Choosing the Mountain West States

High-net-worth buyers are increasingly relocating to the Mountain West states—Idaho, Montana, Wyoming, Utah, and Colorado—attracted by tax advantages, privacy, natural beauty, and outdoor recreation. Luxury real estate has evolved from rustic cabins to sophisticated...

Buying or Selling: What’s Your Agent Strategy?

Visit Real Estate offices early and ask questions to gauge their professionalism and fit. Understand seller motivations to make offers with attractive terms that could win deals.

How to get a mortgage when you’re self-employed

Self-employed individuals can qualify for a home loan, but they may face additional challenges in proving income stability. To improve approval chances, consider non-conforming loans, make larger down payments, raise credit scores, and lower debts. Lenders require...

Most Affordable Cities to Buy a Home in Utah (2025)

Here is an overview of affordable cities in Utah for homebuyers in 2025, highlighting median prices, cost of living, and unique features for each city. This provides an at-a-glance guide to communities where your housing dollar might stretch further. Most Affordable...

Will the Housing Market Rebound? Predictions for 2025 and 2026

The U.S. housing market is expected to see gradual growth through late 2025 and into 2026, with no major price drops on the horizon. Existing-home sales rose 2% in July 2025, inventory is up 15.7% year-over-year, and the median price is holding steady at $422,400....

Global Real Estate: $19.5T by 2031

The global residential Real Estate market will reach USD 19.5T by 2031, growing at 9.2% CAGR. Urban growth in emerging nations will drive increased demand for residential Real Estate by 2030.

Salt Lake County Shines as Top Choice for New Families

Childcare costs as a percent of median household income: 21.34% Housing costs as a percentage of median household income: 20.84% Percentage of population under age 10: 13.12% Number of children under age 10: 155,636 Ratio of total population to primary care...

Top 10 Tips for First-Time Homebuyers

First-time homebuyers should identify their current and future needs, understand the true cost of homeownership including taxes and maintenance, and start saving early for down payments and closing costs. Building and managing credit wisely is crucial. Research...

Time to Sell? Key Market Signals

Outgrowing or underusing your space signals it might be time to sell and move on. A strong seller’s market boosts sale price, speed, and overall success of your listing.