Taking the Fear Out of the Mortgage Process

A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and a good credit history.

Once you’re ready to apply, here are 5 easy steps Freddie Mac suggests to follow:

- Find out your current credit history and credit score– Even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score® for all closed loans in September was 737, according to Ellie Mae.

- Start gathering all of your documentation– This includes income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional– Your real estate agent will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender– He or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval– A pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you’re serious about buying.

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure you’re ready to take on the financial responsibilities of becoming a homeowner.

What To Do with Your Vacation Home as Summer Ends

What To Do with Your Vacation Home as Summer Ends As summer comes to a close, is it time to think about selling your vacation home? Based on recent data and expert opinions, it’s something you may want to consider. According to research from the National Association...

Utah Real Estate Housing Stats

Expert News on Mortgage Rates

What Do Experts Say About Today’s Mortgage Rates? Mortgage rates are hovering near record lows, and that’s good news for today’s homebuyers. The graph below shows mortgage rates dating back to 2016 and where today falls by comparison.Generally speaking, when rates are...

Auto DraftTime Is Money When It Comes to Your Home

If you bought your home a number of years ago, chances are you have a lot of opportunities between your home equity and today's low mortgage rates. Let's connect to make sure you don't miss out.

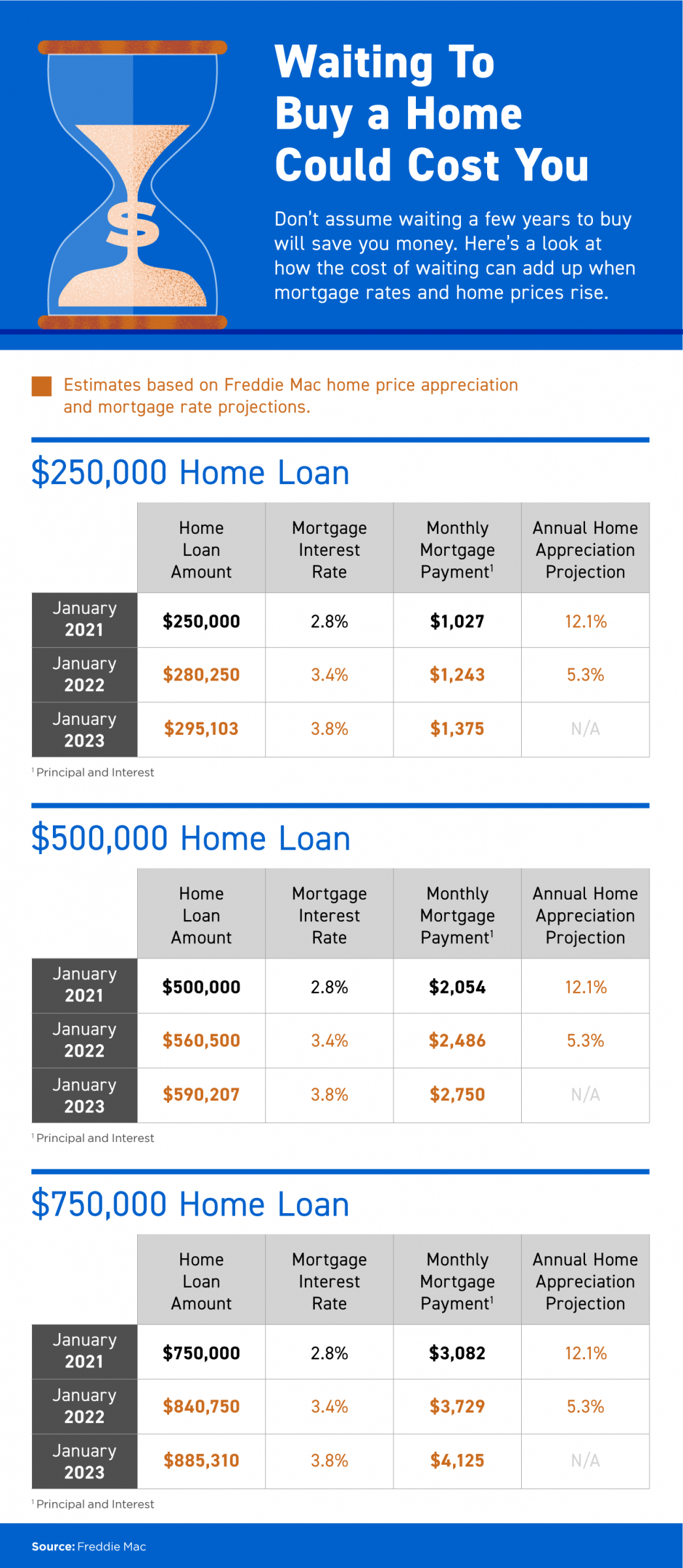

Important News! Buying a Home Could Cost You!

Waiting To Buy a Home Could Cost You Some Highlights If you’re thinking of buying a home but wondering if waiting a few years will save you in the long run, think again. The longer the wait, the more you’ll pay, especially when mortgage rates and home prices rise....

A Look at Home Price Appreciation Through 2025

A Look at Home Price Appreciation Through 2025 Home prices have increased significantly over the last year, which in turn has grown the net worth of homeowners. Appreciation and home equity are directly linked – as the value of a home increases, so does a homeowner’s...

Happy Independence Day

Happy Independence Day!Wishing you a happy and safe Independence Day.

What Do Experts See on the Horizon for the Second Half of the Year 2021?

What Do Experts See on the Horizon for the Second Half of the Year?As we move into the latter half of the year, questions about what’s to come are top of mind for buyers and sellers. Near record-low mortgage rates coupled with rising home price appreciation kicked off...

What To Expect as Appraisal Gaps Grow

What To Expect as Appraisal Gaps GrowIn today’s real estate market, low inventory and high demand are driving up home prices. As many as 54% of homes are getting offers over the listing price, based on the latest Realtors Confidence Index from the National Association...

Save Time and Effort by Selling with the Right Agent

Save Time and Effort by Selling with the Right AgentSelling a house is a time-consuming process – especially if you decide to do it on your own, known as a For Sale By Owner (FSBO). From conducting market research to reviewing legal documents, handling negotiations,...