Taking the Fear Out of the Mortgage Process

A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage.

For many, the mortgage process can be scary, but it doesn’t have to be!

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and a good credit history.

Once you’re ready to apply, here are 5 easy steps Freddie Mac suggests to follow:

- Find out your current credit history and credit score– Even if you don’t have perfect credit, you may already qualify for a loan. The average FICO Score® for all closed loans in September was 737, according to Ellie Mae.

- Start gathering all of your documentation– This includes income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional– Your real estate agent will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender– He or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval– A pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you’re serious about buying.

Bottom Line

Do your research, reach out to professionals, stick to your budget, and be sure you’re ready to take on the financial responsibilities of becoming a homeowner.

Early October is the Sweet Spot for Buyers

Early October is the Sweet Spot for Buyers Are you looking to buy a home? If so, we’ve got good news for you. While there’s no denying the housing market is having a great year, many of the headlines are focused on the perks for sellers. But what about buyers today?...

As Home Equity Rises, So Does Your Wealth

As Home Equity Rises, So Does Your Wealth Homeownership is still a crucial part of the American dream. For those people who own a home (and those looking to buy one), it’s clear that being a homeowner has considerable benefits both emotionally and financially. In...

Free Fall Selling Guide is Here! Get Yours!

Selling your home this fall? Free Fall Selling Guide is Here! Get Yours!

If You’re a Buyer, Is Offering Asking Price Enough?

If You’re a Buyer, Is Offering Asking Price Enough? In today’s real estate market, buyers shouldn’t shop for a home with the expectation they’ll be able to negotiate a lower sales price. In a typical housing market, buyers try to determine how much less than the...

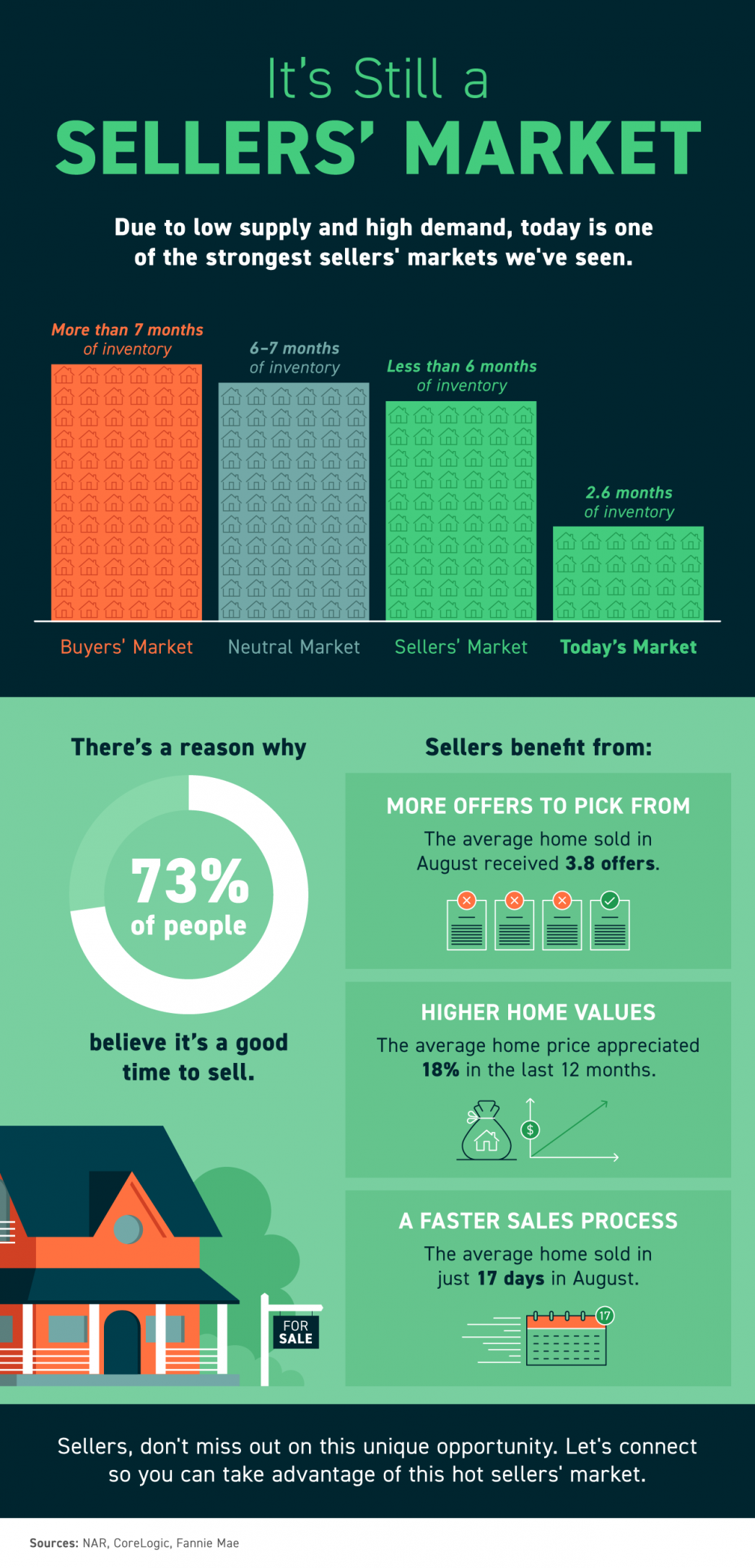

It’s Still a Sellers’ Market In Utah

It’s Still a Sellers’ Market Some Highlights Due to low supply and high demand, today is one of the strongest sellers’ markets we’ve seen. Sellers can benefit from more offers to pick from, higher home values, and a faster sales process. That might be why 73% of...

Is a 20% Down Payment Really Necessary To Purchase a Home?

Is a 20% Down Payment Really Necessary To Purchase a Home? There’s a common misconception that, as a homebuyer, you need to come up with 20% of the total sale price for your down payment. In fact, a recent survey by Lending Tree asks what is keeping consumers from...

Market Stats for So Jo

South Jordan Market Update

Have You Ever Seen a Housing Market Like This?

Have You Ever Seen a Housing Market Like This? Some Highlights Whether you’re buying or selling – today’s housing market has plenty of good news to go around. Buyers can take advantage of today's mortgage rates to escape rising rents and keep monthly...

Is the Number of Homes for Sale Finally Growing?

Is the Number of Homes for Sale Finally Growing? Salt Lake County Active Single Family on September 1st was at 820 Units as of September 16th up slightly to 887 Utah County September 1st was at 664 as of September 16th down to 651 An important metric in today’s...

Reasons You Should Consider Selling This Fall

Reasons You Should Consider Selling This Fall If you're trying to decide when to sell your house, there may not be a better time to list than right now. The ultimate sellers' market we're in today won't last forever. If you’re thinking of making a move, here are four...