RIGHTSIZING? EMPTY NEST? READY TO DOWNSIZE?

Do you have rooms that aren’t being used? Stuff that you don’t remember using for the last ten years? Yard seems to grow bigger every year? These are questions that I ask myself as I approach the 60 year old mark. Am I really using all this space? Do I need all this space? Do my hobbies and passions require the home I am in or can I free up time and equity by finding a more suitable home?

Time, space, passions, budget and maintenance all play a role in staying or moving. The community and neighborhood, mainly neighbors can play a role as well. Some of us stay where we are just because our neighbors are so awesome! I know we have such thoughtful neighbors it would be hard to say good bye to them.

There comes a point in time when hard decisions just have to be made. Your home starts to become a ball and chain around your neck. Property taxes, water bills, heating, electricity and yard care are just too much. You really don’t want to rely on friends and family for constant help. Independence is still a top priority!

As I write this article my Father and Mother still live in the house where I went to grade school. In his 80’s it takes him all week to do what he did in a day. In a good way he keeps occupied and active. The yard looks like a photo out of a gardening magazine! So for now this works for them. I ask myself do I want to move when I am 85? Probably not! I know my Grandad stayed in his home after Grandma passed for at least 15 years. Alone and on his own. Family made frequent visits but still he was alone most of the time till passing in his 90”s.

In reflecting on when best to make a move it would be before my mid 70’s or when my health declines. Once you pass a certain age I think your move would be to assisted living. Not my idea of what I would want. Everyone is different.

Find out What Your Home is Worth

Fall in Love with Homeownership

111,285 Reasons You Should Buy a Home This Year

111,285 Reasons You Should Buy a Home This Year The financial benefits of buying a home versus renting one are always up for debate. However, one element of the equation is often ignored – the ability to build wealth as a homeowner. According to the latest...

What Do Supply and Demand Tell Us About Today’s Housing Market

What Do Supply and Demand Tell Us About Today’s Housing Market? There’s a well-known economic theory – the law of supply and demand – that explains what’s happening with prices in the current real estate market. Put simply, when demand for an item is high, prices...

Early October is the Sweet Spot for Buyers

Early October is the Sweet Spot for Buyers Are you looking to buy a home? If so, we’ve got good news for you. While there’s no denying the housing market is having a great year, many of the headlines are focused on the perks for sellers. But what about buyers today?...

As Home Equity Rises, So Does Your Wealth

As Home Equity Rises, So Does Your Wealth Homeownership is still a crucial part of the American dream. For those people who own a home (and those looking to buy one), it’s clear that being a homeowner has considerable benefits both emotionally and financially. In...

Free Fall Selling Guide is Here! Get Yours!

Selling your home this fall? Free Fall Selling Guide is Here! Get Yours!

If You’re a Buyer, Is Offering Asking Price Enough?

If You’re a Buyer, Is Offering Asking Price Enough? In today’s real estate market, buyers shouldn’t shop for a home with the expectation they’ll be able to negotiate a lower sales price. In a typical housing market, buyers try to determine how much less than the...

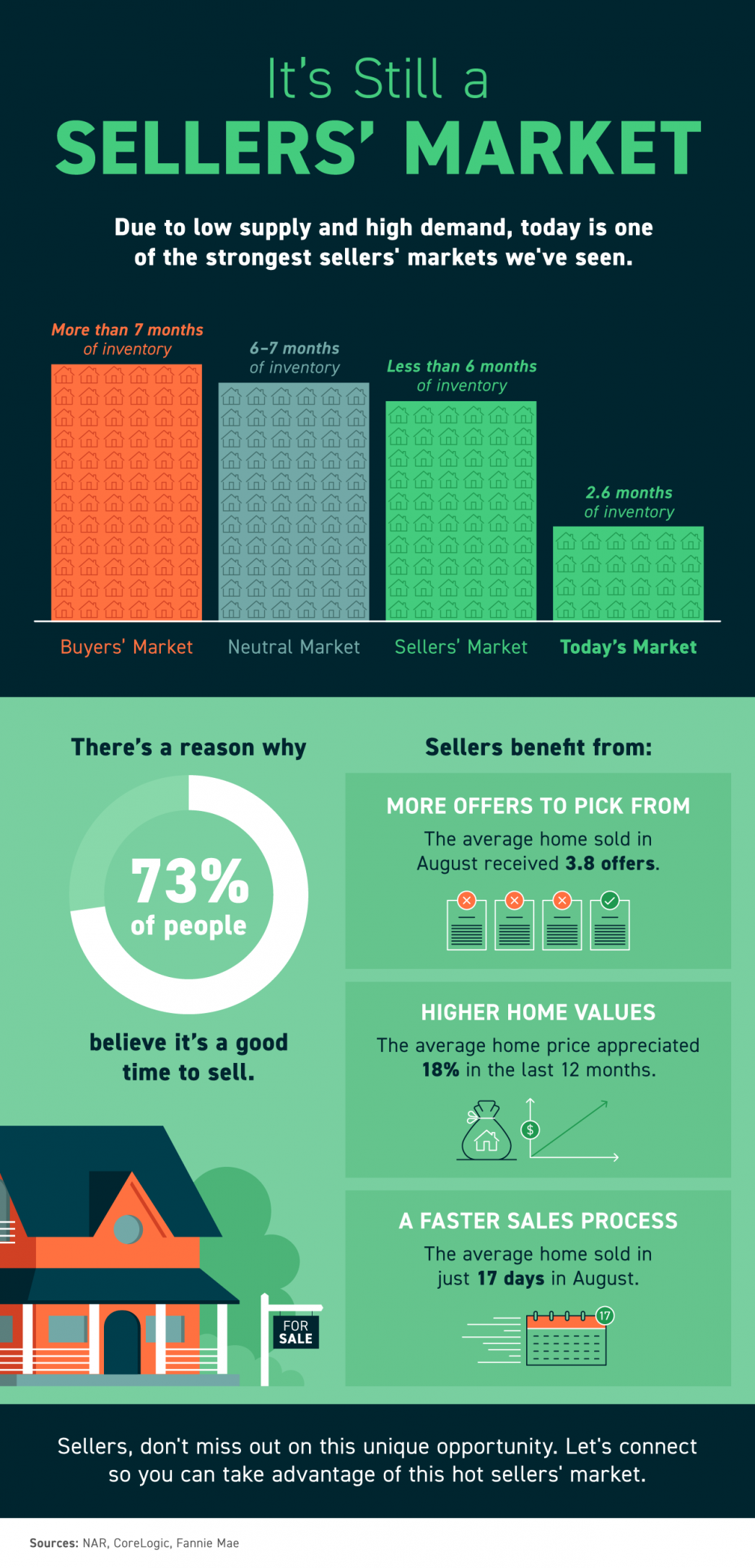

It’s Still a Sellers’ Market In Utah

It’s Still a Sellers’ Market Some Highlights Due to low supply and high demand, today is one of the strongest sellers’ markets we’ve seen. Sellers can benefit from more offers to pick from, higher home values, and a faster sales process. That might be why 73% of...

Is a 20% Down Payment Really Necessary To Purchase a Home?

Is a 20% Down Payment Really Necessary To Purchase a Home? There’s a common misconception that, as a homebuyer, you need to come up with 20% of the total sale price for your down payment. In fact, a recent survey by Lending Tree asks what is keeping consumers from...

Market Stats for So Jo

South Jordan Market Update