RIGHTSIZING? EMPTY NEST? READY TO DOWNSIZE?

Do you have rooms that aren’t being used? Stuff that you don’t remember using for the last ten years? Yard seems to grow bigger every year? These are questions that I ask myself as I approach the 60 year old mark. Am I really using all this space? Do I need all this space? Do my hobbies and passions require the home I am in or can I free up time and equity by finding a more suitable home?

Time, space, passions, budget and maintenance all play a role in staying or moving. The community and neighborhood, mainly neighbors can play a role as well. Some of us stay where we are just because our neighbors are so awesome! I know we have such thoughtful neighbors it would be hard to say good bye to them.

There comes a point in time when hard decisions just have to be made. Your home starts to become a ball and chain around your neck. Property taxes, water bills, heating, electricity and yard care are just too much. You really don’t want to rely on friends and family for constant help. Independence is still a top priority!

As I write this article my Father and Mother still live in the house where I went to grade school. In his 80’s it takes him all week to do what he did in a day. In a good way he keeps occupied and active. The yard looks like a photo out of a gardening magazine! So for now this works for them. I ask myself do I want to move when I am 85? Probably not! I know my Grandad stayed in his home after Grandma passed for at least 15 years. Alone and on his own. Family made frequent visits but still he was alone most of the time till passing in his 90”s.

In reflecting on when best to make a move it would be before my mid 70’s or when my health declines. Once you pass a certain age I think your move would be to assisted living. Not my idea of what I would want. Everyone is different.

Find out What Your Home is Worth

The Main Reason Mortgage Rates Are So High

The Main Reason Mortgage Rates Are So HighToday’s mortgage rates are top-of-mind for many homebuyers right now. As a result, if you’re thinking about buying for the first time or selling your current house to move into a home that better fits your needs, you may be...

The True Value of Homeownership

The True Value of Homeownership Buying and owning your home can make a big difference in your life by bringing you joy and a sense of belonging. And with June being National Homeownership Month, it’s the perfect time to think about all the benefits homeownership...

Keys to Success for First-Time Homebuyers

Keys to Success for First-Time Homebuyers Buying your first home is an exciting decision and a major milestone that has the power to change your life for the better. As a first-time homebuyer, it’s a vision you can bring to life, but, as the National Association of...

Today’s Real Estate Market: The ‘Unicorns’ Have Galloped Off

Today’s Real Estate Market: The ‘Unicorns’ Have Galloped Off Comparing real estate metrics from one year to another can be challenging in a normal housing market. That’s due to possible variability in the market making the comparison less meaningful or accurate....

Remember and Honor Those Who Gave All

Remember and Honor Those Who Gave All We remember and honor those who gave all. Some Highlights

The Benefits of Selling Now, According to Experts

The Benefits of Selling Now, According to Experts If you’re trying to decide if now’s the time to sell your house, here’s what you should know. The limited number of homes available right now gives you a big advantage. That’s because there are more buyers out there...

Why Buyers Need an Expert Agent by Their Side

Why Buyers Need an Expert Agent by Their Side The process of buying a home can feel a bit intimidating, even under normal circumstances. But today's market is still anything but normal. There continues to be a very limited number of homes for sale, and that’s creating...

What You Need To Know About Home Price News

What You Need To Know About Home Price News The National Association of Realtors (NAR) will release its latest Existing Home Sales Report tomorrow. The information it contains on home prices may cause some confusion and could even generate some troubling headlines....

Homeowners Have Incredible Equity To Leverage Right Now

Homeowners Have Incredible Equity To Leverage Right Now Even though home prices have moderated over the last year, many homeowners still have an incredible amount of equity. But what is equity? In the simplest terms, equity is the difference between the market value...

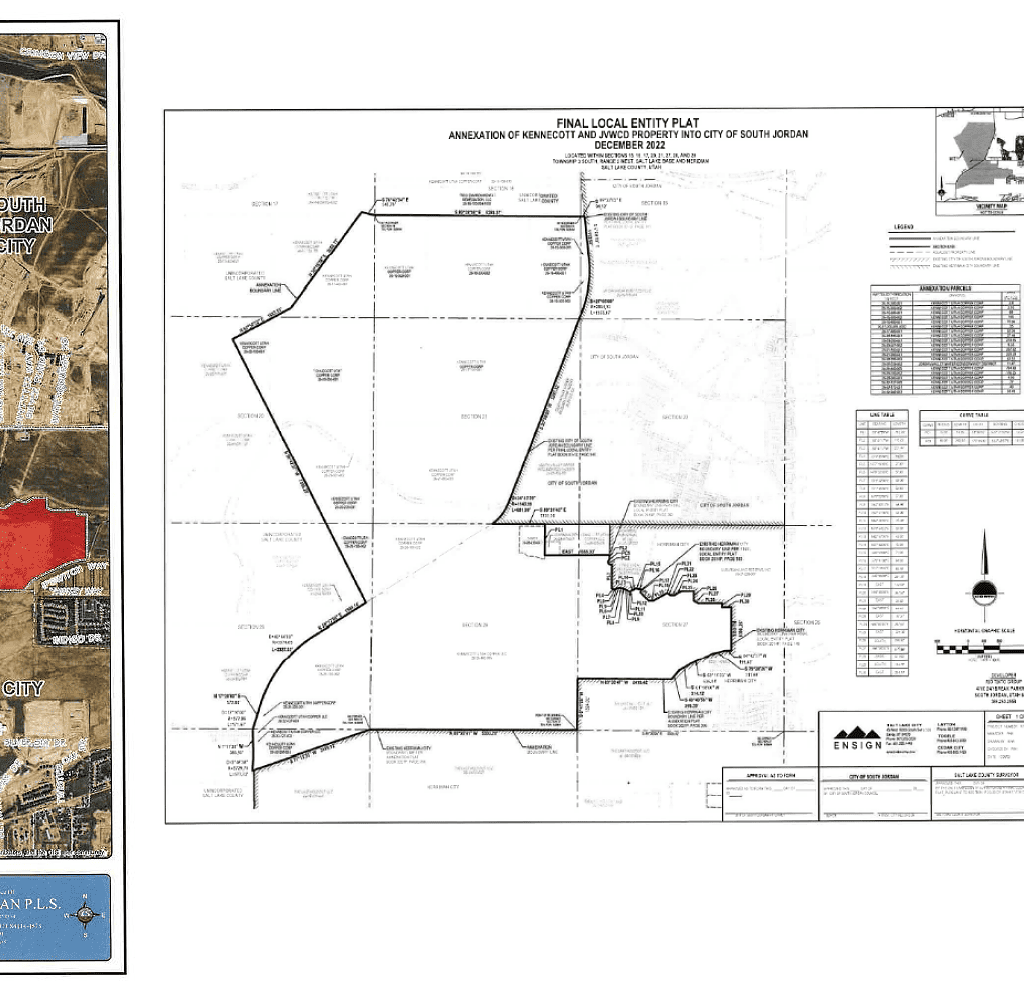

South Jordan City Council has recently announced the annexation of over 2,000 acres of land

South Jordan City Council has recently announced the annexation of over 2,000 acres of land. This move is expected to bring significant growth and development to the area. The annexed land is located in the western part of the city and includes several large parcels...