As the world continues to evolve, so too does the way we invest and transact. In recent years, cryptocurrencies such as Bitcoin and Ethereum have emerged as prominent investment vehicles for tech-savvy individuals. And with the growing popularity of digital currencies, the real estate industry has started to embrace this new form of payment. Whether you’re a seasoned crypto investor or someone curious about the potential benefits, this article will explore the ins and outs of buying real estate using cryptocurrency specifically in the beautiful state of Utah. Get ready to discover the exciting possibilities of combining the digital world of cryptocurrency with the tangible world of real estate!

The Rise Of Crypto Currency In Real Estate Investments

Utah, just like many other parts of the world, has witnessed a surge in the use of cryptocurrency in various industries. One particular sector that has experienced a profound impact is real estate. The rise of cryptocurrency in real estate investments has brought about a paradigm shift in the way people buy and sell properties, offering unique opportunities and challenges for both buyers and sellers.

Cryptocurrency, the digital currency that utilizes cryptography for secure transactions and control the creation of new units, has steadily gained popularity as an alternative form of investment. Bitcoin, the most well-known cryptocurrency, has paved the way for other digital currencies like Ethereum, Ripple, and Litecoin. These digital assets provide investors with a decentralized and secure method of transferring wealth, revolutionizing traditional financial systems.

In recent years, Utah has emerged as a hub for cryptocurrency enthusiasts and blockchain technology startups, attracting individuals and businesses eager to explore the potential of this innovative form of currency. This convergence of tech-savvy individuals and a flourishing real estate market has created a unique synergy, enabling the purchase of properties using cryptocurrency.

One of the primary benefits of buying real estate with cryptocurrency is the potential for increased transparency and reduced transaction costs. Cryptocurrency utilizes blockchain technology, a distributed ledger that ensures all transactions are recorded across a network of computers, making it virtually impossible to alter or manipulate the data. This transparency promotes trust between parties involved in real estate transactions, mitigating the risk of fraudulent activities and reducing the need for intermediaries such as banks or title companies. Ultimately, this can result in lower transaction fees and faster, more streamlined processes.

Moreover, cryptocurrency provides an avenue for international buyers to invest in Utah real estate without the complications of traditional currency exchanges and regulations. With cryptocurrency, the transaction is not subject to the fluctuations of foreign exchange rates, making it an attractive option for global investors seeking stability and diversification.

However, it’s essential to acknowledge the challenges of utilizing cryptocurrency in real estate transactions. One significant concern is the volatile nature of cryptocurrencies. The value of these digital assets can fluctuate dramatically within a short period, potentially affecting the agreed-upon price of a property. Buyers and sellers must carefully consider market trends and evaluate the risks associated with cryptocurrency before entering into a transaction.

Another challenge is the limited acceptance of cryptocurrency in the real estate industry. While more and more businesses are embracing digital currencies, many sellers still prefer traditional forms of payment. As a result, finding sellers willing to accept cryptocurrency can be a hurdle, requiring dedicated platforms or real estate agents with expertise in this emerging market.

To navigate these challenges, buyers and sellers must educate themselves about cryptocurrency and its implications in the real estate market. Professionals such as real estate agents and lawyers who possess a deep understanding of both industries can offer valuable guidance throughout the transaction process.

In conclusion, the rise of cryptocurrency in real estate investments in Utah brings a new dimension to property transactions, offering increased transparency, reduced transaction costs, and potential opportunities for international investors. However, it’s important to approach these transactions with caution, considering the volatility of cryptocurrencies and the limited acceptance within the industry. As this market continues to evolve, both buyers and sellers can benefit from staying informed and seeking professional advice to maximize the potential of cryptocurrency in real estate investments in Utah.

Understanding The Benefits And Risks Of Buying Real Estate With Crypto Currency

When it comes to buying real estate, the world of cryptocurrency has brought about a new and exciting avenue for potential buyers. Utah, known for its stunning landscapes, diverse recreational opportunities, and strong economy, has also seen a rise in the acceptance of cryptocurrency as a form of payment for real estate transactions. However, before diving into this innovative trend, it is crucial to understand the benefits and risks associated with buying real estate with cryptocurrency.

One of the most significant advantages of purchasing real estate with cryptocurrency is the potential for increased privacy and security. Cryptocurrency transactions rely on blockchain technology, which provides a decentralized system that ensures transparency and eliminates the need for intermediaries like banks. This means that the buyer can retain their anonymity while completing the transaction, as personal information and financial details are not explicitly disclosed.

Another notable benefit is the potential for quick and seamless transactions. Traditional real estate transactions often involve mountains of paperwork, multiple parties, and lengthy waiting periods. However, with cryptocurrency, the entire process can be expedited, allowing buyers to secure their dream property in a matter of hours rather than weeks. The elimination of intermediaries and complex procedures reduces the chances of paperwork errors and delays, making the buying process more efficient and convenient.

Furthermore, investing in real estate with cryptocurrency opens up opportunities for diversification. Cryptocurrency presents an alternative form of investment that allows individuals to protect their wealth from the fluctuations of traditional financial markets. By incorporating real estate into their cryptocurrency portfolio, buyers can enjoy the benefits of both worlds, potentially increasing their returns and reducing the risk associated with a single investment.

However, as with any investment, there are inherent risks involved when using cryptocurrency to purchase real estate. One of the primary concerns is the volatility of the cryptocurrency market. Bitcoin, the most well-known cryptocurrency, has experienced significant price fluctuations throughout its existence. The value of cryptocurrencies can skyrocket or plummet in a short span of time, potentially affecting the buyer’s purchasing power and overall investment.

Additionally, the legality and regulatory framework surrounding cryptocurrency in real estate transactions are still evolving. While some states, including Utah, have embraced the use of cryptocurrency for real estate, others have not yet provided specific guidelines or legislation. This lack of regulatory clarity can create uncertainty and potentially expose buyers to legal risks.

Another risk to consider is the potential for fraudulent activities. Although blockchain technology offers enhanced security, cybercriminals are continually finding new ways to exploit vulnerabilities. Buyers must exercise caution and conduct thorough due diligence to ensure the legitimacy of the real estate transaction and the involved parties. Engaging the services of an experienced real estate attorney who specializes in cryptocurrency transactions can provide an additional layer of protection.

Lastly, there may be limited options available for purchasing real estate using cryptocurrency. While the popularity of cryptocurrency is growing rapidly, it remains relatively niche in the real estate market. Buyers may face challenges finding sellers willing to accept cryptocurrency as payment or encounter limitations in terms of the types of properties available for purchase.

In conclusion, buying real estate with cryptocurrency in Utah offers distinct advantages, such as enhanced privacy, quick transactions, and diversification opportunities. However, it also comes with risks, including market volatility, regulatory uncertainty, potential fraud, and limited options. It is crucial for buyers to carefully assess these benefits and risks, seek professional guidance, and conduct thorough research before embarking on a real estate transaction using cryptocurrency. With proper precautions and a clear understanding of the landscape, the convergence of cryptocurrency and real estate can pave the way for exciting opportunities in Utah’s property market.

Exploring The Real Estate Market In Utah For Crypto Currency Transactions

Utah, known for its stunning natural beauty and growing tech industry, has become an attractive destination for real estate investors. With the rise of cryptocurrencies, a new avenue is emerging for those looking to invest in properties within the state. In this section, we will explore the real estate market in Utah and how crypto currency transactions are shaping the industry.

The concept of using crypto currency to purchase real estate is relatively new, but it is steadily gaining traction. While still not mainstream, more and more sellers in Utah are starting to accept cryptocurrencies such as Bitcoin and Ethereum as a form of payment for their properties. This trend can be attributed to the increasing acceptance and understanding of digital currencies among both buyers and sellers.

One of the primary reasons why crypto currency transactions are becoming popular in the Utah real estate market is the potential for anonymity and security. Blockchain technology, the foundation of cryptocurrencies, offers decentralized and transparent transactions. This appeals to both buyers and sellers, as it eliminates the need for intermediaries such as banks, reduces transaction fees, and provides a higher level of privacy.

Moreover, the potential for significant financial gains from crypto investments is another reason behind the increasing interest in real estate transactions with digital currencies. With the volatility and potential return on investment that cryptocurrencies offer, investors are looking for ways to diversify their holdings. Real estate, which has historically proven to be a stable and profitable investment, is an appealing option for those looking to leverage their crypto assets.

Utah, in particular, offers a myriad of opportunities for crypto currency transactions, thanks to its thriving real estate market. The state boasts a growing tech sector, attracting young professionals and investors alike. In cities such as Salt Lake City and Park City, there is a mix of commercial and residential properties available that cater to a wide range of budgets and preferences.

The acceptance of crypto currency transactions in Utah’s real estate market is not limited to high-end properties. Sellers across various price points are beginning to explore this alternative payment option, creating opportunities for different types of investors to participate in the market. This inclusivity is one of the factors contributing to the rise of crypto currency transactions within the state.

However, it is essential to understand that while the option to buy real estate with crypto currency is available, it still comes with its risks and challenges. Cryptocurrencies can be volatile and subject to sudden price fluctuations. Therefore, buyers must conduct thorough research and due diligence before engaging in any real estate transaction involving digital currencies.

Additionally, buyers and sellers must ensure they comply with all applicable laws and regulations regarding real estate and crypto currency transactions in Utah. Working with experienced professionals, such as real estate agents or attorneys, who have expertise in both fields, can help navigate any legal complexities and ensure a smooth transaction process.

As the popularity of cryptocurrencies continues to rise and their adoption becomes more mainstream, it is likely we will see an increasing number of real estate transactions in Utah conducted through digital currencies. The potential benefits, such as security, privacy, and financial diversification, make this emerging trend a viable option for both investors and sellers in the state.

In conclusion, the real estate market in Utah is embracing the use of crypto currencies as a means of payment. While still not widely adopted, the growing acceptance of digital currencies by sellers opens up new opportunities for investors. Buyers looking to utilize their crypto assets in the Utah real estate market must exercise caution, conduct thorough research, and ensure compliance with applicable laws and regulations. With the right approach, individuals can leverage the benefits of crypto currencies to make successful real estate transactions in this beautiful state.

Tips For Successfully Buying Real Estate With Crypto Currency In Utah

As an emerging form of digital currency, the use of cryptocurrency in real estate transactions is becoming increasingly popular. Utah, with its thriving real estate market and tech-savvy residents, has presented itself as a favorable destination for those looking to invest in real estate using cryptocurrency. If you’re considering buying real estate with cryptocurrency in Utah, here are a few tips to help you navigate the process successfully.

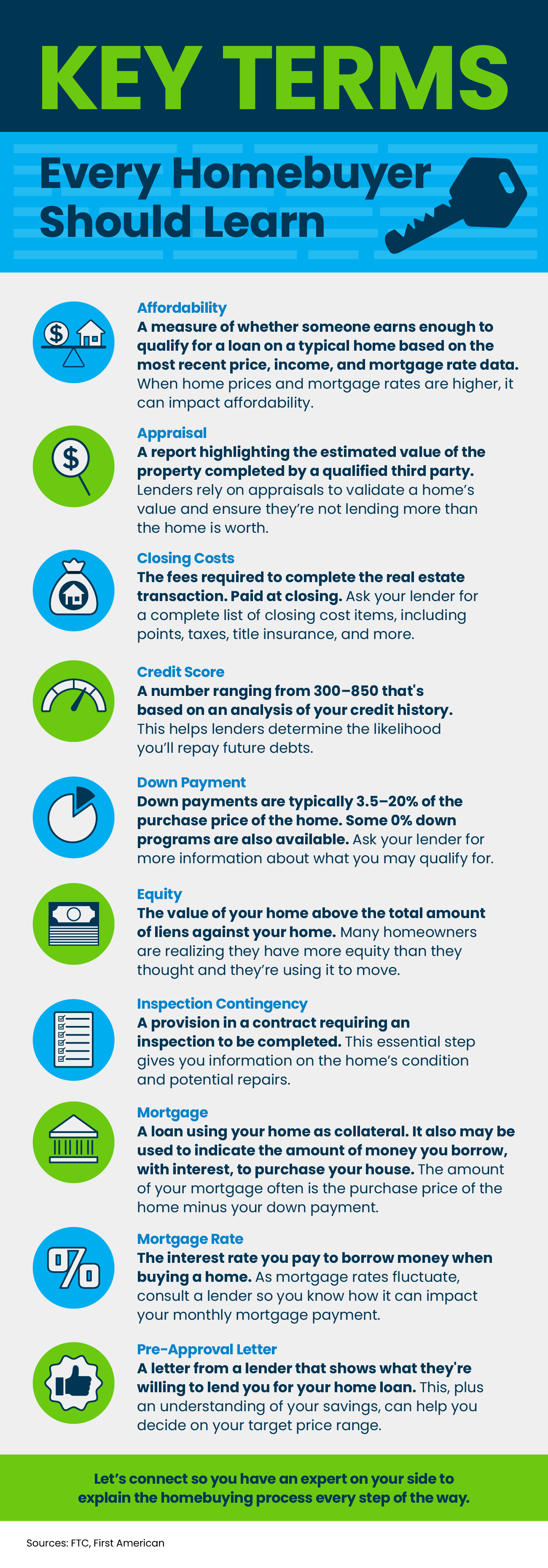

1. Education is key: Before diving into the world of real estate transactions with cryptocurrency, it is crucial to familiarize yourself with the basic concepts and workings of both real estate and cryptocurrency. Understand the risks, benefits, and legal implications involved in using cryptocurrency as a means of payment. Additionally, stay updated on the latest trends, regulations, and developments in both the real estate and cryptocurrency markets.

2. Partner with an experienced real estate agent: Collaborating with a knowledgeable and experienced real estate agent who is well-versed in cryptocurrency transactions can significantly streamline the buying process. A reliable agent will not only assist you in finding suitable properties but will also guide you through the intricacies of purchasing real estate with cryptocurrency. They can provide valuable insights, negotiate favorable deals, and ensure a smooth transaction from start to finish.

3. Choose the right cryptocurrency: When purchasing real estate with cryptocurrency, it’s essential to determine which cryptocurrency to use. While Bitcoin remains the most widely accepted cryptocurrency in real estate transactions, some sellers may accept other mainstream cryptocurrencies like Ethereum or Litecoin. Research which cryptocurrencies are most widely accepted in the Utah real estate market, and consider factors such as transaction speed, security, and transaction fees before finalizing your decision.

4. Conduct due diligence on the property: Just like with any real estate purchase, conducting thorough due diligence is paramount. Research the property thoroughly, including its title, ownership history, legal restrictions, and any liens or encumbrances. It’s advisable to involve legal counsel to ensure you’re protected throughout the transaction. Remember, cryptocurrency transactions are irreversible, so verifying the property’s authenticity and legality is of utmost importance.

5. Keep track of cryptocurrency regulations: Cryptocurrency regulations can vary from state to state and even country to country. Stay informed about the regulatory environment surrounding cryptocurrency transactions in Utah to ensure compliance with local laws. Consult with legal experts who specialize in cryptocurrency transactions and real estate in Utah to ensure that you adhere to all the necessary guidelines.

6. Secure your cryptocurrency assets: Protecting your cryptocurrency assets is crucial, especially during a real estate transaction. Implement robust security measures such as using hardware wallets, multi-factor authentication, and strong encryption protocols to safeguard your cryptocurrency from cyber threats. Consult with cybersecurity professionals to ensure your digital assets remain secure.

7. Prepare for potential market volatility: Cryptocurrency markets are known for their high volatility. When purchasing real estate with cryptocurrency, it’s important to be prepared for market fluctuations and price volatility. Consider consulting with financial advisors to develop a comprehensive risk management strategy that aligns with your investment goals and risk tolerance.

8. Consult with tax professionals: Real estate transactions, particularly those involving cryptocurrency, have tax implications. Cryptocurrency transactions can trigger capital gains taxes or other tax liabilities. Consulting with tax professionals who specialize in cryptocurrency transactions and real estate in Utah will ensure you meet all your tax obligations and prevent any unpleasant surprises down the line.

In conclusion, buying real estate with cryptocurrency in Utah can be an exciting and rewarding endeavor. By educating yourself, working with professionals who specialize in cryptocurrency transactions, conducting thorough due diligence, and staying informed about legal and market regulations, you can navigate the process successfully. Remember to approach each transaction with caution, and seek guidance from experts to make informed decisions that align with your investment objectives.