With Inventory Low: Will Your Dream Home Need Some TLC?

According to a new survey from Move.com, the wave of first-time homebuyers hitting the market this summer has resulted in an interesting statistic. Nearly 60% of buyers searching for a home this spring are willing to consider buying a fixer-upper, with 95% believing that the projects needed will increase their new home’s value!

Realtor.com’s Chief Economist, Danielle Hale, pointed to low-inventory at the entry-level price range for the increase in willingness to renovate.

“The combination of rising home prices and limited entry-level homes for sale is prompting many home shoppers to consider homes that need renovating.

Replete with inspiration at their fingertips – like Pinterest, Instagram, and various home renovation TV shows – some home shoppers are comfortable tackling home renovation jobs to find a home that balances their needs with their budget.”

Just over half of all respondents who said they would be willing to buy a home in need of some TLC, would also spend more $20,000 to make the home fit their needs.

The most common ‘expected’ renovation is a kitchen remodel which can run anywhere from $22,000 for a minor remodel to $66,000 for a major remodel.

This isn’t a new trend by any means. According to the Joint Center for Housing Studies at Harvard University, home improvement project spending reached a new high in 2018.

“Americans spent $336.9 billion on remodeling projects, up 7.4% from the $313.6 billion a year earlier.”

Home renovation television shows have given many buyers hope that they could renovate a home they can afford into their dream home!

Bottom Line

If you are one of the many Americans considering buying a home this spring, let’s get together to help you find a house with the potential to be your dream home!

Why Moving to a Smaller Home After Retirement Makes Life Easier

Why Moving to a Smaller Home After Retirement Makes Life Easier Retirement is a time for relaxation, adventure, and enjoying the things you love. As you imagine this exciting new chapter in your life, it's important to think about whether your current home still fits...

Why Your Asking Price Matters Even More Right Now

Why Your Asking Price Matters Even More Right Now If you’re thinking about selling your house, here’s something you really need to know. Even though it’s still a seller’s market today, you can’t pick just any price for your listing. While home prices are still...

Things To Avoid After Applying for a Mortgage

Things To Avoid After Applying for a Mortgage Some Highlights There are a few key things you’ll want to avoid after applying for a mortgage to make sure you’re in the best position when you get to the closing table. Don’t change bank accounts, apply for new credit,...

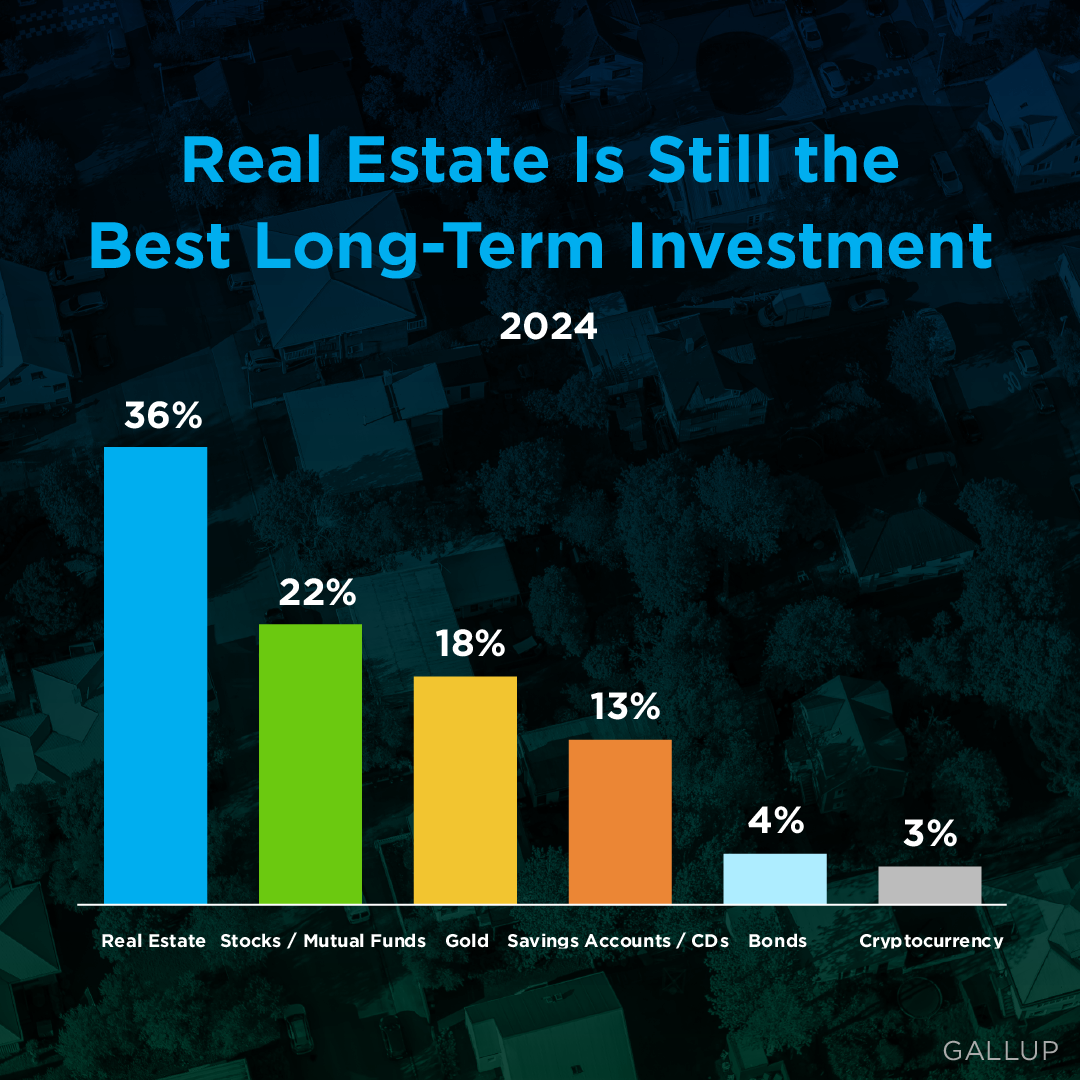

Real Estate Is the Best Investment

Did you know? Real estate has been voted the best long-term investment for 12 years straight. That’s because history shows home values usually go up. And when that happens, it helps homeowners grow their net worth. So, if you’re debating renting or buying, remember to...

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024 As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales. Home Prices Are Expected To Climb Moderately Home prices are...

Do Elections Impact the Housing Market?

Do Elections Impact the Housing Market? The 2024 Presidential election is just months away. As someone who’s thinking about potentially buying or selling a home, you’re probably curious about what effect, if any, elections have on the housing market. It’s a great...

More Than a House: The Emotional Benefits of Homeownership

More Than a House: The Emotional Benefits of Homeownership With all the headlines and talk about housing affordability, it can be tempting to get lost in the financial side of buying a home. That’s only natural as you think about the dollars and cents of it...

How Missing or Ghosting A Home Showing Can Damage Your Reputation And Business In Real Estate

How Missing or Ghosting A Home Showing Can Damage Your Reputation And Business In Real Estate In the competitive world of real estate, maintaining a stellar reputation is not just important; it's paramount. Missing a home showing might seem like a minor mishap, easily...

Real Estate Agent Marketing Methods

Ready to sell your house? One of your top priorities may be getting help marketing your home. Partnering with a great agent can make all the difference. These are just a few strategies we can use to get your house more visibility. Ready to maximize your home's...

Hiring a PSA or Pricing Strategy Advisor is the Key to Pricing your Home Right

Your Agent Is the Key To Pricing Your House Right [INFOGRAPHIC] Some Highlights The asking price for your house can impact your bottom line and how quickly it sells. Both under- and overpricing have drawbacks. So to find the right price for your house, lean on your...