With Inventory Low: Will Your Dream Home Need Some TLC?

According to a new survey from Move.com, the wave of first-time homebuyers hitting the market this summer has resulted in an interesting statistic. Nearly 60% of buyers searching for a home this spring are willing to consider buying a fixer-upper, with 95% believing that the projects needed will increase their new home’s value!

Realtor.com’s Chief Economist, Danielle Hale, pointed to low-inventory at the entry-level price range for the increase in willingness to renovate.

“The combination of rising home prices and limited entry-level homes for sale is prompting many home shoppers to consider homes that need renovating.

Replete with inspiration at their fingertips – like Pinterest, Instagram, and various home renovation TV shows – some home shoppers are comfortable tackling home renovation jobs to find a home that balances their needs with their budget.”

Just over half of all respondents who said they would be willing to buy a home in need of some TLC, would also spend more $20,000 to make the home fit their needs.

The most common ‘expected’ renovation is a kitchen remodel which can run anywhere from $22,000 for a minor remodel to $66,000 for a major remodel.

This isn’t a new trend by any means. According to the Joint Center for Housing Studies at Harvard University, home improvement project spending reached a new high in 2018.

“Americans spent $336.9 billion on remodeling projects, up 7.4% from the $313.6 billion a year earlier.”

Home renovation television shows have given many buyers hope that they could renovate a home they can afford into their dream home!

Bottom Line

If you are one of the many Americans considering buying a home this spring, let’s get together to help you find a house with the potential to be your dream home!

5 Simple Graphs That Prove This Is Not Like the Last Time

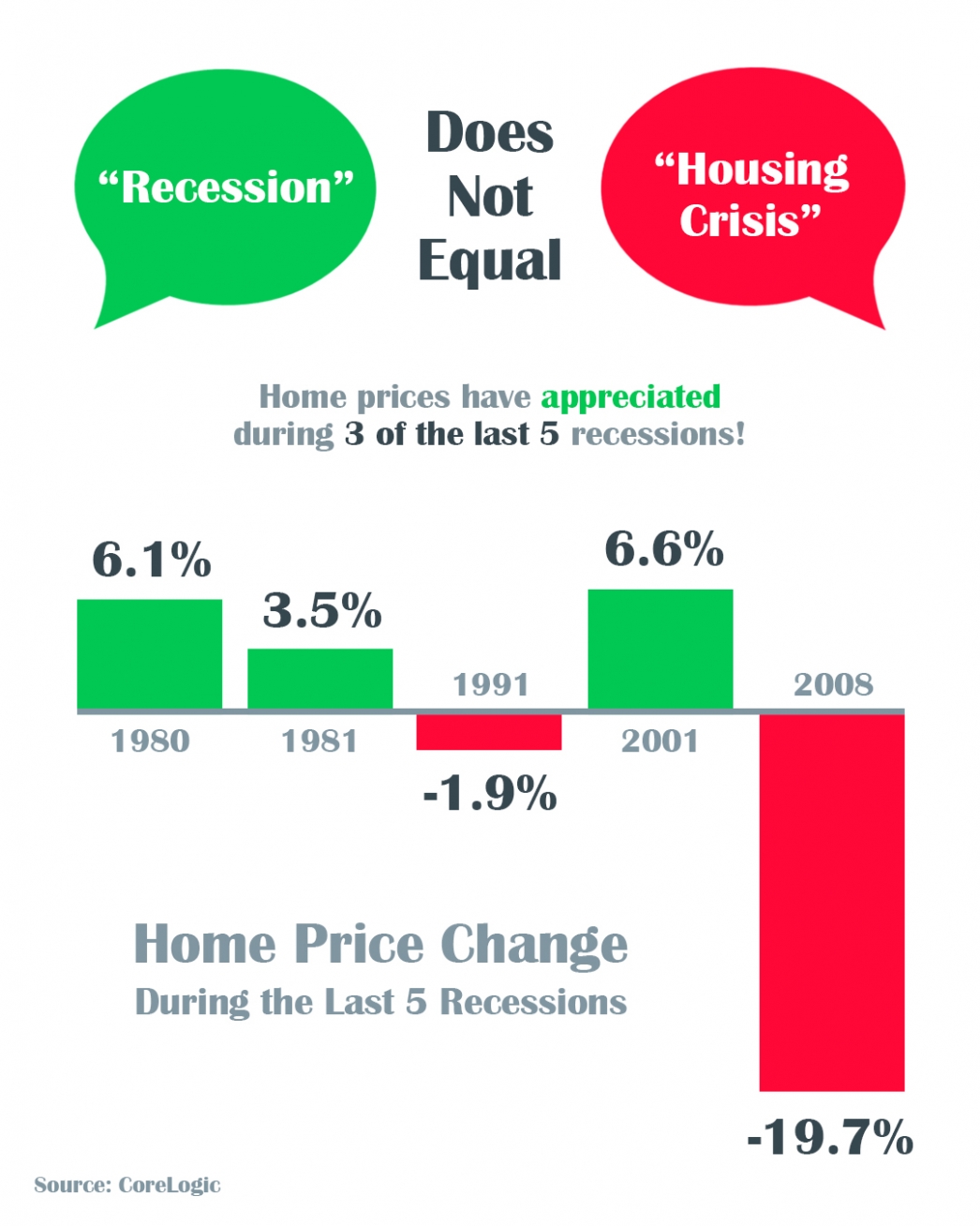

A Recession Does Not Equal a Housing Crisis

A Recession Does Not Equal a Housing Crisis Some HighlightsThe COVID-19 pandemic is causing an economic slowdown.The good news is, home values actually increased in 3 of the last 5 U.S. recessions and decreased by less than 2% in the 4th.All things considered, an...

Coronavirus Map

View the the interactive map https://google.org/crisisresponse/covid19-map

Coronavirus (COVID-19)

Notice the On Set Dates Below

Three Reasons Why This Is Not a Housing Crisis

Three Reasons Why This Is Not a Housing Crisis In times of uncertainty, one of the best things we can do to ease our fears is to educate ourselves with research, facts, and data. Digging into past experiences by reviewing historical trends and understanding the peaks...

Happy St Patrick’s Day Utah!

Two Big Myths in the Homebuying Process

Two Big Myths in the Homebuying Process The 2020 Millennial Home Buyer Report shows how this generation is not really any different from previous ones when it comes to homeownership goals: “The majority of millennials not only want to own a home, but 84% of...

5 Simple Graphs Proving This Is NOT Like the Last Time

5 Simple Graphs Proving This Is NOT Like the Last Time With all of the volatility in the stock market and uncertainty about the Coronavirus (COVID-19), some are concerned we may be headed for another housing crash like the one we experienced from 2006-2008. The...

Yes, You Can Still Afford a Home

Yes, You Can Still Afford a Home The residential real estate market has come roaring out of the gates in 2020. Compared to this time last year, the number of buyers looking for a home is up 20%, and the number of home sales is up almost 10%. The increase in purchasing...

Confidence Is the Key to Success for Young Homebuyers

Confidence Is the Key to Success for Young HomebuyersBuying your first home can seem overwhelming. Thankfully, there’s a lot of great information out there to help you feel more confident as you learn about the process. For those in younger generations who aspire to...