With Inventory Low: Will Your Dream Home Need Some TLC?

According to a new survey from Move.com, the wave of first-time homebuyers hitting the market this summer has resulted in an interesting statistic. Nearly 60% of buyers searching for a home this spring are willing to consider buying a fixer-upper, with 95% believing that the projects needed will increase their new home’s value!

Realtor.com’s Chief Economist, Danielle Hale, pointed to low-inventory at the entry-level price range for the increase in willingness to renovate.

“The combination of rising home prices and limited entry-level homes for sale is prompting many home shoppers to consider homes that need renovating.

Replete with inspiration at their fingertips – like Pinterest, Instagram, and various home renovation TV shows – some home shoppers are comfortable tackling home renovation jobs to find a home that balances their needs with their budget.”

Just over half of all respondents who said they would be willing to buy a home in need of some TLC, would also spend more $20,000 to make the home fit their needs.

The most common ‘expected’ renovation is a kitchen remodel which can run anywhere from $22,000 for a minor remodel to $66,000 for a major remodel.

This isn’t a new trend by any means. According to the Joint Center for Housing Studies at Harvard University, home improvement project spending reached a new high in 2018.

“Americans spent $336.9 billion on remodeling projects, up 7.4% from the $313.6 billion a year earlier.”

Home renovation television shows have given many buyers hope that they could renovate a home they can afford into their dream home!

Bottom Line

If you are one of the many Americans considering buying a home this spring, let’s get together to help you find a house with the potential to be your dream home!

Salt Lake Home Sales Climb to Record High in July 2020

Salt Lake Home Sales Climb to Record High in July Salt Lake County home sales reached an all-time high in July at 2,093 homes sold, 15 percent higher than July 2019. It's the first time monthly sales surpassed 2,000 closings since the MLS began keeping records....

Utah Real Estate Tip – there are no “easy” transactions.

Real Estate Legal Tip - there are no "easy" transactions.Some people say that when the market is hot, "I can sell my home myself," or "I don't need an experienced agent because it costs money," or "how hard can it be?"Curtis Bullock From the Salt Lake Board of...

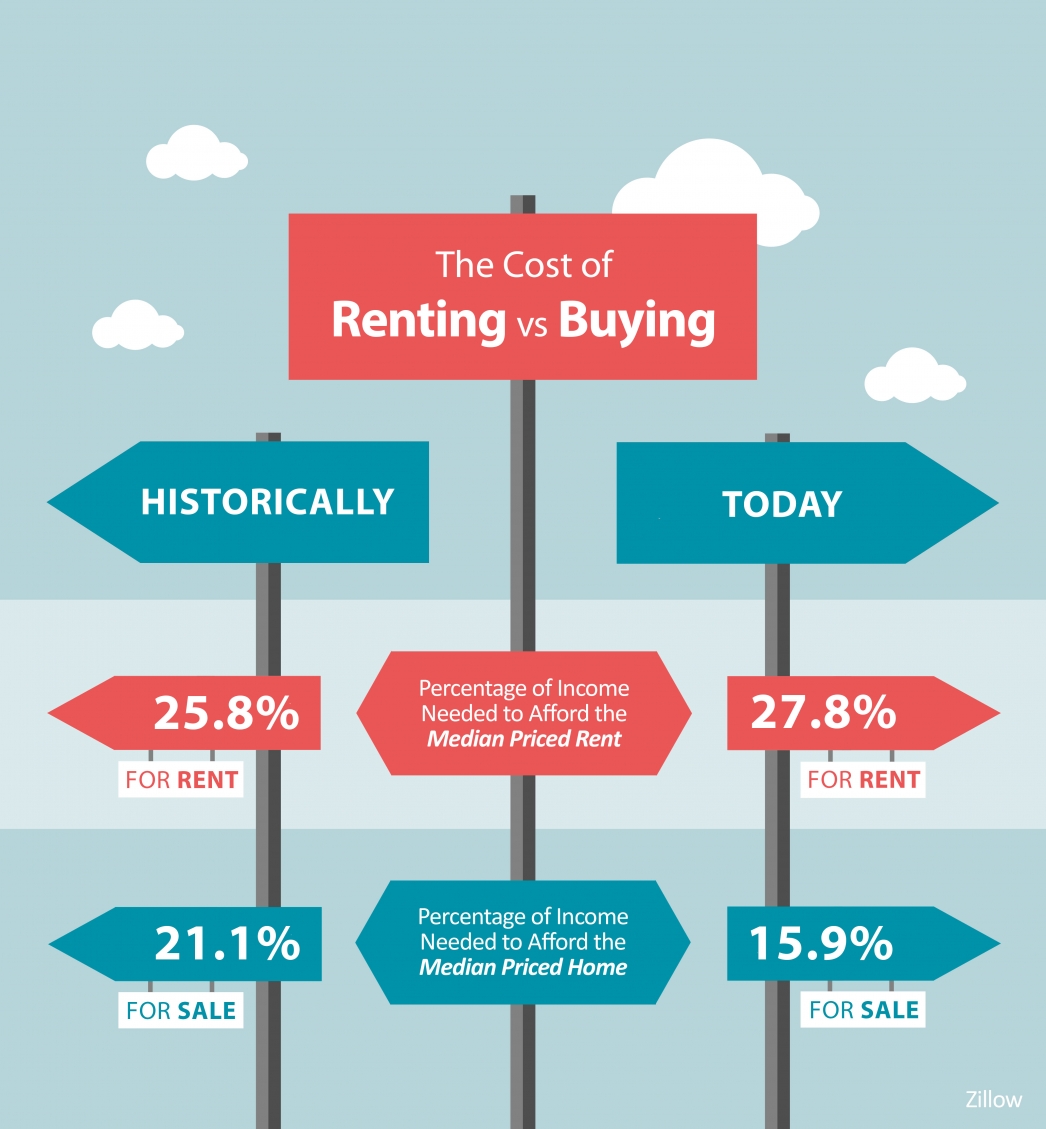

The Cost of Renting Vs. Buying a Home

The Cost of Renting Vs. Buying a HomeSome HighlightsThe percentage of income needed to afford a median-priced home today is declining, while that for renting is on the rise.This is making buying a home an increasingly attractive option for many people, especially with...

Forbearance Numbers Are Lower Than Experts Forecasted

Forbearances have stayed well under the rate experts initially forecasted. Let's connect if you have questions about your options.

Top Reasons People Are Moving This Year In 2020

The Top Reasons People Are Moving This YearToday, Americans are moving for a variety of different reasons. The current health crisis has truly re-shaped our lifestyles and our needs. Spending extra time where we currently live is enabling many families to re-evaluate...

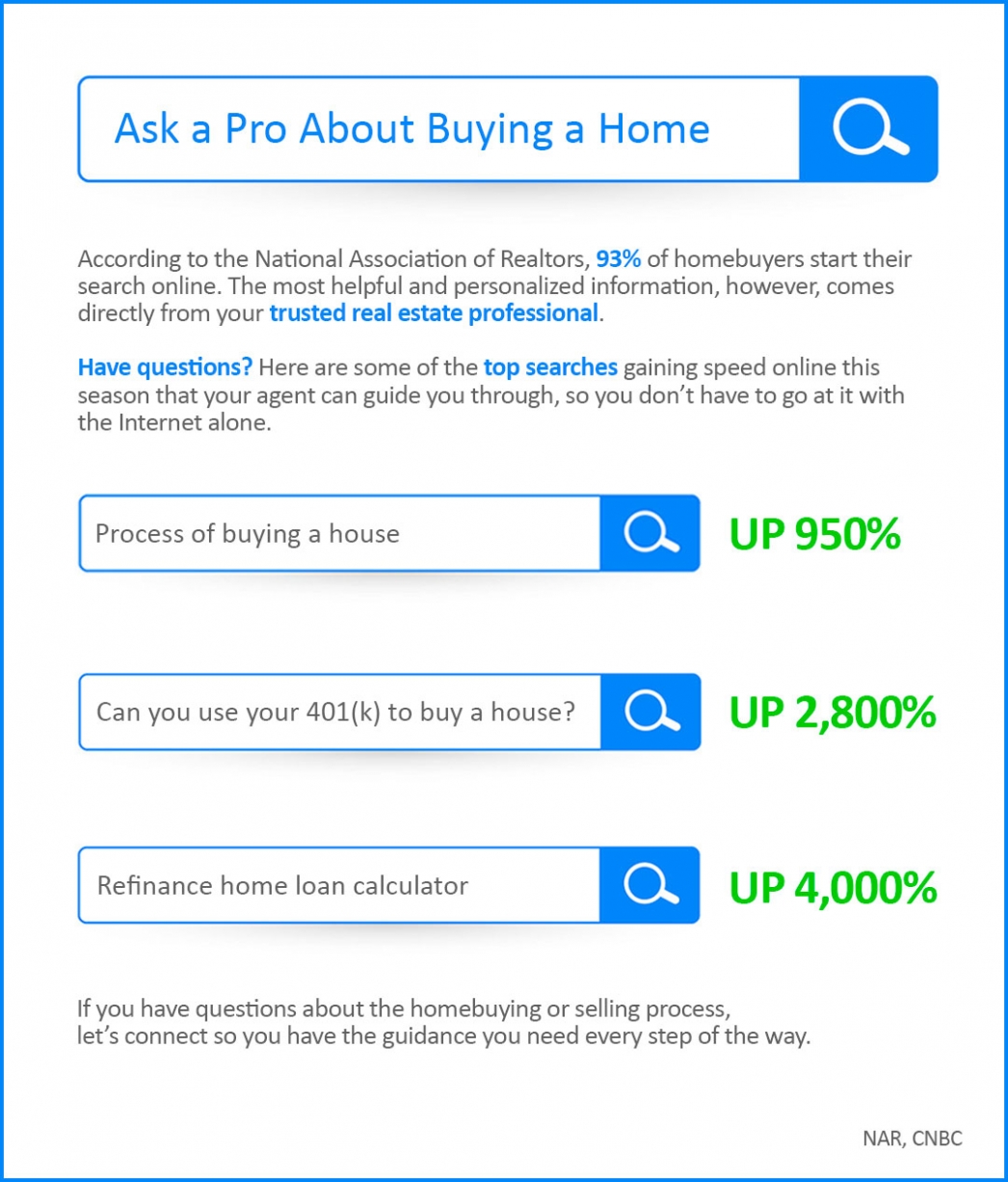

Ask a Pro About Buying a Home

Ask a Pro About Buying a Home Some HighlightsAccording to trending data, searches for key real estate topics are skyrocketing online.Clearly, lots of people have questions about buying a home, and other topics related to the process.Working with a trusted real estate...

Home Has a Whole New Meaning Today

Forbearance Numbers Are Lower than Expected

Forbearance Numbers Are Lower than ExpectedOriginally, some housing industry analysts were concerned that the mortgage forbearance program (which allows families to delay payments to a later date) could lead to an increase in foreclosures when forbearances end. Some...

Are you Thinking About Selling? Sellers Are Returning to the Housing Market

Sellers Are Returning to the Housing MarketGet Your PEAR Report Today! (Professional Equity Assessment Report)In today’s housing market, it can be a big challenge for buyers to find homes to purchase, as the number of houses for sale is far below the current demand....

The Beginning of an Economic Recovery In Utah

The Beginning of an Economic RecoveryThe news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand...