How To List Your Home for the Best Price

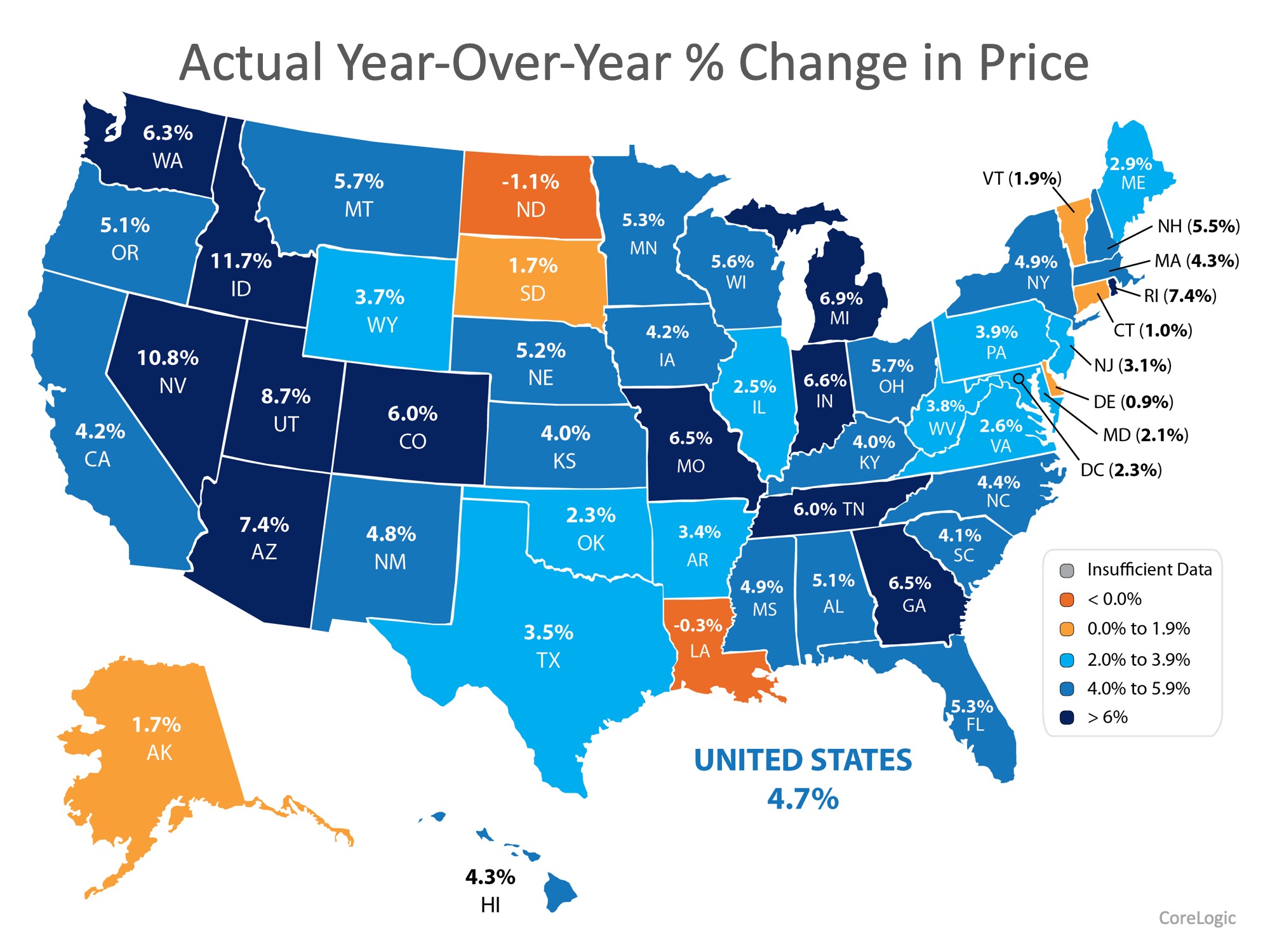

If your plan for 2019 includes selling your home, you will want to pay attention to where experts believe home values are headed. According to the latest Home Price Index from CoreLogic, home prices increased by 4.7% over the course of 2018.

The map below shows the results of the latest index by state.

Real estate is local. Each state appreciates at different levels. The majority of the country saw at least a 2.0% gain in home values, while some residents in North Dakota and Louisiana may have felt prices slow slightly.

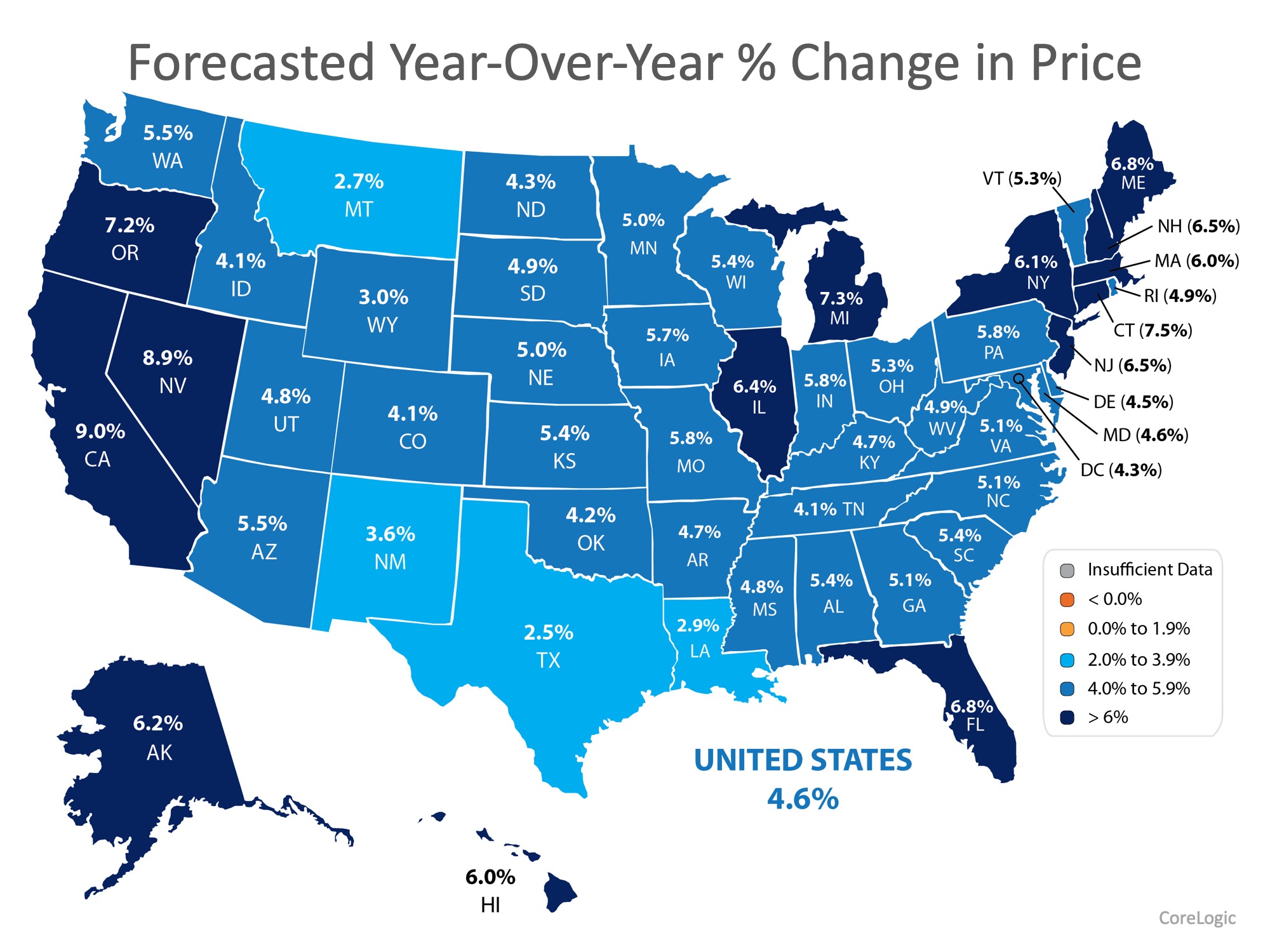

This effect will be short lived. In the same report, CoreLogic forecasts that every state in the Union will experience at least 2.0% appreciation, with the majority of the country gaining at least 4.0%! The prediction for the country comes in at 4.6%. For a median-priced home, that translates to over $14,000 in additional equity next year! (The map below shows the forecast by state.)

So, how does this help you list your home for the best price?

Armed with the knowledge of how much experts believe your house will appreciate this year, you will be able to set an appropriate price for your listing from the start. If homes like yours are appreciating at 4.0%, you won’t want to list your home for more than that amount!

One of the biggest mistakes homeowners make is pricing their homes too high and reducing the price later when they do not get any offers. This can lead buyers to believe that there may be something wrong with the home, when in fact the price was just too high for the market.

Bottom Line

Pricing your home right from the start is one of the most challenging parts of selling your home. Once you decide to list your house, let’s get together to discuss where home values are headed in your area!

Maximizing Returns: How to Refinance Your Investment Property

Buying a second home involves stricter mortgage rules and higher rates. Refinancing can optimize cash flow and change terms, rates, or release equity on rental properties. Conventional loans are required for cash-out refinancing on investment properties. Leveraging...

Salt Lake County property tax bills could see a slight drop this year

Salt Lake County's certified property tax rate decreased from 0.1297% to 0.1253% to adjust for inflation, keeping revenue stable without raising taxes. New growth added $3.76 million in revenue, though slightly below projections. Some residents will see different...

Rising Tariffs: Will Renters Face the Cost?

Apartment construction slowing down could lead landlords to raise rents due to limited supply. U.S. asking rents have stabilized, but tariffs may disrupt the rental market and drive prices up.

How to Get Your Property Sale-Ready in 5 Steps

Enhance curb appeal: A well-maintained exterior creates trust and attracts buyers from the moment they arrive. Declutter and depersonalize: Remove personal items to allow buyers to imagine themselves in the space.

Utah: America’s Next Hot Growth Market

Utah ranks among the fastest-growing states in the US as of 2025. Utah balances outdoor adventure with economic opportunity. High quality of life draws nationwide movers. Young families flock to Utah’s vibrant tech scene. Utah’s lower-than-average living costs help...

Tips for selling a house fast

A Fannie Mae survey reveals that 86% of participants believe it's a bad time to buy a house due to affordability issues, with Freddie Mac reporting a 6.86% 30-year fixed mortgage rate. However, homeowners' perception of selling conditions remains positive....

Happy Fourth of July

To all great Americans around the world, a very Happy Fourth of July to you all. This day is incredibly significant as the day the United States officially became its own nation. Let’s celebrate America’s birthday with festivals, parades, fireworks and other festive...

Goldman Sees More Rate Cuts Ahead

Goldman Sachs expects 3 rate cuts in 2025, totaling 0.75%, while the Fed currently projects only two. Tariffs and higher costs are likely driving Goldman’s forecast, predicting slower growth and weaker consumer confidence

Have 3 Remodeling Options? High-Value Ones for 2025

Not all renovations boost home value; strategic improvements matter most for 2025. Energy-efficient upgrades like solar panels and insulation cut utility bills and attract budget-conscious buyers.

Can You Afford a 3-Bed Home in Utah in 2025?

In 2025, buying a home remains out of reach for many Americans as housing prices continue to rise. A recent report shows that in 35 out of 50 states, a 6-figure income is now required to afford a median-priced 3-bed home. In high-cost states like Utah, buyers need a...