3 Reasons Why We Are Not Heading Toward Another Housing Crash

With home prices softening, some are concerned that we may be headed toward the next housing crash. However, it is important to remember that today’s market is quite different than the bubble market of twelve years ago.

Here are three key metrics that will explain why:

- Home Prices

- Mortgage Standards

- Foreclosure Rates

HOME PRICES

A decade ago, home prices depreciated dramatically, losing about 29% of their value over a four-year period (2008-2011). Today, prices are not depreciating. The level of appreciation is just decelerating.

Home values are no longer appreciating annually at a rate of 6-7%. However, they have still increased by more than 4% over the last year. Of the 100 experts reached for the latest Home Price Expectation Survey, 94 said home values would continue to appreciate through 2019. It will just occur at a lower rate.

MORTGAGE STANDARDS

Many are concerned that lending institutions are again easing standards to a level that helped create the last housing bubble. However, there is proof that today’s standards are nowhere near as lenient as they were leading up to the crash.

The Urban Institute’s Housing Finance Policy Center issues a quarterly index which,

“…measures the percentage of home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.”

Last month, their January Housing Credit Availability Index revealed:

“Significant space remains to safely expand the credit box. If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.”

FORECLOSURE INVENTORY

Within the last decade, distressed properties (foreclosures and short sales) made up 35% of all home sales. The Mortgage Bankers’ Association revealed just last week that:

“The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.95 percent…This was the lowest foreclosure inventory rate since the first quarter of 1996.”

Bottom Line

After using these three key housing metrics to compare today’s market to that of the last decade, we can see that the two markets are nothing alike.

3 Reasons Why We Are Not Heading Toward Another Housing Crash

With home prices softening, some are concerned that we may be headed toward the next housing crash. However, it is important to remember that today’s market is quite different than the bubble market of twelve years ago.

Here are three key metrics that will explain why:

- Home Prices

- Mortgage Standards

- Foreclosure Rates

HOME PRICES

A decade ago, home prices depreciated dramatically, losing about 29% of their value over a four-year period (2008-2011). Today, prices are not depreciating. The level of appreciation is just decelerating.

Home values are no longer appreciating annually at a rate of 6-7%. However, they have still increased by more than 4% over the last year. Of the 100 experts reached for the latest Home Price Expectation Survey, 94 said home values would continue to appreciate through 2019. It will just occur at a lower rate.

MORTGAGE STANDARDS

Many are concerned that lending institutions are again easing standards to a level that helped create the last housing bubble. However, there is proof that today’s standards are nowhere near as lenient as they were leading up to the crash.

The Urban Institute’s Housing Finance Policy Center issues a quarterly index which,

“…measures the percentage of home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.”

Last month, their January Housing Credit Availability Index revealed:

“Significant space remains to safely expand the credit box. If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.”

FORECLOSURE INVENTORY

Within the last decade, distressed properties (foreclosures and short sales) made up 35% of all home sales. The Mortgage Bankers’ Association revealed just last week that:

“The percentage of loans in the foreclosure process at the end of the fourth quarter was 0.95 percent…This was the lowest foreclosure inventory rate since the first quarter of 1996.”

Bottom Line

After using these three key housing metrics to compare today’s market to that of the last decade, we can see that the two markets are nothing alike.

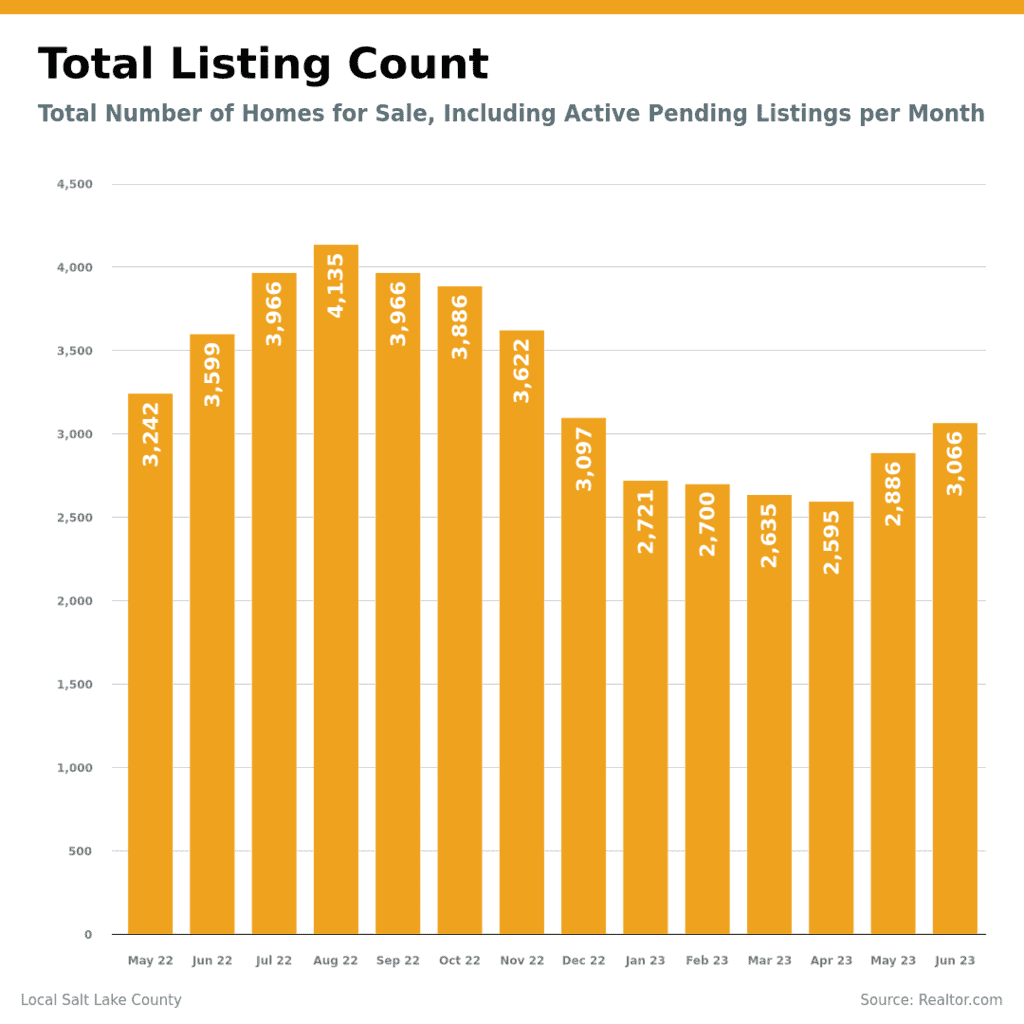

Salt Lake County Market Insights By Marty Gale Utah Realty

Salt Lake County Market Insights from May 2022 to June 2023 Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY HOME MARKETING SPECIALIST (CLHM) PSA (Pricing Strategy Advisor) General...

What Makes A Great Real Estate Agent

What Makes A Great Real Estate Agent Are you on the hunt for your dream home or perhaps looking to sell your property for top dollar? Choosing the right real estate agent is essential in ensuring a smooth and successful transaction. But what exactly sets apart a...

Are you or a loved one facing the prospect of downsizing? It can be an overwhelming process.

Marty's Monday Blog Are you or a loved one facing the prospect of downsizing? It can be an overwhelming process, filled with practical and emotional challenges. That's why utilizing the expertise of a Senior Real Estate Specialist (SRES) can make all the difference....

Key Housing Market Trends

Key Housing Market Trends Some Highlights If you’re considering buying or selling a home, you’ll want to know what’s happening in the housing market. Housing inventory is still very low, prices are climbing back up, and homes are selling fast when priced right. If you...

Economic Trends And Factors Influencing The Luxury Home Market In Utah

Welcome to our blog article all about the exciting developments and trends in Utah's luxury home market this fall! As the leaves change color and the cool autumn breeze settles in, Utah's real estate market is buzzing with activity. Whether you're a potential buyer or...

Homebuyers Are Still More Active Than Usual

Homebuyers Are Still More Active Than Usual Even though the housing market is no longer experiencing the frenzy that was so characteristic of the last couple of years, it doesn’t mean today’s market is at a standstill. In actuality, buyer traffic is still strong...

Tips for Making Your Best Offer on a Home

Tips for Making Your Best Offer on a Home While the wild ride that was the ‘unicorn’ years of housing is behind us, today’s market is still competitive in many areas because the supply of homes for sale is still low. If you’re looking to buy a home this season, know...

Don’t Fall for the Next Shocking Headlines About Home Prices

Don’t Fall for the Next Shocking Headlines About Home Prices If you’re thinking of buying or selling a home, one of the biggest questions you have right now is probably: what’s happening with home prices? And it’s no surprise you don’t have the clarity you need on...

Low Housing Inventory Is a Sweet Spot for Sellers

Low Housing Inventory Is a Sweet Spot for Sellers Some Highlights Today’s housing inventory is still well below more normal years. This low inventory is why homes that are priced right are still selling quickly and seeing multiple offers. If you want to sell your...

Renting or Selling Your House: What’s the Best Move?

Renting or Selling Your House: What's the Best Move? If you’re a homeowner ready to make a move, you may be thinking about using your current house as a short-term rental property instead of selling it. A short-term rental (STR) is typically offered as an alternative...