The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

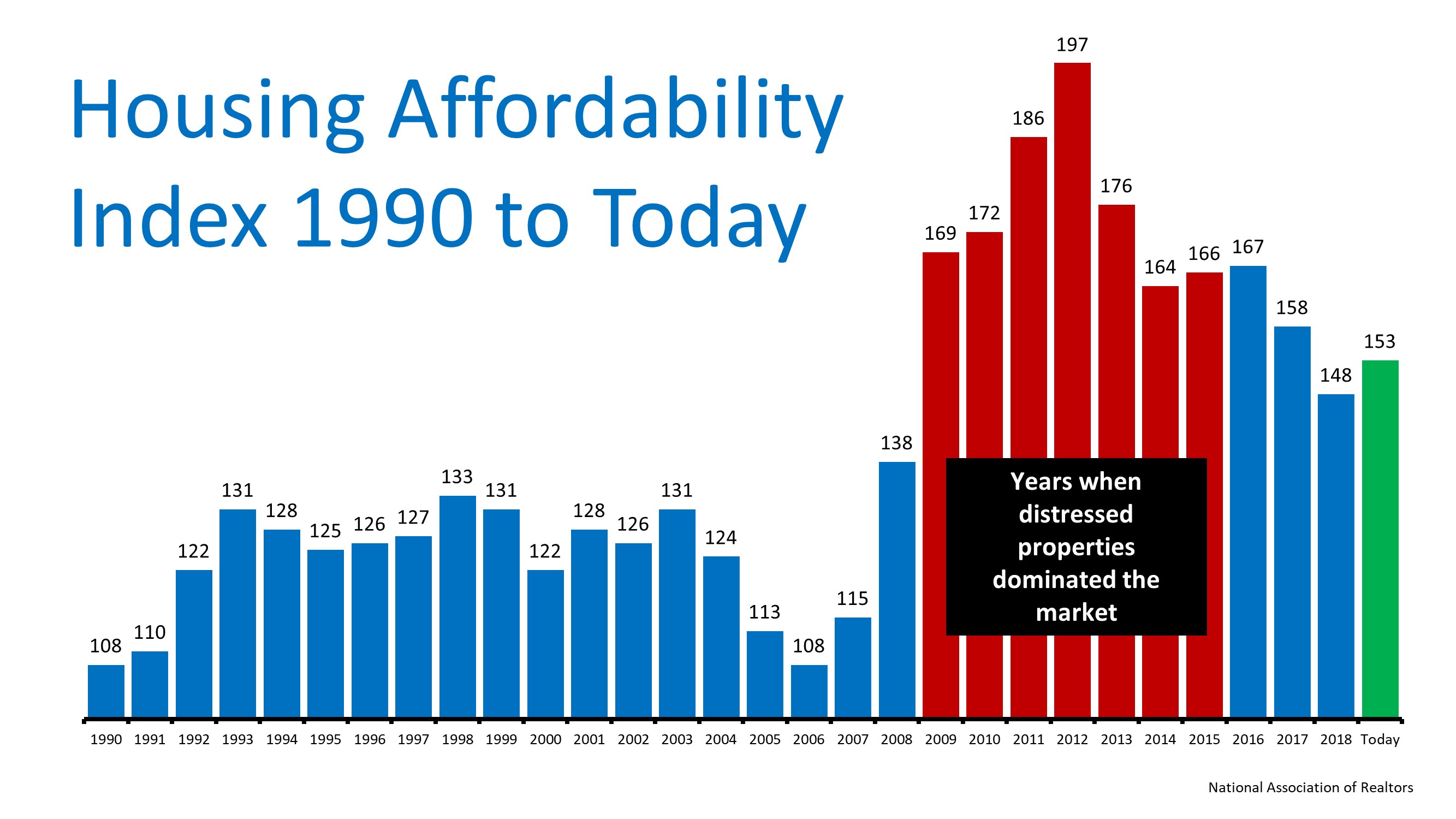

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Coronavirus (COVID-19)

Notice the On Set Dates Below

Three Reasons Why This Is Not a Housing Crisis

Three Reasons Why This Is Not a Housing Crisis In times of uncertainty, one of the best things we can do to ease our fears is to educate ourselves with research, facts, and data. Digging into past experiences by reviewing historical trends and understanding the peaks...

Happy St Patrick’s Day Utah!

Two Big Myths in the Homebuying Process

Two Big Myths in the Homebuying Process The 2020 Millennial Home Buyer Report shows how this generation is not really any different from previous ones when it comes to homeownership goals: “The majority of millennials not only want to own a home, but 84% of...

5 Simple Graphs Proving This Is NOT Like the Last Time

5 Simple Graphs Proving This Is NOT Like the Last Time With all of the volatility in the stock market and uncertainty about the Coronavirus (COVID-19), some are concerned we may be headed for another housing crash like the one we experienced from 2006-2008. The...

Yes, You Can Still Afford a Home

Yes, You Can Still Afford a Home The residential real estate market has come roaring out of the gates in 2020. Compared to this time last year, the number of buyers looking for a home is up 20%, and the number of home sales is up almost 10%. The increase in purchasing...

Confidence Is the Key to Success for Young Homebuyers

Confidence Is the Key to Success for Young HomebuyersBuying your first home can seem overwhelming. Thankfully, there’s a lot of great information out there to help you feel more confident as you learn about the process. For those in younger generations who aspire to...

Equity Gain Growing Across Utah and in Nearly Every State

Equity Gain Growing in Nearly Every State Rising home prices have been in the news a lot lately, and much of the focus is on whether they’re accelerating too quickly and how sustainable the growth in prices really is. One of the often-overlooked benefits of rising...

Mortgage rates fell to their lowest level March 2020

Mortgage rates fell to their lowest level on record Thursday, pulled down by fears that the spread of coronavirus could weigh on the U.S. economy. The average rate on a 30-year fixed-rate mortgage fell to 3.29 percent from 3.45 percent last week and down from 4.41...

Thinking of Getting Your House Ready to Sell?