The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

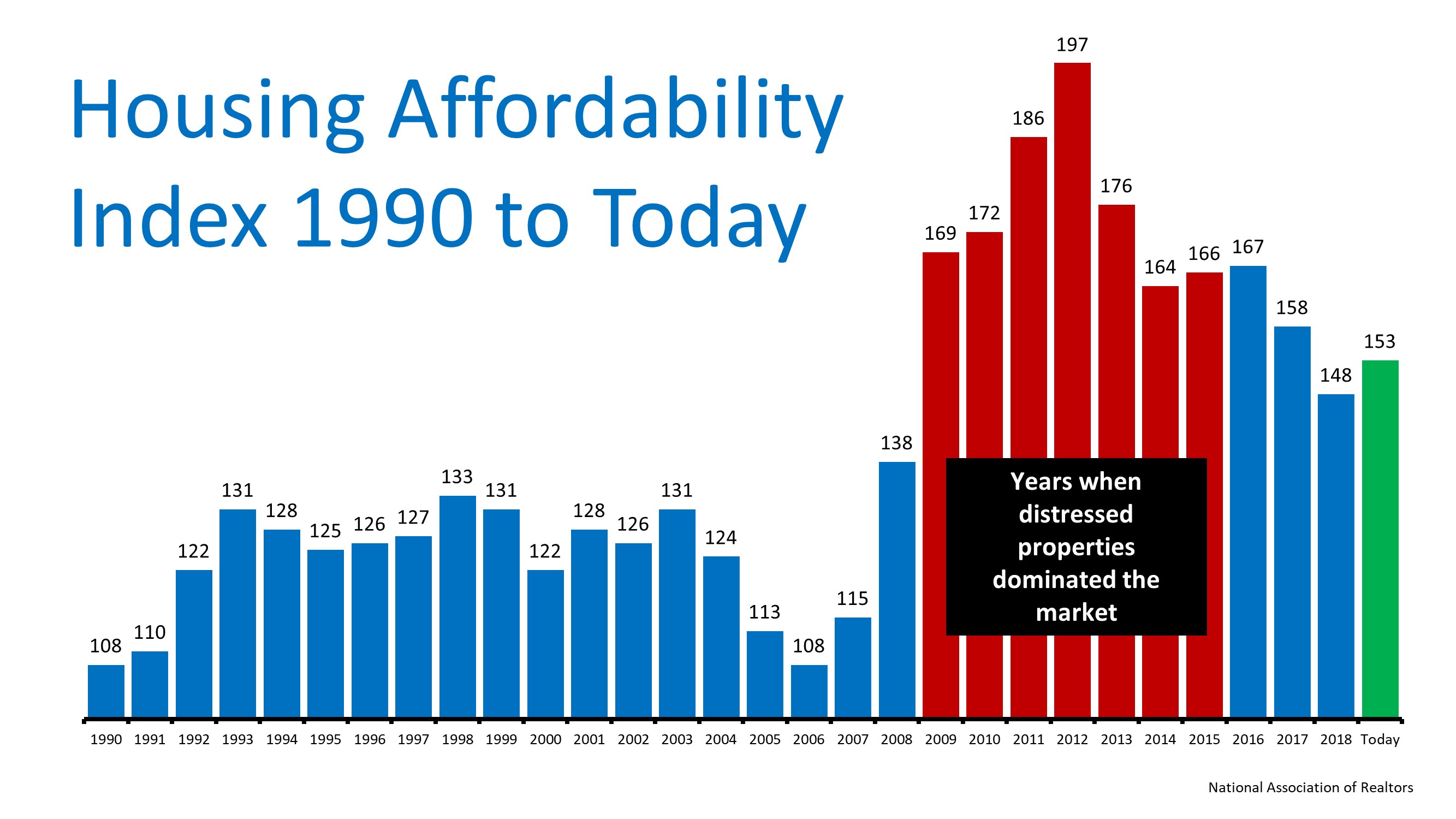

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Homebuyer Tips for Finding the One

Homebuyer Tips for Finding the One Some Highlights The best advice carries across multiple areas of life. When it comes to homebuying, a few simple tips can help you stay on track. Because of increased demand, you’ll need to be patient and embrace compromises during...

Local Market Update for September 2021

Auto Draft

What Do Past Years Tell Us About Today’s Real Estate Market?

What Do Past Years Tell Us About Today’s Real Estate Market? As you follow the news, you’re likely seeing headlines discussing what’s going on in today’s housing market. Chances are high that some of the more recent storylines you’ve come across mention terms...

The Big Question: Should You Renovate or Move?

The Big Question: Should You Renovate or Move? The last 18 months changed what many buyers are looking for in a home. Recently, the American Institute of Architects released their AIA Home Design Trends Survey results for Q3 2021. The survey reveals the following: 70%...

Fall in Love with Homeownership

111,285 Reasons You Should Buy a Home This Year

111,285 Reasons You Should Buy a Home This Year The financial benefits of buying a home versus renting one are always up for debate. However, one element of the equation is often ignored – the ability to build wealth as a homeowner. According to the latest...

What Do Supply and Demand Tell Us About Today’s Housing Market

What Do Supply and Demand Tell Us About Today’s Housing Market? There’s a well-known economic theory – the law of supply and demand – that explains what’s happening with prices in the current real estate market. Put simply, when demand for an item is high, prices...

Early October is the Sweet Spot for Buyers

Early October is the Sweet Spot for Buyers Are you looking to buy a home? If so, we’ve got good news for you. While there’s no denying the housing market is having a great year, many of the headlines are focused on the perks for sellers. But what about buyers today?...

As Home Equity Rises, So Does Your Wealth

As Home Equity Rises, So Does Your Wealth Homeownership is still a crucial part of the American dream. For those people who own a home (and those looking to buy one), it’s clear that being a homeowner has considerable benefits both emotionally and financially. In...