The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

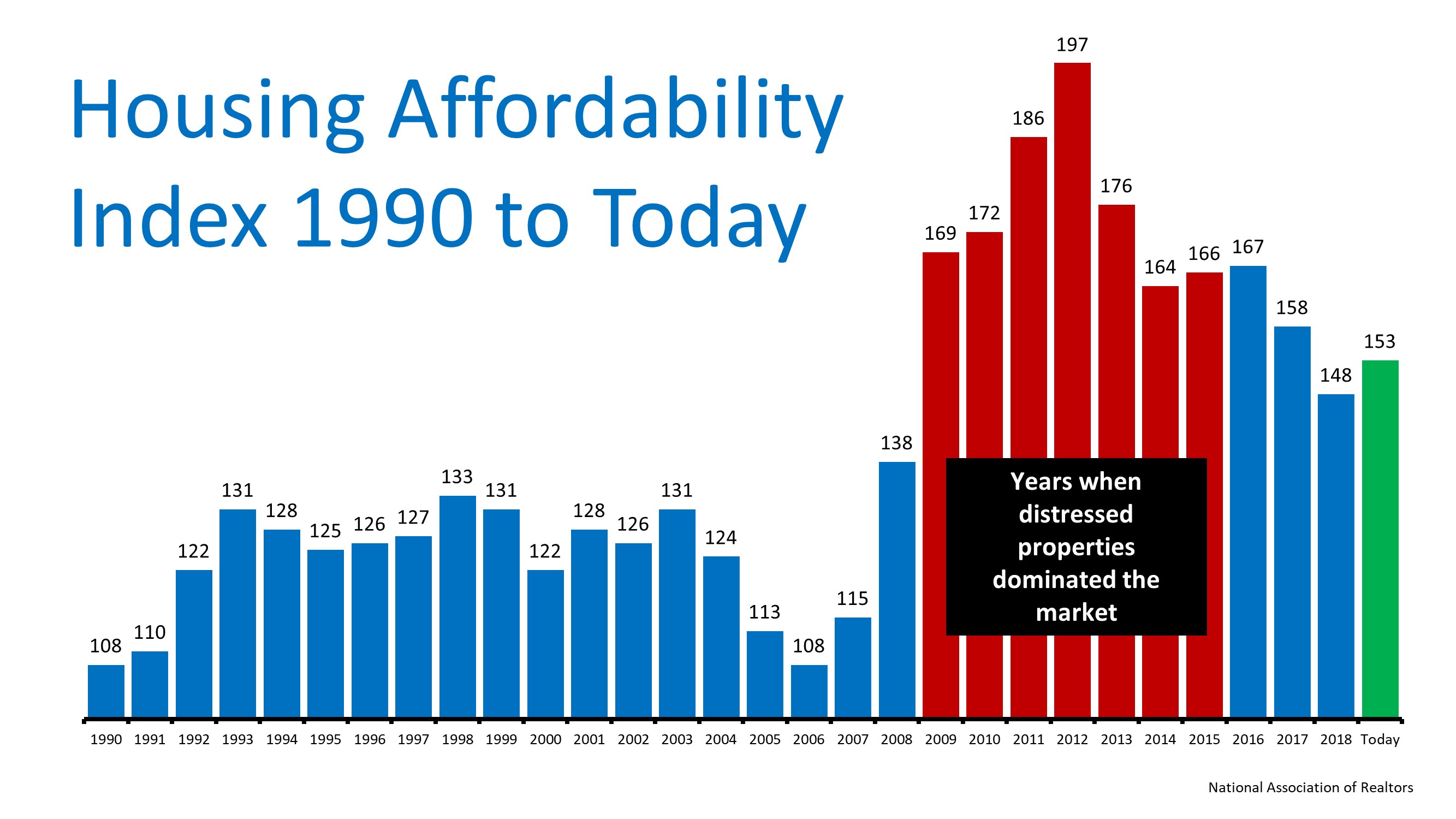

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Pricing your house based on current market conditions means it’s more likely to sell quickly. Let’s connect so you can have the best advice when you sell today.

Is the Shifting Market a Challenge or an Opportunity for Homebuyers?

Is the Shifting Market a Challenge or an Opportunity for Homebuyers?If you tried to buy a home during the pandemic, you know the limited supply of homes for sale was a considerable challenge. It created intense bidding wars which drove home prices up as buyers...

3 Graphs To Show This Isn’t a Housing Bubble

3 Graphs To Show This Isn’t a Housing Bubble With all the headlines and buzz in the media, some consumers believe the market is in a housing bubble. As the housing market shifts, you may be wondering what’ll happen next. It’s only natural for concerns to creep in that...

Why the Forbearance Program Changed the Housing Market

Why the Forbearance Program Changed the Housing Market When the pandemic hit in 2020, many experts thought the housing market would crash. They feared job loss and economic uncertainty would lead to a wave of foreclosures similar to when the housing bubble burst over...

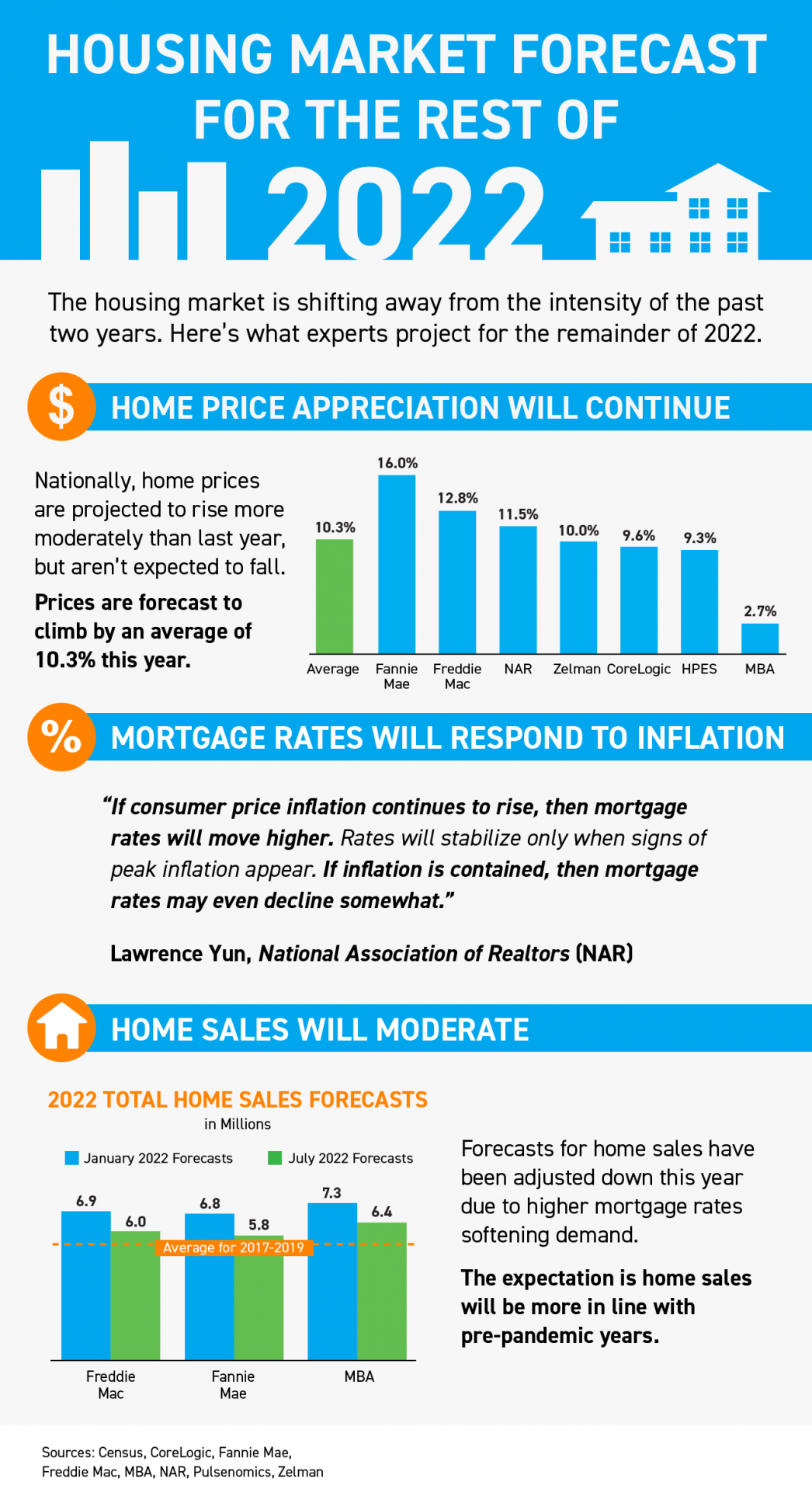

Housing Market Forecast for the Rest of 2022

Housing Market Forecast for the Rest of 2022 Some Highlights The housing market is shifting away from the intensity of the past two years. Here’s what experts project for the remainder of 2022. Home prices are forecast to rise more moderately than last year. Mortgage...

Why It’s Still a Sellers’ Market

Why It’s Still a Sellers’ Market As there’s more and more talk about the real estate market cooling off from the peak frenzy it saw during the pandemic, you may be questioning what that means for your plans to sell your house. If you’re thinking of making a move, you...

Pre-Approval Is a Strategic Move When You’re Buying a Home

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...

Expert Housing Market Forecasts for the Second Half of the Year

Expert Housing Market Forecasts for the Second Half of the Year The housing market is at a turning point, and if you’re thinking of buying or selling a home, that may leave you wondering: is it still a good time to buy a home? Should I make a move this year? To help...

Happy 4th of July

Happy Independence Day

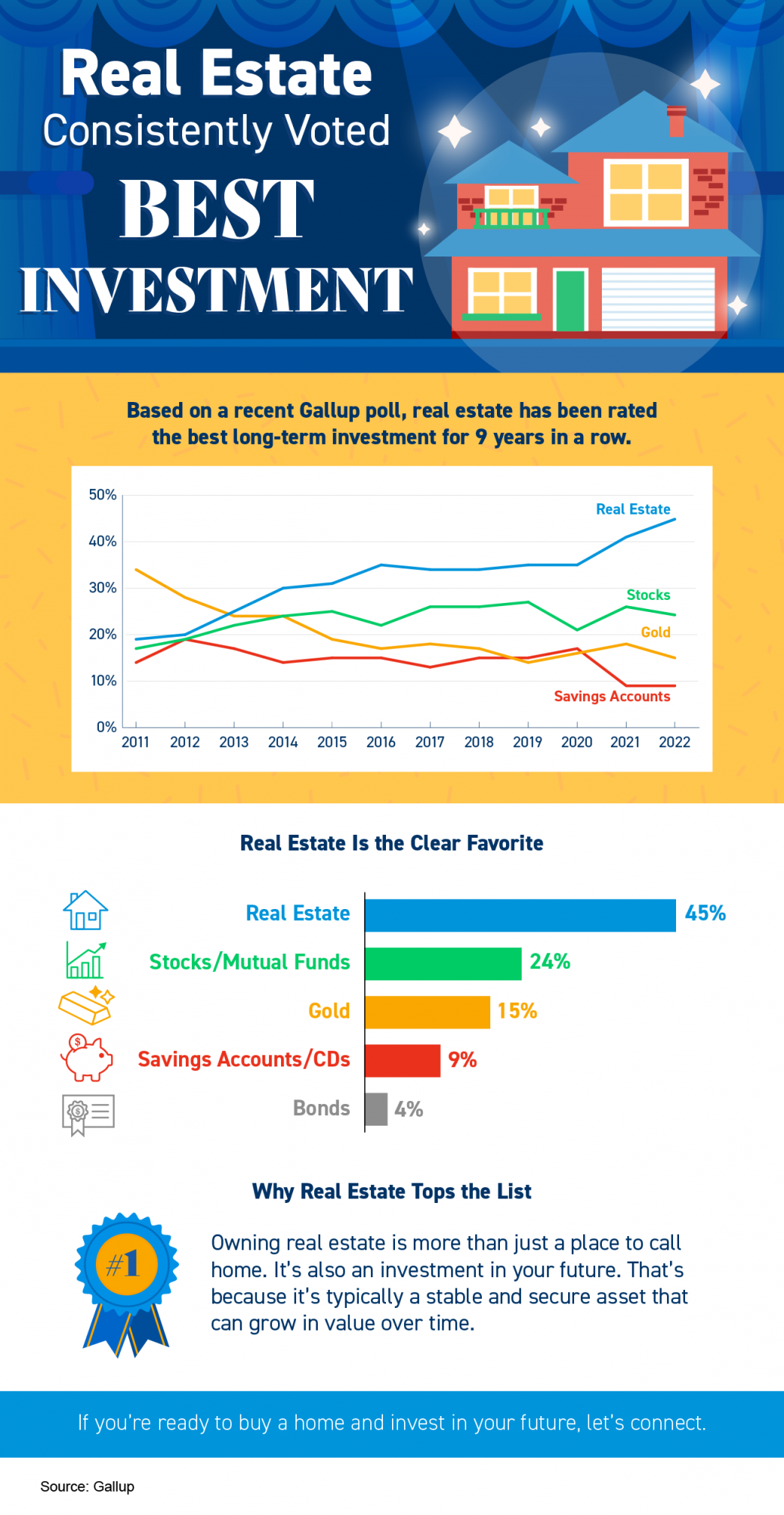

Real Estate Consistently Voted Best Investment

Real Estate Consistently Voted Best Investment Some Highlights Based on a recent Gallup poll, real estate has been rated the best long-term investment for nine years in a row. Owning real estate is more than just a place to call home. It’s also an investment in your...