The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

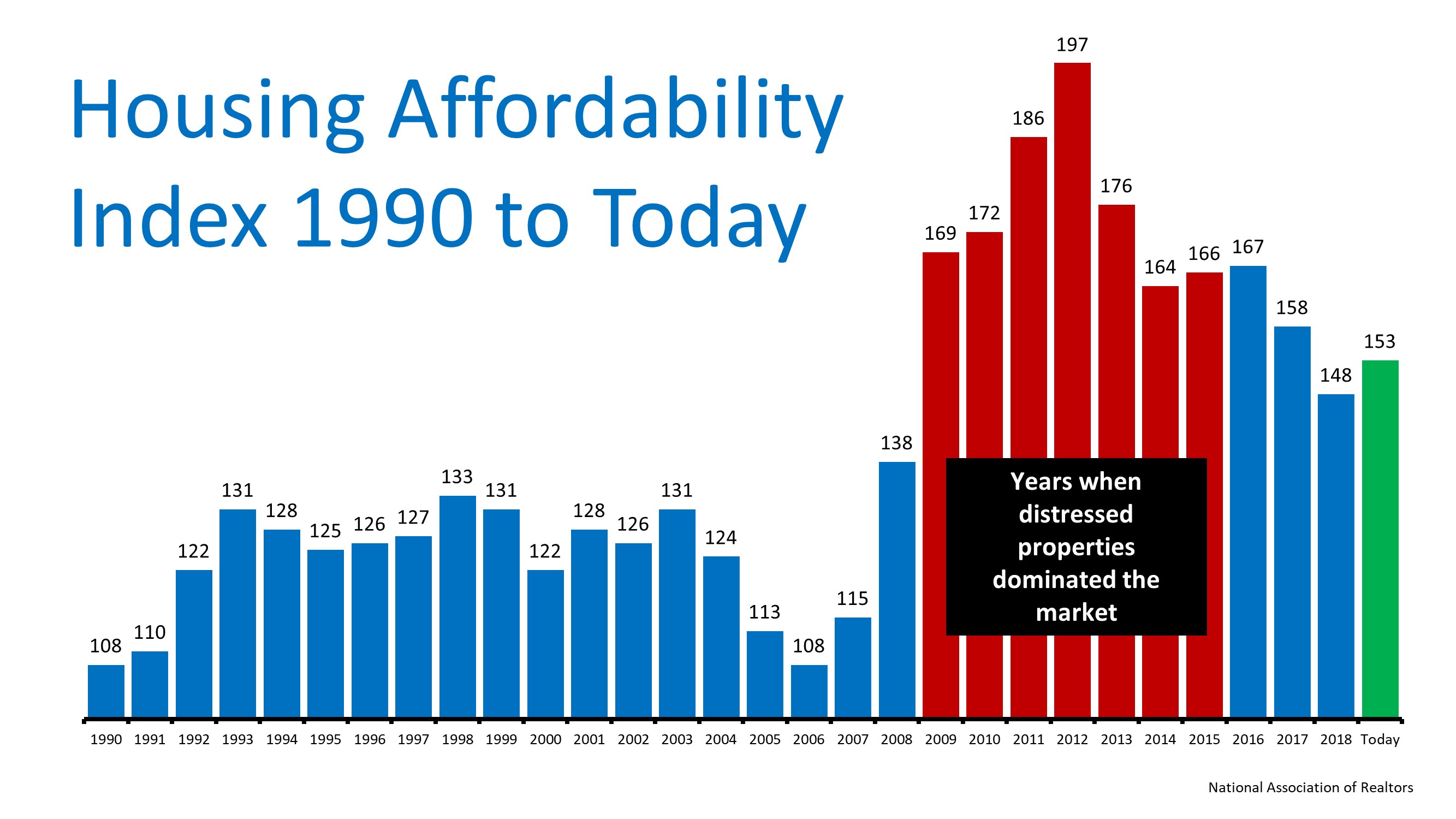

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

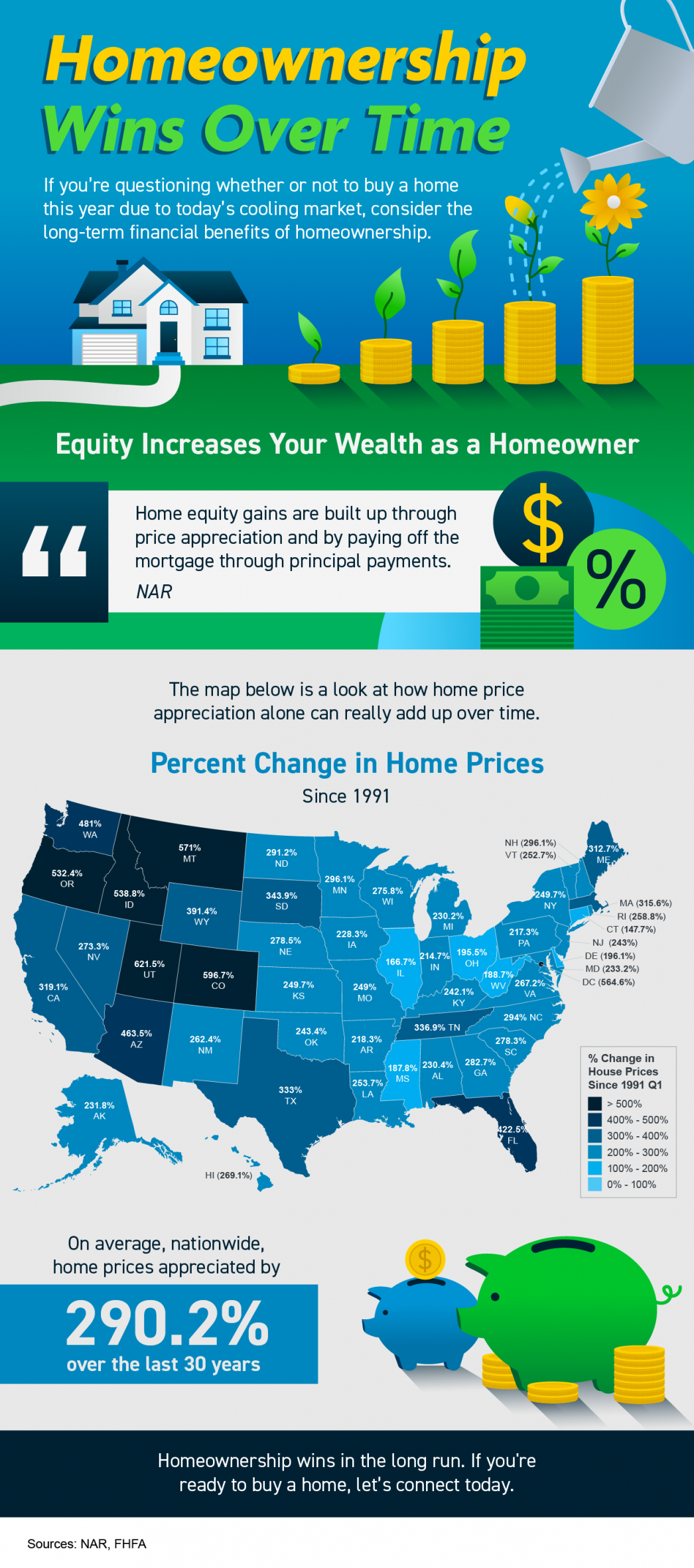

Homeownership Wins Over Time

Homeownership Wins Over Time Some Highlights If you’re questioning whether or not to buy a home this year due to today’s cooling market, consider the long-term financial benefits of homeownership. As a homeowner, equity increases your wealth. On average, nationwide,...

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn’t Have To Be.

Do You Believe Homeownership Is Out of Reach? Maybe It Doesn’t Have To Be. It turns out, millennials aren’t the renter generation after all. The 2022 Consumer Insights Report from Mynd says there’s a portion of millennial and Gen Z buyers who are pursuing...

Sell Your House Before the Holidays

Sell Your House Before the Holidays As you look ahead to the winter season, you’re likely making plans and thinking about what you want to achieve before the year ends. One of those key decision points could be whether or not you want to move this year. If the...

Taking the Fear out of Saving for a Home

Taking the Fear out of Saving for a Home If you’re planning to buy a home, knowing what to budget for and how to save may sound scary at first. But it doesn’t have to be. One way to take the fear out of budgeting is understanding some of the costs you might...

when one door closes

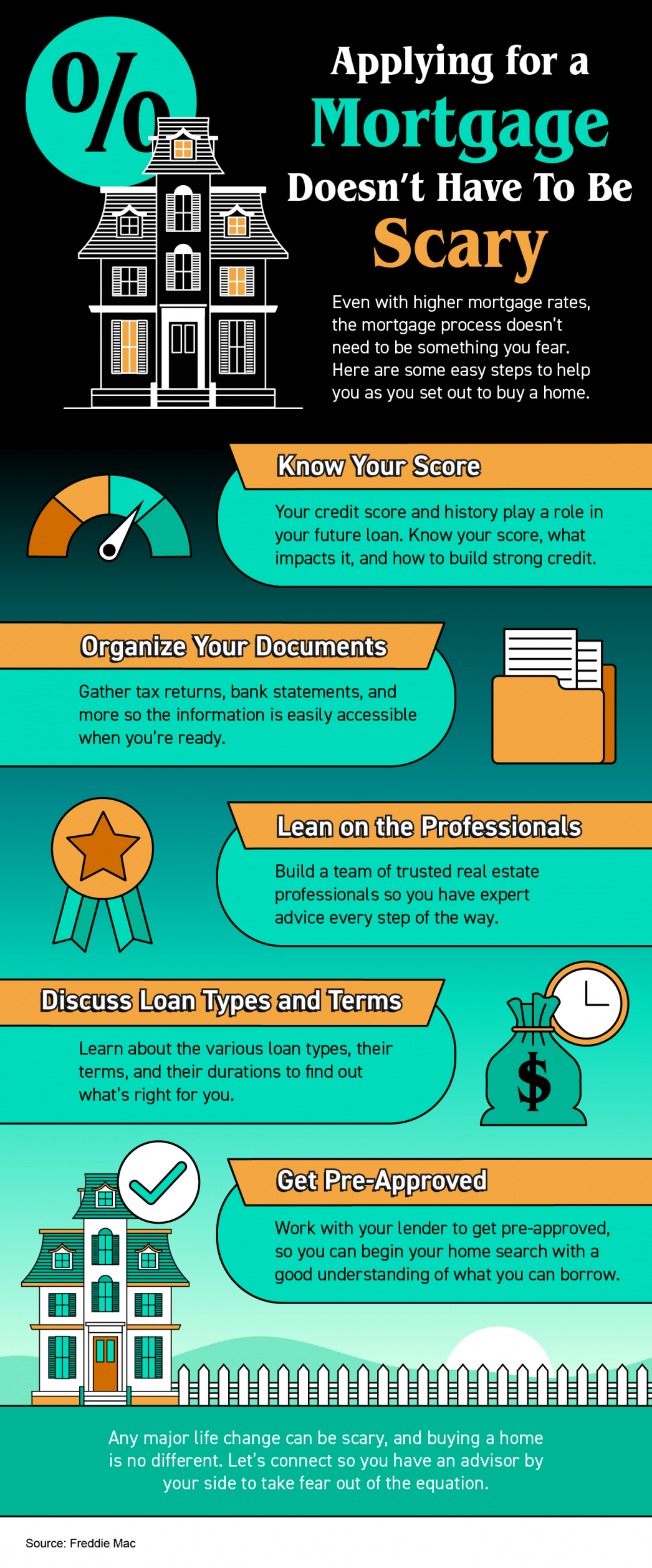

Applying for a Mortgage Doesn’t Have To Be Scary

Applying for a Mortgage Doesn’t Have To Be Scary Some Highlights Even with higher mortgage rates, the mortgage process doesn’t need to be something you fear. Here are some steps to help as you set out to buy a home. Know your credit score and work to build strong...

Millennials Are Still a Driving Force of Today’s Buyer Demand

Millennials Are Still a Driving Force of Today’s Buyer Demand If you’re thinking about selling your house but wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what...

3 Graphs Showing Why Today’s Housing Market Isn’t Like 2008

3 Graphs Showing Why Today’s Housing Market Isn’t Like 2008 With all the headlines and talk in the media about the shift in the housing market, you might be thinking this is a housing bubble. It’s only natural for those thoughts to creep in that make you think it...

Pre-Approval Is a Critical First Step on Your Homebuying Journey

Pre-Approval Is a Critical First Step on Your Homebuying Journey If you’re planning to buy a home this year, one of the first steps on your journey is getting pre-approved. Especially in today’s market when mortgage rates are higher than they were just a few months...

Tips For First-Time Homebuyers

Tips For First-Time Homebuyers Some Highlights If you’re trying to buy your first home in today’s housing market, you’ll want to know what you can do as mortgage rates rise and inventory stays low overall. Connect with a lender to get pre-approved, prioritize your...