The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

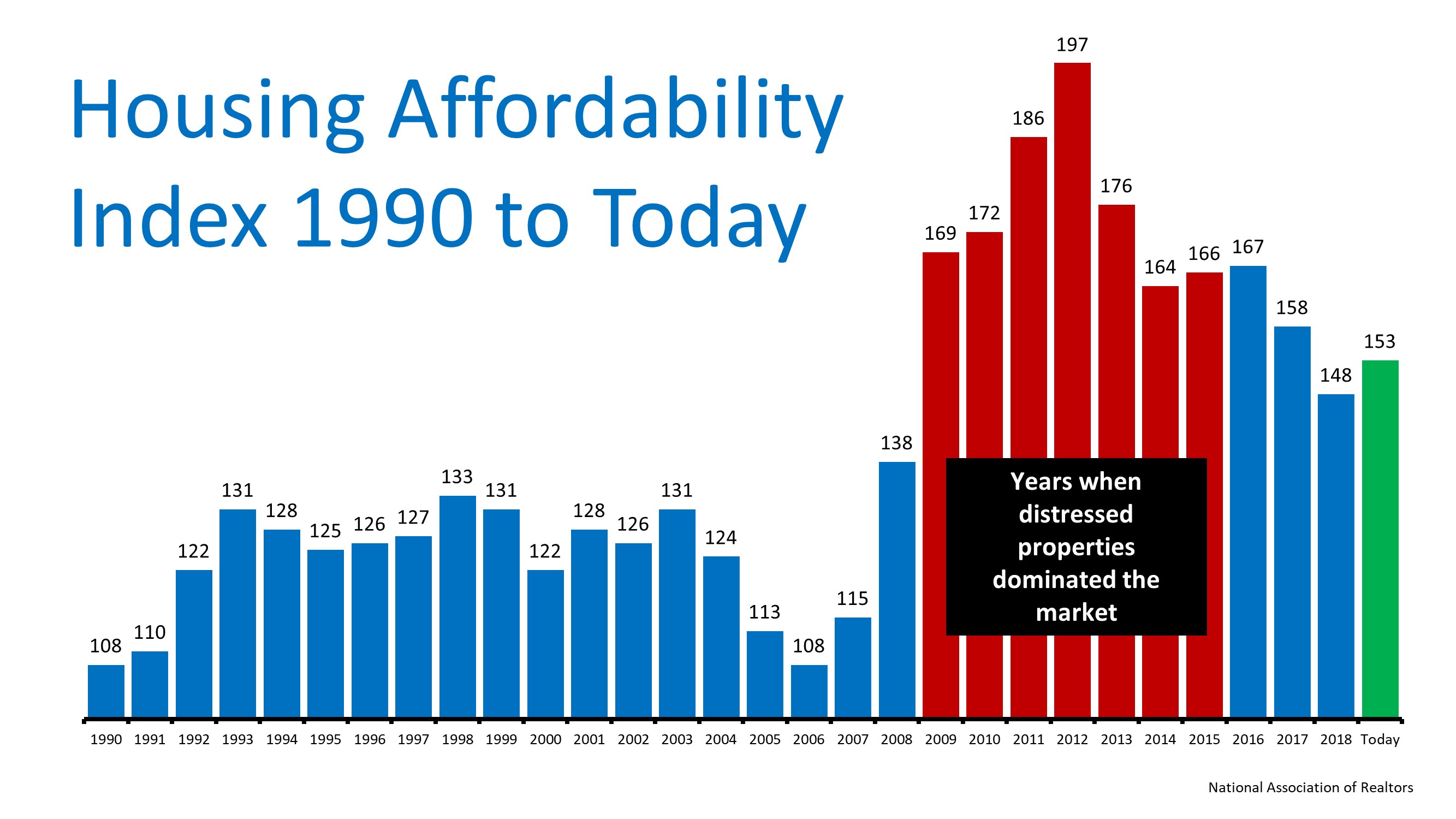

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

11 Must-Do Actions To Ensure A Smooth Transition Into Your New Residence

11 Must-Do Actions To Ensure A Smooth Transition Into Your New Residence Moving into a new residence marks a significant milestone that brims with excitement and potential. However, to translate this new beginning into a seamless transition, careful planning and a...

3 Helpful Tips for First-Time Homebuyers

3 Helpful Tips for First-Time Homebuyers Some Highlights Trying to buy your first home? If you’re worried about affordability today or the limited number of homes for sale, these tips can help. Look into homebuyer programs, expand your search area, and consider...

Short list of things that you must get rid of before moving

Embarking on a new chapter of your life by relocating to a different home can be an exciting yet daunting process. The key to ensuring a smooth and stress-free move lies in effective preparation and organization, of which a critical component is the pre-move purge....

What Are Experts Saying About the Spring Housing Market?

What Are Experts Saying About the Spring Housing Market? If you’re planning to move soon, you might be wondering if there'll be more homes to choose from, where prices and mortgage rates are headed, and how to navigate today’s market. If so, here's what the...

NAR Lawsuit Update – How does this effect Utah Realty?

NAR Lawsuit Update What we Know.... The NAR has reached a settlement agreement on the class action lawsuits relating to the offer of compensation rule. Details are in the link below. There is much to digest and more info and training will come out in the days ahead....

Why Access Is So Important When Selling Your House

Why Access Is So Important When Selling Your House If you’re gearing up to sell your house this spring, one of the early conversations you’ll have with your agent is about how much access you want to give buyers. And you may not realize just how important it is to...

Why There Won’t Be a Recession That Tanks the Housing Market

Why There Won’t Be a Recession That Tanks the Housing Market There’s been a lot of recession talk over the past couple of years. And that may leave you worried we’re headed for a repeat of what we saw back in 2008. Here’s a look at the latest expert projections to...

The First Step: Getting Pre-Approved for a Mortgage

The First Step: Getting Pre-Approved for a Mortgage Some Highlights If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow....

Why You Want an Agent’s Advice for Your Move

Why You Want an Agent’s Advice for Your Move No matter how you slice it, buying or selling a home is a big decision. And when you’re going through any change in your life and you need some guidance, what do you do? You get advice from people who know what they’re...

How Changing Mortgage Rates Impact You

How Changing Mortgage Rates Impact You Some Highlights If you’re looking to buy a home, it’s important to know how mortgage rates impact what you can afford and how much you’ll pay each month. That’s because even a small change in mortgage rates can have a big impact...