Homes Are More Affordable Today, Not Less Affordable

There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several years.

It’s not, however, just the price of a home that matters.

Homes, in most cases, are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by over a full percentage point since December 2018. Another major piece of the affordability equation is a buyer’s income. The median family income has risen by approximately 3% over the last year.

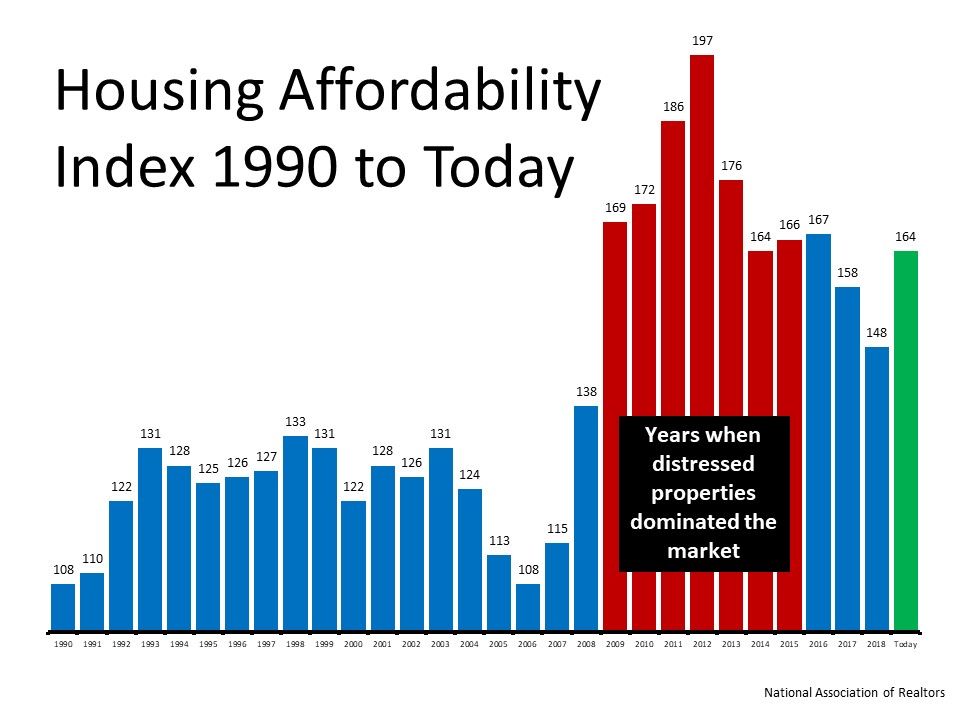

The National Association of Realtors (NAR) releases a monthly Housing Affordability Index. The latest index shows that home affordability is better today than at almost any point over the last 30 years. The index determines how affordable homes are based on the following:

“A Home Affordability Index value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home, assuming a 20 percent down payment so that the monthly payment and interest will not exceed 25 percent of this level of income (qualifying income).”

The higher the index, therefore, the more affordable homes are. Here is a graph showing the index since 1990: Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

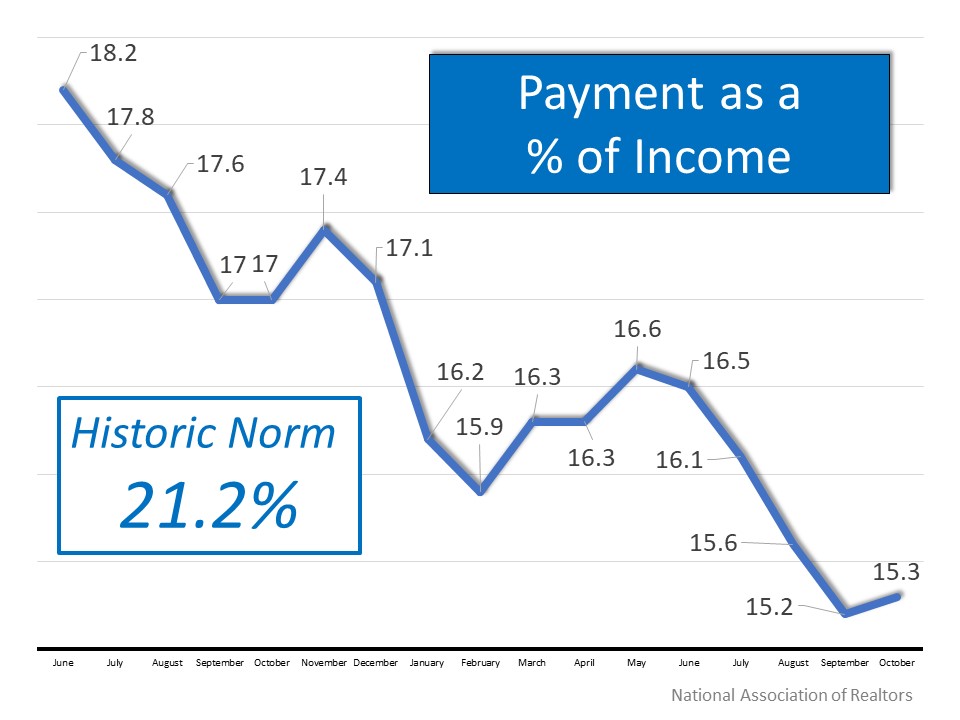

The report on the index also includes a section that calculates the mortgage payment on a median priced home as a percentage of the median national income. Historically, that percentage is just above 21%. Here are the percentages since June of 2018: Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Bottom Line

Whether you’re thinking about buying your first home or moving up to the home of your dreams, don’t let the false narrative about affordability prevent you from moving forward. From an affordability standpoint, this is one of the best times to buy in the last 30 years.

Find The Perfect Home Here

Buyer Guide (Its Free)

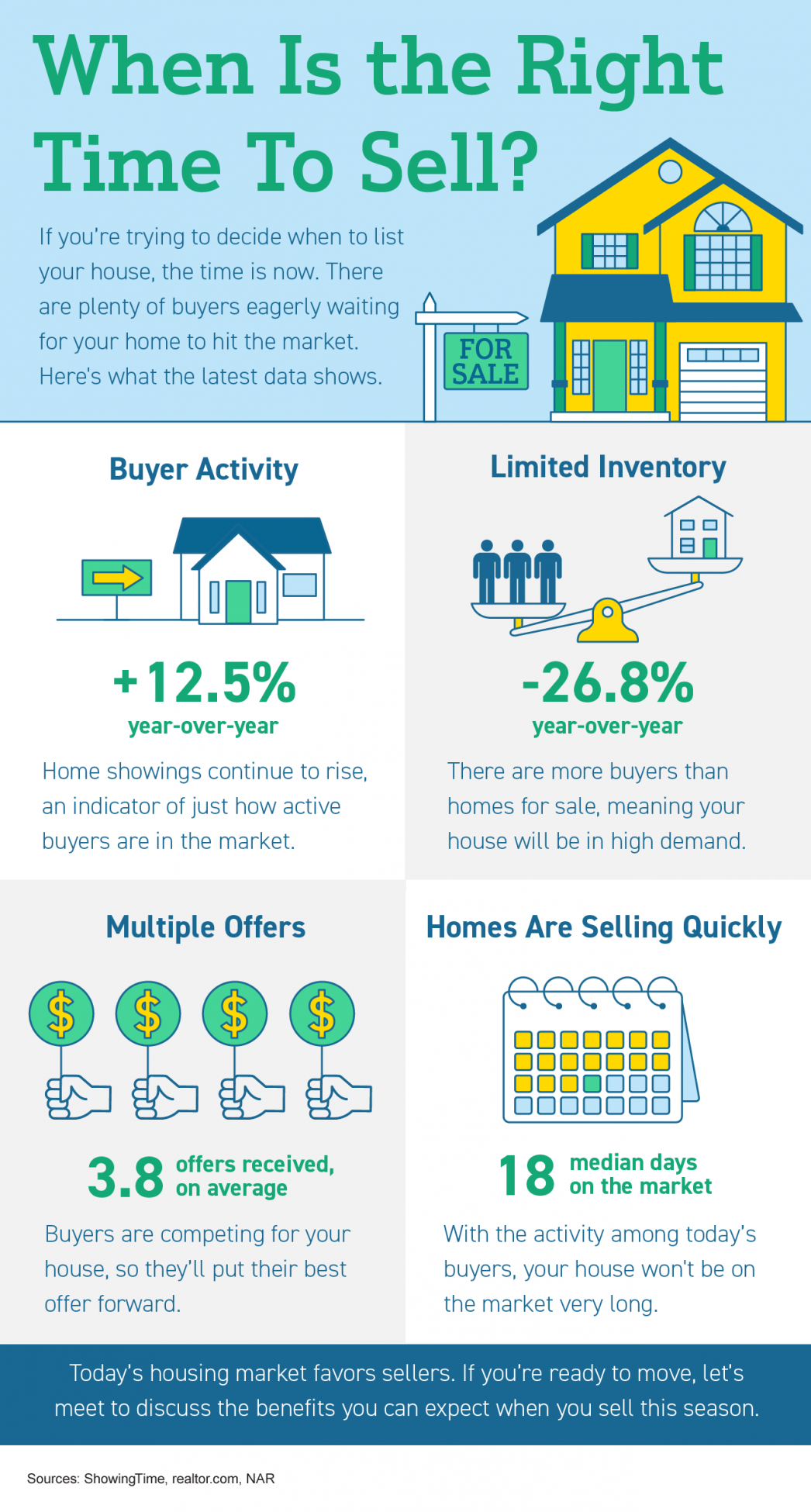

When Is the Right Time To Sell ?

When Is the Right Time To Sell Some Highlights If you’re trying to decide when to list your house, the time is now. There are plenty of buyers eagerly waiting for your home to hit the market. The latest data indicates home...

Why You Shouldn’t Sell Your House on Your Own

Why You Shouldn't Sell Your House on Your Own There's more to selling your house than putting up a For Sale sign....

Expert Insights on the 2022 Housing Market Utah Realty™

Expert Insights on the 2022 Housing Market As we move into 2022, both buyers and sellers are wondering, what’s next? Will there be more homes available to buy? Will prices keep climbing? How high will mortgage rates go? For the answer to those questions and more, we...

Your Best Offer

5 Tips for Making Your Best Offer on a Home As a buyer in a sellers’ market, sometimes it can feel like you’re stuck between a rock and a hard place. When you’re ready to make an offer on a home, remember these five easy tips to help you rise above the competition. 1....

Merry Christmas! Happy New Year! Thank You for All of Your Support

Merry Christmas! Happy New Year! Thank You for All of Your Support

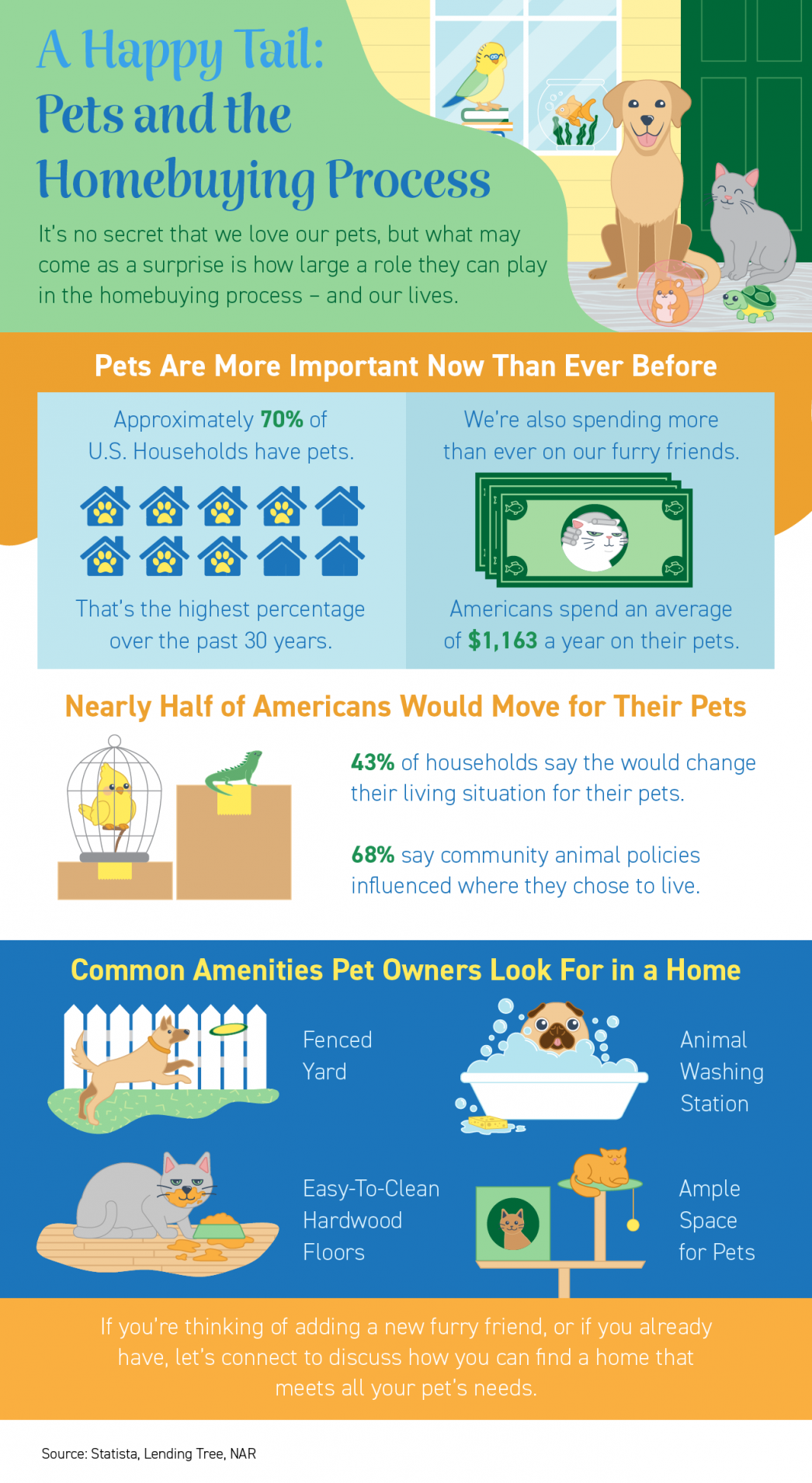

A Happy Tail: Pets and the Homebuying Process

A Happy Tail: Pets and the Homebuying Process Some Highlights It’s no secret that we love our furry friends - about 70% of U.S. households have pets. What may come as a surprise is how large a role they play in the homebuying process. Americans spend $1,163 a year on...

Two Reasons Why Waiting To Buy a Home Will Cost You

Two Reasons Why Waiting To Buy a Home Will Cost You If you’re a homeowner who’s decided your current house no longer fits your needs, or a renter with a strong desire to become a homeowner, you may be hoping that waiting until next year could mean better market...

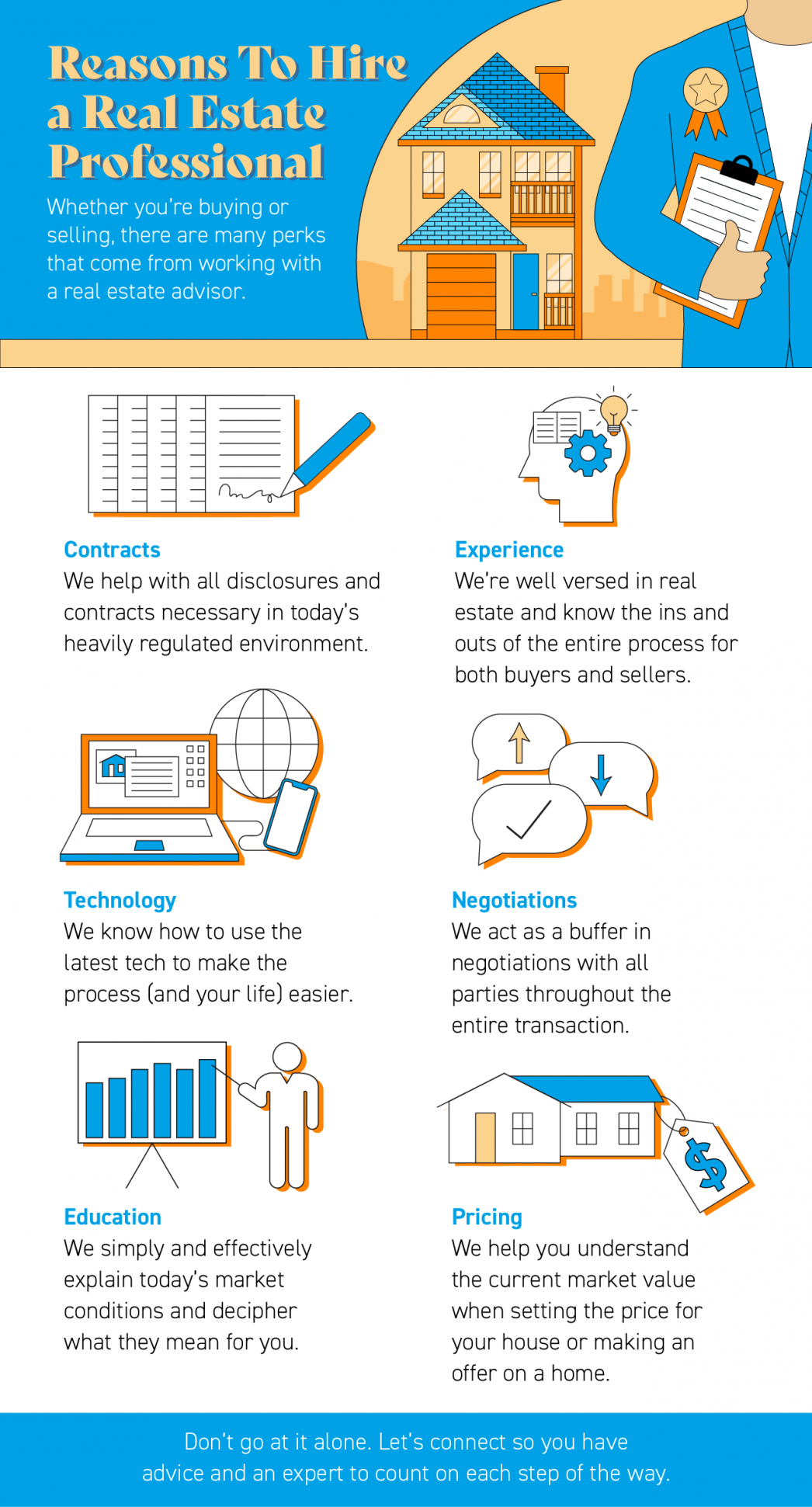

Reasons To Hire a Real Estate Professional

Reasons To Hire a Real Estate Professional Some Highlights Whether you’re buying or selling, there are many perks that come from working with a real estate advisor. Real estate professionals are experts at navigating all aspects of the buying and selling process,...

Happy Thanksgiving This 2021

thank·ful expressing gratitude and relief. "an earnest and thankful prayer OHANA is a Hawaiian term meaning "family" (in an extended sense of the term, including blood-related, adoptive or intentional). THANKSGIVING It began as a day of giving thanks and sacrifice for...

Home Sales About To Surge? We May See a Winter Like Never Before

Home Sales About To Surge? We May See a Winter Like Never Before. Like most industries, residential real estate has a seasonality to it. For example, toy stores sell more toys in October, November, and December than they do in any other three-month span throughout the...