Homes Are More Affordable Today, Not Less Affordable

There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several years.

It’s not, however, just the price of a home that matters.

Homes, in most cases, are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by over a full percentage point since December 2018. Another major piece of the affordability equation is a buyer’s income. The median family income has risen by approximately 3% over the last year.

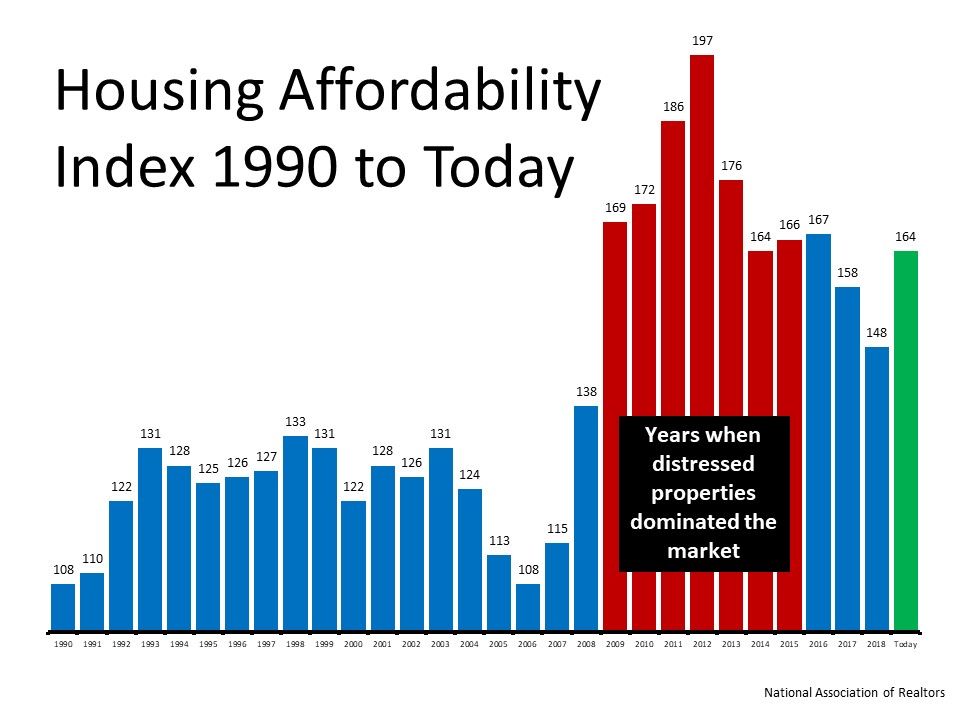

The National Association of Realtors (NAR) releases a monthly Housing Affordability Index. The latest index shows that home affordability is better today than at almost any point over the last 30 years. The index determines how affordable homes are based on the following:

“A Home Affordability Index value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home, assuming a 20 percent down payment so that the monthly payment and interest will not exceed 25 percent of this level of income (qualifying income).”

The higher the index, therefore, the more affordable homes are. Here is a graph showing the index since 1990: Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

Obviously, affordability was better during the housing crash when distressed properties – foreclosures and short sales – sold at major discounts (2009-2015). Outside of that period, however, homes are more affordable today than any other year since 1990, except for 2016.

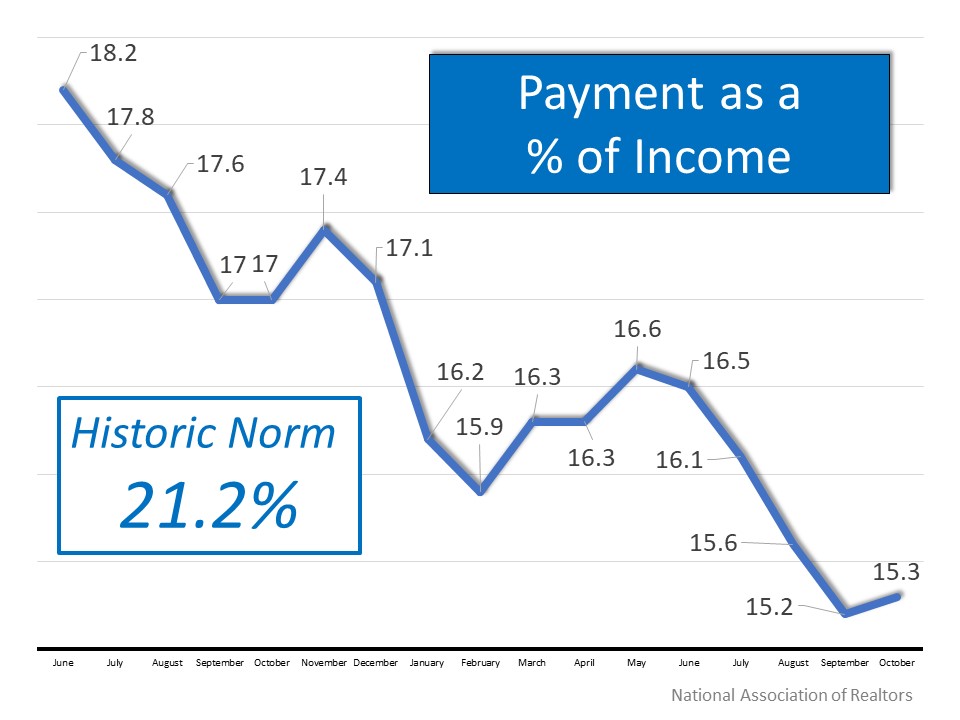

The report on the index also includes a section that calculates the mortgage payment on a median priced home as a percentage of the median national income. Historically, that percentage is just above 21%. Here are the percentages since June of 2018: Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Again, we can see that affordability is much better today than the historical average and has been getting better over the last year and a half.

Bottom Line

Whether you’re thinking about buying your first home or moving up to the home of your dreams, don’t let the false narrative about affordability prevent you from moving forward. From an affordability standpoint, this is one of the best times to buy in the last 30 years.

Find The Perfect Home Here

Buyer Guide (Its Free)

Using Your Tax Refund To Achieve Your Homeownership Goals This Year

Using Your Tax Refund To Achieve Your Homeownership Goals This Year If you’re buying or selling a home this year, you’re likely saving up for a variety of expenses. For buyers, that might include things like your down payment and closing costs. And for sellers, you’re...

The Future of Home Price Appreciation and What It Means for You

The Future of Home Price Appreciation and What It Means for You Many consumers are wondering what will happen with home values over the next few years. Some are concerned that the recent run-up in home prices will lead to a situation similar to the housing crash 15...

Balancing Your Wants and Needs as a Homebuyer Today

Balancing Your Wants and Needs as a Homebuyer Today Since the number of homes for sale is low today, it can feel challenging to find one that checks all your boxes. But if you know which features are absolutely essential in your next home and which ones are just nice...

What’s Happening with Mortgage Rates, and Where Will They Go from Here?

What’s Happening with Mortgage Rates, and Where Will They Go from Here? Based on the Primary Mortgage Market Survey from Freddie Mac, the average 30-year fixed-rate mortgage has increased by 1.2% (3.22% to 4.42%) since January of this year. The rate jumped by more...

The Many Benefits of Homeownership

The Many Benefits of Homeownership The past two years have taught us the true value of homeownership, especially the stability and the feeling of accomplishment it can provide. But homeownership has so much more to offer. Here’s a look at a few of the non-financial...

Why It’s Critical To Price Your House Right

Why It’s Critical To Price Your House Right When you make a move, you want to sell your house for the highest price possible. That might be why many homeowners are eager to list in today’s sellers’ market. After all, with record-low inventory and high buyer demand,...

This Spring Presents Sellers with a Golden Opportunity

This Spring Presents Sellers with a Golden Opportunity If you’re thinking of selling your house this year, timing is crucial. After all, you’ll want to balance getting the most out of the sale of your current home and making the best investment when you buy your next...

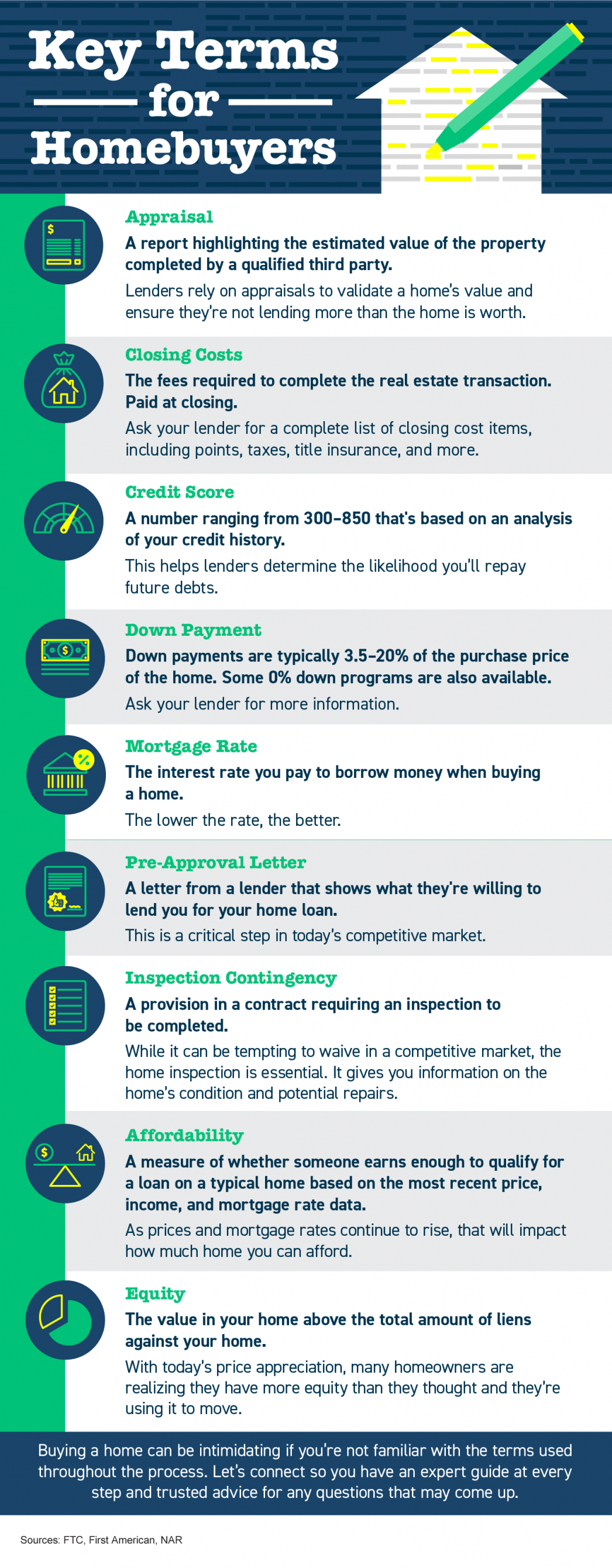

Key Terms for Homebuyers

Key Terms for Homebuyers Some Highlights Knowing key housing terms and how they relate to today’s market is important. For example, when mortgage rates and home prices rise, it impacts how much home you can afford. Terms like appraisal (what lenders rely on to...

The #1 Reason To Sell Your House Today

Why Acting Strategically as a Seller Is Your Best Play

Positive: Professionalism, Responsiveness Marty sat down with my and wife and me to explain his process...