No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

A desire among many seniors is to “age in place.” According to the Senior Resource Guide, the term means,

“…that you will be remaining in your own home for the later years of your life; not moving into a smaller home, assisted living, or a retirement community etcetera.”

There is no doubt about it – there’s a comfort in staying in a home you’ve lived in for many years instead of moving to a totally new or unfamiliar environment. There is, however, new information that suggests this might not be the best option for everyone. The familiarity of your current home is the pro of aging in place, but the potential financial drawbacks to remodeling or renovating might actually be more costly than the long-term benefits.

A recent report from the Joint Center for Housing Studies of Harvard University (JCHS) titled Housing America’s Older Adults explained,

“Given their high homeownership rates, most older adults live in single-family homes. Of the 24 million homeowners age 65 and over, fully 80 percent lived in detached single-family units…The majority of these homes are now at least 40 years old and therefore may present maintenance challenges for their owners.”

If you’re in this spot, 40 years ago you may have had a growing family. For that reason, you probably purchased a 4-bedroom Colonial on a large piece of property in a child-friendly neighborhood. It was a great choice for your family, and you still love that home.

Today, your kids are likely grown and moved out, so you don’t need all of those bedrooms. Yard upkeep is probably very time consuming, too. You might be thinking about taking some equity out of your house and converting one of your bedrooms into a massive master bathroom, and maybe another room into an open-space reading nook. You might also be thinking about cutting back on lawn maintenance by installing a pool surrounded by beautiful paving stones.

It all sounds wonderful, doesn’t it? For the short term, you may really enjoy the new upgrades, but you’ll still have to climb those stairs, pay to heat and cool a home that’s larger than what you need, and continue fixing all the things that start to go wrong with a 40-year-old home.

Last month, in their Retirement Report, Kiplinger addressed the point,

“Renovations are just a part of what you need to make aging in place work for you. While it’s typically less expensive to remain in your home than to pay for assisted living, that doesn’t mean it’s a slam dunk to stay put. You’ll still have a long to-do list. Just one example: You need to plan ahead for how you will manage maintenance and care—for your home, and for yourself.”

So, at some point, the time may come when you decide to sell this house anyway. That can pose a big challenge if you’ve already taken cash value out of your home and used it to do the type of remodeling we mentioned above. Realistically, you may have inadvertently lowered the value of your home by doing things like reducing the number of bedrooms. The family moving into your neighborhood is probably similar to what your family was 40 years ago. They probably have young children, need the extra bedrooms, and may be nervous about the pool.

Before you spend the money to remodel or renovate your current house so you can age in place, let’s get together to determine if it is truly your best option. Making a move to a smaller home in the neighborhood might make the most sense.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

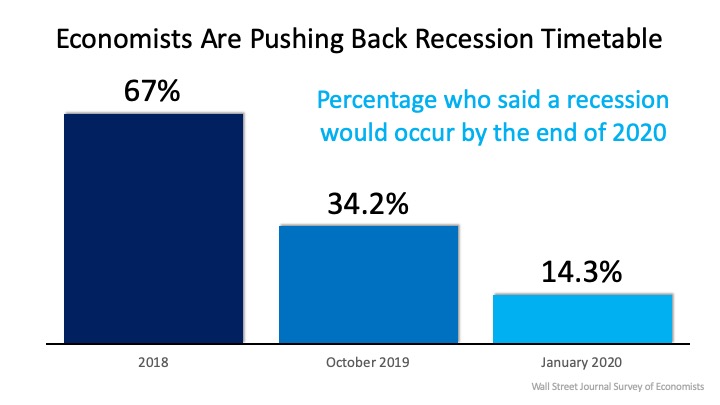

We’re currently in the longest economic recovery in U.S. history. That has caused some to ask experts to project when the next economic slowdown (recession) could occur. Two years ago, 67% of the economists surveyed by the Wall Street Journal (WSJ) for the Economic Forecasting Survey predicted we would have a recession no later than the end of this year (2020). The same study done just three months ago showed more than one third of the economists still saw an economic slowdown right around the corner.

The news caused concern among consumers. This is evidenced by a recent survey done by realtor.com that shows 53% of home purchasers (first-time and repeat buyers) currently in the market believe a recession will occur by the end of this year.

Now, in an article earlier this month, the Wall Street Journal (WSJ) revealed only 14.3% of those economists now believe we’re in danger of a recession occurring this year (see graph below): The WSJ article strongly stated,

The WSJ article strongly stated,

“The U.S. expansion, now in its 11th year, will continue through the 2020 presidential election with a healthy labor market backing it up, economists say.”

This optimism regarding the economy was repeated by others as well.

CNBC, quoting Goldman Sachs economists:

“Just months after almost everyone on Wall Street worried that a recession was just around the corner, Goldman Sachs said a downturn is unlikely over the next several years. In fact, the firm’s economists stopped just short of saying that the U.S. economy is recession-proof.”

“When Barron’s gathers some of Wall Street’s best minds—as we do every January for our annual Roundtable—we expect some consensus, some disagreement…But the 10 veteran investors and economists who convened in New York on Jan. 6 at the Barron’s offices agree that there’s almost no chance of a recession this year.”

“The U.S. economy is heading into 2020 at a pace of steady, sustained growth after a series of interest rate cuts and the apparent resolution of two trade-related threats mostly eliminated the risk of a recession.”

Robert A. Dye, Chief Economist at Comerica Bank:

“I expect that the U.S. economy will avoid a recession in 2020.”

There probably won’t be a recession this year. That’s good news for you, whether you’re looking to buy or sell a home.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Strong demand for homes is being driven by net in-migration and population increase. In 2020, it is projected that Salt Lake County will add 13,700 people to the total county population, according to the 2020 Salt Lake Housing Forecast Report. New housing starts have lagged household formations, creating a housing deficit that continues to push prices higher. According to the Utah Housing Gap Coalition, over the past 10 years a 54,000-unit gap has accrued between the number of Utah families or individuals needing housing and the supply of housing units available.

Median home prices increased across all Wasatch Front counties including: Davis, up 9 percent; Tooele, up 12 percent; Utah, up 6 percent; and Weber, up 7 percent.

The top 10 highest median prices in the fourth quarter by ZIP code area were:

1. Alpine (84004) $752,500, up 30 percent

2. Emigration Canyon (84108) $646,500, up 24 percent

3. Avenues (84103) $644,000, up 14 percent

4. Eden (84310) $578,000, up 9 percent

5. Draper (84020) $570,000, up 8 percent

6. Sandy (84093) $533,500, up 11 percent

7. Holladay (84124) $528,500, up 11 percent

8. Sandy (84092) $518,500, up 10 percent

9. South Jordan (84095) $510,000, up 4 percent

10. Sugar House (84105) $497,430, up 11 percent

The five most affordable ZIP code areas were found in South Ogden ($237,250); Farr West ($252,500); Roy ($260,000); Glendale ($263,000); and Magna ($272,500).

Sales of single-family homes in Salt Lake County were up 1 percent in the fourth quarter year-over-year. Davis County sales increased 3 percent. Tooele County sales were up 7 percent. Utah County sales increased 11 percent. Sales in Weber County were up 4 percent.

The typical Salt Lake home was on the market 45 days in the fourth quarter before it sold, up from 40 days in 2018’s fourth quarter.

(courtesy of Salt Lake Board of Realtors)

In the latest Housing Trends Report, the National Association of Home Builders (NAHB) measured the share of adults planning to buy a home over the next 12 months. The report indicates the percentage of all buyers that will be first-time buyers looking to purchase a home grew from 58% in Q4 2018 to 63% in Q4 2019.

The results revealed,

“Millennials are the most likely generation to be making plans to purchase a home within a year (19%), followed by Gen Z (13%) and Gen X (12%)…Prospective buyers in the youngest two generations are primarily first-time buyers: 88% of Gen Z buyers and 78% of Millennial buyers are reaching out to homeownership for the first time in their lives.”

With a high demand from first-time homebuyers and a shortage of inventory in the current market, selling your existing home this year might be your best move. Why? Because when homebuyers begin their search, they’re not all looking for new construction. Many are eager to find a little charm and character in a place to call home – possibly yours.

In fact, according to the same study, there is a significant demand for existing homes:

“In terms of the type of home these prospective home buyers are interested in, 40% are looking to buy an existing home and 19% a newly-built home. The remaining 41% would buy either a new or existing home.”

With showing activity up among buyers and more new construction coming to market, as a homeowner, you have the opportunity to sell your existing house now and move up into a new one, or downsize into a home that better fits your current and ever-changing needs.

Not all buyers are looking for a newly built house. If you’re ready to take advantage of low mortgage rates and a high demand for your existing home, let’s get together to determine how we will market the charming details of your current house to potential buyers.