Buying a Home Early Can Significantly Increase Future Wealth

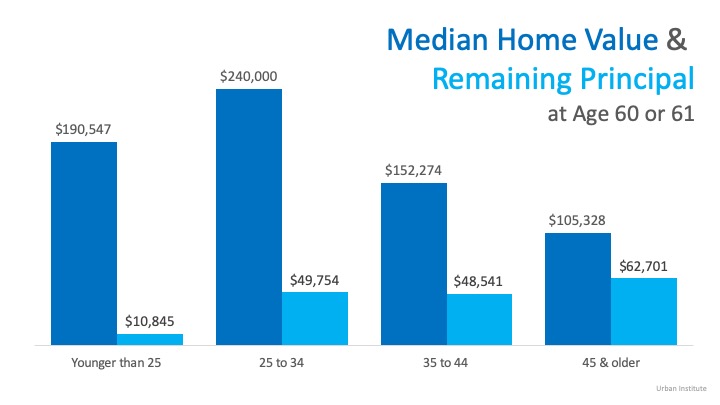

According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60.

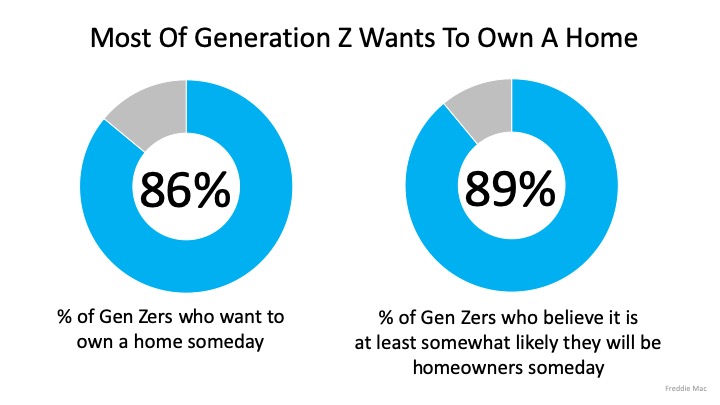

The good news is, our younger generations are strong believers in homeownership.

According to a Freddie Mac survey,

“The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials.

Our survey…finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).”

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

Based on this data, those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-20s and early-30s had close to $50,000 left, but traditionally purchased more expensive homes. Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Bottom Line

As the numbers show, you’re not alone. If you want to buy this year but you’re not sure where to start the process, let’s get together to help you understand the best steps to take from here.

Mortgage rates fell to their lowest level March 2020

Mortgage rates fell to their lowest level on record Thursday, pulled down by fears that the spread of coronavirus could weigh on the U.S. economy. The average rate on a 30-year fixed-rate mortgage fell to 3.29 percent from 3.45 percent last week and down from 4.41...

Thinking of Getting Your House Ready to Sell?

Impact of the Coronavirus on the U.S. Housing Market

Impact of the Coronavirus on the U.S. Housing MarketThe Coronavirus (COVID-19) has caused massive global uncertainty, including a U.S. stock market correction no one could have seen coming. While much of the news has been about the effect on various markets, let’s...

How Interest Rates Can Impact Your Monthly Housing Payments

How Interest Rates Can Impact Your Monthly Housing Payments Spring is right around the corner, so flowers are starting to bloom, and many potential homebuyers are getting ready to step into the market. If you’re thinking of buying this season, here’s how mortgage...

How Your Tax Refund Can Move You Toward Homeownership This Year

How Your Tax Refund Can Move You Toward Homeownership This Year If you’re looking to buy a home in 2020, have you thought about putting your tax refund toward a down payment? Homeownership may be one step closer than you think if you spend your dollars wisely this...

10 Steps to Buying a Home

10 Steps to Buying a Home Some Highlights: If you’re thinking of buying a home and you’re not sure where to start, you’re not alone. Here’s a guide with 10 simple steps to follow in the homebuying process. Be sure to work with a trusted real estate professional to...

How Much “Housing Wealth” Can You Build in a Decade?

How Much “Housing Wealth” Can You Build in a Decade? Earlier this month, the National Association of Realtors (NAR) released a special study titled Single-Family Home Price Gains by Years of Tenure. The study estimates median home price appreciation over the last 30...

Thinking of Selling? Now May Be the Time

Thinking of Selling? Now May Be the Time. The housing market has started off much stronger this year than it did last year. Lower mortgage interest rates have been a driving factor in that change. The average 30-year rate in 2019, according to Freddie Mac, was 3.94%....

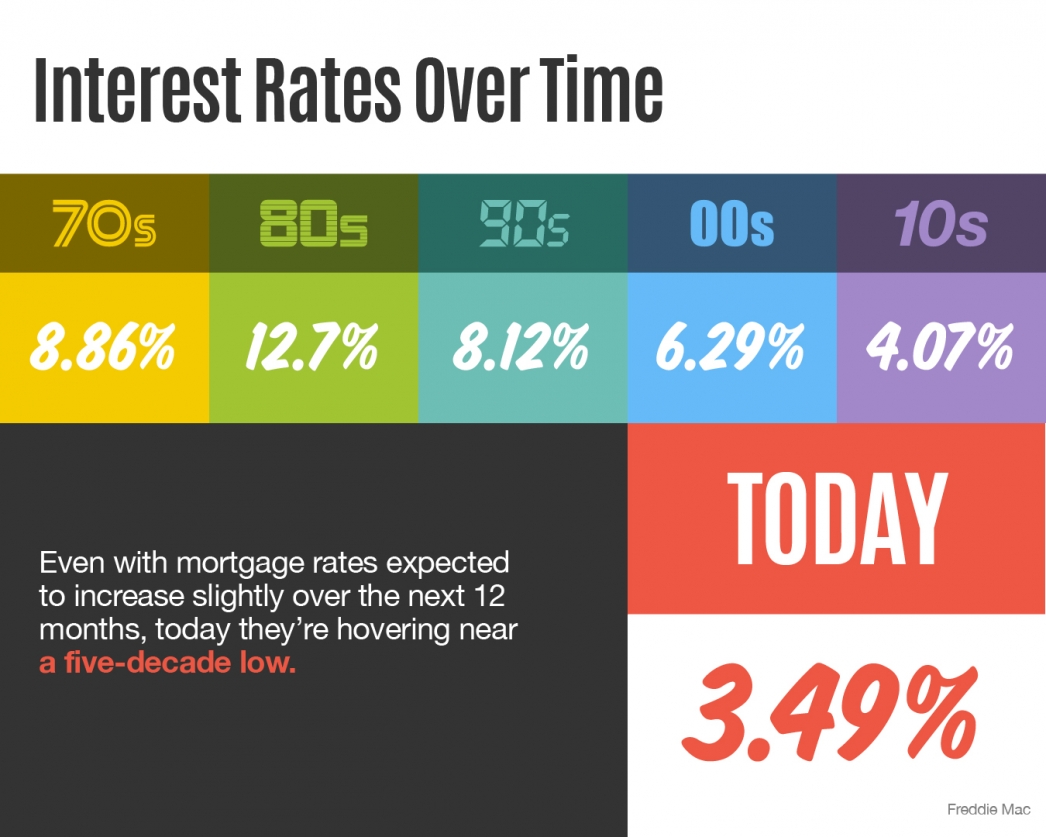

Income Rates Over Time

Some Highlights: With interest rates hovering at near historic lows, now is a great time to look back at where they’ve been, and how much they’ve changed over time. According to Freddie Mac, mortgage interest rates are currently hovering near a five-decade low. The...

Entry-Level Homeowners Are in the Driver’s Seat

Entry-Level Homeowners Are in the Driver’s Seat One thing helping homeowners right now is price appreciation, especially in the entry-level market. In the latest Home Price Insights report, CoreLogic reveals how home prices increased by 4% year-over-year and projects...

Mortgage rates fell to their lowest level March 2020

Mortgage rates fell to their lowest level on record Thursday, pulled down by fears that the spread of coronavirus could weigh on the U.S. economy. The average rate on a 30-year fixed-rate mortgage fell to 3.29 percent from 3.45 percent last week and down from 4.41...

Thinking of Getting Your House Ready to Sell?

Impact of the Coronavirus on the U.S. Housing Market

Impact of the Coronavirus on the U.S. Housing MarketThe Coronavirus (COVID-19) has caused massive global uncertainty, including a U.S. stock market correction no one could have seen coming. While much of the news has been about the effect on various markets, let’s...

How Interest Rates Can Impact Your Monthly Housing Payments

How Interest Rates Can Impact Your Monthly Housing Payments Spring is right around the corner, so flowers are starting to bloom, and many potential homebuyers are getting ready to step into the market. If you’re thinking of buying this season, here’s how mortgage...

How Your Tax Refund Can Move You Toward Homeownership This Year

How Your Tax Refund Can Move You Toward Homeownership This Year If you’re looking to buy a home in 2020, have you thought about putting your tax refund toward a down payment? Homeownership may be one step closer than you think if you spend your dollars wisely this...

10 Steps to Buying a Home

10 Steps to Buying a Home Some Highlights: If you’re thinking of buying a home and you’re not sure where to start, you’re not alone. Here’s a guide with 10 simple steps to follow in the homebuying process. Be sure to work with a trusted real estate professional to...

How Much “Housing Wealth” Can You Build in a Decade?

How Much “Housing Wealth” Can You Build in a Decade? Earlier this month, the National Association of Realtors (NAR) released a special study titled Single-Family Home Price Gains by Years of Tenure. The study estimates median home price appreciation over the last 30...

Thinking of Selling? Now May Be the Time

Thinking of Selling? Now May Be the Time. The housing market has started off much stronger this year than it did last year. Lower mortgage interest rates have been a driving factor in that change. The average 30-year rate in 2019, according to Freddie Mac, was 3.94%....

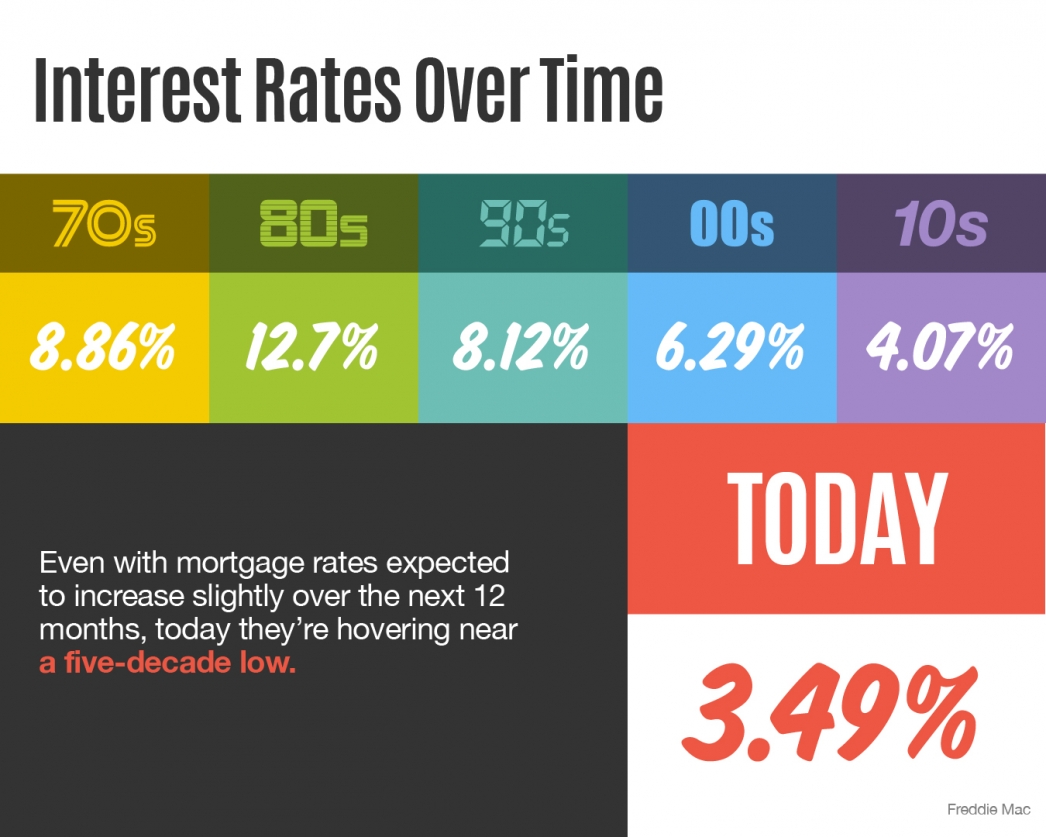

Income Rates Over Time

Some Highlights: With interest rates hovering at near historic lows, now is a great time to look back at where they’ve been, and how much they’ve changed over time. According to Freddie Mac, mortgage interest rates are currently hovering near a five-decade low. The...

Entry-Level Homeowners Are in the Driver’s Seat

Entry-Level Homeowners Are in the Driver’s Seat One thing helping homeowners right now is price appreciation, especially in the entry-level market. In the latest Home Price Insights report, CoreLogic reveals how home prices increased by 4% year-over-year and projects...

[mlcalc default=”mortgage_only”]