Buying a Home Early Can Significantly Increase Future Wealth

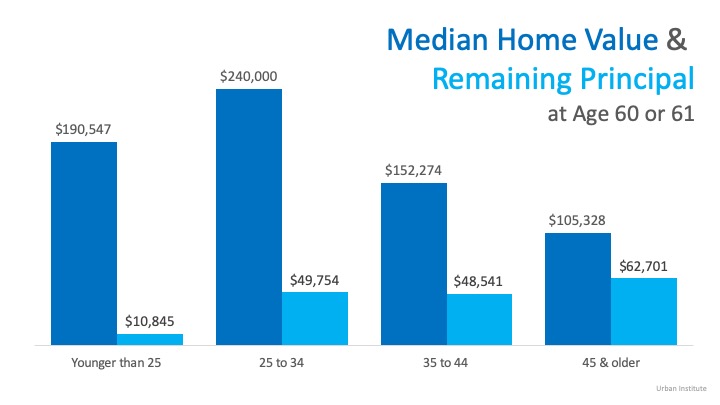

According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60.

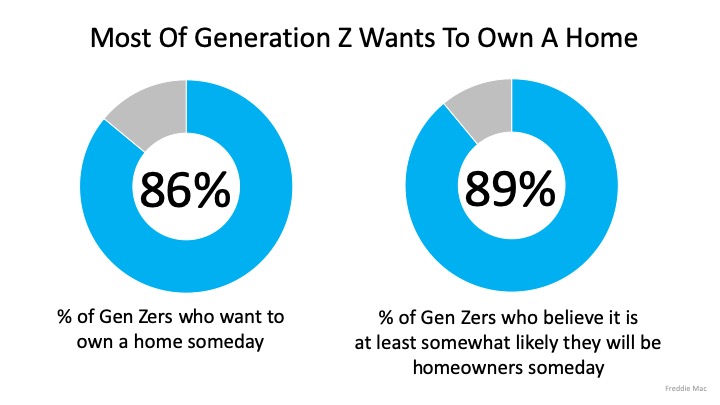

The good news is, our younger generations are strong believers in homeownership.

According to a Freddie Mac survey,

“The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials.

Our survey…finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).”

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

Based on this data, those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-20s and early-30s had close to $50,000 left, but traditionally purchased more expensive homes. Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Bottom Line

As the numbers show, you’re not alone. If you want to buy this year but you’re not sure where to start the process, let’s get together to help you understand the best steps to take from here.

Thinking of Selling Your House? Now May be the Right Time. Utah Realty Can Help

Thinking of Selling Your House? Now May be the Right Time. Experienced Realtors at Utah Realty Can Help! Inventory is arguably the biggest challenge for buyers in today’s housing market. There are simply more buyers actively looking for homes to purchase than there...

Mortgage Rates Fall to 50 year low

Mortgage Rates Fall Below 3% Some Highlights Mortgage rates hit another all-time low, falling below 3% this week. If you’re ready to buy a home, now is a great time to truly get more for your money at this historic moment. Let’s connect today to determine your best...

Real Estate is a Top Investment

Mortgage Rates Hit Record Lows for Three Consecutive Weeks

Mortgage Rates Hit Record Lows for Three Consecutive WeeksOver the past several weeks, Freddie Mac has reported the average 30-year fixed mortgage rate dropping to record lows, all the way down to 3.03%. Last week’s reported rate reached the lowest point in the...

Buyers: Are You Ready for a Bidding War?

Utah Buyers: Are You Ready for a Bidding War?Hiring an Expert with 34 Years of experience might just be what you need to rise to the top! With businesses reopening throughout the country and some experts indicating early signs of a much-anticipated...

Americans Rank Real Estate Best Investment for 7 Years Running

Americans Rank Real Estate Best Investment for 7 Years Running Some Highlights Real estate has outranked stocks, savings accounts, and gold as the best long-term investment among Americans for the past 7 years. The belief in the stability of housing as a long-term...

Best Time to Sell? When Competition Is at an All-Time Low

Best Time to Sell? When Competition Is at an All-Time Low In a recent survey of home sellers by Qualtrics, 87% of respondents said they were concerned their home won’t sell because of the pandemic and resulting economic recession. Of the respondents, 51% said they are...

Taking Advantage of Homebuying Affordability in Today’s Market

Taking Advantage of Homebuying Affordability in Today’s MarketEveryone is ready to buy a home at different times in their lives, and despite the health crisis, today is no exception. Understanding how affordability works and the main market factors that impact it may...

A Historic Rebound for the Housing Market

A Historic Rebound for the Housing Market Pending Home Sales increased by 44.3% in May, registering the highest month-over-month gain in the index since the National Association of Realtors (NAR) started tracking this metric in January 2001. So, what exactly are...

INDEPENDENCE DAY JULY 4TH

Thinking of Selling Your House? Now May be the Right Time. Utah Realty Can Help

Thinking of Selling Your House? Now May be the Right Time. Experienced Realtors at Utah Realty Can Help! Inventory is arguably the biggest challenge for buyers in today’s housing market. There are simply more buyers actively looking for homes to purchase than there...

Mortgage Rates Fall to 50 year low

Mortgage Rates Fall Below 3% Some Highlights Mortgage rates hit another all-time low, falling below 3% this week. If you’re ready to buy a home, now is a great time to truly get more for your money at this historic moment. Let’s connect today to determine your best...

Real Estate is a Top Investment

Mortgage Rates Hit Record Lows for Three Consecutive Weeks

Mortgage Rates Hit Record Lows for Three Consecutive WeeksOver the past several weeks, Freddie Mac has reported the average 30-year fixed mortgage rate dropping to record lows, all the way down to 3.03%. Last week’s reported rate reached the lowest point in the...

Buyers: Are You Ready for a Bidding War?

Utah Buyers: Are You Ready for a Bidding War?Hiring an Expert with 34 Years of experience might just be what you need to rise to the top! With businesses reopening throughout the country and some experts indicating early signs of a much-anticipated...

Americans Rank Real Estate Best Investment for 7 Years Running

Americans Rank Real Estate Best Investment for 7 Years Running Some Highlights Real estate has outranked stocks, savings accounts, and gold as the best long-term investment among Americans for the past 7 years. The belief in the stability of housing as a long-term...

Best Time to Sell? When Competition Is at an All-Time Low

Best Time to Sell? When Competition Is at an All-Time Low In a recent survey of home sellers by Qualtrics, 87% of respondents said they were concerned their home won’t sell because of the pandemic and resulting economic recession. Of the respondents, 51% said they are...

Taking Advantage of Homebuying Affordability in Today’s Market

Taking Advantage of Homebuying Affordability in Today’s MarketEveryone is ready to buy a home at different times in their lives, and despite the health crisis, today is no exception. Understanding how affordability works and the main market factors that impact it may...

A Historic Rebound for the Housing Market

A Historic Rebound for the Housing Market Pending Home Sales increased by 44.3% in May, registering the highest month-over-month gain in the index since the National Association of Realtors (NAR) started tracking this metric in January 2001. So, what exactly are...

INDEPENDENCE DAY JULY 4TH

[mlcalc default=”mortgage_only”]