3 Things to Know in the Housing Market Today!

A lot is happening in the world, and it’s having a direct impact on the housing market. The reality is this: some of it is positive and some of it may be negative. Some we just don’t know yet.

The following three areas of the housing market are critical to understand: interest rates, building materials, and the outlook for an economic slowdown.

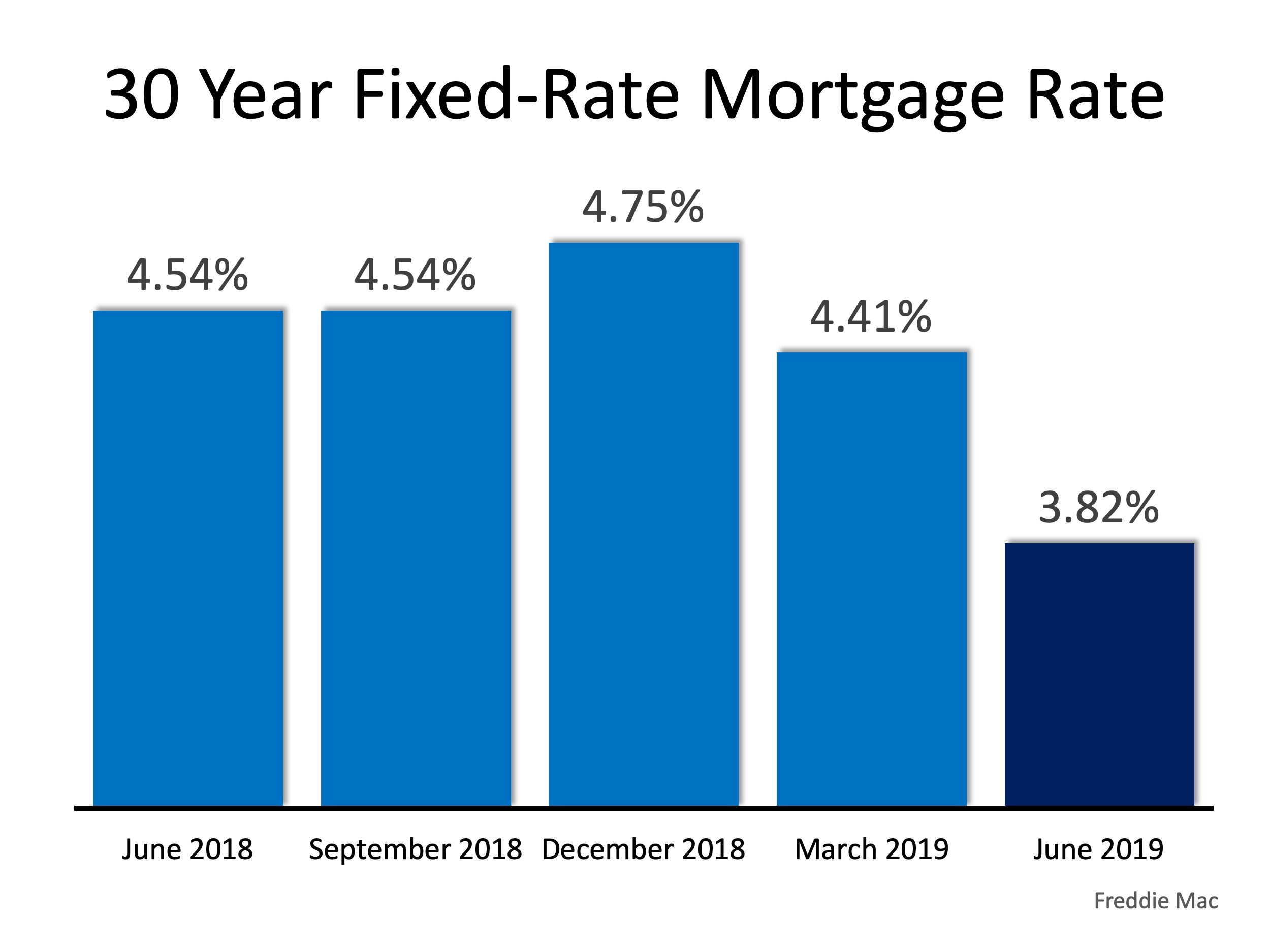

1. Interest Rates

One of the most important things to consider when buying a home is the interest rate you will be charged to borrow the money. In our recent post we posed the question, “Are Low Interest Rates Here To Stay?” The latest information from Freddie Mac makes it appear they are. We are currently at a 21-month low in interest rates.

2. Building Materials

Talk of tariffs could also affect the housing market. According to a recent article, the National Association of Home Builders reports that as much as $10 billion in goods imported from China are used in homebuilding. Depending on the outcome of the tariff and trade discussions between several countries, there could be as much as a 25% boost in the cost of building materials.

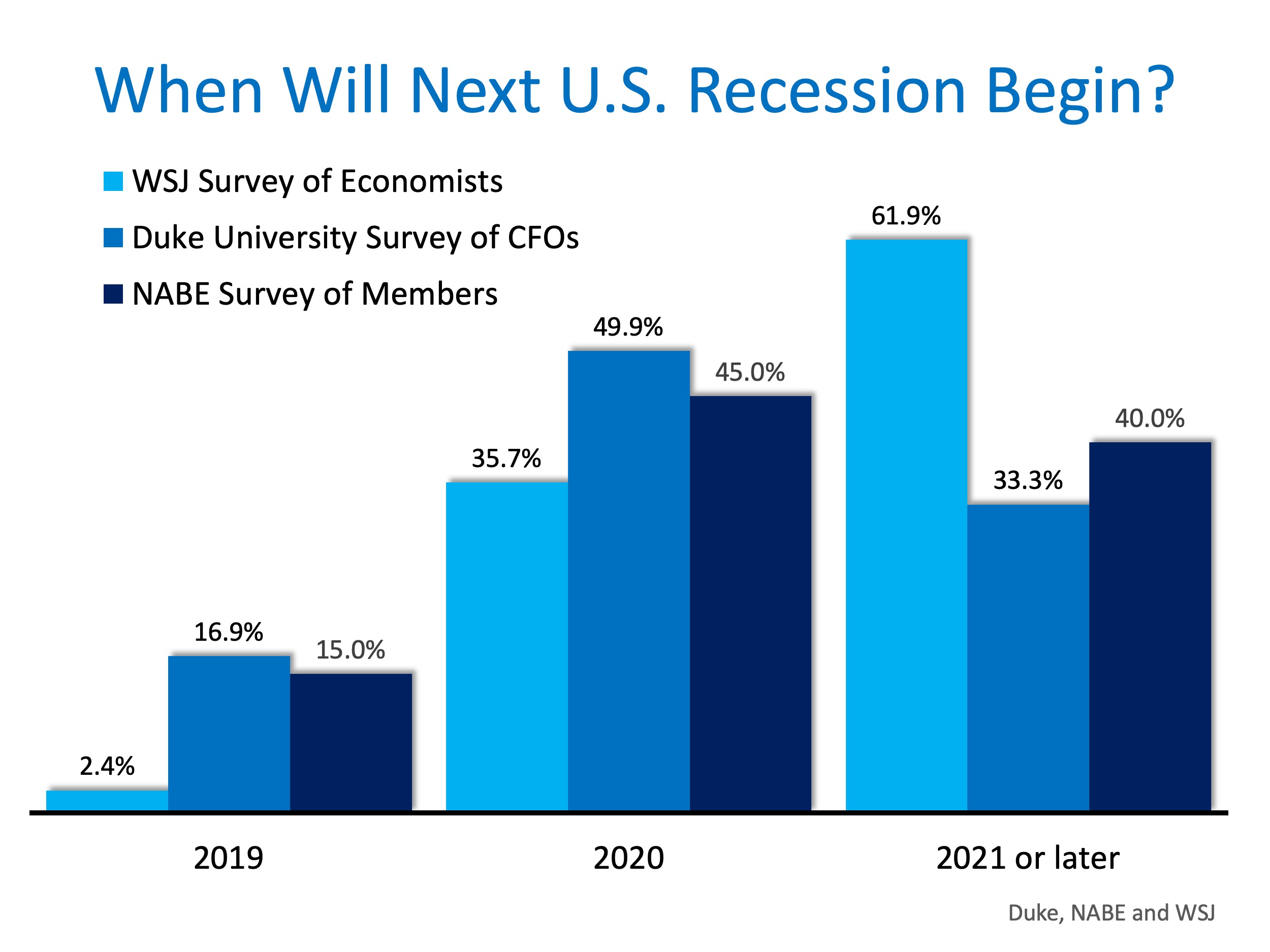

3. Economic Slowdown

In a prior blog post on this topic, we began the year with many economic leaders thinking we could expect a recession in late 2019 or early 2020. As spring approached, we reported that economists had started to push that projection past 2020. Now, three leading surveys indicate that it may begin in the next eighteen months.

Bottom Line

We are in a strong housing market. Wages are increasing, home prices are appreciating, and mortgage rates are the lowest they have been in 21 months. Whether you are thinking of buying or selling, it’s a great time to be in the market.

4 mortgage interest rate scenarios that could occur in 2025

Mortgage rates have fluctuated since January 2024, starting near 7% and briefly dropping to 6.15% in September before rising to an average of 6.93%. Experts predict various scenarios for 2025, including rate stability, gradual declines, continued volatility, or...

Fed Interest Rate Forecast for 2025-26: Expert Insights

Fed Funds Rate Trends Forecast: - 2025 rate: drop to 4.0% - 2026 rate: to hold ~3.8% Economic Outlook for 2025: - GDP growth: taper from 1.8% to 2.5% by year-end - Rate cuts respond to slower economic growth

Winter Savings Tips for 2025 Homebuyers

Track your spending this winter to identify areas for cost-cutting before buying a home in 2025. Winter-proof your home to reduce energy bills and save money during the colder months.

Western state governors eye public lands for affordable housing development

Colorado Gov. Jared Polis and other Western governors are exploring the use of federal lands to address the affordable housing crisis in the region. In Nevada, officials are leveraging a federal law to acquire land for development at reduced prices, while...

Utah’s Fall Housing Market Shows Growth Despite Higher Prices

Utah's fall housing market in 2024 experienced a 1.6% increase in home prices and a 12.5% rise in sales compared to the previous year, with a median home price of $553,000. In Salt Lake City, prices rose by 7.3% to an average of $550,000, although sales decreased...

What Makes Your Home Sell Faster?

Pricing slightly below market value attracts multiple offers and encourages faster sales across regions. Well-maintained exteriors and appealing landscapes boost property attractiveness in any climate.

Thanksgiving The True Meaning

Thanksgiving Day, celebrated predominantly in the United States, is often symbolized by the quintessential turkey dinner and indulgent pies, marking a period of feasting and familial gatherings. However, the essence of this holiday transcends beyond the mere...

Should you have your home pre-appraised before placing it on the Market?

In the complex and often unpredictable journey of selling a home, understanding the value of your property through a pre-listing appraisal emerges as a critical step that can significantly impact the outcome of your sale. This introduction to pre-listing appraisals...

State of Utah Market Update – Residential Homes

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY HOME MARKETING...

6 Must-Haves for a 2025 Home Sale

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY HOME MARKETING SPECIALIST (CLHM) PSA (Pricing Strategy Advisor) General Contractor 2000 (in-active) e-pro (advanced digital marketing)...