3 Questions You Need To Ask Before Buying A Home

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.

Ask yourself the following three questions to help determine if now is a good time for you to buy in today’s market.

1. Why am I buying a home in the first place?

This is truly the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with money.

For example, a study by realtor.com found that “73% said buying in a good school district was “important” in their search.”

This report supports a study by the Joint Center for Housing Studies at Harvard University which revealed that the top four reasons Americans buy a home have nothing to do with money. The actual reasons are:

- A good place to raise children and provide them with a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of that space

What does owning a home mean to you? What non-financial benefits will you and your family gain from owning a home? The answer to that question should be the biggest reason you decide to purchase or not.

2. Where are home values headed?

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), the median price of homes sold in February (the latest data available) was $249,500. This is up 3.6% from last year. The increase also marks the 84th consecutive month with year-over-year gains.

Looking at home prices year over year, CoreLogic is forecasting an increase of 4.6%. In other words, a home that costs you $250,000 today will cost you an additional $11,500 if you wait until next year to buy it.

What does that mean to you?

Simply put, with prices increasing, it may cost you more if you wait until next year to buy. Your down payment will also need to be higher in order to account for the higher price of the home you wish to buy.

3. Where are mortgage interest rates headed?

A buyer must be concerned about more than just prices. The ‘long-term cost’ of a home can be dramatically impacted by even a small increase in mortgage rates.

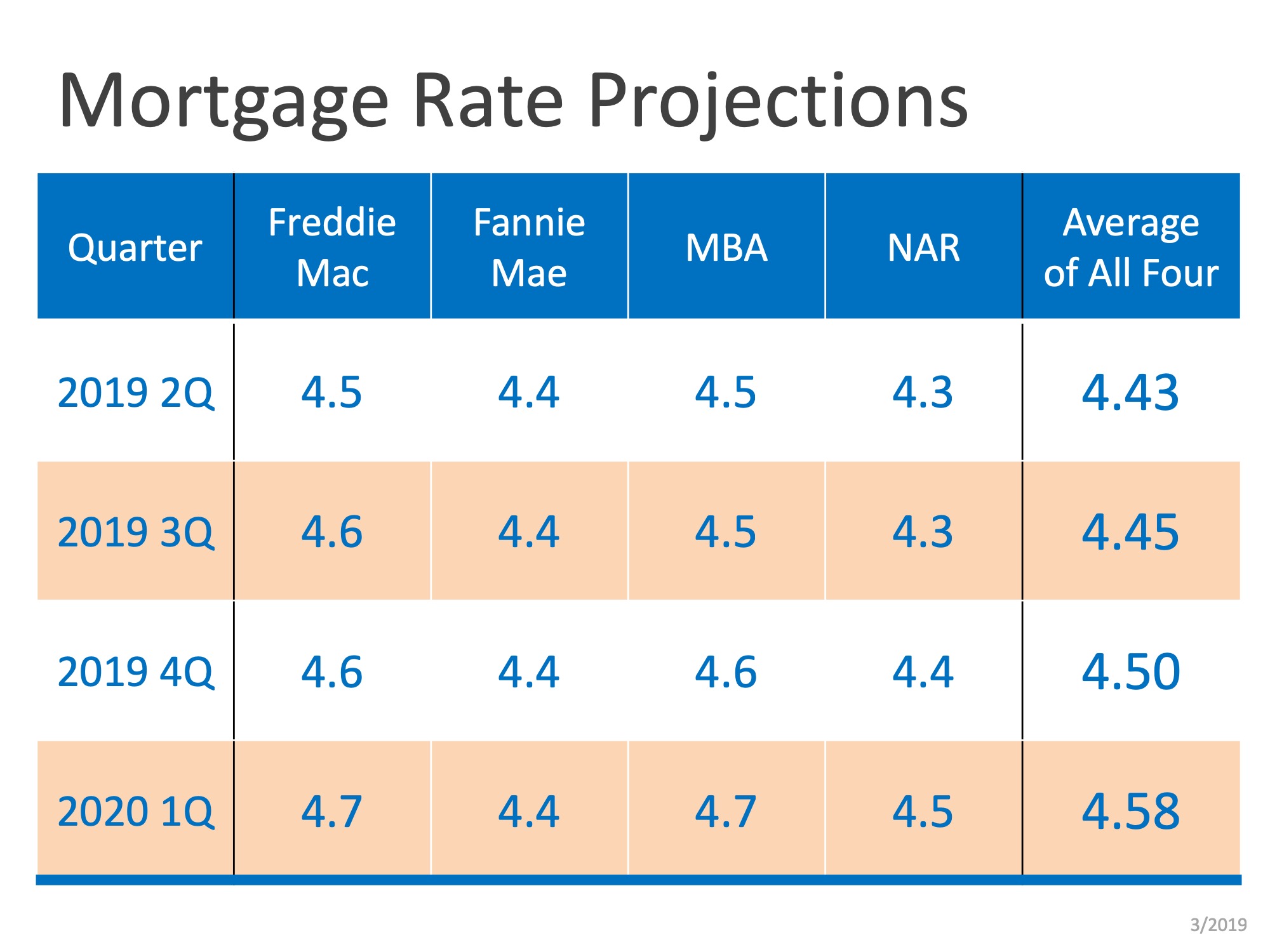

Freddie Mac, Fannie Mae, the Mortgage Bankers Association and NAR have all projected that mortgage interest rates will increase over the next twelve months, as you can see in the chart below:

Bottom Line

Only you and your family will know for certain if now is the right time to purchase a home. Answering these questions will help you make that decision.

Want To Sell Your House This Spring? Price It Right.

Want To Sell Your House This Spring? Price It Right. Over the last year, the housing market’s gone through significant change. While it’s still a sellers’ market, homes that are priced right are selling, and they get the most attention from buyers right now. If you’re...

Your Tax Refund Can Help You Achieve Your Homebuying Goals

Your Tax Refund Can Help You Achieve Your Homebuying Goals Have you been saving up to buy a home this year? If so, you know there are a variety of expenses involved – from your down payment to closing costs. But there’s good news – your tax refund can help you achieve...

Salt Lake County Multi-Family

Salt Lake County Multi-Family Comparing February 2022 to February 2023 The multi-family housing market in Salt Lake County faced several challenges in February, as heightened interest rates led to a noticeable decrease in sales activity for properties such as...

The Key Advantage of Investing in a Home

The Key Advantage of Investing in a Home Some Highlights Buying a home is a major way to build wealth and gain financial stability. That’s why, across different income levels, the largest part of most homeowners’ net worth is their equity. Let’s connect today so you...

Top Two Reasons People Sell Their Home

Two Reasons You Should Sell Your House Wondering if you should sell your house this year? As you make your decision, think about what’s motivating you to consider moving. A recent survey from realtor.com asked why homeowners are thinking about selling their houses...

How Changing Mortgage Rates Can Affect You

How Changing Mortgage Rates Can Affect You The 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects...

Facts About Closing Costs

Facts About Closing Costs Some Highlights If you’re thinking about buying a home, be sure to plan for closing costs. Closing costs are typically 2% to 5% of the total purchase price of a home, and they can include things like government recording costs, appraisal...

We’re in a Sellers’ Market. What Does That Mean?

We’re in a Sellers’ Market. What Does That Mean? Even though activity in the housing market has slowed from the frenzy we saw over a year ago, today’s low supply of homes for sale is still a sellers’ market. But what does that really mean? And why are conditions today...

4 Key Tips for Selling Your House This Spring

4 Key Tips for Selling Your House This Spring Spring has arrived, and that means more and more people are getting their homes ready to sell. But with recent shifts in real estate, this year’s spring housing market will be different from the frenzy of the past several...

Get Ready: The Best Time To List Your House Is Almost Here

Get Ready: The Best Time To List Your House Is Almost Here If you’re thinking about selling this spring, it’s time to get moving – the best week to list your house is fast approaching. Experts at realtor.com looked at seasonal trends from recent years (excluding 2020...