3 Questions You Need To Ask Before Buying A Home

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.

Ask yourself the following three questions to help determine if now is a good time for you to buy in today’s market.

1. Why am I buying a home in the first place?

This is truly the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with money.

For example, a study by realtor.com found that “73% said buying in a good school district was “important” in their search.”

This report supports a study by the Joint Center for Housing Studies at Harvard University which revealed that the top four reasons Americans buy a home have nothing to do with money. The actual reasons are:

- A good place to raise children and provide them with a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of that space

What does owning a home mean to you? What non-financial benefits will you and your family gain from owning a home? The answer to that question should be the biggest reason you decide to purchase or not.

2. Where are home values headed?

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), the median price of homes sold in February (the latest data available) was $249,500. This is up 3.6% from last year. The increase also marks the 84th consecutive month with year-over-year gains.

Looking at home prices year over year, CoreLogic is forecasting an increase of 4.6%. In other words, a home that costs you $250,000 today will cost you an additional $11,500 if you wait until next year to buy it.

What does that mean to you?

Simply put, with prices increasing, it may cost you more if you wait until next year to buy. Your down payment will also need to be higher in order to account for the higher price of the home you wish to buy.

3. Where are mortgage interest rates headed?

A buyer must be concerned about more than just prices. The ‘long-term cost’ of a home can be dramatically impacted by even a small increase in mortgage rates.

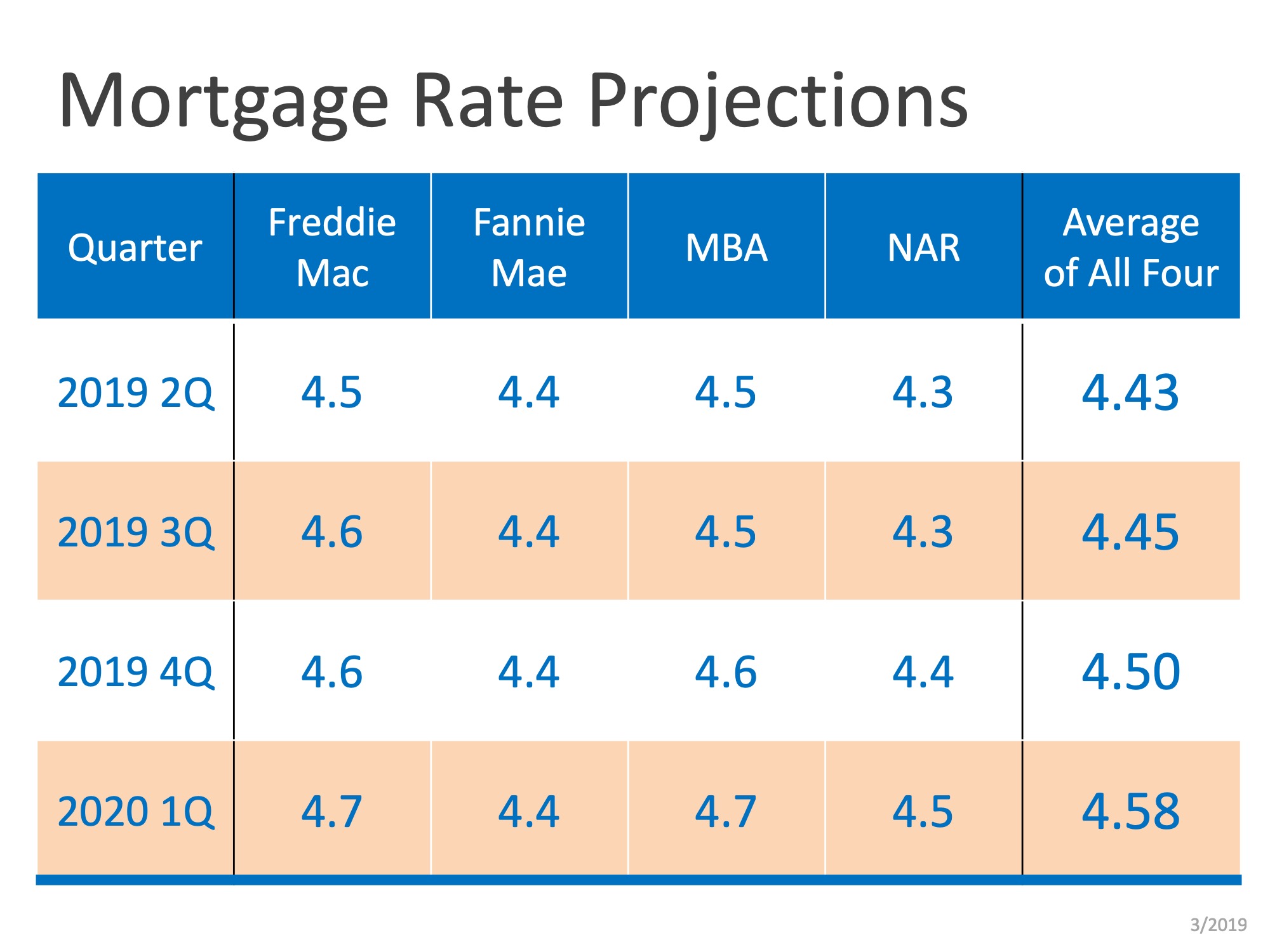

Freddie Mac, Fannie Mae, the Mortgage Bankers Association and NAR have all projected that mortgage interest rates will increase over the next twelve months, as you can see in the chart below:

Bottom Line

Only you and your family will know for certain if now is the right time to purchase a home. Answering these questions will help you make that decision.

Thinking About Buying a Home? Ask Yourself These Questions

Thinking About Buying a Home? Ask Yourself These Questions If you’re thinking of buying a home this year, you’re probably paying closer attention than normal to the housing market. And you’re getting your information from a variety of channels: the news, social media,...

Things To Consider If Your House Didn’t Sell

Things To Consider If Your House Didn’t Sell If your listing has expired and your house didn’t sell, it's completely normal to feel a mix of frustration and disappointment. Understandably, you're probably wondering what may have gone wrong. Here are three questions to...

What Experts Say About The Housing Market in 2024

The Benefits of Working With an Experienced Agent When You Sell Your House

The Benefits of Working With an Experienced Agent When You Sell Your House Some Highlights When it comes to selling your house, the expertise of a trusted real estate agent can make a big difference. They’ll explain what’s happening today, what that means for you, and...

Retiring Soon? Why Moving Might Be the Perfect Next Step

Retiring Soon? Why Moving Might Be the Perfect Next Step If you’re thinking about retirement or have already retired this year, it’s a good time to consider if your current house is still a good fit for the next chapter in your life. Fortunately, you may be in a...

Get Ready To Buy a Home by Improving Your Credit Score

Get Ready To Buy a Home by Improving Your Credit Score As the new year approaches, the idea of buying a home might be on your mind. It’s an exciting goal to set, and it's never too early to start laying the groundwork. One crucial step to prepare for homeownership is...

Get Your House Ready To Sell This Winter

Get Your House Ready To Sell This Winter [INFOGRAPHIC] Some Highlights As you get ready to sell your house, there are a few things you should add to your to-do list to make it inviting and boost curb appeal. To name just a couple, it’s a good idea to declutter, take...

Why Mortgage Rates Could Continue To Decline

Why Mortgage Rates Could Continue To Decline When you read about the housing market, you’ll probably come across some information about inflation or recent decisions made by the Federal Reserve (the Fed). But how do those two things impact you and your homebuying...

Expert Quotes on the 2024 Housing Market Forecast

Expert Quotes on the 2024 Housing Market Forecast If you’re thinking about buying or selling a home soon, you probably want to know what you can expect from the housing market in 2024. In 2023, higher mortgage rates, confusion over home price headlines, and a lack of...

Why Now Is Still a Great Time To Sell Your House

Why Now Is Still a Great Time To Sell Your House If you were worried buyer demand disappeared when mortgage rates went up, the data shows there are plenty of interested buyers still out there. The housing market isn't as frenzied as it was during the ‘unicorn’...