3 Benefits to Buying Your Dream Home This Year

Outside of a strong economy, low unemployment, and higher wages, there are three more great reasons why you may want to consider buying your dream home this year instead of waiting.

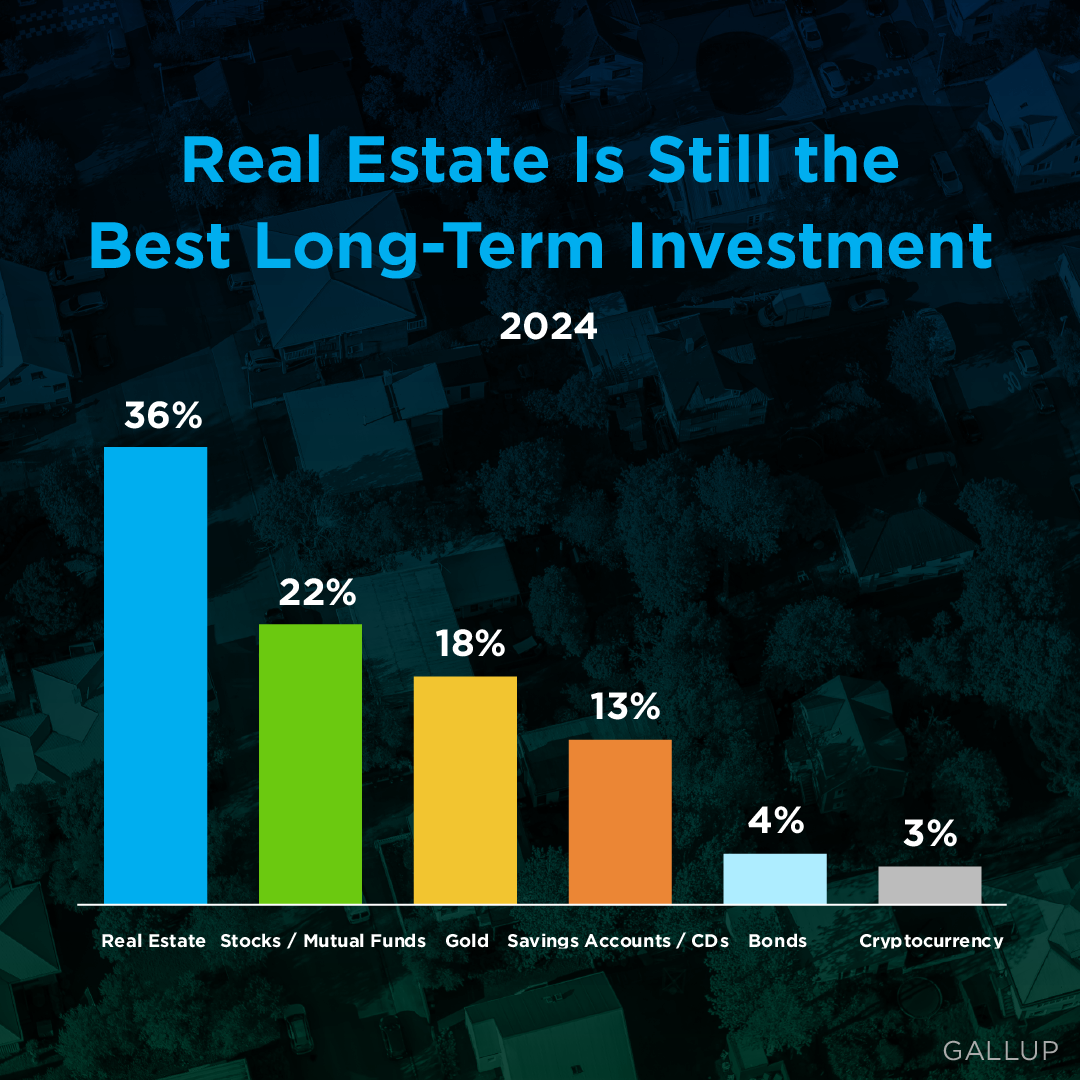

1. Buying a Home is a Great Investment

Several reports indicate that real estate is a good investment, topping other options such as gold, stocks, bonds, and savings. Why? Real estate helps build equity, a form of investing for you and your family. According to CoreLogic’s Equity Report,

“U.S. homeowners with mortgages (roughly 64% of all properties) have seen their equity increase by a total of nearly $457 billion since the third quarter 2018, an increase of 5.1%, year over year.”

This means the average homeowner gained approximately $5,300 in equity over the past year. If you want to start building your equity, put your housing costs to work for you through homeownership this year.

2. Mortgage Interest Rates Are Low

The Primary Mortgage Market Survey from Freddie Mac indicates that interest rates for a 30-year mortgage have fallen since November 2018 when they hit 4.94%. In their latest forecast, Freddie Mac expects rates to remain low, leveling out to a yearly average of 3.8% in 2020.

When you purchase a home at a low mortgage rate, it will impact your monthly mortgage payment, giving you the opportunity to buy more house for your money.

3. Investing in Your Family is a Win

There are some renters who haven’t purchased a home yet because they’re uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you’re living rent-free with your parents, you’re paying a mortgage – either yours or that of your landlord.

Today, rental prices continue to increase, and when you’re paying your landlord’s mortgage instead of your own, you’re not the one earning the equity. As an owner, your mortgage payment is a form of ‘forced savings’ you can use later in life to reinvest in your family. You can use it for a variety of opportunities, such as saving for your children’s education, moving up to a bigger home, or starting your own business. As a renter, it can be more challenging to achieve those types of dreams without home equity working for you.

Bottom Line

Buying a home sooner rather than later could lead to substantial savings and long-term financial growth for you and your family. Let’s get together to determine if homeownership is the right choice for you this year.

Real Estate Is the Best Investment

Did you know? Real estate has been voted the best long-term investment for 12 years straight. That’s because history shows home values usually go up. And when that happens, it helps homeowners grow their net worth. So, if you’re debating renting or buying, remember to...

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024 As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales. Home Prices Are Expected To Climb Moderately Home prices are...

Do Elections Impact the Housing Market?

Do Elections Impact the Housing Market? The 2024 Presidential election is just months away. As someone who’s thinking about potentially buying or selling a home, you’re probably curious about what effect, if any, elections have on the housing market. It’s a great...

More Than a House: The Emotional Benefits of Homeownership

More Than a House: The Emotional Benefits of Homeownership With all the headlines and talk about housing affordability, it can be tempting to get lost in the financial side of buying a home. That’s only natural as you think about the dollars and cents of it...

How Missing or Ghosting A Home Showing Can Damage Your Reputation And Business In Real Estate

How Missing or Ghosting A Home Showing Can Damage Your Reputation And Business In Real Estate In the competitive world of real estate, maintaining a stellar reputation is not just important; it's paramount. Missing a home showing might seem like a minor mishap, easily...

Real Estate Agent Marketing Methods

Ready to sell your house? One of your top priorities may be getting help marketing your home. Partnering with a great agent can make all the difference. These are just a few strategies we can use to get your house more visibility. Ready to maximize your home's...

Hiring a PSA or Pricing Strategy Advisor is the Key to Pricing your Home Right

Your Agent Is the Key To Pricing Your House Right [INFOGRAPHIC] Some Highlights The asking price for your house can impact your bottom line and how quickly it sells. Both under- and overpricing have drawbacks. So to find the right price for your house, lean on your...

Home Prices Rising in the Next 5 Years

Wondering about the future of home prices? Here's the scoop. Experts forecast a steady rise in home prices until at least 2028. That means buying now sets you up to gain equity as values climb. But, if you wait, the price of a home will only be higher later on. If you...

The Number of Homes for Sale Is Increasing

The Number of Homes for Sale Is Increasing There’s no denying the last couple of years have been tough for anyone trying to buy a home because there haven’t been enough houses to go around. But things are starting to look up. There are more homes up for grabs this...

Home Prices Are Climbing in These Top Cities

Home Prices Are Climbing in These Top Cities Thinking about buying a home or selling your current one to find a better fit? If so, you might be wondering what's going on with home prices these days. Here's the scoop. The latest national data from Case-Shiller and...