3 Benefits to Buying Your Dream Home This Year

Outside of a strong economy, low unemployment, and higher wages, there are three more great reasons why you may want to consider buying your dream home this year instead of waiting.

1. Buying a Home is a Great Investment

Several reports indicate that real estate is a good investment, topping other options such as gold, stocks, bonds, and savings. Why? Real estate helps build equity, a form of investing for you and your family. According to CoreLogic’s Equity Report,

“U.S. homeowners with mortgages (roughly 64% of all properties) have seen their equity increase by a total of nearly $457 billion since the third quarter 2018, an increase of 5.1%, year over year.”

This means the average homeowner gained approximately $5,300 in equity over the past year. If you want to start building your equity, put your housing costs to work for you through homeownership this year.

2. Mortgage Interest Rates Are Low

The Primary Mortgage Market Survey from Freddie Mac indicates that interest rates for a 30-year mortgage have fallen since November 2018 when they hit 4.94%. In their latest forecast, Freddie Mac expects rates to remain low, leveling out to a yearly average of 3.8% in 2020.

When you purchase a home at a low mortgage rate, it will impact your monthly mortgage payment, giving you the opportunity to buy more house for your money.

3. Investing in Your Family is a Win

There are some renters who haven’t purchased a home yet because they’re uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you’re living rent-free with your parents, you’re paying a mortgage – either yours or that of your landlord.

Today, rental prices continue to increase, and when you’re paying your landlord’s mortgage instead of your own, you’re not the one earning the equity. As an owner, your mortgage payment is a form of ‘forced savings’ you can use later in life to reinvest in your family. You can use it for a variety of opportunities, such as saving for your children’s education, moving up to a bigger home, or starting your own business. As a renter, it can be more challenging to achieve those types of dreams without home equity working for you.

Bottom Line

Buying a home sooner rather than later could lead to substantial savings and long-term financial growth for you and your family. Let’s get together to determine if homeownership is the right choice for you this year.

4 Major Reasons Households in Forbearance Won’t Lose Their Homes to Foreclosure

4 Major Reasons Households in Forbearance Won’t Lose Their Homes to ForeclosureThere has been a lot of discussion as to what will happen once the 2.3 million households currently in forbearance no longer have the protection of the program. Some assume there could...

Don’t Sell on Your Own Just Because It’s a Sellers’ Market

Don’t Sell on Your Own Just Because It’s a Sellers’ MarketIn a sellers’ market, some homeowners might be tempted to try to sell their house on their own (known as For Sale By Owner, or FSBO) instead of working with a trusted real estate professional. When the...

Top 10 commercial real estate markets for 2021

NAR Study Puts Salt Lake in Top 10 Commercial Markets The National Association of Realtors® identified the top 10 commercial real estate markets for 2021. They are: Austin-Round Rock, Texas; Cape Coral-Fort Myers, Florida; Charleston-North Charleston, South...

What It Means To Be in a Sellers’ Market

What It Means To Be in a Sellers’ Market If you’ve given even a casual thought to selling your house in the near future, this is the time to really think seriously about making a move. Here’s why this season is the ultimate sellers’ market and the optimal time to make...

2021 Real Estate Myth Buster

2021 Real Estate Myth BusterSome HighlightsThere are a lot of misconceptions about buying or selling a home today, making it challenging to know exactly how to navigate the current real estate landscape.Here’s a little clarity when it comes to 5 common myths about the...

What Credit Score Do You Need for a Mortgage?

What Credit Score Do You Need for a Mortgage? According to data from the most recent Origination Insight Report by Ellie Mae, the average FICO® score on closed loans reached 753 in February. As lending standards have tightened recently, many are concerned over whether...

Thinking of Buying or Selling This Spring? Free How to Guide

>>>> Free Guides to Buying and Selling this spring! <<<<

6 Simple Graphs Proving This Is Nothing Like Last Time

6 Simple Graphs Proving This Is Nothing Like Last Time Last March, many involved in the residential housing industry feared the market would be crushed under the pressure of a once-in-a-lifetime pandemic. Instead, real estate had one of its best years ever. Home sales...

5 Reasons to Sell Your House This Spring

5 Reasons to Sell Your House This Spring When selling a house, most homeowners hope for a quick and profitable transaction that puts them in a position to make a great move. If you’re waiting for the best time to win as a seller, the market is calling your name this...

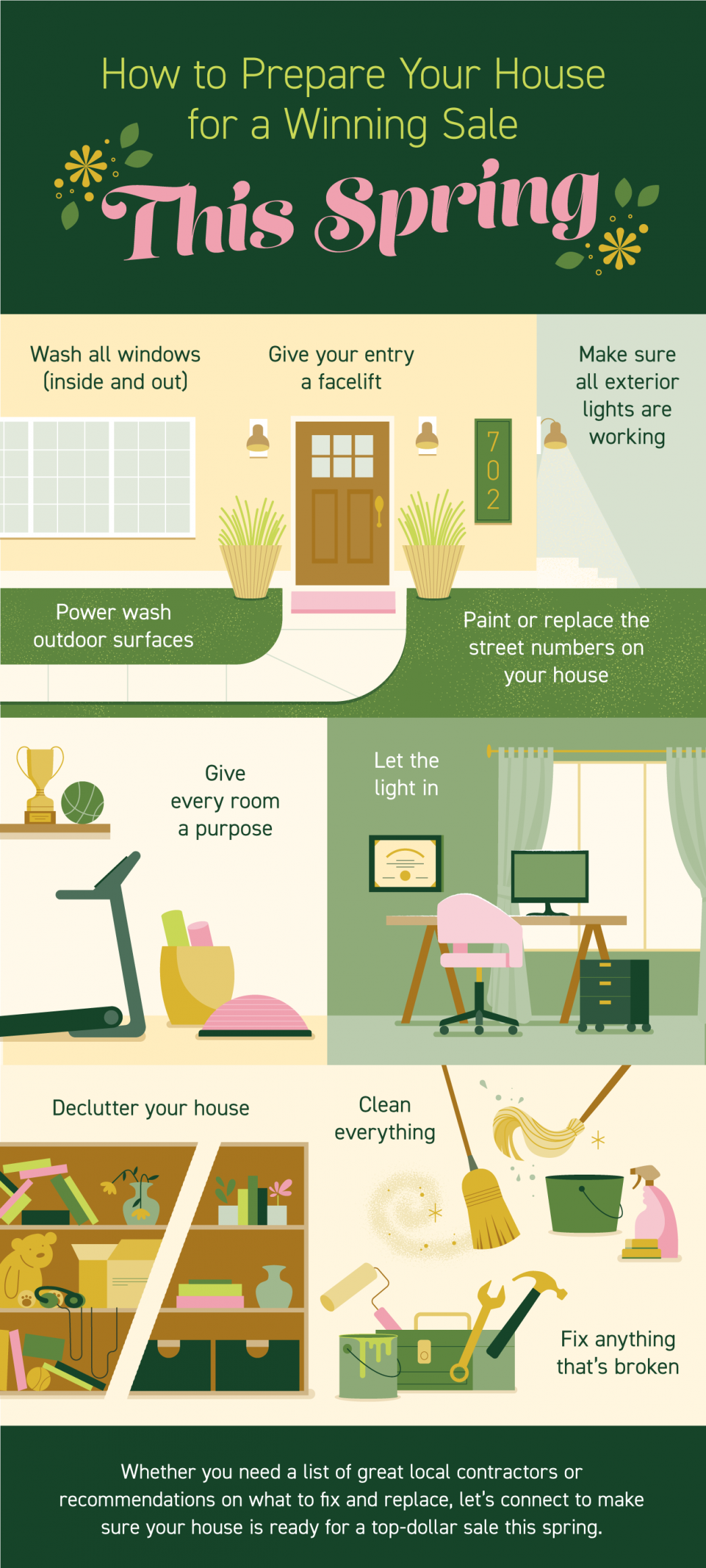

How to Prepare Your House for a Winning Sale This Spring

How to Prepare Your House for a Winning Sale This Spring Some Highlights With so few homes available to buy today, houses are in high demand, and they’re selling fast. That means it’s a great time to sell if you’re ready to make a move. Let’s connect to make sure...