3 Benefits to Buying Your Dream Home This Year

Outside of a strong economy, low unemployment, and higher wages, there are three more great reasons why you may want to consider buying your dream home this year instead of waiting.

1. Buying a Home is a Great Investment

Several reports indicate that real estate is a good investment, topping other options such as gold, stocks, bonds, and savings. Why? Real estate helps build equity, a form of investing for you and your family. According to CoreLogic’s Equity Report,

“U.S. homeowners with mortgages (roughly 64% of all properties) have seen their equity increase by a total of nearly $457 billion since the third quarter 2018, an increase of 5.1%, year over year.”

This means the average homeowner gained approximately $5,300 in equity over the past year. If you want to start building your equity, put your housing costs to work for you through homeownership this year.

2. Mortgage Interest Rates Are Low

The Primary Mortgage Market Survey from Freddie Mac indicates that interest rates for a 30-year mortgage have fallen since November 2018 when they hit 4.94%. In their latest forecast, Freddie Mac expects rates to remain low, leveling out to a yearly average of 3.8% in 2020.

When you purchase a home at a low mortgage rate, it will impact your monthly mortgage payment, giving you the opportunity to buy more house for your money.

3. Investing in Your Family is a Win

There are some renters who haven’t purchased a home yet because they’re uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you’re living rent-free with your parents, you’re paying a mortgage – either yours or that of your landlord.

Today, rental prices continue to increase, and when you’re paying your landlord’s mortgage instead of your own, you’re not the one earning the equity. As an owner, your mortgage payment is a form of ‘forced savings’ you can use later in life to reinvest in your family. You can use it for a variety of opportunities, such as saving for your children’s education, moving up to a bigger home, or starting your own business. As a renter, it can be more challenging to achieve those types of dreams without home equity working for you.

Bottom Line

Buying a home sooner rather than later could lead to substantial savings and long-term financial growth for you and your family. Let’s get together to determine if homeownership is the right choice for you this year.

Watching the Stock Market? Check the Value of Your Home for Good News.

Watching the Stock Market? Check the Value of Your Home for Good News. While watching the stock market recently may have started to feel pretty challenging, checking the value of your home should come as welcome relief in this volatile time. If you’re a homeowner,...

Buyers Are Regaining Some of Their Negotiation Power in Today’s Housing Market

Buyers Are Regaining Some of Their Negotiation Power in Today’s Housing Market If you're thinking about buying a home today, there's welcome news. Even though it’s still a sellers’ market, it’s a more moderate sellers’ market than last year. And the days of feeling...

Your Guides to Buying or Selling a Home This Fall

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...

Expert Forecasts on Mortgage Rates

Expert Forecasts on Mortgage Rates If you’ve been thinking of buying a home, you may have been watching what’s happened with mortgage rates over the past year. It’s true they’ve risen dramatically, but where will they go from here, especially as the market continues...

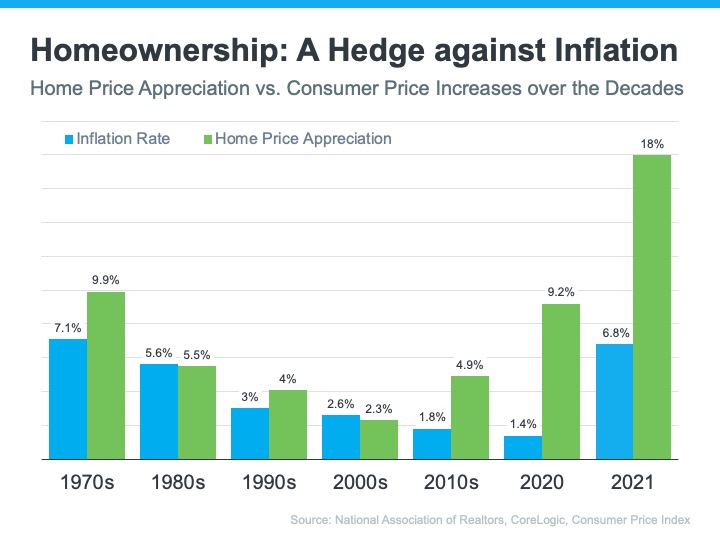

How Owning a Home Builds Your Net Worth

How Owning a Home Builds Your Net Worth Owning a home is a major financial milestone and an achievement to take pride in. One major reason: the equity you build as a homeowner gives your net worth a big boost. And with high inflation right now, the link between owning...

Should I wait to buy a home?

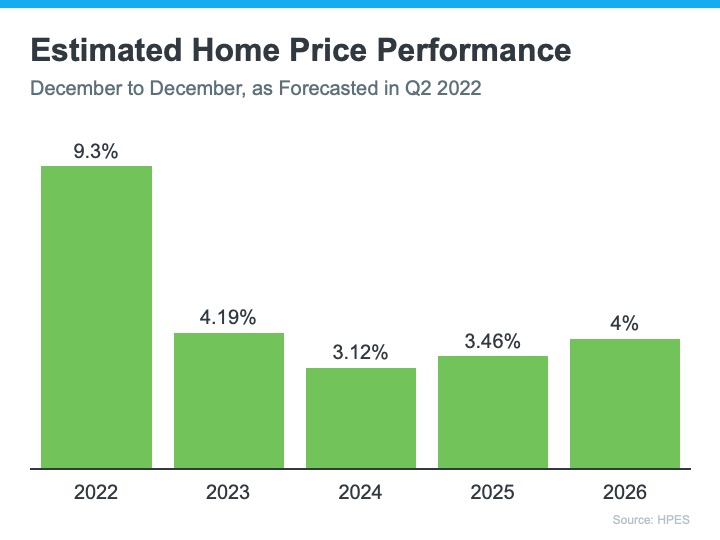

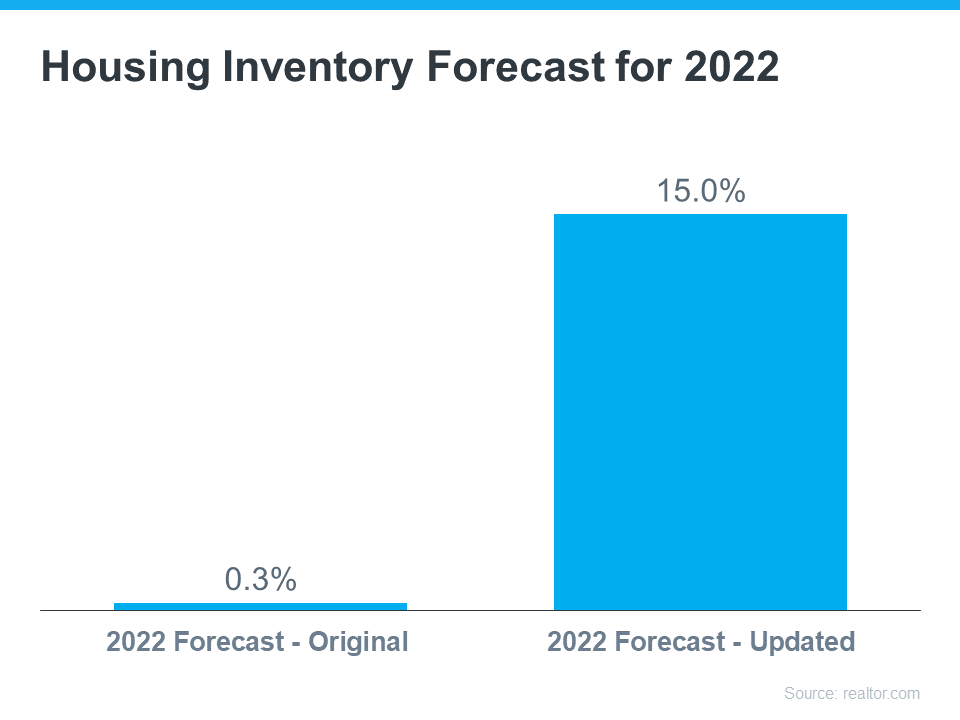

Part 4 Should I wait to buy a home? This is probably one of the biggest questions you’re getting asked right now, and it’s never been more important to have a good answer for it. Even though purchasing a home today may not be as easy as it was a couple of years ago,...

What will happen the second half of this year?

Part 3 What will happen the second half of this year? Yes, we are seeing a slowdown. However, we are really just heading back toward the market pace we saw pre-pandemic, and those were still great years for real estate. Focus on the big picture, and that’s this: the...

Expert Housing Market Forecasts for the Second Half of the Year

Expert Housing Market Forecasts for the Second Half of the Year The housing market is at a turning point, and if you’re thinking of buying or selling a home, that may leave you wondering: is it still a good time to buy a home? Should I make a move this year? To help...

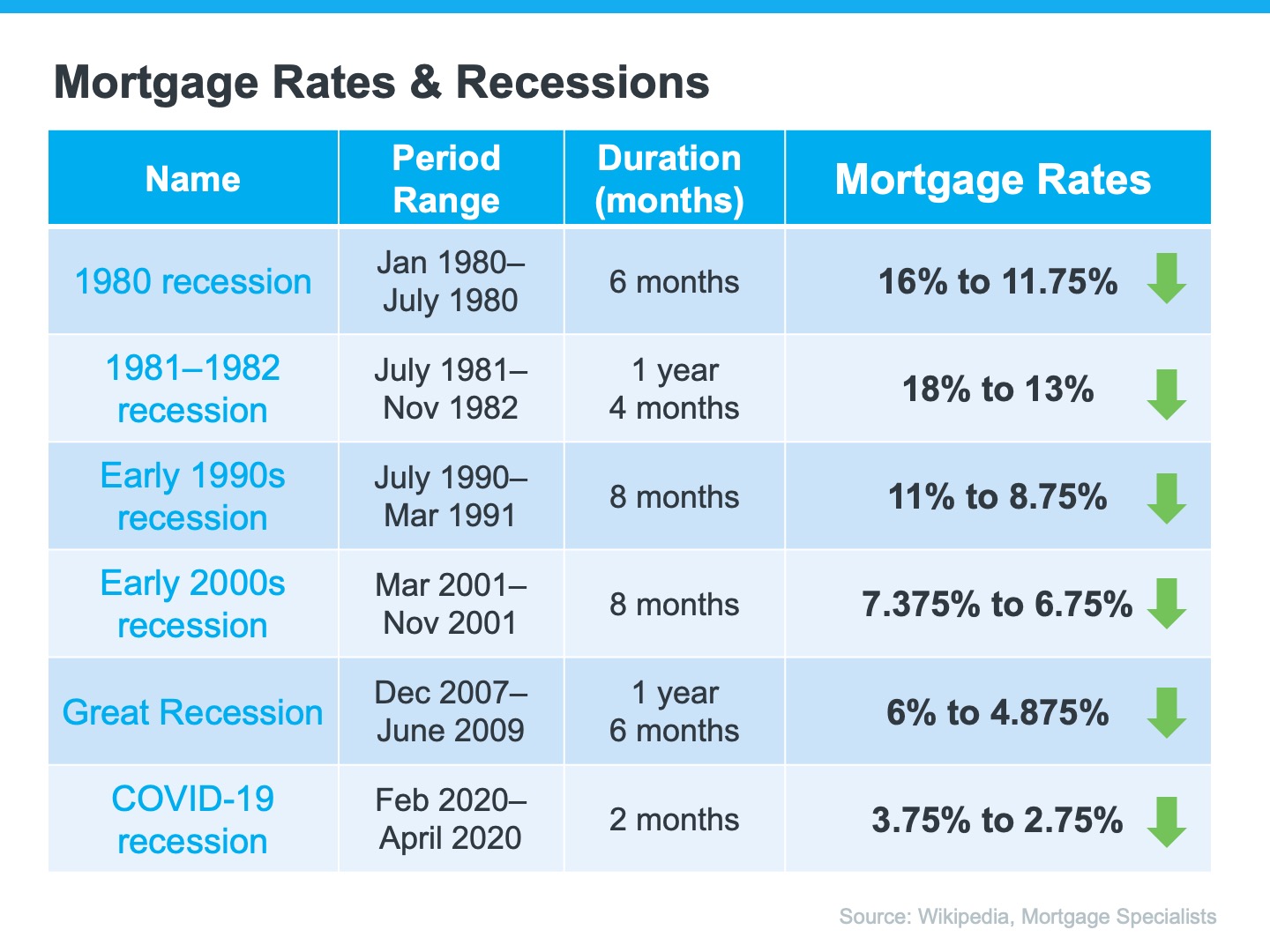

If the economy slows further, what does that mean for real estate?

IN TIMES OF UNCERTAINTY, PEOPLE FOLLOW THE CERTAIN Part 3 If the economy slows further, what does that mean for real estate? Post-2009, nothing will strike fear into the hearts of buyers and sellers like the word “recession.” But as the economy slows down, history...

What’s happening with mortgage rates, now and in the future? Part 2

What’s happening with mortgage rates, now and in the future? Rising mortgage rates are no doubt one of the biggest factors impacting the housing market right now. But it’s important to remind your clients that the low rates of the last few years were an anomaly. As...