The 2020 Real Estate Projections That May Surprise You

This will be an interesting year for residential real estate. With a presidential election taking place this fall and talk of a possible recession occurring before the end of the year, predicting what will happen in the 2020 U.S. housing market can be challenging. As a result, taking a look at the combined projections from the most trusted entities in the industry when it comes to mortgage rates, home sales, and home prices is incredibly valuable – and they may surprise you.

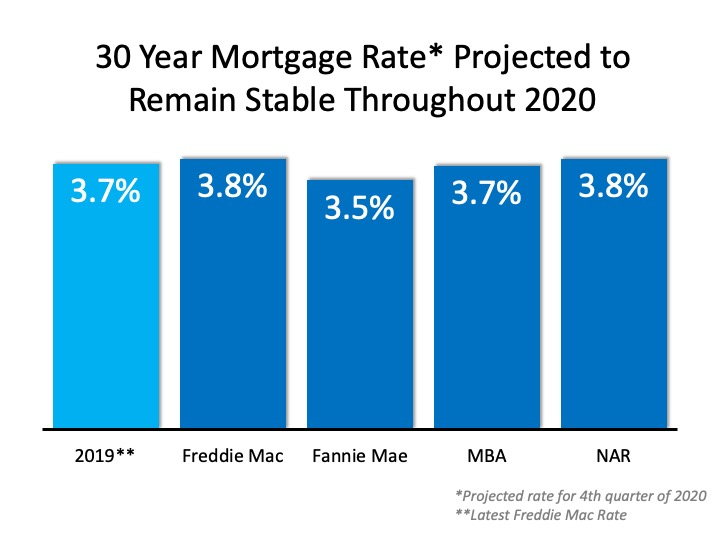

Mortgage Rates

Projections from the experts at the National Association of Realtors (NAR), the Mortgage Bankers Association (MBA), Fannie Mae, and Freddie Mac all forecast mortgage rates remaining stable throughout 2020: Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Here are the average mortgage interest rates over the last several decades:

- 1970s: 8.86%

- 1980s: 12.70%

- 1990s: 8.12%

- 2000s: 6.29%

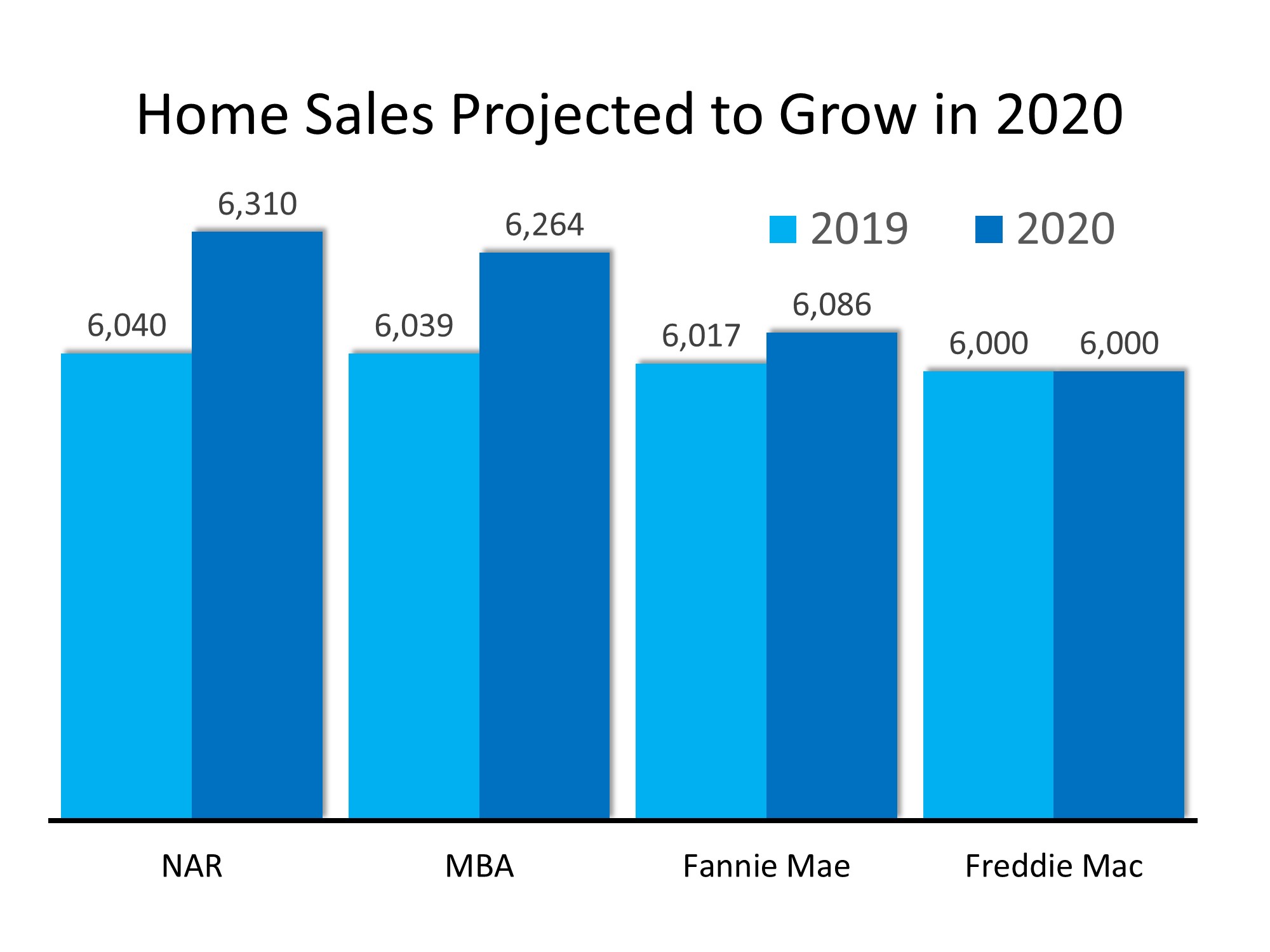

Home Sales

Three of the four expert groups noted above also predict an increase in home sales in 2020, and the fourth sees the transaction number remaining stable: With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

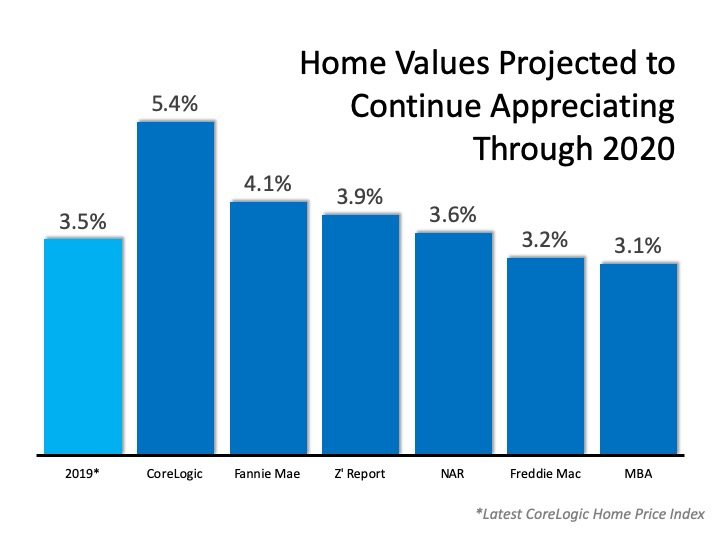

Home Prices

Below are the projections from six different expert entities that look closely at home values: CoreLogic, Fannie Mae, Ivy Zelman’s “Z Report”, the National Association of Realtors (NAR), Freddie Mac, and the Mortgage Bankers Association (MBA). Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Is a Recession Possible?

In early 2019, a large percentage of economists began predicting a recession may occur in 2020. In addition, a recent survey of potential home purchasers showed that over 50% agreed it would occur this year. The economy, however, remained strong in the fourth quarter, and that has caused many to rethink the possibility.

For example, Goldman Sachs, in their 2020 U.S. Outlook, explained:

“Markets sounded the recession alarm this year, and the average forecaster now sees a 33% chance of recession over the next year. In contrast, our new recession model suggests just a 20% probability. Despite the record age of the expansion, the usual late-cycle problems—inflationary overheating and financial imbalances—do not look threatening.”

Bottom Line

Mortgage rates are projected to remain under 4%, causing sales to increase in 2020. With growing demand and a limited supply of inventory, prices will continue to appreciate, while the threat of an impending recession seems to be softening. It looks like 2020 may be a solid year for the real estate market.

Why You Should Move to Utah

Suburbs of Salt Lake City are booming with new homes. Low unemployment and tech sector growth fuel migration. Affordable pricing compared to West Coast states. Access to skiing, hiking, and national parks. Ideal for families seeking active, balanced lifestyles.

Is Utah Real Estate Finally Cooling Down?

Utah Real Estate prices remain high, but the pace of growth has clearly slowed in recent months. Median monthly mortgage payments in Utah have dropped, improving affordability for first-time homebuyers. Listings are up across Utah, giving buyers more options and...

Utah 2025: Buyers Gain From Balance

Rising listings in Salt Lake suburbs support choice and negotiation. Family-oriented neighborhoods showing long-term value potential.

Where are the most new homes being built in the U.S.? In Utah?

Utah ranks 4th nationally for new home builds, authorizing 18.6 new units per 1,000 existing homes in 2024. Despite a nearly 25% drop in new home authorizations since 2022, Utah's median home price remains high at $535,217. The Salt Lake City-Murray area ranked...

Utah ranks No. 4 for most new homes being built in the US

Utah ranks fourth in the U.S. for new home builds, authorizing 18.6 new units per 1,000 existing homes in 2024. Despite a nearly 25% drop in new home authorizations since 2022, Utah maintains one of the highest median home prices at $535,217. The Salt Lake City-Murray...

Global Vacation Rental Market Grows 5% CAGR by 2033

Global vacation rental market to grow from $92.61B in 2025 to $136.83B by 2033. 5% CAGR driven by tech, personalization, remote work trends, and flexible travel preferences.

The price has reduced for this Listing, check it out Listing Address: 614 W ANDERSON Murray, UT 84123

New Carpet! 4 Bedroom 2 Bath updated Murray home. Granite counters, multiple gathering spaces, hardwood floors, and a large yard. Conveniently located, close to freeway access, IMC, shopping, schools, and canyons.

2025-27 Real Estate: Prices Rise 3.5% Yearly, Building Slows

US home prices are forecast to ↑ 3.5% annually through 2027, the slowest since 2011. Tariffs are expected to reduce construction of budget homes, with 90% of analysts predicting fewer builds

Could a Rate Cut Free Housing’s ‘Stuck Pig’?

Despite Fed rate cuts, 2025’s housing market remains a “stuck pig,” trapped by affordability and structural issues. Median home prices remain 4.2x median income; price gains forecast between 0.6% and 6.1% for 2025.

Utah 2025: Boomtowns Adjust to New Normal

Salt Lake City prices likely to flatten or dip as post-pandemic migration slows. New builds and resale listings ease supply crunch seen in boom years.