The 2020 Real Estate Projections That May Surprise You

This will be an interesting year for residential real estate. With a presidential election taking place this fall and talk of a possible recession occurring before the end of the year, predicting what will happen in the 2020 U.S. housing market can be challenging. As a result, taking a look at the combined projections from the most trusted entities in the industry when it comes to mortgage rates, home sales, and home prices is incredibly valuable – and they may surprise you.

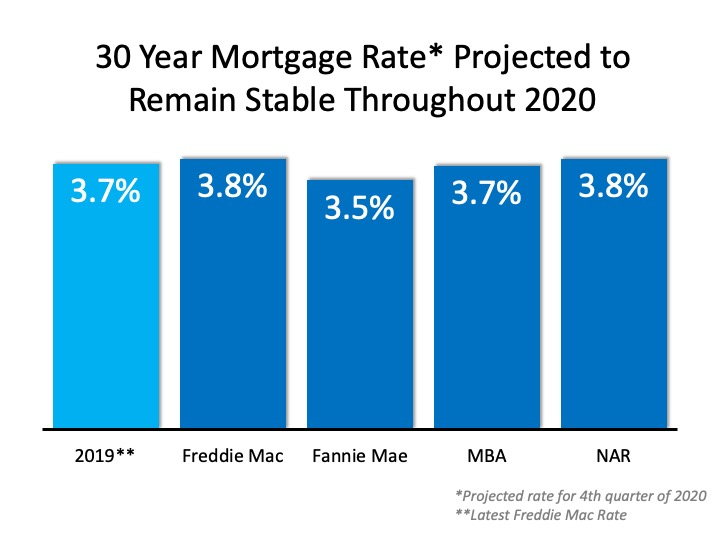

Mortgage Rates

Projections from the experts at the National Association of Realtors (NAR), the Mortgage Bankers Association (MBA), Fannie Mae, and Freddie Mac all forecast mortgage rates remaining stable throughout 2020: Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Here are the average mortgage interest rates over the last several decades:

- 1970s: 8.86%

- 1980s: 12.70%

- 1990s: 8.12%

- 2000s: 6.29%

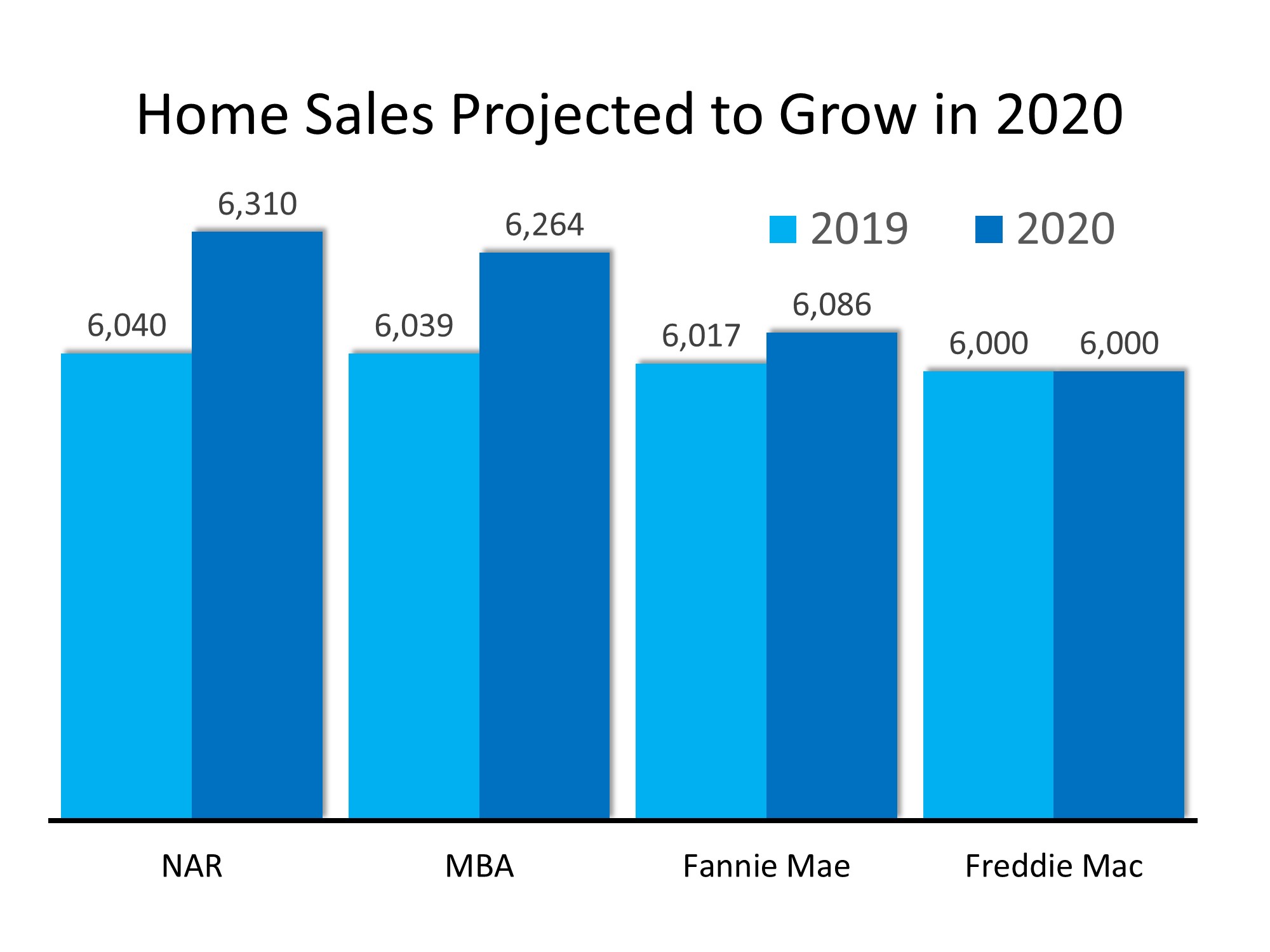

Home Sales

Three of the four expert groups noted above also predict an increase in home sales in 2020, and the fourth sees the transaction number remaining stable: With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

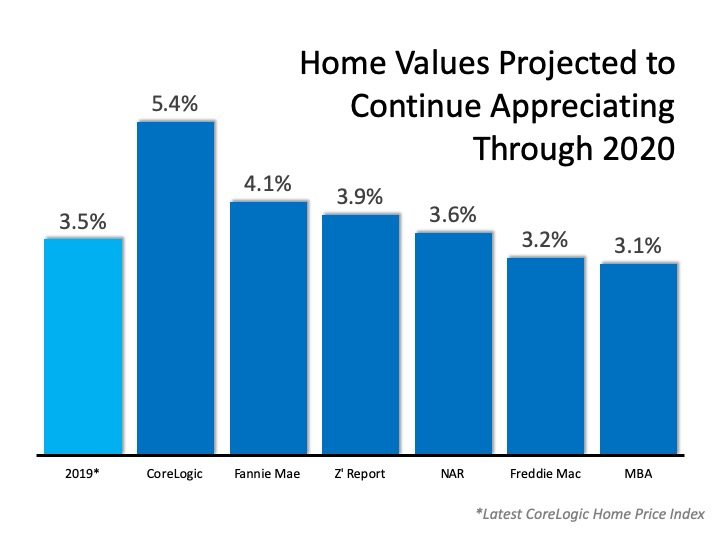

Home Prices

Below are the projections from six different expert entities that look closely at home values: CoreLogic, Fannie Mae, Ivy Zelman’s “Z Report”, the National Association of Realtors (NAR), Freddie Mac, and the Mortgage Bankers Association (MBA). Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Is a Recession Possible?

In early 2019, a large percentage of economists began predicting a recession may occur in 2020. In addition, a recent survey of potential home purchasers showed that over 50% agreed it would occur this year. The economy, however, remained strong in the fourth quarter, and that has caused many to rethink the possibility.

For example, Goldman Sachs, in their 2020 U.S. Outlook, explained:

“Markets sounded the recession alarm this year, and the average forecaster now sees a 33% chance of recession over the next year. In contrast, our new recession model suggests just a 20% probability. Despite the record age of the expansion, the usual late-cycle problems—inflationary overheating and financial imbalances—do not look threatening.”

Bottom Line

Mortgage rates are projected to remain under 4%, causing sales to increase in 2020. With growing demand and a limited supply of inventory, prices will continue to appreciate, while the threat of an impending recession seems to be softening. It looks like 2020 may be a solid year for the real estate market.

2025 Housing Forecast: Housing Prices up 3%

The experts forecast a 3% national housing price increase in 2025 due to limited supply. High mortgage rates discourage homeowners from selling, keeping supply low and supporting price stability.

Will 2026 Finally Jumpstart Home Sales?

High mortgage rates in 2025 slowed home sales, but improvement is expected starting in 2026. Experts predict existing home sales may ↑ 10–15% as conditions improve in 2026.

Homebuyers, Don’t Wait for a Miracle Rate

Mortgage rates increased after five weeks of declines, driven by stronger-than-expected economic indicators. Experts forecast minimal rate relief through late 2025 despite Federal Reserve predictions of future cuts. Waiting for rate drops may backfire as housing...

Slight Dip Ahead for U.S. Home Prices

U.S. home prices are projected to decline by 0.9% by Early-Q2 2026. The forecast reverses earlier predictions of price increases, signaling a cooling housing market.

Mortgage Rate Predictionsfor Q3 2025

Long Forecast predicts slight drops: July 6.84%, August 6.79%, September 6.74%. MBA expects 6.7% average in Q3; NAR, Realtor.com see 6.2%–6.4% by year-end. 15-year fixed rates forecasted to drop from 6.01% in July to 5.88% in September. Experts expect gradual rate...

Are mortgage rates falling? What homebuyers need to know

Mortgage rates for 30-year fixed loans have dropped to around 6.63%, the lowest since April, due to a weaker-than-expected jobs report causing Treasury yields to fall. Experts suggest this dip may be temporary but advise buyers to act now rather than wait for perfect...

The Salt Lake metro area is shifting to a renter’s market after an apartment construction boom.

Apartment vacancy rates rose to 7.1% in July, signaling an overbuilt market with slowed rent growth. Despite high rents, the market favors renters, with rent days on market decreasing. Utah's average rent dropped to $1,399 in 2025, causing many to delay home...

Forget Tariffs! There’s a New Crisis Impacting Rate Cuts

The Fed held rates at 4.25–4.5%, ignoring Trump’s calls for aggressive cuts. Trump imposed steep tariffs, triggering fears of price hikes on goods and vehicles.

How to Know if a Home Fits Your Lifestyle?

Research local schools even if you don’t have kids — they influence home values. Consider internet availability and speed, especially for remote work or streaming needs.

Are Buyers Really Optimistic About Housing?

Over half of U.S. buyers feel the market is better than last year, showing cautious optimism. Seventy-five percent of buyers are waiting for lower prices and interest rates before purchasing homes.