The 2020 Real Estate Projections That May Surprise You

This will be an interesting year for residential real estate. With a presidential election taking place this fall and talk of a possible recession occurring before the end of the year, predicting what will happen in the 2020 U.S. housing market can be challenging. As a result, taking a look at the combined projections from the most trusted entities in the industry when it comes to mortgage rates, home sales, and home prices is incredibly valuable – and they may surprise you.

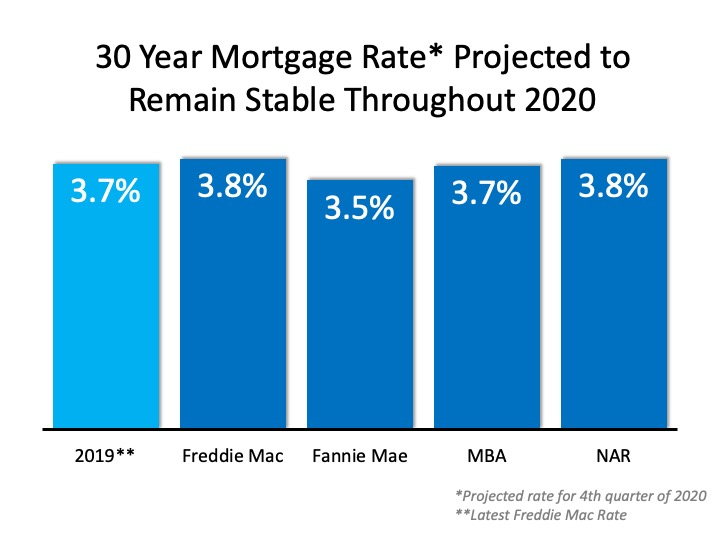

Mortgage Rates

Projections from the experts at the National Association of Realtors (NAR), the Mortgage Bankers Association (MBA), Fannie Mae, and Freddie Mac all forecast mortgage rates remaining stable throughout 2020: Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Here are the average mortgage interest rates over the last several decades:

- 1970s: 8.86%

- 1980s: 12.70%

- 1990s: 8.12%

- 2000s: 6.29%

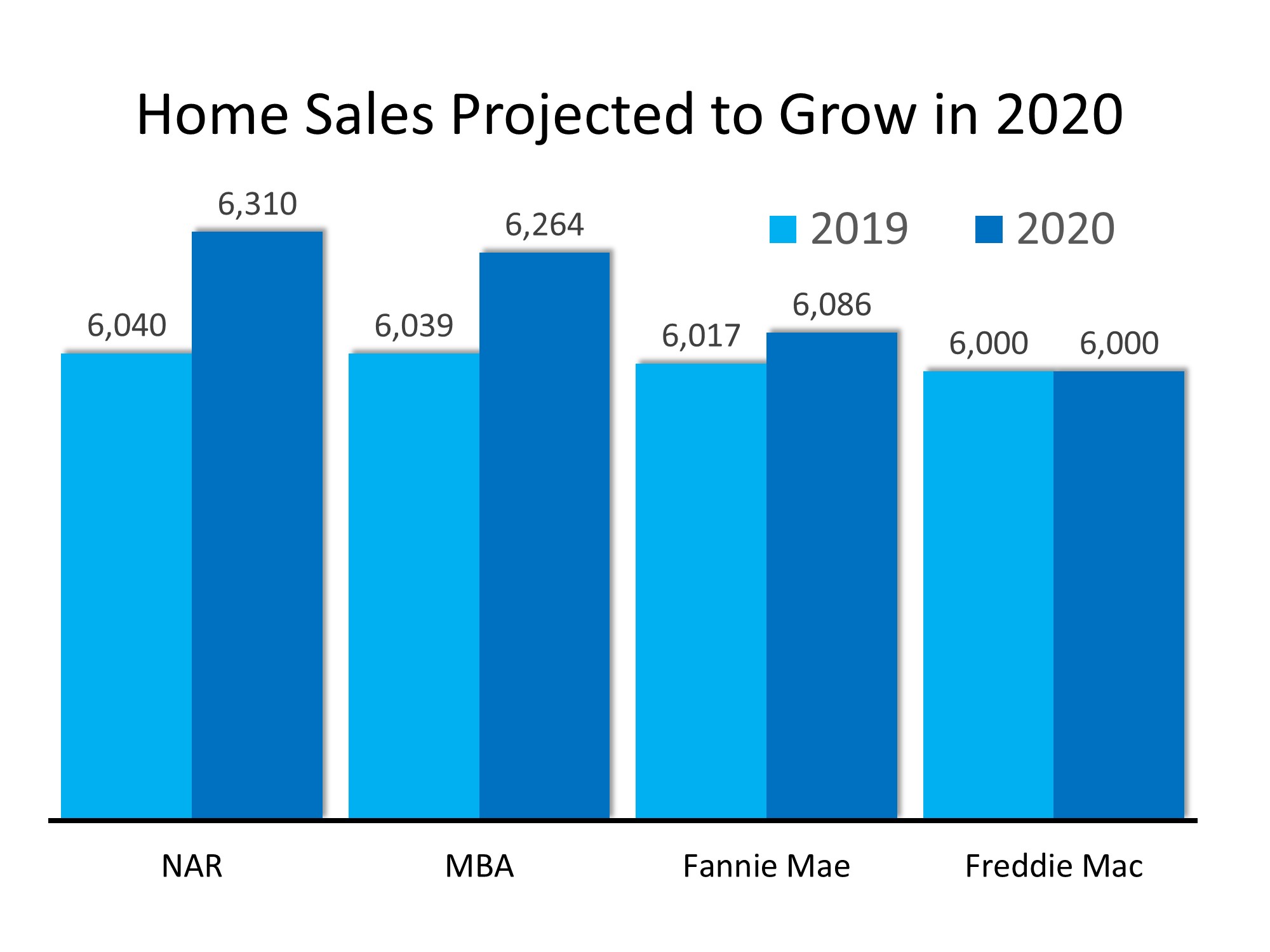

Home Sales

Three of the four expert groups noted above also predict an increase in home sales in 2020, and the fourth sees the transaction number remaining stable: With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

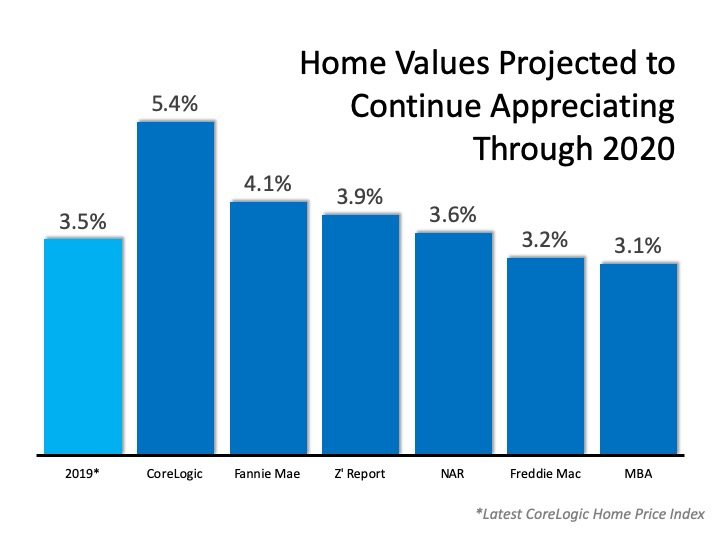

Home Prices

Below are the projections from six different expert entities that look closely at home values: CoreLogic, Fannie Mae, Ivy Zelman’s “Z Report”, the National Association of Realtors (NAR), Freddie Mac, and the Mortgage Bankers Association (MBA). Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Is a Recession Possible?

In early 2019, a large percentage of economists began predicting a recession may occur in 2020. In addition, a recent survey of potential home purchasers showed that over 50% agreed it would occur this year. The economy, however, remained strong in the fourth quarter, and that has caused many to rethink the possibility.

For example, Goldman Sachs, in their 2020 U.S. Outlook, explained:

“Markets sounded the recession alarm this year, and the average forecaster now sees a 33% chance of recession over the next year. In contrast, our new recession model suggests just a 20% probability. Despite the record age of the expansion, the usual late-cycle problems—inflationary overheating and financial imbalances—do not look threatening.”

Bottom Line

Mortgage rates are projected to remain under 4%, causing sales to increase in 2020. With growing demand and a limited supply of inventory, prices will continue to appreciate, while the threat of an impending recession seems to be softening. It looks like 2020 may be a solid year for the real estate market.

Salt Lake County Shines as Top Choice for New Families

Childcare costs as a percent of median household income: 21.34% Housing costs as a percentage of median household income: 20.84% Percentage of population under age 10: 13.12% Number of children under age 10: 155,636 Ratio of total population to primary care...

Top 10 Tips for First-Time Homebuyers

First-time homebuyers should identify their current and future needs, understand the true cost of homeownership including taxes and maintenance, and start saving early for down payments and closing costs. Building and managing credit wisely is crucial. Research...

Time to Sell? Key Market Signals

Outgrowing or underusing your space signals it might be time to sell and move on. A strong seller’s market boosts sale price, speed, and overall success of your listing.

Honoring the Significance of Indigenous Day

Indigenous Peoples’ Day celebrates, recognizes, and honors the beautiful traditions and cultures of the Indigenous People We take a stand for and support the indigenous people on this day. We should also offer our support to those who invest and uplift the indigenous...

Avoid Mortgage Mistakes Buyers Make: Expert Tips

Key mortgage mistakes to avoid include not getting pre-approved, overlooking credit scores, and failing to compare mortgage options. Buyers should budget for total homeownership costs, including property taxes and maintenance. Skipping home inspections and neglecting...

Top Strategies to Sell Your Home Fast in 2025

Price your home right from day one to attract more offers and avoid sitting on the market too long. Boost curb appeal with simple upgrades—fresh paint, landscaping, and clean entryways make a strong first impression. Use professional photos and staging to showcase...

5 Smart Tips to Save Money on Home Closing Costs

Closing costs can add up to more than $10,000, but buyers have strategies to reduce them. Local banks may offer grants, credits, or fee waivers that cut costs without repayment obligations. Conventional loans with larger down payments often reduce costs compared to...

5 Key Takeaways: How to Negotiate to Cut Costs When Closing on a Home

Homebuyers can save money by negotiating key aspects of the purchase, including repairs found during inspections, closing costs, and the closing date. Buyers may also negotiate for home contents like appliances and furniture to be included, as well as for sellers to...

Chasing 4%: The Future of Mortgage Rates

Mortgage rates are expected to gradually ease over the coming years, though a return to 4% remains a longer-term possibility. Past 4% levels were achieved during periods of strong monetary support, showing rates can fall when economic conditions shift significantly. A...

Will 2029’s Home Prices Surpass Pre-Bubble Levels?

National home prices expected to rise by 19.8% through 2029, averaging 3.7% annual growth. Price Growth 2025 (+3.4%) 2026 (+6.8%) 2027 (+10.8%) 2028 (+15.2%) 2029 (+19.8%)