The 2020 Real Estate Projections That May Surprise You

This will be an interesting year for residential real estate. With a presidential election taking place this fall and talk of a possible recession occurring before the end of the year, predicting what will happen in the 2020 U.S. housing market can be challenging. As a result, taking a look at the combined projections from the most trusted entities in the industry when it comes to mortgage rates, home sales, and home prices is incredibly valuable – and they may surprise you.

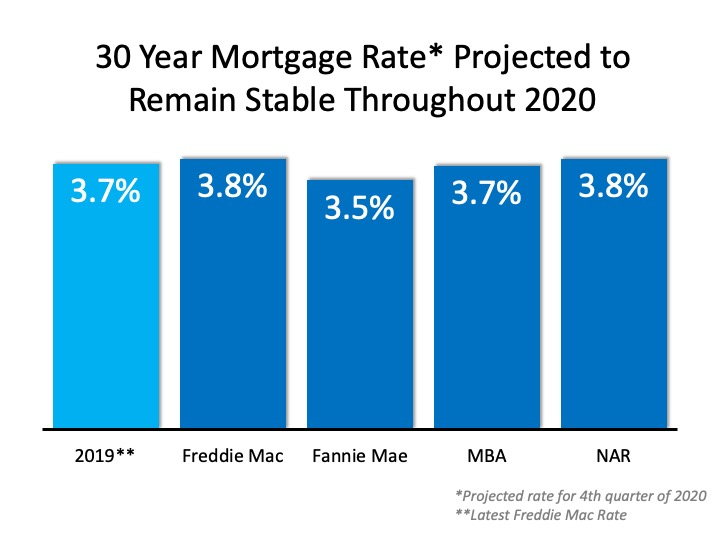

Mortgage Rates

Projections from the experts at the National Association of Realtors (NAR), the Mortgage Bankers Association (MBA), Fannie Mae, and Freddie Mac all forecast mortgage rates remaining stable throughout 2020: Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Since rates have remained under 5% for the last decade, we may not fully realize the opportunity we have right now.

Here are the average mortgage interest rates over the last several decades:

- 1970s: 8.86%

- 1980s: 12.70%

- 1990s: 8.12%

- 2000s: 6.29%

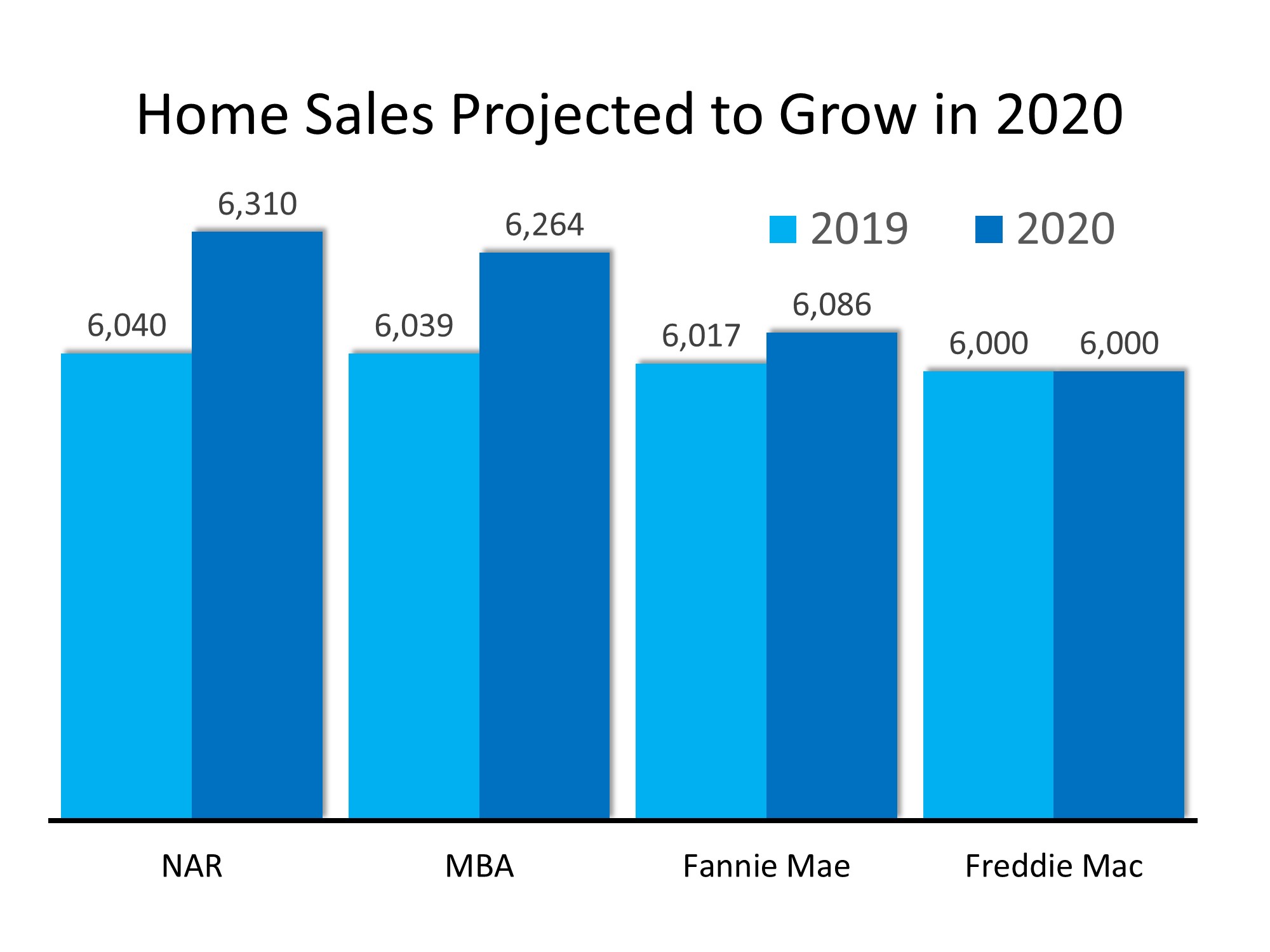

Home Sales

Three of the four expert groups noted above also predict an increase in home sales in 2020, and the fourth sees the transaction number remaining stable: With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

With mortgage rates remaining near all-time lows, demand should not be a challenge. The lack of available inventory, however, may moderate the increase in sales.

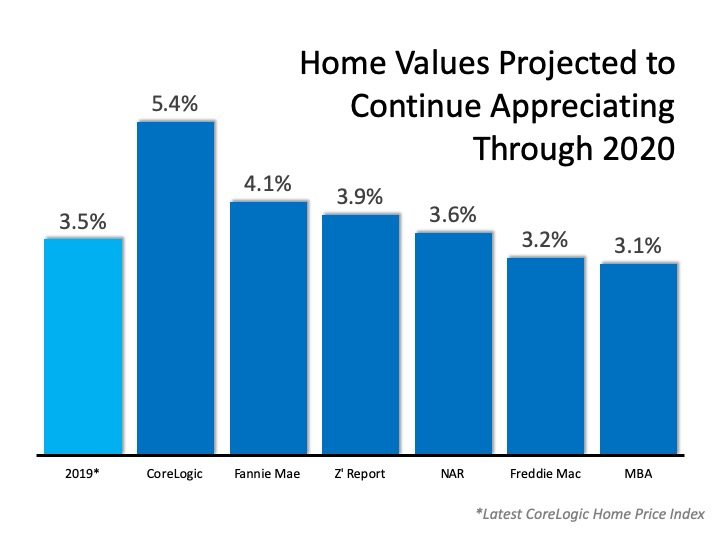

Home Prices

Below are the projections from six different expert entities that look closely at home values: CoreLogic, Fannie Mae, Ivy Zelman’s “Z Report”, the National Association of Realtors (NAR), Freddie Mac, and the Mortgage Bankers Association (MBA). Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Each group has home values continuing to improve through 2020, with four of them seeing price appreciation increasing at a greater pace than it did in 2019.

Is a Recession Possible?

In early 2019, a large percentage of economists began predicting a recession may occur in 2020. In addition, a recent survey of potential home purchasers showed that over 50% agreed it would occur this year. The economy, however, remained strong in the fourth quarter, and that has caused many to rethink the possibility.

For example, Goldman Sachs, in their 2020 U.S. Outlook, explained:

“Markets sounded the recession alarm this year, and the average forecaster now sees a 33% chance of recession over the next year. In contrast, our new recession model suggests just a 20% probability. Despite the record age of the expansion, the usual late-cycle problems—inflationary overheating and financial imbalances—do not look threatening.”

Bottom Line

Mortgage rates are projected to remain under 4%, causing sales to increase in 2020. With growing demand and a limited supply of inventory, prices will continue to appreciate, while the threat of an impending recession seems to be softening. It looks like 2020 may be a solid year for the real estate market.

Marty Gale: A Real Estate Journey Spanning 38 Years

When it comes to real estate, there are few professionals who can boast the level of experience and expertise that Marty Gale brings to the table. With an impressive 38 years in the business, Marty has not only weathered the ups and downs of the industry, but has...

The Perfect Home Could Be the One You Perfect After Buying

The Perfect Home Could Be the One You Perfect After Buying There’s no denying mortgage rates and home prices are higher now than they were last year and that’s impacting what you can afford. At the same time, there are still fewer homes available for sale than the...

Your Homebuying Adventure

Your Homebuying Adventure Some Highlights Here are the key milestones you’ll encounter on your path to homeownership. From building your team, to house hunting, all the way to moving into your new home – it’s an exciting adventure. Your journey starts here. Let’s...

Why You Need To Use a Real Estate Agent When You Buy a Home

Why You Need To Use a Real Estate Agent When You Buy a Home If you’ve recently decided you’re ready to become a homeowner, chances are you’re trying to figure out what to do first. It can feel a bit overwhelming to know where to start, but the good news is you don’t...

New Loan Limits Raised To Help Home Buyers in 2024

The year 2024 has begun with a bang, as the Federal Housing Administration (FHA) and conventional loan limits have increased. This means that potential homebuyers and refinancers now have even more opportunities to secure funding for their dream homes or make...

Experts Project Home Prices Will Rise over the Next 5 Years

Experts Project Home Prices Will Rise over the Next 5 Years Even with so much data showing home prices are actually rising in most of the country, there are still a lot of people who worry there will be another price crash in the immediate future. In fact, a recent...

Wednesday Word | After-Repair Value

"Wednesday Word" After-Repair Value or ARV What Is After-Repair Value (ARV) In Real Estate? ARV is the estimated value of a property after completed renovations, not in its current condition. House flippers commonly use ARV as a way to gauge the worth of a...

Are the Top 3 Housing Market Questions on Your Mind?

Are the Top 3 Housing Market Questions on Your Mind? When it comes to what’s happening in the housing market, there’s a lot of confusion going around right now. You may hear one thing in conversation with your friends, see something totally different on the news, and...

Is Wall Street Buying Up All the Homes in America?

Is Wall Street Buying Up All the Homes in America?If you’re thinking about buying a home, you may find yourself interested in the latest real estate headlines so you can have a pulse on all of the things that could impact your decision. If that’s the case, you’ve...

cost-effective and flexible solution for an accessory dwelling unit (ADU)?

Are you searching for a cost-effective and flexible solution for an accessory dwelling unit (ADU)? Look no further than a manufactured double wide mobile home. ADUs have gained popularity as a versatile and affordable housing option, and manufactured homes offer...