2 Myths Holding Back Home Buyers

Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that,

“For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment…

…Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20% down.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the funds needed to qualify for a home loan. According to the same report:

22% of renters and 31% of homeowners believe lenders require 20% or more of a home’s sale price as a down payment for a typical mortgage today. And,

“If a 20% down payment was required, 70% of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30% indicated they would never be able to afford a home.”

While many believe at least 20% down is necessary to buy the home of their dreams, they do not realize programs are available which permit as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined!

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Many either don’t know or are misinformed concerning the FICO® score necessary to qualify, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

3 Things to Know in the Housing Market Today in Utah!

3 Things to Know in the Housing Market Today! A lot is happening in the world, and it’s having a direct impact on the housing market. The reality is this: some of it is positive and some of it may be negative. Some we just don’t know yet. The following three areas of...

What is the Cost of Waiting Until Next Year to Buy?- Utah Realty

Will Home Prices Rise In 2019

What is Important to Boomers when Selling their House

What is Important to Boomers when Selling their House? If you are a “baby boomer” (born between 1946 and 1964), you may be thinking about selling your current home. Your children may have finally moved out. Your large, four-bedroom house with three bathrooms no longer...

The Feeling You Get from Owning Your Home – Utah Realty

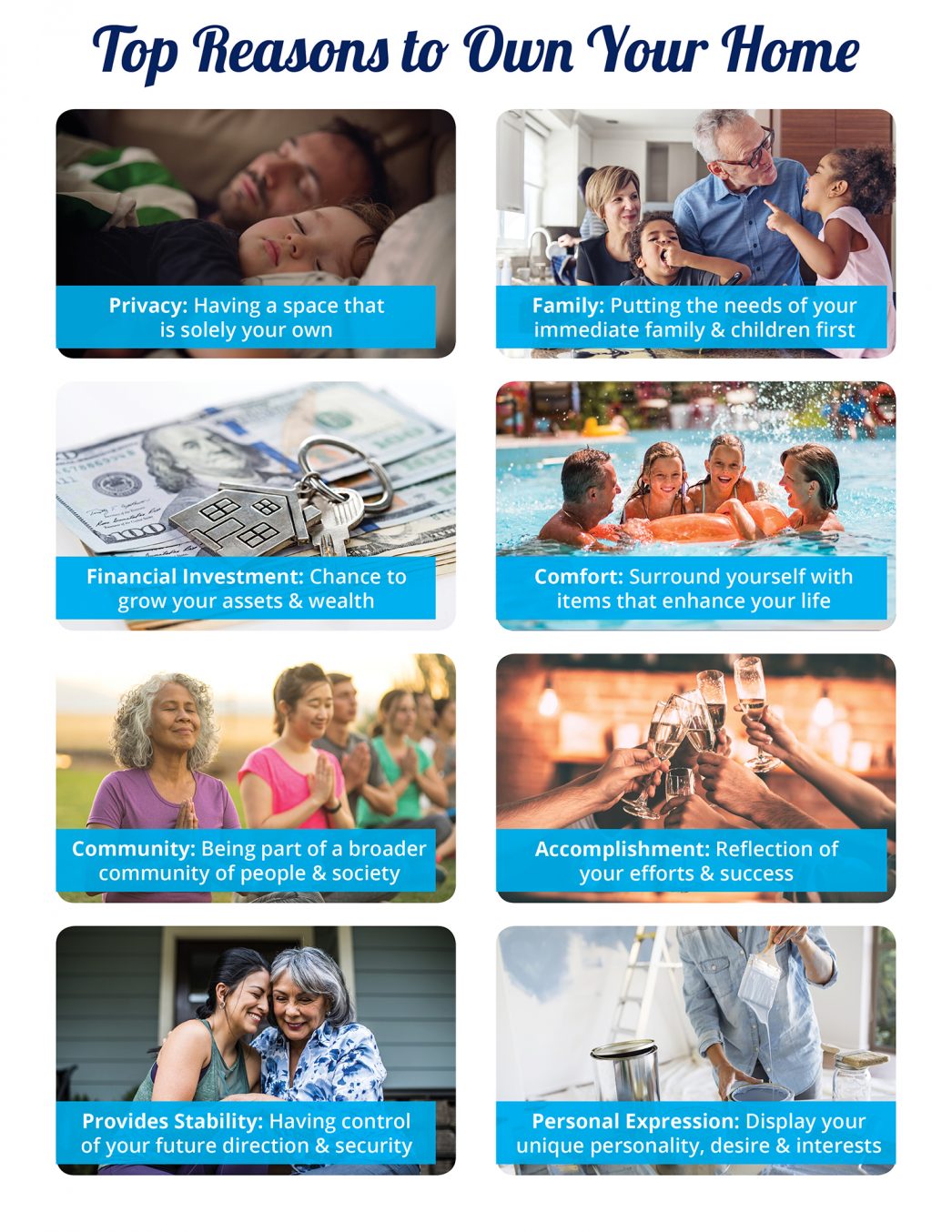

The Feeling You Get from Owning Your Home We often talk about the financial reasons why buying a home makes sense. But, more often than not, the emotional reasons are the more powerful and compelling ones. No matter what shape or size your living space is, the concept...

Top 5 reasons to own a home

June is National Homeownership Month

Some Highlights: June is National Homeownership Month! Now is a great time to reflect on the many benefits of homeownership that go way beyond the financial. What reasons do you have to own your own home?

Housing Affordability Index Today

The Ultimate Truth about Housing Affordability Courtesy of Marty Gale Utah Realty There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the...

Utah Realty – Utah is Number Three with New Homes Built

Utah Realty – 2 Things You Need to Know to Properly Price Your Home

2 Things You Need to Know to Properly Price Your Home In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high...